Unpacking the Latest Options Trading Trends in McDonald's

Unpacking the Latest Options Trading Trends in McDonald's

Financial giants have made a conspicuous bullish move on McDonald's. Our analysis of options history for McDonald's (NYSE:MCD) revealed 18 unusual trades.

金融巨头们对麦当劳采取了明显的看好策略。我们对麦当劳 (NYSE:MCD) 期权历史分析发现了18次异常交易。

Delving into the details, we found 38% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $257,540, and 11 were calls, valued at $618,338.

深入研究后我们发现,有38%的交易员看涨,而33%的交易员看跌。我们发现的所有交易中,有7次看跌交易,价值为$257,540,还有11次看涨交易,价值为$618,338。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $200.0 to $300.0 for McDonald's during the past quarter.

分析这些合同的成交量和未平仓量,似乎这些大手在过去一个季度一直在关注麦当劳的价格区间从$200.0到$300.0。

Volume & Open Interest Trends

成交量和未平仓量趋势

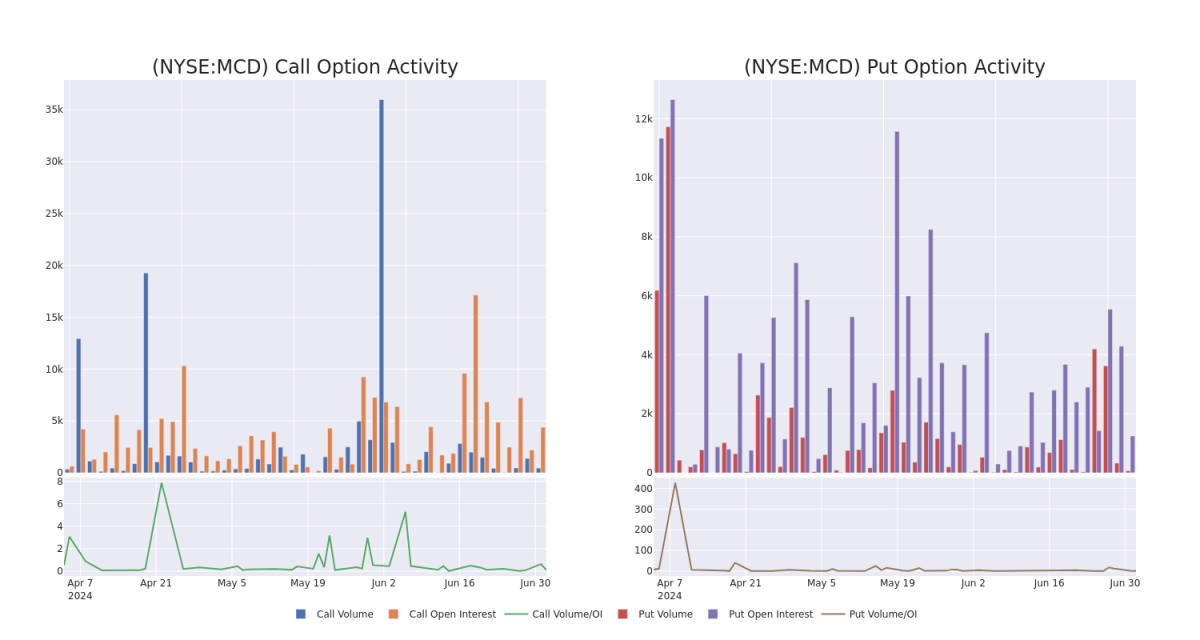

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for McDonald's's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across McDonald's's significant trades, within a strike price range of $200.0 to $300.0, over the past month.

