Smart Money Is Betting Big In SCHW Options

Smart Money Is Betting Big In SCHW Options

Investors with a lot of money to spend have taken a bullish stance on Charles Schwab (NYSE:SCHW).

资金雄厚的投资者已经看好了嘉信理财(纽交所:SCHW)。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SCHW, it often means somebody knows something is about to happen.

无论这些人是机构还是富人,我们都不知道。但当涉及到SCHW这样大的事情时,通常意味着某些人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Charles Schwab.

今天,Benzinga的期权扫描器发现了8笔Charles Schwab的非常规期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 62% bullish and 25%, bearish.

这些大资金交易者的总体情感一分为二,62%看涨和25%看淡。

Out of all of the special options we uncovered, 3 are puts, for a total amount of $263,344, and 5 are calls, for a total amount of $456,625.

在我们揭示的所有特殊期权中,有3个看跌期权,总金额为263,344美元,有5个看涨期权,总金额为456,625美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $45.0 to $85.0 for Charles Schwab during the past quarter.

分析这些合同的成交量和持仓量,似乎大牌选手们一直在密切关注Charles Schwab的价格窗口区间,从45.0美元到85.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

In terms of liquidity and interest, the mean open interest for Charles Schwab options trades today is 3143.67 with a total volume of 44.00.

在流动性和兴趣方面,今天Charles Schwab期权交易的平均持仓量为3143.67,总成交量为44.00。

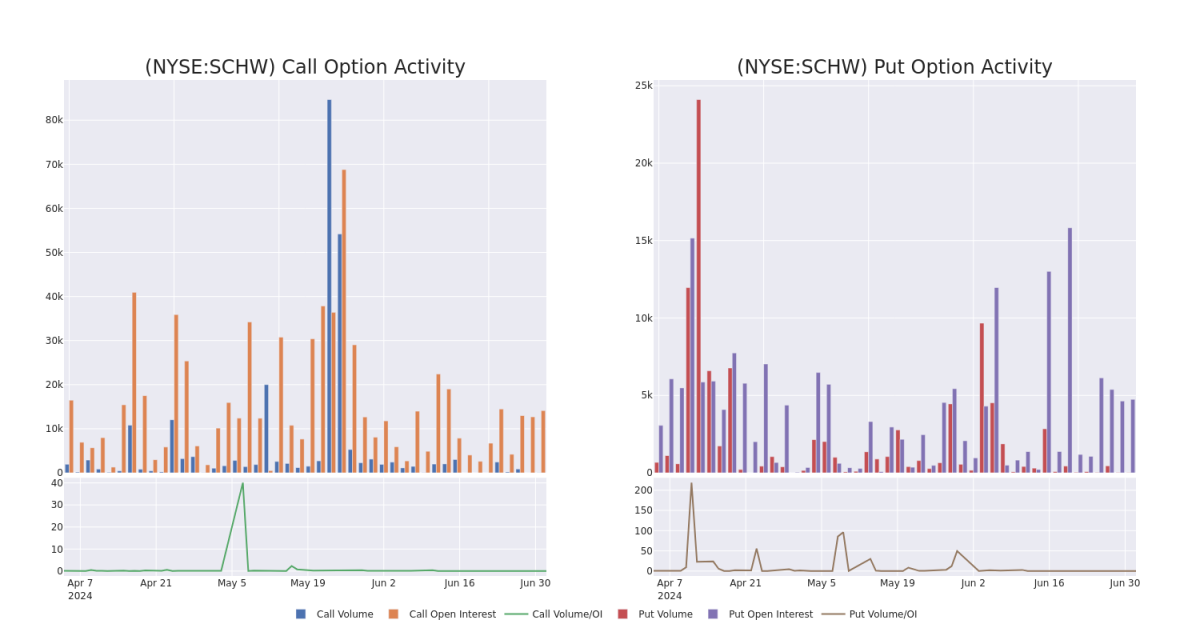

In the following chart, we are able to follow the development of volume and open interest of call and put options for Charles Schwab's big money trades within a strike price range of $45.0 to $85.0 over the last 30 days.

