Verizon Communications Options Trading: A Deep Dive Into Market Sentiment

Verizon Communications Options Trading: A Deep Dive Into Market Sentiment

Deep-pocketed investors have adopted a bullish approach towards Verizon Communications (NYSE:VZ), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in VZ usually suggests something big is about to happen.

有实力的投资者对verizon通信(纽交所:VZ)采取了看好的投资策略,这是股市玩家们不能忽视的。本轮追踪的公开期权记录数据显示,这些投资者的身份仍然是个谜,但是VZ的这一重大动作通常意味着即将有重大事件发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Verizon Communications. This level of activity is out of the ordinary.

我们从本次观察中获得了这些信息,当Benzinga的期权扫描仪今天突显出了Verizon通信的9起非凡的期权活动时。这一活动水平是超出寻常的。

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 22% bearish. Among these notable options, 3 are puts, totaling $177,810, and 6 are calls, amounting to $518,732.

这些重量级投资者的总体心态是分裂的,44%看好,22%看淡。在这些值得关注的期权中,有3个看跌,共计177,810美元;有6个看涨,共计518,732美元。

Predicted Price Range

预测价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $32.0 to $60.0 for Verizon Communications over the last 3 months.

考虑到这些合约的成交量和持仓量,似乎鲸鱼们在过去的3个月里一直在瞄准verizon通信32.0到60.0美元的价格区间。

Volume & Open Interest Trends

成交量和未平仓量趋势

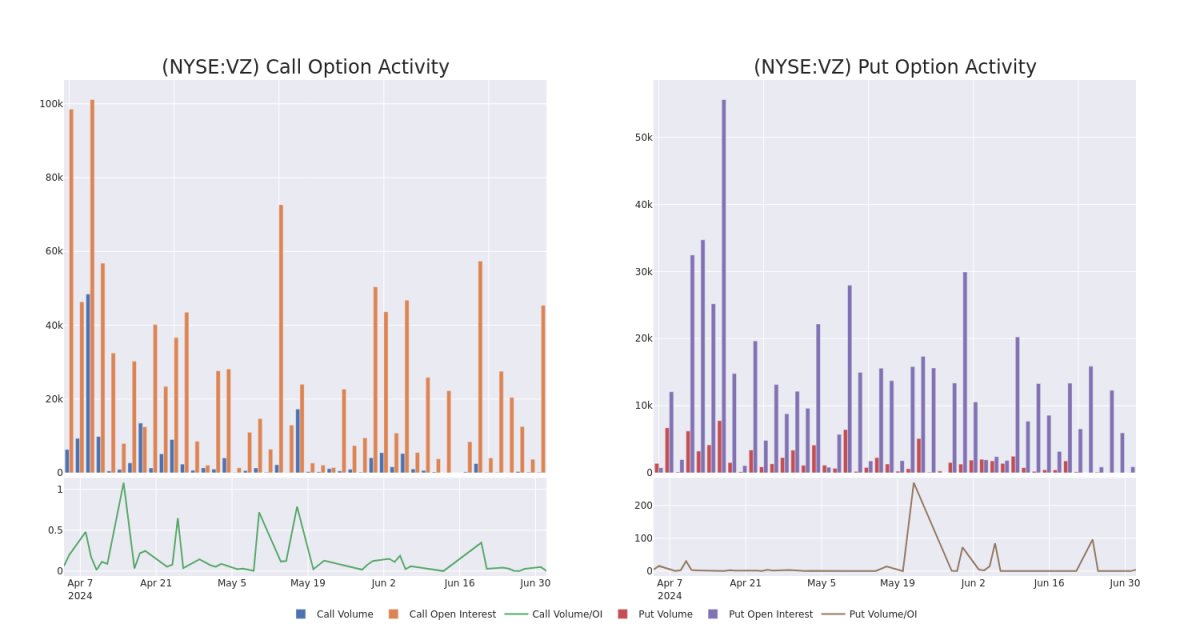

In today's trading context, the average open interest for options of Verizon Communications stands at 5787.12, with a total volume reaching 169.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Verizon Communications, situated within the strike price corridor from $32.0 to $60.0, throughout the last 30 days.

