Enphase Energy's Options: A Look at What the Big Money Is Thinking

Enphase Energy's Options: A Look at What the Big Money Is Thinking

Financial giants have made a conspicuous bullish move on Enphase Energy. Our analysis of options history for Enphase Energy (NASDAQ:ENPH) revealed 29 unusual trades.

金融巨头对enphase energy做出明显的看好举动。我们对NASDAQ:ENPH的期权历史进行了分析,发现有29次非寻常交易。

Delving into the details, we found 44% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 19 were puts, with a value of $2,710,078, and 10 were calls, valued at $452,794.

深入分析后,我们发现44%的交易者看涨,44%的交易者看淡。我们发现所有交易中有19次看跌,总价值为2,710,078美元,有10次看涨,总价值为452,794美元。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $200.0 for Enphase Energy during the past quarter.

分析这些合约的成交量和未平仓利益,似乎这些大玩家在过去的季度中一直关注Enphase Energy价格区间从55.0到200.0美元。

Volume & Open Interest Trends

成交量和未平仓量趋势

In terms of liquidity and interest, the mean open interest for Enphase Energy options trades today is 803.31 with a total volume of 2,389.00.

就流动性和利益而言,Enphase Energy期权交易的平均未平仓利益为803.31,成交总量为2,389.00。

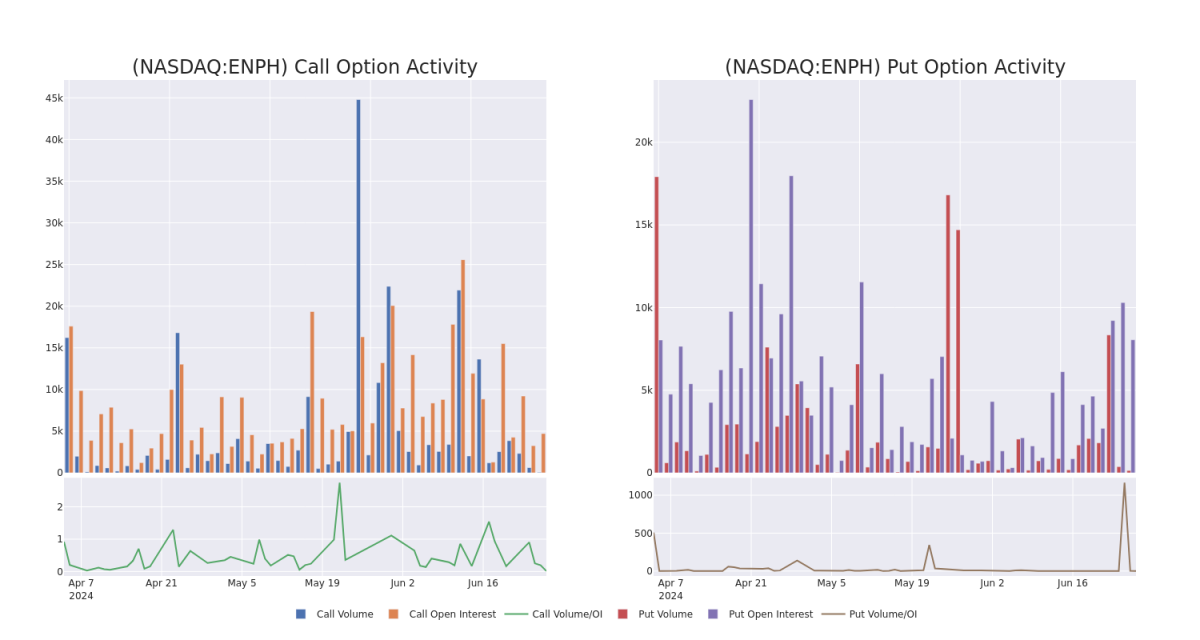

In the following chart, we are able to follow the development of volume and open interest of call and put options for Enphase Energy's big money trades within a strike price range of $55.0 to $200.0 over the last 30 days.

