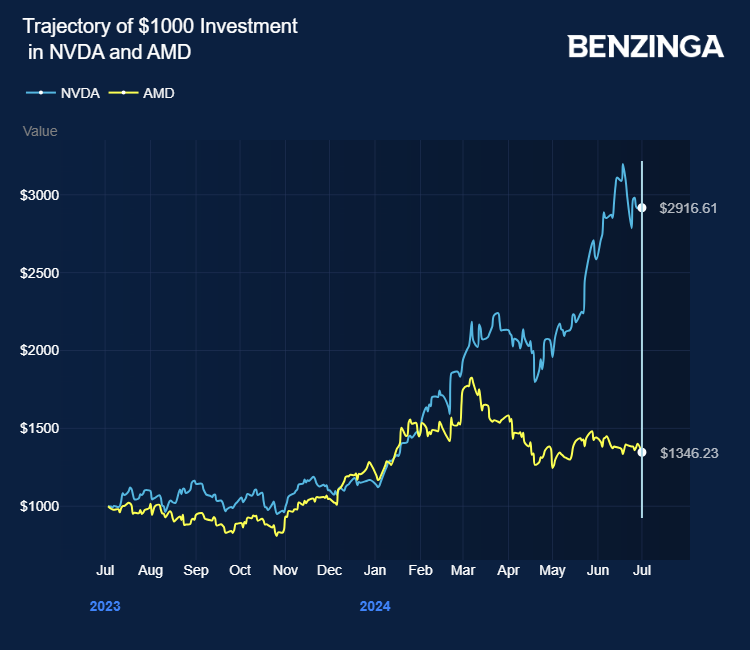

Nvidia Corp (NASDAQ:NVDA) and peer semiconductor stocks, including Advanced Micro Devices, Inc (NASDAQ:AMD), are trading lower Monday following strength in the first half of 2024, driven by AI momentum.

Nvidia faces upcoming charges from French antitrust regulators. The charges allege anti-competitive practices, marking the first instance of such enforcement against Nvidia, Reuters reported.

French authorities initiated dawn raids in the graphics cards sector last September, explicitly targeting Nvidia. These raids culminated in a statement of objections and a formal charge sheet against the company.

Also Read: Nvidia and AMD Lead Semiconductor Surge Amid AI Boom, TSMC Expands

Also Read: Nvidia and AMD Lead Semiconductor Surge Amid AI Boom, TSMC Expands

Since the release of the generative AI application ChatGPT late last year, Nvidia's chip demand has surged, prompting increased regulatory scrutiny on both sides of the Atlantic. The company's dominant position in the AI and computer graphics chip market has drawn attention from antitrust authorities.

Morgan Stanley analyst Joseph Moore maintained Nvidia with an Overweight and raised the price target from $116 to $144.

Moore highlighted the catalyst path remained strong as the surge in H20 builds and demand removed any concern about a pre-Blackwell platform pause.

The data points he discussed in his two Asia notes and his U.S. checks remained robust. However, it was clear the market was at the tail end of the Hopper cycle, and the frothiness and visibility were lower than it was — and given the enthusiasm that Moore was hearing for the Blackwell platform, lower than it would be.

Still, he noted demand side indications remained robust for Hopper. Hopper builds continued to go up as H100 transitions to H200, and Moore was confident sales of both products would remain strong.

Moore's numbers for the next couple of quarters have not changed, but as the Blackwell platform visibility grows, he was increasing his data center estimates for calendar year 2025 to about 35% growth.

NVDA, AMD Price Actions: Nvidia shares traded lower by 0.44% to $123.07 at the last check Monday. AMD is down 3.78% at $156.18.

Also Read:

Photo: Shutterstock

受人工智能势头推动,英伟达公司(纳斯达克股票代码:NVDA)和包括先进微设备公司(纳斯达克股票代码:AMD)在内的同行半导体股票在2024年上半年走强,周一走低。

英伟达即将面临法国反垄断监管机构的指控。路透社报道,这些指控指控存在反竞争行为,这标志着首次对Nvidia进行此类执法。

去年9月,法国当局发起了对显卡领域的黎明袭击,明确针对的是Nvidia。这些突袭行动最终形成了一份反对声明和一份针对该公司的正式指控表。

另请阅读:在人工智能繁荣中,英伟达和AMD引领半导体激增,台积电扩张

另请阅读:在人工智能繁荣中,英伟达和AMD引领半导体激增,台积电扩张

自去年年底发布生成式人工智能应用程序 ChatGPT 以来,英伟达的芯片需求激增,这促使大西洋两岸加强了监管审查。该公司在人工智能和计算机图形芯片市场的主导地位引起了反垄断机构的关注。

摩根士丹利分析师约瑟夫·摩尔维持英伟达增持,并将目标股价从116美元上调至144美元。

摩尔强调,随着20年下半年的增长和需求的激增,人们对Blackwell平台暂停前的任何担忧都消失了,催化剂路径仍然强劲。

他在两份亚洲报告和美国支票中讨论的数据点仍然强劲。但是,很明显,市场正处于Hopper周期的尾声,泡沫和能见度也低于以前——考虑到摩尔听到的对Blackwell平台的热情,也低于预期的水平。

尽管如此,他指出,Hopper的需求方迹象仍然强劲。随着上半年向上半年的过渡,Hopper的产量继续增长,摩尔相信这两款产品的销售将保持强劲。

摩尔在接下来的几个季度的数字没有变化,但随着Blackwell平台知名度的提高,他正在将2025日历年的数据中心估计值提高到约35%的增长。

NVDA,AMD价格走势:英伟达股价在周一的最后一次检查中下跌0.44%,至123.07美元。AMD下跌3.78%,至156.18美元。

另请阅读:

照片:Shutterstock

另请阅读:在人工智能繁荣中,英伟达和AMD引领半导体激增,台积电扩张

另请阅读:在人工智能繁荣中,英伟达和AMD引领半导体激增,台积电扩张