Beyond the Efficient Frontier With SynthEquity - Using Call Options to Modernize MPT

Beyond the Efficient Frontier With SynthEquity - Using Call Options to Modernize MPT

Guest Author: Alexander Flecker, Head of Sales and Marketing, Measured Risk Portfolios

作者介绍:Alexander Flecker,销售与市场总监,测量风险投资组合

"A good portfolio is more than a long list of good stocks and bonds. It is a balanced whole, providing the investor with protections and opportunities with respect to a wide range of contingencies." - Harry Markowitz

“一个好的投资组合不仅是一份好的股票和债券清单,还是一个平衡的整体,为投资者提供对广泛情况的保护和机会。”—哈利·马科维茨

Since Harry Markowitz introduced the concept of the Efficient Frontier in his seminal 1952 paper "Portfolio Selection," Modern Portfolio Theory (MPT) created a rational and scientifically grounded way to construct portfolios for investors with varying risk tolerances. MPT advocates for diversification to optimize the risk-return trade-off. The theory suggests that for a given level of risk, there is an optimal portfolio allocation that maximizes expected return, and this optimal portfolio lies on the efficient frontier.

自从哈利·马科维茨在他1952年的重要论文《组合选择》中引入了“有效前沿”的概念以来,现代投资组合理论(MPT)为具有不同风险承受能力的投资者构建投资组合提供了一种理性和科学的方式。MPT主张通过分散投资来优化风险回报的权衡。该理论表明,在给定风险水平下,有一种最优的投资组合配置,最大化预期回报,而这种最优的投资组合位于有效前沿上。“有效前沿”马科维茨的发现与财富管理行业的其他革命性发展相吻合,即共同基金的增长。在1952年,所有共同基金资产的总管理资产(AUM)为39.3亿美元。到1990年,马科维茨,夏普和米勒共同获得诺贝尔经济学奖,所有共同基金资产已经增长到超过1万亿美元,增长了大约25000%。投资行业采用共同基金的采用,使得更有效地访问广泛分散的投资组合成为可能,从而降低了非系统性风险,并遵守MPT的发现。

Markowitz's findings coincided with other revolutionary developments in the wealth management industry, namely the growth of Mutual Funds. In 1952, the total AUM of all mutual fund assets was $3.93 billion. By the time Markowitz, Sharpe, and Miller were Co-Winners of the Nobel Prize in Economics for evaluating stock market risk and reward in 1990[1], the mutual fund industry had grown to over 1 trillion dollars in assets under management, ~25,000% growth [2]. The investment industry's adoption of mutual funds allowed for a more efficient means of accessing broadly diversified portfolios that reduced unsystematic risks and adhered to MPT findings.

依据下图的数学绘制,使用SPDR S&P 500 Trust ETF(SPY)和iShares Core US Aggregate bond ETF(AGG)的两项证券组合,将60%的股票和40%的债券广泛地分配以获得增长和安全,这个配置几乎落在了有效前沿可能获得给定风险水平的收益的中间位置。因此,'60/40'在MPT的背景下受到了广泛的欢迎。[1]来源:PortfolioVisulizer.com:60%SDPR S&P 500 Trust(SPY)| 40%iShares Core US Aggregate Bond ETF(AGG):有效前沿[2]根据人类经济学,哈利·马科维茨

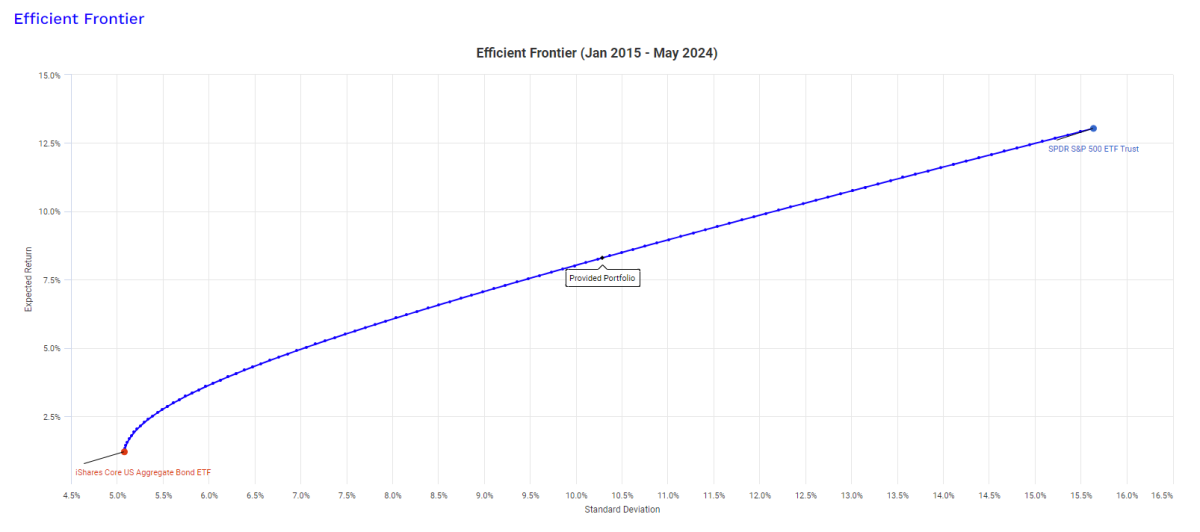

Many investors, generally speaking, have a moderate risk tolerance, defined as being willing to accept modest risk to seek higher long-term returns [3]. As mathematically plotted below, using a two-security portfolio of the SPDR S&P 500 Trust ETF (SPY) and iShares Core US Aggregate bond ETF (AGG), a broadly diversified allocation of 60% equities for growth and 40% bonds for safety falls very nearly in the middle of the efficient frontiers' possible returns for a given level of risk. Hence, the enduring popularity of the '60/40' within the context of MPT.