检查成交量和未平仓量可以为股票研究提供关键见解。这些信息对于观察麦当劳的期权在某些执行价格处的流动性和兴趣水平至关重要。以下是我们对过去一个月内麦当劳重要交易在执行价格区间$200.0到$300.0,看跌和看涨期权的成交量和未平仓量趋势的快照。

McDonald's 30-Day Option Volume & Interest Snapshot

麦当劳30天期权成交量与利益快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MCD | CALL | SWEEP | BULLISH | 12/20/24 | $11.6 | $11.45 | $11.59 | $255.00 | $151.9K | 706 | 26 |

| MCD | CALL | SWEEP | BEARISH | 01/16/26 | $34.95 | $33.05 | $33.5 | $240.00 | $147.2K | 161 | 2 |

| MCD | CALL | SWEEP | BULLISH | 01/17/25 | $1.64 | $1.56 | $1.64 | $300.00 | $82.0K | 2.6K | 59 |

| MCD | PUT | SWEEP | BULLISH | 12/20/24 | $32.45 | $31.1 | $31.1 | $280.00 | $55.9K | 55 | 0 |

| MCD | PUT | SWEEP | NEUTRAL | 01/17/25 | $10.55 | $10.3 | $10.55 | $245.00 | $48.5K | 540 | 66 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 麦当劳 | 看涨 | SWEEP | 看好 | 12/20/24 | $11.6 | $11.45 | $11.59 | $255.00 | $151.9K | 706 | 26 |

| 麦当劳 | 看涨 | SWEEP | 看淡 | 01/16/26 | $34.95 | $33.05 | $33.5 | $240.00 | $147.2K | 161 | 2 |

| 麦当劳 | 看涨 | SWEEP | 看好 | 01/17/25 | $1.64 | 1.56美元 | $1.64 | $ 300.00 | $82.0K | 2.6K | 59 |

| 麦当劳 | 看跌 | SWEEP | 看好 | 12/20/24 | $32.45 | $31.1 | $31.1 | $280.00 | $55.9K | 55 | 0 |

| 麦当劳 | 看跌 | SWEEP | 中立 | 01/17/25 | $10.55 | $10.3 | $10.55 | 245.00美元 | $48.5K | 540 | 66 |

About McDonald's

关于麦当劳

McDonald's is the largest restaurant owner-operator in the world, with 2023 system sales of $130 billion across nearly than 42,000 stores and 115 markets. McDonald's pioneered the franchise model, building its footprint through partnerships with independent restaurant franchisees and master franchise partners around the globe. The firm earns roughly 60% of its revenue from franchise royalty fees and lease payments, with most of the remainder coming from company-operated stores across its three core segments: the United States, internationally operated markets, and international developmental/licensed markets.

麦当劳是世界上最大的餐厅所有者和经营者,在近42,000家店铺和115个市场实现了2023年的1300亿美元的系统销售。麦当劳开创了特许经营模式,通过与全球各地的独立餐厅特许加盟商和总特许加盟商的合作建立了自己的业务范围。该公司大约60%的营业收入来自特许经营费用和租赁付款,其余的大部分来自其三个核心业务领域:美国、国际经营市场和国际开发/许可市场中的公司经营店铺。

Having examined the options trading patterns of McDonald's, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了麦当劳的期权交易模式后,我们的注意力现在直接转向公司。这种转变让我们深入探讨其目前的市场地位和业绩。

Where Is McDonald's Standing Right Now?

麦当劳现在的立场在哪里?

- Currently trading with a volume of 1,898,161, the MCD's price is down by -0.61%, now at $248.47.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 27 days.

- 目前交易量为1,898,161,麦当劳的股价下跌了-0.61%,现在为$248.47。

- RSI读数表明该股票目前可能被超卖。

- 预期的盈利发布还有27天。

Expert Opinions on McDonald's

麦当劳的专家意见

In the last month, 4 experts released ratings on this stock with an average target price of $293.25.

在过去一个月中,有4位专家对这支股票发表了评级,平均目标价为$293.25。

- An analyst from Goldman Sachs has revised its rating downward to Neutral, adjusting the price target to $288.

- An analyst from Guggenheim has decided to maintain their Buy rating on McDonald's, which currently sits at a price target of $280.

- Reflecting concerns, an analyst from TD Cowen lowers its rating to Buy with a new price target of $305.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for McDonald's, targeting a price of $300.

- 高盛分析师将评级下调至中立,将目标价调整为288美元。

- 高盛的一位分析师决定维持对麦当劳的买入评级,目前的目标价为$280。

- 出于担忧,TD科温(TD Cowen)的分析师将该公司的评级降为买入,并设立了一个新的目标价为305美元。

- 摩根大通的一位分析师继续持有麦当劳的超配评级,目标价为$300。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。