The Five-year Decline in Earnings Might Be Taking Its Toll on Gates Industrial (NYSE:GTES) Shareholders as Stock Falls 4.3% Over the Past Week

The Five-year Decline in Earnings Might Be Taking Its Toll on Gates Industrial (NYSE:GTES) Shareholders as Stock Falls 4.3% Over the Past Week

Gates Industrial Corporation plc (NYSE:GTES) shareholders might be concerned after seeing the share price drop 12% in the last quarter. On the bright side the share price is up over the last half decade. Unfortunately its return of 41% is below the market return of 94%.

纽交所的Gates Industrial Corporation plc (NYSE:GTES) 股东们可能会担心股价在上一季度下跌了12%。 光明面是股价在过去五年中上涨了。不幸的是,它的回报率为41%,低于市场回报率94%。

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

虽然过去的一周削弱了公司的五年回报,但让我们看看业务的最近趋势,并查看收益是否已对齐。

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

引用巴菲特的话顺便说一下,“船只将环游世界,但支持地球平面学会的人将大有可为。 在市场上,价格和价值之间将继续存在巨大的差异...”通过比较EPS和股价变化,我们可以了解到投资者对公司的态度随时间的变化程度。

Gates Industrial's earnings per share are down 20% per year, despite strong share price performance over five years.

尽管股价表现强劲,Gates Industrial的每股收益年减少20%。

Essentially, it doesn't seem likely that investors are focused on EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

实际上,投资者似乎并没有关注EPS。由于EPS的变化似乎与股价的变化不相关,因此值得关注其他指标。

On the other hand, Gates Industrial's revenue is growing nicely, at a compound rate of 4.1% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

另一方面,Gates Industrial的营业收入在过去五年中以4.1%的复合增长率增长。在这种情况下,公司可能为了推动增长而牺牲了当前的每股收益。

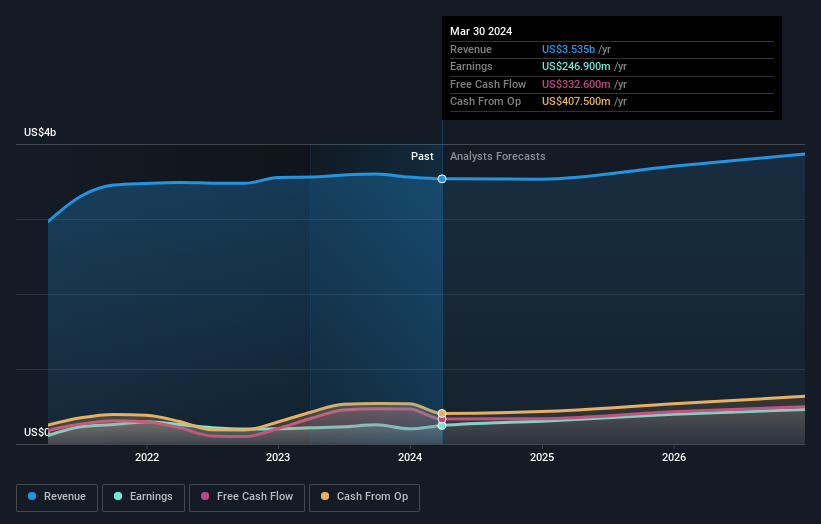

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

下图显示了收益和营收随时间变化的情况(如果你点击图像,可以看到更多细节):

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Gates Industrial in this interactive graph of future profit estimates.

我们认为股权内部交易增加是积极的,但大多数人认为盈利和营收增长趋势是业务更有意义的指导。您可以在这个未来利润估计的互动图表中看到分析师对Gates Industrial的预测。

A Different Perspective

不同的观点

Gates Industrial shareholders are up 15% for the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 7% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Gates Industrial , and understanding them should be part of your investment process.

Gates Industrial的股东们今年的回报率为15%。但是仍然低于市场平均水平。光明面是,这仍然是一种收益,而且它实际上比过去五年的7%的平均回报更好。这可能表明公司正在赢得新的投资者,追求其策略。

Gates Industrial is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Gates Industrial不是唯一的内部股权交易增加的股票。对于那些喜欢找到较少知名公司的人,这个最近有内部人员购买的增长公司的免费列表可能是一个好选择。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

请注意,本文所引述的市场回报反映了目前在美国交易所上市的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?关于内容有所顾虑?直接和我们联系。或电邮 editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者,也可以发送电子邮件至editorial-team@simplywallst.com