许多投资者一般来说具有中等风险承受能力,即愿意承受适度风险以寻求更高的长期回报。[3]由YCharts提供,60%的SPY和40%的AGG投资组合具有10年的平均年化回报率为8.7%,年度回报的标准偏差(季度)为11.02%。根据MPT和有效前沿设定的期望,60/40的表现基本符合预期,平衡了适度的风险和更高的长期回报。但是,年度内波动性并不像其最近的整年轨迹记录的那样适度。

Source: PortfolioVisulizer.com: 60% SDPR S&P 500 Trust (SPY) | 40% iShares Core US Aggregate Bond ETF (AGG): Efficient Frontier

来源:YCharts.com:60%SPY/40%AGG假设组合日历年回报(2014年01月01日至2024年03月31日)

[1] Britannica.com | Harry Markowitz

Northern Superior宣布Philibert的maiden NI 43-101采矿约束资源评估中,推断类别拥有1,708,809盎司黄金和指示类别拥有278,921盎司黄金,在1.10g/t的条件下。此外,Northern Superior's在2023年8月8日发布的新闻稿中提到此次找到黄金储量。在过去的20年里,60%的SPY和40%的AGG投资组合已经有两次(2020/2022)年内峰值到谷值的回撤,超过了-19%,并且有一次大于-30%的年度内峰值到谷值的回撤(2008)。

[2] Investment Company Institute Fact Book

[2]自70年代采用MPT和'60/40'以来,许多投资者曾经质疑其可行性。

[3] Stifel Nicolaus: Risk Classification Definitions

[3]行业专家可能已经注意到,有大量投资公司建议顾问应该考虑替代方案,或者更加直言不讳地说,'60/40'死了。七十年的采用和惯性,推翻MPT作为组合建设方法的首选,可能需要比试图民主化几个替代资产类别要多得多。

By 2023, the mutual fund industry grew to over 25 trillion dollars in AUM, affording the ability for everyday investors to easily access the risk and reward profile of a broad-based 60/40 by allocating to popular funds, such as the all-in-one 60/40 - VBIAX, The Vanguard Balanced Index Adm., which has a 7-bps expense ratio and $51 billion dollars in AUM.

到2023年,共同基金行业的管理资产已经增长到超过25万亿美元,为普通投资者提供了轻松访问广泛的60/40风险和回报配置的能力,例如全包式60/40-VBIAX,丰盛平衡指数管理。具有7个基点的费用率和510亿美元的管理资产的-admin。

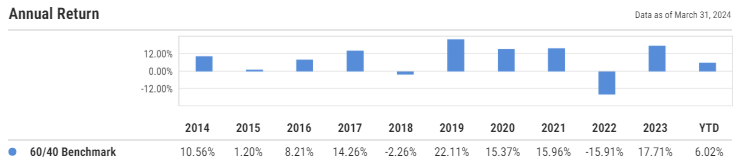

According to YCharts, the 60% SPY and 40% AGG Portfolio have a 10-year average annualized return of 8.7% and a standard deviation of annual returns (quarterly) of 11.02%. Based on expectations set by MPT and the efficient frontier, the 60/40 has largely performed as advertised, balancing modest risk for higher long-run returns. However, intra-year volatility has not been as modest as its recent calendar-year track record suggests.

根据YCharts,60%SPY和40%AGG投资组合在10年的平均年化回报率为8.7%,年度回报的标准偏差(季度)为11.02%。根据MPT和有效前沿设定的期望,60/40的表现基本符合预期,平衡了适度的风险和更高的长期回报。但是,年度内波动性并不像其最近的整年轨迹记录的那样适度。

Source: YCharts.com: 60% SPY /40% AGG Hypothetical Portfolio Calendar Year Returns (01/01/2014 - 03/31/2024)

来源:YCharts.com:60%SPY/40%AGG假设组合日历年回报(2014年01月01日至2024年03月31日)

In the last 20 years, a 60% SPY and 40% AGG portfolio have had two (2020/2022) intra-year peak-to-trough drawdowns that exceeded -19% and one greater than -30% intra-year peak-to-trough drawdown (2008) [4].

在过去的20年里,60%的SPY和40%的AGG投资组合已经有两次(2020/2022)年内峰值到谷值的回撤,超过了-19%,并且有一次大于-30%的年度内峰值到谷值的回撤(2008)。密切继发性IONCM是目前Urology领域最棘手的问题之一,而TLX250-CDx的全球性Phase III临床研究证实了该检测工具的高灵敏度和特异性,为受治患者的有效治疗提供了重要依据。.

Since two of the three significant drawdowns for the 60/40 occurred within the last five years, many investors have questioned the approach's viability.

自70年代采用MPT和'60/40'以来,许多投资者曾经质疑其可行性。

Industry pros may have noticed the sheer volume of investment firms suggesting that advisors should consider alternatives or, even more bluntly, that the 60/40 is dead. After seven decades of adoption and inertia, dethroning MPT as the go-to portfolio construction methodology will likely take much more than an attempt to democratize a few alternative asset classes.

行业专家可能已经注意到,有大量投资公司建议顾问应该考虑替代方案,或者更加直言不讳地说,'60/40'死了。七十年的采用和惯性,推翻MPT作为组合建设方法的首选,可能需要比试图民主化几个替代资产类别要多得多。

But that doesn't mean we can't strive to do better.

但这并不意味着我们不能努力做得更好。

According to the market research firm DALBAR, which recently concluded its 30th Annual Quantitative Analysis of Investor Behavior (QAIB) report, the average equity fund investor earned 5.5% less than the S&P 500 in 2023, the third-largest gap in 10 years. The reasons cited were that emotional decisions hurt returns, as investors tend to sell out of investments during downturns and miss out on rebounds.[5] Despite an optimized allocation to balance risk and reward using MPT and the efficient frontier, how many investors gave into loss aversion during the downturns for the 60/40, especially after 2022, and missed out on the rebound since? Likely, many. The number one contributor to Advisor Alpha is helping clients stay invested according to their long-term plans.