在今天的交易背景下,Verizon通信期权的平均持仓量为5787.12,总成交量达到了169.00。附带的图表展示了最近30天期权中高价值交易的看涨和看跌期权成交量和持仓量在32.0到60.0美元的执行价格走势。

Verizon Communications Option Activity Analysis: Last 30 Days

Verizon Communications期权活动分析:最近30天

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VZ | CALL | TRADE | BEARISH | 01/17/25 | $0.56 | $0.39 | $0.42 | $47.00 | $282.9K | 12.2K | 3 |

| VZ | PUT | SWEEP | BEARISH | 10/18/24 | $5.4 | $5.3 | $5.4 | $46.00 | $82.6K | 894 | 0 |

| VZ | CALL | TRADE | BULLISH | 01/16/26 | $6.7 | $6.7 | $6.7 | $35.00 | $67.0K | 6.7K | 8 |

| VZ | CALL | TRADE | BULLISH | 01/16/26 | $10.25 | $8.25 | $9.85 | $32.00 | $51.2K | 1.4K | 0 |

| VZ | PUT | TRADE | NEUTRAL | 01/17/25 | $19.3 | $19.0 | $19.15 | $60.00 | $47.8K | 6 | 25 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| verizon | 看涨 | 交易 | 看淡 | 01/17/25 | $0.56 | 0.39美元 | $0.42 | $47.00 | 282.9K美元 | 12.2K | 3 |

| verizon | 看跌 | SWEEP | 看淡 | 10/18/24 | $5.4 | $5.3 | $5.4 | $46.00 | $82.6K | 894 | 0 |

| verizon | 看涨 | 交易 | 看好 | 01/16/26 | $6.7 | $6.7 | $6.7 | 35.00美元 | $67.0K | 6.7千 | 8 |

| verizon | 看涨 | 交易 | 看好 | 01/16/26 | $10.25 | $8.25 | $9.85 | $32.00 | $51.2K | 1.4千 | 0 |

| verizon | 看跌 | 交易 | 中立 | 01/17/25 | $19.3 | $19.0 | $19.15 | $60.00 | $47.8K | 6 | 25 |

About Verizon Communications

关于Verizon通信

Wireless services account for about 70% of Verizon Communications' total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 21 million prepaid phone customers (following the acquisition of Tracfone) via its nationwide network, making it the largest US wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 29 million homes and businesses and serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers' networks.

无线电信服务业务占据了Verizon通信总服务收入的约70%,几乎全部营业利润。该公司通过其全国性的网络为约93百万后付和21百万预付手机客户提供服务(收购Tracfone后),成为美国最大的无线电信运营商。固定线路电信业务包括在东北部地区的本地网络,覆盖约2900万家庭和企业,并服务约800万宽带客户。Verizon还为全国的企业客户提供电信服务,通常使用自己和其他运营商的网络的混合体。

After a thorough review of the options trading surrounding Verizon Communications, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面审核了Verizon通信的期权交易后,我们将更详细地研究该公司。这包括对其当前市场状态和表现的评估。

Where Is Verizon Communications Standing Right Now?

Verizon Communications现在处于什么状态?

- Trading volume stands at 8,724,557, with VZ's price down by -0.26%, positioned at $41.63.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 20 days.

- 交易量为8,724,557手,VZ的价格下跌了-0.26%,位于41.63美元。

- RSI指标显示该股票目前处于超买和超卖之间的中立状态。

- 预计20天内公布收益报告。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Verizon Communications with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也可能带来更高的利润。精明的交易者通过持续教育、策略性的交易调整、利用各种因子和保持对市场动态的关注来减轻这些风险。通过Benzinga Pro获取Verizon通信的最新期权交易情报,获得实时提醒。