在下图中,我们能够跟踪过去30天Charles Schwab大额交易的看涨和看跌期权的成交量和持仓量的发展情况,在45.0美元到85.0美元的行权价范围内。

Charles Schwab 30-Day Option Volume & Interest Snapshot

Charles Schwab 30天期权成交量和持仓量总览

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SCHW | PUT | TRADE | BEARISH | 01/17/25 | $3.65 | $3.55 | $3.65 | $70.00 | $169.3K | 4.4K | 0 |

| SCHW | CALL | TRADE | BULLISH | 11/15/24 | $1.36 | $1.31 | $1.34 | $85.00 | $134.0K | 416 | 0 |

| SCHW | CALL | SWEEP | BULLISH | 01/17/25 | $3.95 | $3.9 | $3.95 | $80.00 | $106.9K | 10.8K | 19 |

| SCHW | CALL | TRADE | BULLISH | 08/16/24 | $1.21 | $1.16 | $1.2 | $77.50 | $96.0K | 2.6K | 12 |

| SCHW | CALL | SWEEP | BULLISH | 01/17/25 | $3.95 | $3.9 | $3.95 | $80.00 | $90.4K | 10.8K | 19 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SCHW | 看跌 | 交易 | 看淡 | 01/17/25 | $3.65 | $3.55 | $3.65 | 70.00美元 | $169.3K | 4.4K | 0 |

| SCHW | 看涨 | 交易 | 看好 | 11/15/24 | $1.36 | $1.31 | $1.34 | $85.00 | $134.0K | 416 | 0 |

| SCHW | 看涨 | SWEEP | 看好 | 01/17/25 | $3.95 | $3.9 | $3.95 | $80.00 | $106.9K | 10.8K | 19 |

| SCHW | 看涨 | 交易 | 看好 | 08/16/24 | $1.21 | $1.16 | $1.2 | $77.50 | $96.0K | 2.6K | 12 |

| SCHW | 看涨 | SWEEP | 看好 | 01/17/25 | $3.95 | $3.9 | $3.95 | $80.00 | $90.4K | 10.8K | 19 |

About Charles Schwab

关于嘉信理财

Charles Schwab operates in brokerage, wealth management, banking, and asset management. It runs a large network of brick-and-mortar brokerage branch offices and a well-established online investing website, and it has mobile trading capabilities. It also operates a bank and a proprietary asset-management business and offers services to independent investment advisors. Schwab is among the largest firms in the investment business, with over $8 trillion of client assets at the end of December 2023. Nearly all of its revenue is from the United States.

Charles Schwab在券商、财富管理、银行和资产管理领域运营。它经营着一个庞大的线下券商网点网络和一个成熟的在线投资网站,并具有移动交易功能。它还经营一个银行和专有资产管理业务,并向独立投资顾问提供服务。Schwab是投资业务中最大的公司之一,截至2023年12月底,客户资产总额超过8万亿美元。几乎所有的营业收入都来自美国。

Following our analysis of the options activities associated with Charles Schwab, we pivot to a closer look at the company's own performance.

在我们分析与Charles Schwab相关的期权活动之后,我们转向更近距离地观察公司的表现。

Charles Schwab's Current Market Status

Charles Schwab的当前市场状况

- Trading volume stands at 4,273,906, with SCHW's price up by 0.98%, positioned at $74.14.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 14 days.

- 成交量为4,273,906,SCHW的价格涨了0.98%,定位于74.14美元。

- RSI指标显示该股票可能接近超买。

- 预计在14天内公布收益声明。

Professional Analyst Ratings for Charles Schwab

Charles Schwab的专业分析师评级

1 market experts have recently issued ratings for this stock, with a consensus target price of $76.0.

1位市场专家最近对这支股票进行了评级,共识目标价为76.0美元。

- An analyst from Keefe, Bruyette & Woods has decided to maintain their Market Perform rating on Charles Schwab, which currently sits at a price target of $76.

- Keefe,Bruyette&Woods的分析师决定维持他们对Charles Schwab的市场表现评级,目前的价格目标为76美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。