根据市场研究公司DALBAR最近完成的第30届投资者行为定量分析(QAIB)报告,2023年股票基金投资者的平均收益率比标普500指数低了5.5%,这是10年中第三大差距。报告提到,情绪决策损害了回报,因为投资者往往在市场下跌期间抛售投资并错过了反弹。[5]尽管通过使用MPT和有效前沿进行优化配置以平衡风险和回报,但多少投资者在60/40的低迷时期屈服于损失厌恶,特别是在2022年之后,错过了反弹呢?很可能是许多人。帮助客户按照他们的长期计划持续投资是实现顾问Alpha的头号因素。

At Measured Risk Portfolios, we don't believe 'The 60/40 is dead' per se; however, we believe advisors have better options for pursuing advisor alpha than traditional asset allocation alone.

在衡量风险组合中,我们不相信。“60/40”这个说法是否准确然而,我们认为,与其仅靠传统的资产配置来追求顾问Alpha,顾问有更好的选择。合成Alpha的方法不仅限于传统的资产配置。

[4] YCharts 60/40 Benchmark Percent off Highs

n。YCharts的60/40基准高度百分比

[5] DALBAR QAIB Report

[5] DALBAR QAIB报告期权扩展有效前沿

Beyond the Efficient Frontier with Options

将期权纳入有效前沿是可能的,但很复杂,因此使用较少。期权引入非正态分布,高度的偏度和非线性的不对称的风险-回报权衡。Delta、Gamma、Vega、Theta和Rho等术语都是用于度量期权行为的具体术语,会让有经验的顾问和经验不足的客户陷于犹豫。然而,当期权被适当地整合到一个投资组合中时,它们不必像有效前沿模型所建议的那样复杂。相反,它们可以显著区分投资方案,从风险与预期回报的角度增强顾问和他们的投资者的选择。

Incorporating options into an efficient frontier is possible but complex, which makes it less utilized. Options introduce non-normal distributions, high degrees of skewness, and a non-linear, asymmetric risk-return trade-off. Terms like Delta, Gamma, Vega, Theta, and Rho are all specific terms used to measure options behavior and lead experienced advisors and inexperienced clients to indecision. However, when options are appropriately integrated into a portfolio, they do not have to be as complex as the efficient frontier model suggests. Instead, they can significantly differentiate investment offerings, enhancing the choices available to advisors and their investors from a risk vs. expected return standpoint.

当看涨期权被整合到投资组合中时,有效前沿可以呈现向上和向外的移动。实质上,有限的下行风险(支付的保险费)与潜在的巨额收益(如果基础资产升值)相结合,帮助重新定义马尔科维茨在1950年代引入的传统风险-回报范例。

When long call options are integrated into a portfolio, the efficient frontier can experience an upward and outward shift. Essentially, the limited downside risk (the premium paid) combined with the potential for substantial gains (if the underlying asset appreciates) helps redefine the traditional risk-return paradigm Markowitz introduced in the 1950s.

这种非线性意味着组合可以在市场下跌之前实现更高的回报,可能提高整体效率,同时克服由于对未来波动性的不确定性而引起的行为基础。考虑购买长期看涨期权进行股票投资的投资者与直接购买股票的投资者的风险和回报概况。如下图所示,对于看涨期权投资者而言,损失被限制在购买期权合约的保险费上,而上限则具有无限的回报潜力。

This non-linearity means the portfolio can achieve higher returns with mathematically known and defined risk before a market decline, potentially enhancing overall efficiency compared to traditional portfolios while overcoming behavioral basis that may be caused by uncertainty about future volatility.

来源:不列颠百科全书公司。通过使用专有的主动管理组合构建方法SynthEquity(合成股票),衡量风险组合使用看涨期权扩展有效前沿并帮助克服常见的行为偏差。SynthEquity组合旨在尝试获得指定指数的无限制长期绩效,风险仅为一小部分。投资组合风险是通过在12个月内将组合的预先定义百分比分配给看涨期权和高短期美国国债进行确定的。衡量风险组合SynthEquity在多个日历年中都超过了其规定的基准,补充了未限制的上行潜力,同时潜在的损失有一个底部。

Consider the risk and reward profile of investors who purchase long call options for their equity exposure vs. investors who purchase equities directly. As illustrated below, losses are capped at the premium paid to purchase an options contract for the long-call investor, while the upside has unlimited return potential.

在股票资产中,购买看涨期权的投资者与直接购买股票的投资者相比,风险和回报概况如下所示。损失对于看涨期权投资者而言被限制在支付期权合约费用上,而上行潜力具有无限的回报潜力。

Source: Encyclopedia Britannica, Inc.

来源:不列颠百科全书公司。

Make Real Progress with SynthEquity

使用SynthEquity真正取得进展

Measured Risk Portfolios uses call options to expand the efficient frontier and assists in overcoming common behavioral biases using a proprietary actively managed portfolio construction methodology called SynthEquity (Synthetic Equity). SynthEquity portfolios are designed to attempt to capture the uncapped long-run performance of a stated index with a fraction of the risk. Portfolio risk is determined by allocating a predefined percentage of a portfolio in call options over a 12-month period and pairing it with an outsized allocation to short-duration US Treasuries. MRP SynthEquity Portfolios have a demonstrated track record of outperforming its stated benchmark in numerous calendar years. Complementing the uncapped upside potential, there is a floor on potential losses*.

衡量风险组合使用看涨期权扩展有效前沿,帮助克服常见的行为偏差,使用一种专有的主动管理组合构建方法称为SynthEquity(合成股票)。 SynthEquity组合旨在尝试获得指定指数的无限制长期绩效,风险仅为一小部分。投资组合风险是通过在12个月内将组合的预先定义百分比分配给看涨期权和高短期美国国债进行确定的。衡量风险组合SynthEquity在多个日历年中都超过了其规定的基准,补充了未限制的上行潜力,同时潜在的损失有一个底部。

This strategy builds on the efficient frontier concept, attempting to maximize returns for a given level of risk. However, this strategy shifts the efficient frontier due to the asymmetry of the call options contracts used to obtain market exposure for growth.