在下面的图表中,我们可以跟踪过去30天Enphase Energy看跌和看涨期权成交量和未平仓利益的发展情况,这些交易的执行价范围在55.0到200.0美元之间。

Enphase Energy Option Volume And Open Interest Over Last 30 Days

过去30天Enphase Energy期权成交量和未平仓利益

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENPH | PUT | TRADE | NEUTRAL | 01/16/26 | $26.85 | $26.4 | $26.65 | $100.00 | $1.5M | 1.0K | 0 |

| ENPH | PUT | SWEEP | BULLISH | 07/26/24 | $24.85 | $22.5 | $22.5 | $119.00 | $225.0K | 143 | 0 |

| ENPH | PUT | SWEEP | BULLISH | 01/17/25 | $13.2 | $13.1 | $13.1 | $90.00 | $110.0K | 1.6K | 0 |

| ENPH | PUT | SWEEP | BEARISH | 07/19/24 | $3.5 | $3.45 | $3.5 | $95.00 | $92.4K | 1.8K | 97 |

| ENPH | CALL | SWEEP | BULLISH | 09/20/24 | $2.95 | $2.9 | $2.95 | $130.00 | $88.7K | 1.3K | 20 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENPH | 看跌 | 交易 | 中立 | 01/16/26 | $26.85 | $26.4 | $26.65 | $100.00。 | 1.5百万美元 | 1.0K | 0 |

| ENPH | 看跌 | SWEEP | 看好 | 07/26/24 | $24.85 | 22.5 | 22.5 | $119.00 | $225.0K | 143 | 0 |

| ENPH | 看跌 | SWEEP | 看好 | 01/17/25 | $13.2 | $13.1 | $13.1 | $90.00 | $110.0K | 1.6K | 0 |

| ENPH | 看跌 | SWEEP | 看淡 | 07/19/24 | $3.5 | $3.45 | $3.5 | $ 95.00 | $92.4K | 1.8K | 97 |

| ENPH | 看涨 | SWEEP | 看好 | 09/20/24 | $2.95应翻译为$2.95 | $2.9 | $2.95应翻译为$2.95 | $130.00 | $88.7K | 1.3K | 20 |

About Enphase Energy

关于Enphase能源化工

Enphase Energy is a global energy technology company. The company delivers smart, easy-to-use solutions that manage solar generation, storage, and communication on one platform. The company's microinverter technology primarily serves the rooftop solar market and produces a fully integrated solar-plus-storage solution. Geographically, it derives a majority of revenue from the United States.

Enphase能源化工是一家全球能源科技公司。该公司提供智能易用的解决方案,其中一站式管理太阳能发电、储能和通信。该公司的微逆变器技术主要服务于屋顶太阳能市场,并生产一种完全集成的太阳能+储能解决方案。地理上,它从美国获得了大部分收入。

Following our analysis of the options activities associated with Enphase Energy, we pivot to a closer look at the company's own performance.

在我们对Enphase Energy关联的期权活动进行分析后,我们将目光转向公司自身的表现。

Current Position of Enphase Energy

Enphase Energy目前的位置

- Trading volume stands at 2,345,133, with ENPH's price down by -0.77%, positioned at $96.51.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 23 days.

- 交易量为2,345,133,ENPH的价格下跌了-0.77%,位于96.51美元。

- RSI指标显示该股票可能已被超卖。

- 预计23天后公布收益报告。

What The Experts Say On Enphase Energy

关于Enphase Energy,专家的看法

3 market experts have recently issued ratings for this stock, with a consensus target price of $111.94.

最近有3名市场专家对该股票发表了评级,共识目标价为111.94美元。

- Showing optimism, an analyst from HSBC upgrades its rating to Buy with a revised price target of $166.

- In a cautious move, an analyst from GLJ Research downgraded its rating to Sell, setting a price target of $45.

- An analyst from JP Morgan has decided to maintain their Overweight rating on Enphase Energy, which currently sits at a price target of $124.

- 汇丰银行的分析师表现乐观,升级了其评级,将其修订后的价格目标上调至166美元。

- GLJ Research的分析师小心谨慎,将其评级下调为卖出,设置了45美元的价格目标。

- JP Morgan的分析师决定维持其Enphase Energy的超重评级,目前预设价格目标为124美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Enphase Energy with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供更高的盈利潜力。精明的交易者通过持续继续教育、策略性的交易调整、利用各种因子和保持对市场动态的关注来减轻这些风险。通过Benzinga Pro保持对Enphase Energy最新期权交易的关注,获取实时提醒。