FedEx Unusual Options Activity

FedEx Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on FedEx.

有大量资金可支配的鲸鱼们采取了明显看淡联邦快递的立场。

Looking at options history for FedEx (NYSE:FDX) we detected 18 trades.

查看纽交所联邦快递(NYSE:FDX)的期权历史记录,我们发现了18次交易。

If we consider the specifics of each trade, it is accurate to state that 22% of the investors opened trades with bullish expectations and 66% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,22%的投资者持看涨期权,66%持看淡期权。

From the overall spotted trades, 7 are puts, for a total amount of $313,682 and 11, calls, for a total amount of $491,033.

从整体交易中发现,总共有7次看跌期权交易,总额为313,682美元,和11次看涨期权交易,总额为491,033美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $250.0 to $320.0 for FedEx during the past quarter.

分析这些合同的成交量和未平仓合约,似乎大型投资者在过去的一个季度内一直在关注联邦快递价格区间在$250.0到$320.0之间。

Insights into Volume & Open Interest

成交量和持仓量分析

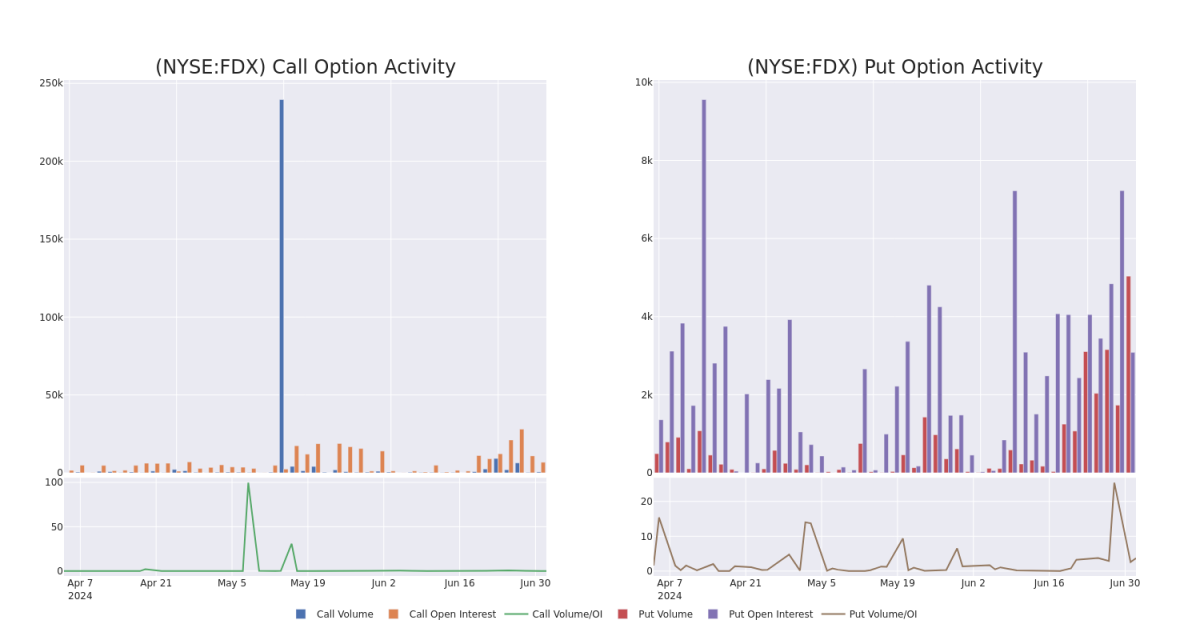

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for FedEx's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across FedEx's significant trades, within a strike price range of $250.0 to $320.0, over the past month.

检查成交量和未平仓合约对股票研究提供了关键的见解。这些信息对于衡量联邦快递特定行权价格的期权的流动性和利益水平至关重要。下面,我们呈现了过去一个月内,在$250.0到$320.0行权价格区间内,在联邦快递重要交易中看涨和看跌期权成交量和未平仓合约的趋势快照。

FedEx Option Activity Analysis: Last 30 Days

联邦快递期权活动分析:过去30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FDX | PUT | SWEEP | BEARISH | 01/16/26 | $19.05 | $18.55 | $18.75 | $260.00 | $93.7K | 86 | 0 |

| FDX | CALL | SWEEP | BEARISH | 03/21/25 | $20.5 | $19.6 | $19.6 | $320.00 | $62.7K | 77 | 70 |

| FDX | CALL | SWEEP | NEUTRAL | 08/02/24 | $9.7 | $9.6 | $9.6 | $295.00 | $62.4K | 565 | 1 |

| FDX | PUT | TRADE | BEARISH | 07/05/24 | $1.92 | $1.84 | $1.92 | $297.50 | $57.6K | 1.5K | 2.0K |

| FDX | CALL | SWEEP | BEARISH | 01/17/25 | $30.25 | $30.0 | $30.0 | $290.00 | $57.0K | 791 | 29 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 联邦快递 | 看跌 | SWEEP | 看淡 | 01/16/26 | $19.05 | $18.55 | 18.75美元 | $260.00 | $93.7K | 86 | 0 |

| 联邦快递 | 看涨 | SWEEP | 看淡 | 03/21/25 | $20.5 | $19.6 | $19.6 | $320.00 | $62.7千美元 | 77 | 70 |

| 联邦快递 | 看涨 | SWEEP | 中立 | 08/02/24 | 9.7 | 9.6 | 9.6 | $295.00 | $62.4千美元 | 565 | 1 |

| 联邦快递 | 看跌 | 交易 | 看淡 | 07/05/24 | $1.92 | $1.84 | $1.92 | $297.50 | $57.6K | 1.5K | 2.0K |

| 联邦快递 | 看涨 | SWEEP | 看淡 | 01/17/25 | $30.25 | $30.0应该是指目标价$30.0。 | $30.0应该是指目标价$30.0。 | $290.00 | $57.0K | 791 | 29 |

About FedEx

关于联邦快递

FedEx pioneered overnight delivery in 1973 and remains the world's largest express package provider. In its fiscal 2024, which ended May 2024, FedEx derived 47% of revenue from its express division, 37% from ground, and 10% from freight, its asset-based less-than-truckload shipping segment. The remainder comes from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNT Express in 2016, boosting the firm's presence across Europe. TNT was previously the fourth-largest global parcel delivery provider.

联邦快递在1973年开创了隔夜递送,现仍是全球最大的快递包裹提供商。在截至2024年5月的财年中,联邦快递47%的营业收入来自其快递部门,37%来自地面运输,10%来自其资产为基础的零担运输细分部门。其余收入来自其他服务,包括提供文件生产/快递的联邦快递办公室和提供全球货币的联邦快递物流。联邦快递于2016年收购了荷兰包裹运送公司TNT Express,增强了该公司在欧洲的实力。TNT曾是全球第四大包裹递送提供商。

Where Is FedEx Standing Right Now?

联邦快递现在的处境如何?

- Currently trading with a volume of 1,234,496, the FDX's price is down by -0.23%, now at $297.98.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 78 days.

- 联邦快递目前成交量为1,234,496,价格下跌了-0.23%,现价为$297.98。

- RSI读数表明股票目前可能超买。

- 预期的收益发布还有78天。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。