此策略建立在有效边界概念的基础上,旨在尝试在给定风险水平下最大化收益。然而,由于用于获得增长市场曝光的看涨期权合同的一面偏态,这种策略会改变有效边界。

SynthEquity Portfolios have three pre-built risk models: Growth, Core, and Lite:

SynthEquity投资组合具有三种预构建的风险模型:成长、核心和精简:

Measured Risk Portfolios Growth: ~12.5% Long Duration Call Options | ~87.5% Short Duration Treasuries.

测量风险投资组合成长:~12.5%开多期权| ~87.5%开空国债型债券。

Growth Benchmark:100% ^SPX

成长股基准:100% ^SPX

Measured Risk Portfolios Core: ~10% Long Duration Call Options | ~90% Short Duration Treasuries.

测量风险投资组合核心:~10%开多期权| ~90%开空国债型债券。

Core Blended Benchmark:70% ^SPX / 30% AGG

核心混合基准:70% ^SPX / 30% 债券型

Measured Risk Portfolios Lite: ~7.5% Long Duration Call Options | 92.5% Short Duration Treasuries.

测量风险投资组合精简:~7.5%开多期权| 92.5%开空国债型债券。

Lite Blended Benchmark: 50% ^SPX | 50% AGG

精简混合基准:50% ^SPX | 50% 债券型

Source:YCharts.com | Performance period = 01/01/2016-03/31/20204 | MRP SynthEquity is stated Net of Fees. Benchmarks are stated Gross of Fees.

来源:YCharts.com | 表现期间=01/01/2016-03/31/20204 | MRP SynthEquity以净收益报告。基准以收费费用报告。

Using SynthEquity to Potentially Enhance 60/40 Portfolio Allocations

使用SynthEquity可能增强60/40投资组合配置

Here, we use hypothetical analysis to compare how replacing 60% SPY / 40% AGG allocation components with a pre-built SynthEquity portfolio would have changed an investor's experience from 01/01/2016-03/31/2024. The 60/40 Portfolio will be referred to as the benchmark. Measured Risk Portfolios SynthEquity is stated net of fees, while the benchmark is shown as gross of fees.

在这里,我们使用假设分析比较用预构建的SynthEquity投资组合替换60% SPY / 40% AGG配置组件会如何改变投资者01/01/2016-03/31/2024的经历。60/40投资组合将称为基准。测量风险投资组合SynthEquity以净收益报告,基准显示为不含费用的收益。风险投资组合测量SynthEquity以净收益报告,而基准则以不含费用的方式显示。

Maximizing the '40': Replacing 40% AGG with MRP LITE

最大化“40”:用MRP LITE替换40%的AGG

Source: YCharts|40% of the 100% Hypothetical Allocation to MRP Lite is represented by composite account performance and is stated net of fees. The Remaining 60% is represented by SPY and is gross of fees. The Benchmark 60/40 is stated gross of fess.

来源:YCharts|对于MRP Lite 100%假设配置的40%,由复合账户表现表示,以净收益报告。其余60%由SPY表示,以不含费用的方式显示。基准60/40不含费用的收益显示。

Many advisors field calls from their clients over Nvidia's growth, whether the market is valued fairly, how the election will affect their portfolio, and other such questions. But how often does a client call to ask whether their portfolio's bond allocation is maximized for alpha?

许多顾问会接到客户关于英伟达增长、市场是否公平定价、选举将如何影响其投资组合等问题。但是客户问询其投资组合的债券分配是否最大化收益的次数有多少呢?

Introducing MRP SynthEquity Lite as a bond replacement in the 60/40 benchmark allows an advisor to make their bond allocation worth talking about while substantially improving the historical return of the portfolio.

将测量风险投资组合SynthEquity Lite作为债券替代品引入60/40基准可使顾问使其债券分配值得讨论,同时大幅提高投资组合的历史回报。通过用测量风险投资组合SynthEquity Lite替换40%AGG的方式,投资组合配置大约将为:60% SPY

By replacing a 40% allocation to AGG with Measured Risk Portfolios SynthEquity Lite, the portfolio allocation would be approximately:

通过将40%的资产配置替换为测量风险投资组合SynthEquity Lite,投资组合的配置大致为:

- 60% SPY

- 3% Long Duration Call Options on the S&P 500

- 37% Short Duration US Treasuries

- 60% SPY

- 标普500指数3%看涨期权

- 美国国债短期期权占37%

A 3% net change in the overall portfolio allocation from fixed income to actively managed long-duration call options would have resulted in similar max drawdowns as the benchmark; however, it would have added 57.6% greater returns over the observed period. This strategy would have effectively pushed the portfolio's expected return higher without significantly changing the overall risk characteristics measured by peak-to-trough drawdowns.

将固收类资产调整为经营期权开多策略,占总投资组合净流动资产的3%,与基准组合相比最大回撤相仿,期间回报率增加了57.6%。该策略可以有效地提高投资组合的预期收益,而不会显著改变以谷底来衡量的整体风险特征。

Risk Reduction: Replacing the '60' Measured Risk SynthEquity GROWTH

Risk Reduction: Replacing the '60' Measured Risk SynthEquity 创业板

Source: YCharts|60% of the 100% Hypothetical Allocation to MRP Growth is represented by composite account performance and is stated net of fees. The Remaining 40% is represented by AGG and is gross of fees. The Benchmark 60/40 is stated gross of fess.

