Snap's Options: A Look at What the Big Money Is Thinking

Snap's Options: A Look at What the Big Money Is Thinking

Financial giants have made a conspicuous bearish move on Snap. Our analysis of options history for Snap (NYSE:SNAP) revealed 11 unusual trades.

Snap的期权历史分析显示,金融巨头已经看淡了Snap。我们发现11笔飞凡交易。

Delving into the details, we found 36% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $1,186,776, and 6 were calls, valued at $243,805.

具体分析显示,36%的交易者看涨,54%的交易者看淡。我们发现了所有的交易中,5笔是认购期权,价值1,186,776美元,6笔是认沽期权,价值243,805美元。

Predicted Price Range

预测价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.0 to $30.0 for Snap during the past quarter.

分析这些合同的成交量和持仓量显示,过去一个季度内大户一直在密切关注Snap在12.0至30.0美元的价位窗口。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

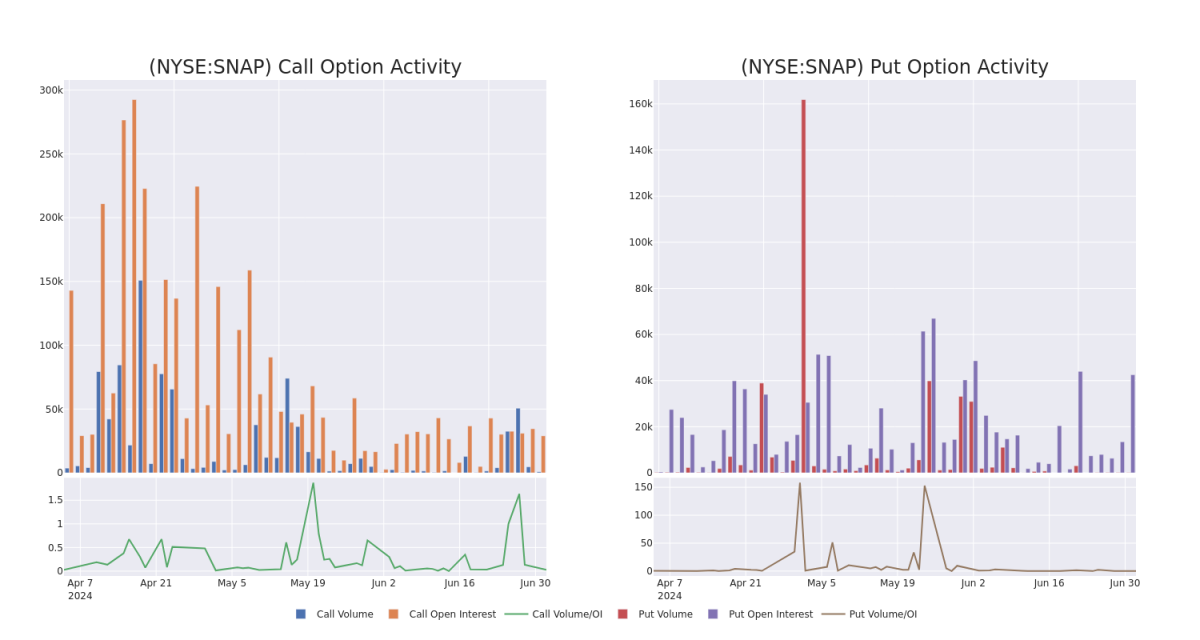

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Snap's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Snap's significant trades, within a strike price range of $12.0 to $30.0, over the past month.

检验成交量和持仓量为股票研究提供了关键的见解。这些信息在评估Snap在某些行权价下的期权流动性和利好程度时至关重要。下面,我们展示了过去一个月中Snap的看涨期权和看跌期权在12.0至30.0美元行权价范围内的成交和持仓趋势。

Snap Option Volume And Open Interest Over Last 30 Days

Snap选项的成交量和未平仓量在过去的30天内

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | PUT | TRADE | BEARISH | 01/16/26 | $2.22 | $2.15 | $2.21 | $12.00 | $884.0K | 5.1K | 46 |

| SNAP | PUT | SWEEP | BEARISH | 08/16/24 | $1.24 | $1.22 | $1.22 | $15.00 | $176.4K | 33.9K | 3 |

| SNAP | CALL | TRADE | BULLISH | 10/18/24 | $3.2 | $3.1 | $3.2 | $14.00 | $81.2K | 466 | 1 |

| SNAP | PUT | SWEEP | BULLISH | 07/26/24 | $0.65 | $0.57 | $0.57 | $14.00 | $57.6K | 446 | 0 |

| SNAP | CALL | SWEEP | BEARISH | 06/20/25 | $1.13 | $1.06 | $1.08 | $30.00 | $41.0K | 6.6K | 99 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | 看跌 | 交易 | 看淡 | 01/16/26 | $2.22 | $2.15 | $2.21 | 12.00美元 | $884.0K | 5.1K | 46 |

| SNAP | 看跌 | SWEEP | 看淡 | 08/16/24 | $1.24 | $1.22 | $1.22 | 15.00美元 | $176.4K | 33,900 | 3 |

| SNAP | 看涨 | 交易 | 看好 | 10/18/24 | $3.2 | $3.1 | $3.2 | $14.00 | $81.2K | 466 | 1 |

| SNAP | 看跌 | SWEEP | 看好 | 07/26/24 | $0.65 | $0.57 | $0.57 | $14.00 | $57.6K | 446 | 0 |

| SNAP | 看涨 | SWEEP | 看淡 | 06/20/25 | $1.13 | 1.06美元 | $1.08 | $30.00 | $41.0K | 6,600份 | 99 |

About Snap

关于Snap

Snap owns one of the most popular social networking apps, Snapchat, claiming more than 400 million daily active users as of the end of 2023. Snap generates nearly all its revenue from advertising. While only about one quarter of users are in North America, the region accounts for about 65% of sales.

Snap拥有最受欢迎的社交网络应用程序之一Snapchat,在2023年底拥有超过4亿日活跃用户。Snap几乎所有的收入都来自广告。尽管只有大约四分之一的用户在北美,但该地区占销售额的约65%。

Following our analysis of the options activities associated with Snap, we pivot to a closer look at the company's own performance.

在分析了Snap的期权活动后,我们将转而更详细地观察公司的表现。

Where Is Snap Standing Right Now?

Snap目前所处的地位在哪里?

- Currently trading with a volume of 7,262,704, the SNAP's price is up by 1.97%, now at $16.34.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 21 days.

- 目前Snap交易量为7,262,704,股价上涨1.97%,目前为16.34美元。

- RSI读数表明该股目前可能接近超买水平。

- 预计财报发布在21天内。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Snap with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高的利润潜力。精明的交易者通过持续的教育、战略性的交易调整、利用各种因子以及保持市场动态的关注来降低这些风险。通过Benzinga Pro获取Snap的最新期权交易,获得实时提示。