Amazon Vs. Apple: The Showdown At All-Time Highs

Amazon Vs. Apple: The Showdown At All-Time Highs

As the stock market sizzles in mid-2024, investors are eyeing two tech titans: Amazon.com, Inc. (NASDAQ:AMZN) and Apple Inc. (NASDAQ:AAPL). Both stocks have hit all-time highs – with Amazon hitting the $200.43 mark and Apple stock hitting the $220.38 mark during day trading on Tuesday.

随着2024年中期股市的繁荣,投资者正在关注两个科技巨头:亚马逊(NASDAQ:AMZN)和 苹果(NASDAQ:AAPL)。两只股票均创下历史新高-亚马逊股价达到200.43美元,苹果股价达到220.38美元,在周二的盘中交易中。

With both stocks being extremely popular and watched by Wall Street investors, the common all-time-high event raises the burning question: which is the better buy?

由于这两只股票都非常受欢迎,备受华尔街投资者关注,共同创下历史新高,引发了一个关键问题:哪一只股票是更好的买入?

Amazon Stock

亚马逊股票

Amazon's stock has soared, up 53.59% in the past year and 31.63% year-to-date. It recently touched a 52-week high of $200.43. With a market cap of $2.08 trillion and a P/E ratio of 56.02, Amazon is a heavyweight in tech.

亚马逊的股价飙升,过去一年涨了53.59%,今年截至目前涨了31.63%,最近触及52周高点200.43美元。亚马逊的市值为2.08万亿美元,市盈率为56.02,是科技业的重量级选手之一。

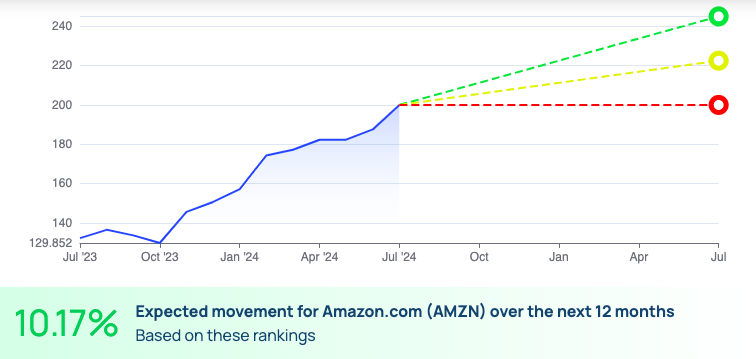

Source: Benzinga Report

来源: Benzinga 报告

Analysts are bullish, with 43 ratings predicting a 12-month price target range of $200 to $245, averaging $222.50. This suggests a potential upside of 10.17%. The latest ratings from Needham, Wells Fargo, and B of A Securities, released between June 26 and July 1, imply a 10.66% upside with an average price target of $221.33.

分析师看好,预测12个月的目标价位在200美元到245美元之间,平均为222.5美元,共有43个评级。这表明潜在的上升空间为10.17%。来自Needham、Wells Fargo和B of A Securities的最新评级于6月26日至7月1日发布,平均目标价为221.33美元,意味着有10.66%的上涨空间。

Apple Stock

苹果股票

Apple's stock has also performed well, up 14.45% over the past year and 14.41% year-to-date, closing at $220.27 on July 2. With a market cap of $3.36 trillion and a P/E ratio of 34.26, Apple remains a market leader.

苹果的股价也表现良好,过去一年涨了14.45%,今年截至目前涨了14.41%,于7月2日收于220.27美元。苹果的市值为3.36万亿美元,市盈率为34.26,仍然是市场领导者。

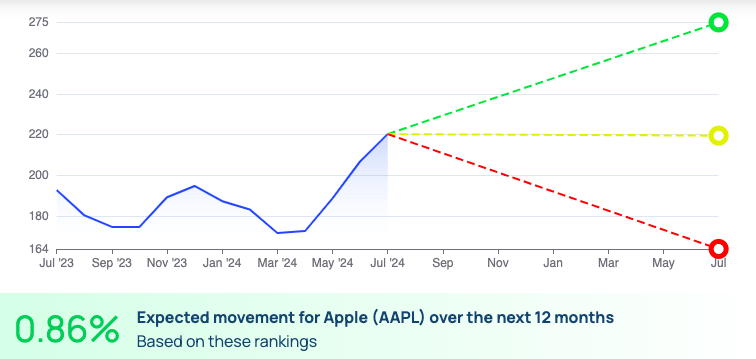

Source: Benzinga Report

来源: Benzinga 报告

However, analysts forecast a modest upside. With 33 ratings suggesting a 12-month price target range of $164 to $275, the average is $219.50, indicating just a 0.86% potential rise. Recent ratings from UBS, Needham, and Oppenheimer, dated June 28 and July 1, offer an average target of $220, a minimal 0.27% upside.

然而,分析师预测股价有限上涨。共有33个评级预测12个月的目标价位在164美元到275美元之间,平均为219.5美元,仅显示潜在上涨0.86%。UBS、Needham和Oppenheimer最近的评级(于6月28日至7月1日发布)提供了平均目标价220美元,仅有0.27%的上涨空间。

Read Also: Top Apple Executive Phil Schiller To Join OpenAI Board As Observer, Giving iPhone Maker Equal Status With Microsoft After Landmark AI Agreement Reached: Report

阅读更多:顶级苹果高管菲尔·席勒(Phil Schiller)将加入OpenAI董事会担任观察员,在与微软达成里程碑式人工智能协议后,给iPhone制造商平等地位。

Amazon Vs. Apple

亚马逊vs苹果

Growth Potential: Amazon shows more promise with a 10.17% projected upside versus Apple's 0.86%.

增长潜力:亚马逊的预期上涨10.17%,而苹果仅为0.86%。

Valuation: Amazon's P/E of 56.02 suggests higher growth expectations compared to Apple's 34.26, but also higher risk.

估值:亚马逊的市盈率为56.02,表明相对于苹果的34.26,有更高的增长预期,但也意味着风险更大。

Market Position: Amazon dominates e-commerce and cloud computing, while Apple leads in consumer electronics. Apple's larger market cap and lower P/E might appeal to conservative investors, whereas Amazon's growth potential attracts those seeking higher returns.

市场地位:亚马逊主导电子商务和云计算,而苹果则在消费电子领域处于领先地位。苹果更大的市值和较低的市盈率可能更适合保守型投资者,而亚马逊的增长潜力则吸引那些寻求更高回报的投资者。

Recent Momentum: Amazon's stronger recent performance hints at continued upward momentum.

最近的势头:亚马逊表现更强劲,暗示着持续的上涨势头。

Both Amazon and Apple are stellar investments.

亚马逊和苹果都是很棒的投资选择。

However, Amazon appears to offer better growth prospects with a higher potential upside. Investors looking for robust growth may find Amazon more appealing, while those valuing stability might prefer Apple. As always, investment decisions should align with individual goals and risk tolerance.

然而,亚马逊似乎提供更好的增长前景,具有更高的潜在上涨空间。寻求强劲增长的投资者可能会发现亚马逊更具吸引力,而那些注重稳定性的投资者可能更喜欢苹果。但是,投资决策应与个人的目标和风险承受能力相一致。

- Nasdaq 100 Notches Record Daily Close, Boosted By Mega-Cap Giants, Fed Rate Cut Optimism

- nasdaq 100创下历史新高,受到巨头公司和联邦减息乐观情绪的推动

Photo: Shutterstock

Photo: shutterstock