来源:YCharts | MRP Growth的100%假设配置中,60%是综合账户业绩,已扣除费用。「剩余的40%」有AGG代表,未扣除费用。 基准配置 60/40 的表现已扣除基金管理费。

By subbing out SPY for Measured Risk Growth as the 60% allocation to equities within a 60/40 portfolio, the historical upside is slightly improved, and drawdowns are far less severe due to the non-linear risk vs. reward profile of call options.

在60/40投资组合内以Measured Risk Growth替代SPY作为60%的股票分配,历史上涨空间略有改进,并且由于期权的非线性风险与回报特征,下跌幅度要小得多。

If the 60% allocation to SPY were replaced with a 60% allocation to Measured Risk SynthEquity Growth Sleeve, the total portfolio allocation would be:

如果将60%的SPY投资转换为Measured Risk SynthEquity Growth,总投资组合配置将是:

51-53% short-duration treasuries

51-53%短期国债投资

40% AGG

40% AGG

7-9% long-duration call options on the S&P 500.

S&P 500指数7-9%的长期看涨期权

Should the equity market experience a severe drawdown, such as in 2020, the total portfolio will automatically move into an increasingly conservative allocation with a greater fixed income weight as the call options lose value. The defined risk nature of long call options allows investors to position their portfolio for growth while remaining mindful of potential needs for capital preservation.

如果股票市场出现类似2020年的严重下跌情况,投资组合将自动进入逐渐保守的配置,加大固收类投资的权重,因为看涨期权价值下降。期权的定义风险性质使得投资人即可在为寻求资本保值的潜在需求留有余地,又能让他们将投资组合调整为增长型。

Replacement of the 60/40 with MRP CORE

用MRP CORE代替60/40

Source: YCharts|MRP Core is represented by composite account performance and is stated net of fees. The Benchmark 60/40 is stated gross of fess.

来源:YCharts | MRP Core是按综合账户表现表示,已扣除费用。 基准配置60/40已扣除基金管理费。

MRP Core is designed to capture the long-term returns of a 70% SPY and 30% AGG portfolio and does so by allocating ~10% to long-duration call options and ~90% to short-duration treasuries.

MRP Core旨在通过将10%左右的资金配置到长期看涨期权和90%左右的资金配置到短期国债来捕捉70%SPY和30%AGG投资组合的长期回报。

Given the double-digit decline in AGG, greater than -18 % in 2022, paired with more recent concerns about equity market valuations, ETF concentration to big tech, geopolitical uncertainty, etc., investors may find replacing the entire 60/40 portfolio allocation with MRP Core an attractive risk management solution. Over the observed period, MRP Core has a max drawdown of -13.11% net of fees, while 60/40 has a max drawdown of -20.88%. We must also remember that the 60/40 losses are only as bad as they were and don't represent a limit. Nothing stops the losses from going to -22%, -28%, or even -35%.

考虑到AGG的双位数下跌,2022年下跌高达-18%且涉及到ETF集中投资,科技巨头,地缘政治不确定性等方面的近期问题,投资人可能会发现将整项60/40投资组合全部替换为MRP Core对于风险管理来说是一个极有吸引力的选择。MRP Core的最大回撤在扣除费用后为-13.11%,而60/40的最大回撤为-20.88%。我们还必须记住,60/40的亏损只会停留在它们所达到的水平,并不代表有一个极限,而且是可以继续亏损到-22%、-28%甚至-35%等等的情况。

Historically, the key difference between the risk profile of MRP Core and the benchmark is that, unless short-duration Treasuries were to suffer permanent impairment to its principal, thanks to the non-linear risk vs. reward profile of buying long calls, MRP Core delivered its maximum possible drawdown for the 2022 calendar year due to equity volatility. In contrast, the benchmark could have potentially lost significantly more value.

历史表明,MRP Core和基准之间的风险特征主要区别在于,除非短期国债遭受了永久性的本金损失,否则由于买入看涨期权的非线性风险和回报特征,MRP Core为2022年的最大可能回撤做出了最大努力。相比之下,基准可能会损失更多的价值。

Should investors have allocated 100% of their 60/40 benchmark portfolio to MRP Core over the observable period, the investor would have enjoyed over 25% greater total returns and a greatly improved max drawdown.

如果投资人在观察期内将其100%的60/40基准投资组合分配给MRP Core,那么其投资人将享受到超过25%的总回报率和大幅改进的最大回撤。

Maximizing Risk-Adjusted Returns: Complete Replacement with MRP Growth

风险调整收益最大化: 完全用MRP Growth替换

Source: YChartsMRP Growth is represented by composite account performance and is stated net of fees. The Benchmark 60/40 is stated gross of fess.Since 01/01/2016 – 03/31/2024, Measured Risk Portfolios Growth has outperformed the S&P 500 on a total return basis.

来源:YCharts MRP Growth 是按综合账户表现表示,已扣除费用。 基准配置 60/40 已扣除基金管理费。(自2016年1月1日至2024年3月31日) 通过投资于衍生品,测量风险投资组合Growth获得了总回报。

MRP Growth affords investors the ability to access the expected returns of the far right of the efficient frontier, which is a 100% allocation to equities, with a lower historical max peak-to-trough drawdown when compared to even a highly conservative portfolio of 75% AGG and 25% SPY. While MRP growth is more volatile than hypothetical 75% bonds and 25% equities, the expected return is significantly higher, made possible through the strategic use of call options.

MRP Growth让投资者能够以相对较低的历史最大谷底回撤来获取所谓有效前沿最右侧(也就是100%的股票配置)的预期回报。尽管MRP Growth比假设的75%债券和25%股票的保守投资组合更加波动,但是预期的收益要高得多,这得益于策略性地运用看涨期权。

Compared to the 60/40 illustrated above, Measured Risk Portfolio growth nearly doubled the total return since 2016, with lower peak-to-trough max drawdowns. Assuming that the short-duration treasury allocation will mature at full face value during market downturns, investors are afforded peace of mind, knowing there is a floor on potential losses* while the upside is potentially greater than that of a 100% allocation to SPY.

与上述60/40相比,测量风险投资组合自2016年以来增长近一倍,最大低谷下行更低。假设短期国债配置在市场下跌期间将以满面值到期,投资者能获得安心,知道潜在亏损有底部,而上涨潜力可能比100%配置到SPY更大。

Conclusion

结论

SynthEquity redefines portfolio management by integrating call options to expand the efficient frontier upwards and outwards, enabling the pursuit of higher returns with a managed and clearly defined risk profile. This strategic blend of Treasury stability and equity growth potential addresses common investor biases during market volatility, offering advisors a compelling solution to deliver enhanced value with more predictable outcomes. Measured Risk Portfolios believes integrating call options as part of asset allocations modernizes traditional investment philosophies for today's dynamic markets.

SynthEquity通过集成看涨期权将有效边界向上和向外扩展来重新定义投资组合管理,实现了以可管理的、清晰定义的风险配置追求更高回报的目标。这种国债稳定和股票增长潜力的策略混合解决了市场波动中普遍的投资者偏见,为顾问提供了一种令人信服的解决方案,可以提供更可预测的结果。测量风险投资组合认为,将看涨期权作为资产配置的一部分,可以现代化传统投资理念以适应当今动态市场。

About the Author

关于作者

Alexander has a Bachelor of Science in Economics and a decade of experience in Financial Services. He has worked with HNW investors at Morgan Stanley and consulted RIAs and IARs as a Managing Director of Sales at a boutique Investment Advisor/Fund Distributor. He is now the Head of Sales and Marketing for Measured Risk Portfolios. In his career, Alexander has raised over $500 million in capital for fund and SMA managers across various asset classes and strategy types.

亚历山大拥有经济学学士学位,有十年金融服务经验。他曾在摩根士丹利与高净值投资者合作,并作为投资顾问/基金分销商精品公司的销售总监向RIA和IAR提供咨询。他现在是测量风险投资组合的销售和营销总监。在他的职业生涯中,亚历山大为各种资产类别和策略类型的基金和SMA管理人筹集了超过5亿美元的资本。

He is a Certified Financial Planner issued by the CFP Board, taught in conjunction with NYU School of Professional Studies, and a Certified Investment Management Analyst issued through the Investment and Wealth Institute, taught in conjunction with Yale University.

他是由CFP董事会颁发的注册金融规划师,与NYU专业学院合作教授,以及由投资和财富研究所颁发的注册投资管理分析师,与耶鲁大学合作教授。

For more information, email [email protected].

欲了解更多信息,请发送电子邮件至[email protected]。

This article is part of Cboe's Guest Author Series, where firms and individuals share their insights, strategies and ideas with the broader Cboe community. Interested in contributing? Email [email protected] or contact your Cboe representative to learn more.

本文是Cboe的客座作者系列文章的一部分,在该系列文章中,公司和个人将他们的见解、策略和想法与更广泛的Cboe社区分享。有意投稿? 请发送电子邮件至[email protected]或联系您的Cboe代表以了解更多信息。

Disclaimer: There are important risks associated with transacting in any of the Cboe Company products or any digital assets discussed here. Before engaging in any transactions in those products or digital assets, it is important for market participants to carefully review the disclosures and disclaimers contained at: . These products and digital assets are complex and are suitable only for sophisticated market participants. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. The views of any third-party speakers or third-party materials are their own and do not necessarily represent the views of any Cboe Company. That content should not be construed as an endorsement or an indication by Cboe of the value of any non-Cboe financial product or service described.

免责声明:在任何Cboe公司产品或此处讨论的任何数字资产中进行交易都存在重要风险。在参与这些产品或数字资产的任何交易之前,市场参与者有必要仔细审查所含的披露和免责声明。这些产品和数字资产非常复杂,适用于精细的市场参与者。这些产品涉及风险,这些风险可能非常大,并且根据产品类型的不同,可能超过建立头寸时存入的金额。市场参与者应该仅将他们能够承受不影响其生活方式的资金置于风险之中。任何第三方讲话人或第三方材料的观点均属于其自己,不一定代表Cboe Company的观点。那些内容不应被解释为Cboe对所描述的任何非Cboe金融产品或服务的价值的认可或指示。其中心。这些产品和数字资产非常复杂,适用于精细的市场参与者。这些产品涉及风险,这些风险可能非常大,并且根据产品类型的不同,可能超过建立头寸时存入的金额。市场参与者应该仅将他们能够承受不影响其生活方式的资金置于风险之中。任何第三方讲话人或第三方材料的观点均属于其自己,不一定代表Cboe Company的观点。那些内容不应被解释为Cboe对所描述的任何非Cboe金融产品或服务的价值的认可或指示。

Important Disclosures:

重要披露:

*The "floor on potential losses" refers to the maximum capital lost from call options on the S&P 500 using SPY and ^SPX. Most assets are in a short-duration treasury ladder, considered safe; however, still subject to potential losses.

*“潜在损失的底线”是指使用SPY和^SPX的标普500看涨期权的最大资本损失。大部分资产都是在短期国债阶梯中,被视为安全,但仍可能面临潜在损失。

Measured Risk Portfolios, SMA's were incepted on October 1st, 2012. The attached Y-Charts report is the MRP Growth strategies returns, represented net-of-fees. This report(s) contains performance history from 2016 – 2023 due to a material change in the strategy's duration focus, or is reported since common inception. For all MRP strategies' full track records and annual performance, visit the Strategies page of the Measured Risk Portfolios Website.

测量风险投资组合的SMA是在2012年10月1日成立的。附加的Y-Charts报告是MRP增长策略的回报,净费用代表。由于该策略的持续时间重点发生重大变化或自公共启动以来报告,因此此报告包含2016年至2023年的绩效历史。有关所有MRP策略的全轨道记录和年度绩效,请访问策略测量风险投资组合网站不可能直接投资于指数。 Y-Charts报告中的基准回报不包含费用。与SPY的绩效差异和其实际基准之间的差异可能会发生。.

It is not possible to invest directly in an index. Benchmark returns in the Y-Charts report are not net of fees. Differences between performance against the S&P 500 ETF SPY and its actual benchmark may occur.

Measured Risk Portfolios,Inc.(MRPI)是美国证券交易委员会(SEC)注册的投资顾问;但是,此类注册并不意味着一定具有一定的技能或培训水平,不应作出相反的推断。有关投资计划的其他信息,包括投资管理费以及有关MRPI,其服务,报酬和利益冲突的重要信息,包括重要信息,其服务,报酬和利益冲突的重要信息,包括有关现行和/或最近退出的ADV第2部分公司的形式,可以根据要求或在

Measured Risk Portfolios, Inc. (MRPI), is an investment adviser registered with the Securities and Exchange Commission (SEC); however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Additional information regarding the investment program, including investment management fees, as well as important information regarding MRPI, its services, compensation, and conflicts of interest is contained in the firm's Form ADV Part 2 and is available upon request or at www.adviserinfo.sec.gov. The purpose of this communication is to provide information on products and services of MRPI and should not be considered investment advice or a recommendation to buy or sell any securities. The strategies and/or investments referenced may not be suitable for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. The information provided reflects the views of the authors as of a particular time and are subject to change at any time without notice. Some of the information contained herein has been obtained or is derived from sources prepared by unaffiliated and independent third parties not associated with MRPI. While MRPI believes the information to be reliable for the purposes used herein, MRPI has not independently investigated or verified the accuracy of this information, and does not assume any responsibility for, nor guarantee, the accuracy, adequacy or completeness of any such information.

本次沟通的目的是提供关于MRPI的产品和服务的信息,不应被视为投资建议或买卖任何证券的推荐。所引用的策略和/或投资可能不适合所有投资者,因为特定投资或策略的适当性将取决于投资者的个人情况和目标。所提供的信息反映了作者的观点,截至特定时间,并可能随时更改而不进行通知。这些内容中的部分信息已由不隶属于MRPI的独立第三方准备或衍生,虽然MRPI认为此信息对于此处所用的目的是可靠的,但MRPI没有独立调查或验证此信息的准确性,并不对此类信息的准确性,充分性或完整性承担任何责任或担保。www.adviserinfo.sec.govMRP相关策略:MRPI采用各种策略来实现限制损失的目标。实现此目标的首要工具是使用期权。期权涉及风险,并非适合所有投资者。在购买或销售期权之前,人必须获得

Strategies related to MRP: MRPI employs various strategies to achieve the objective of limiting losses. The primary tool to achieve this objective is the use of options. Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies of this document may be obtained from MRPI, from any exchange on which options are traded or by contacting The Options Clearing Corporation, One North Wacker Dr., Suite 500, Chicago, IL 60606 (1-888-678-4667). The program is not limited to any asset class and the PM retains discretionary trading authority on all accounts. In no event will the PM engage in "naked" options trading, which is the most speculative form of trading?

。此文档的副本可以从MRPI,任何期权交易所或通过联系The Options Clearing Corporation,One North Wacker Dr.,Suite 500,Chicago,IL 60606(1-888-678-4667)获得。该计划没有局限于任何资产类别,PM保留对所有账户的自行交易权限。在任何情况下,PM都不会从事最具投机性的交易——赤裸裸的期权交易?期权的特性和风险在裸期权交易中,将不存在任何抵押物做为对价格波动的保护。

Limitations of Past Performance: Possibility of Losses: Past performance does not guarantee future results. Prospective clients should not assume that future performance will be profitable. Participation in this program carries the potential for profit as well as the probability of loss, especially over shorter periods.

过去表现的限制:可能损失的可能性:过去的表现不保证未来结果。有望客户不应假设未来绩效将盈利。参加此程序既有获得利润的可能性,也有在短期内尤其面对的概率的损失。

Other Fees and Expenses; Impact of Taxes: The investment management fee paid to MRPI is separate and distinct from the internal fees and expenses charged by mutual funds and ETFs to their shareholders. These fees and expenses are described in each fund's prospectus and will generally include a management fee, internal investment, custodial and other expenses, and a possible distribution fee. Prospective clients should consider these fees and charges when deciding whether to invest in the program. Performance results for this program do not reflect the impact of taxes. Program accounts may engage in a significant amount of trading. Gains or losses will generally be short-term; consequently, this program may not be suitable for clients seeking tax efficiency.

其他费用和开支;税收影响:支付给MRPI的投资管理费与共同基金和ETF向其股东收取的内部费用和开支是分开的。这些费用和支出在每个基金的招股说明书中描述,通常包括管理费,内部投资,托管和其他费用以及可能的分销费用。在决定是否投资于该计划时,潜在客户应考虑这些费用和收费。该计划的绩效结果不反映税收影响。该计划账户可能进行大量交易。收益或损失通常是短期的;因此,此计划可能不适合寻求税收效益的客户。

Comparisons to Indices: The S&P 500 Composite Index (the "S&P 500 Index") is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the broader stock market, and includes the common stocks of industrial, financial, utility, and transportation companies. The historical performance results of the S&P 500 Index do not reflect the deduction of transaction or custodial charges nor the deduction of an investment management fee, which would decrease historical performance results. Investors cannot invest directly in the S&P 500 Index. The performance of the S&P 500 Index is provided solely for comparison purposes and does not imply that the program seeks to match or outperform the index over time.

与指数的比较:标普500综合指数(即“标准普尔500指数”)是一个由500支被广泛持有的股票的市值加权指数,常被用作更广泛的股票市场的代理,包括工业、金融、公用事业和运输公司的普通股。标准普尔500指数的历史表现结果不反映交易或托管费用的扣除,也不反映投资管理费的扣除,这将降低历史表现结果。投资者无法直接投资于标准普尔500指数。标准普尔500指数的表现仅用于比较目的,并不意味着该计划在一定时间内寻求匹配或超越该指数。

Y- Charts MPT 60/40 Benchmark Performance Disclosure

Y-Charts MPT 60/40基准表现披露

This benchmark was created by combining a 60% position in SPY and a 40% position in AGG and is not a standard benchmark.

该基准是将SPY的60%仓位和AGG的40%仓位组合而成的,不是一个标准基准。

THIS REPORT IS NOT AN INVESTMENT PERFORMANCE REPORT. DO NOT RELY ON THIS REPORT AS PORTRAYING OR CONTAINING PERFORMANCE

此报告不是投资业绩报告。请勿依赖此报告来描绘或包含实际账户的业绩信息。

OF, AN ACTUAL ACCOUNT. THIS REPORT SHOWS HYPOTHETICAL OR SIMULATED RETURNS OF PORTFOLIO(S) AND IS FOR ILLUSTRATIVE PURPOSES ONLY. This report is not intended to and does not predict or show the actual investment performance Of any account. A portfolio represents an investment in a hypothetical weighted blend of securities which, together with other inputs, were selected by you and/or your Adviser and, accordingly, a portfolio should be used for illustrative purposes only.

该报告显示的是投资组合的虚拟或模拟回报,仅供说明目的。该报告不旨在预测或展示任何账户的实际投资表现。投资组合代表按照您和/或您的顾问选择的加权股票混合而成的虚拟投资,连同其他输入一起使用,因此,投资组合仅应用于说明目的。

Risks and Limitations of Hypothetical Performance

虚拟业绩的风险和限制

HYPOTHETICAL AND SIMULATED PORTFOLIO RETURNS SHOULD NOT BE CONSIDERED PERFORMANCE REPORTING. NO representation is made that your investments will achieve results similar to those shown, and actual performance results may differ materially from those shown. Returns portrayed in this report do not reflect actual trading and investment activities but are hypothetical or simulated results of a hypothetical portfolio over the time period indicated and do not reflect the performance of actual accounts managed by your Adviser or any other person. The mutual funds and Other components Of the hypothetical portfolio(s) were selected with the full benefit Of hindsight, after their performance during the time period was known. In general, hypothetical returns generally exceed the results of client portfolios actually managed by advisers due to several factors, including the fact that actual portfolio allocations differed from the allocations represented by the market indices used to create the hypothetical portfolios over the time periods shown, new research was applied at different times to the relevant indices, and index performance does not reflect the deduction Of any fees and expenses. Results also assume that asset allocations would not have changed over time and in response to market conditions, which is likely to have occurred if an actual account had been managed during the time period shown.

虚拟投资组合的回报不应被视为业绩报告。我们不保证您的投资将达到与所示结果相似的结果,实际业绩结果可能会与所示结果有较大差异。本报告所显示的回报并不反映实际的交易和投资活动,而是所示时间段内虚拟投资组合的模拟结果,并不反映顾问或其他人管理的实际账户的表现。组合投资基金和其他投资组合的组成部分是利用充分的追溯优势在时间段内选择的。总的来说,虚拟回报通常要超过顾问实际管理的客户投资组合的结果,这是由于几个因素,包括实际投资组合的配置与用于创建虚拟投资组合的市场指数的配置在时间段内有所不同,新的研究在不同时间应用于相关指数,指数表现并不反映扣除任何费用和开支。结果还假设资产分配在时间和市场条件变化时不会改变,这可能会在实际账户在所示时间段内管理的情况下发生。

Criteria and Assumptions Used in Portfolio Performance

投资组合业绩使用的标准和假设

All portfolios represent hypothetical blended investments of weighted securities as designated by the creator of this report based on the expected financial situation of the intended audience and should be used for illustrative purposes only and should not be considered performance reports. They are calculated by taking a weighted average of the target weights and the securities total return, assuming all dividends reinvested, since the latest rebalance date. These portfolios are assumed to rebalance to the exact designated weights at each calendar quarter or month end - whichever is chosen when setting up the portfolio. No transaction costs or taxes are included. Portfolio holdings are weighted by percentage, not whole share numbers.

所有投资组合均代表基于预期受众的预期财务状况而指定的加权证券的虚拟混合,仅供说明目的,不应视为业绩报告。计算方法是以最新的再平衡日期为基准,将目标权重和证券总回报进行加权平均,假设所有股息都被再投资。假设这些投资组合在每个日历季度或月末精确遵循指定的权重进行再平衡。不包括任何交易成本或税金。投资组合持仓以百分比加权,而不是以整个股票数量加权。

Markowitz's findings coincided with other revolutionary developments in the wealth management industry, namely the growth of Mutual Funds. In 1952, the total AUM of all mutual fund assets was $3.93 billion. By the time Markowitz, Sharpe, and Miller were Co-Winners of the Nobel Prize in Economics for evaluating stock market risk and reward in 1990[1], the mutual fund industry had grown to over 1 trillion dollars in assets under management, ~25,000% growth [2]. The investment industry's adoption of mutual funds allowed for a more efficient means of accessing broadly diversified portfolios that reduced unsystematic risks and adhered to MPT findings.

Markowitz's findings coincided with other revolutionary developments in the wealth management industry, namely the growth of Mutual Funds. In 1952, the total AUM of all mutual fund assets was $3.93 billion. By the time Markowitz, Sharpe, and Miller were Co-Winners of the Nobel Prize in Economics for evaluating stock market risk and reward in 1990[1], the mutual fund industry had grown to over 1 trillion dollars in assets under management, ~25,000% growth [2]. The investment industry's adoption of mutual funds allowed for a more efficient means of accessing broadly diversified portfolios that reduced unsystematic risks and adhered to MPT findings.