PayPal Holdings Unusual Options Activity For July 03

PayPal Holdings Unusual Options Activity For July 03

Financial giants have made a conspicuous bullish move on PayPal Holdings. Our analysis of options history for PayPal Holdings (NASDAQ:PYPL) revealed 10 unusual trades.

金融巨头对PayPal Holdings采取了明显的看好态度。我们对PayPal Holdings(NASDAQ:PYPL)的期权历史进行了分析,发现了10笔异常交易。

Delving into the details, we found 80% of traders were bullish, while 20% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $207,389, and 8 were calls, valued at $414,144.

具体来说,我们发现80%的交易者看好,而20%的交易者表现出看淡的倾向。在我们发现的所有交易中,有2次买入看跌期权,价值207,389美元,而有8次买入看涨期权,价值414,144美元。

What's The Price Target?

价格目标是什么?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $37.5 and $80.0 for PayPal Holdings, spanning the last three months.

经过对成交量和未平仓合约的评估,显然市场主要的操控者将焦点放在PayPal Holdings的价格区间为37.5美元至80.0美元之间,这一区间横跨了最近三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

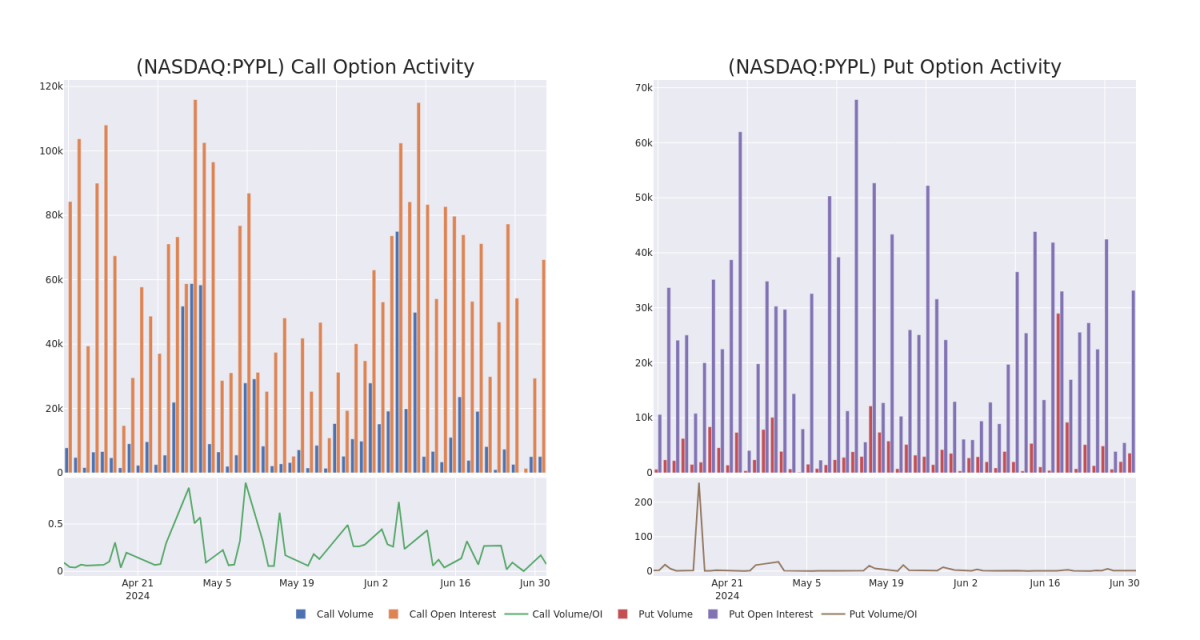

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for PayPal Holdings's options for a given strike price.

这些数据可以帮助您跟踪PayPal Holdings不同行权价格的期权的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of PayPal Holdings's whale activity within a strike price range from $37.5 to $80.0 in the last 30 days.

下面,我们可以观察到过去30天内所有PayPal Holdings的大额交易量和未平仓合约的看跌和看涨期权的演变,这些期权的执行价位于37.5美元至80.0美元之间。

PayPal Holdings 30-Day Option Volume & Interest Snapshot

PayPal Holdings 30天期权成交量及持仓快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | PUT | SWEEP | BULLISH | 01/16/26 | $5.0 | $4.95 | $4.95 | $50.00 | $178.7K | 3.1K | 42 |

| PYPL | CALL | SWEEP | BULLISH | 07/19/24 | $0.96 | $0.95 | $0.96 | $60.00 | $103.0K | 8.2K | 103 |

| PYPL | CALL | SWEEP | BEARISH | 08/16/24 | $1.5 | $1.48 | $1.48 | $65.00 | $59.6K | 8.5K | 242 |

| PYPL | CALL | TRADE | BEARISH | 12/18/26 | $30.4 | $28.25 | $28.26 | $37.50 | $56.5K | 60 | 0 |

| PYPL | CALL | TRADE | BULLISH | 12/18/26 | $10.8 | $9.15 | $10.25 | $80.00 | $51.2K | 587 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | 看跌 | SWEEP | 看好 | 01/16/26 | $5.0 | $4.95 | $4.95 | $50.00 | $178.7K | 3.1K | 42 |

| PYPL | 看涨 | SWEEP | 看好 | 07/19/24 | 0.96美元 | 0.95美元 | 0.96美元 | $60.00 | $103.0K | 8.2K | 103 |

| PYPL | 看涨 | SWEEP | 看淡 | 08/16/24 | $1.5 | 1.48美元 | 1.48美元 | $65.00 | $59.6K | 8.5千 | 242 |

| PYPL | 看涨 | 交易 | 看淡 | 12/18/26 | $30.4 | $28.25 | $28.26 | $37.50 | $56.5千 | 60 | 0 |

| PYPL | 看涨 | 交易 | 看好 | 12/18/26 | $10.8 | 9.15美元 | $10.25 | $80.00 | $51.2K | 587 | 0 |

About PayPal Holdings

关于paypal控股

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

paypal控股于2015年从ebay分拆出来,为商家和消费者提供电子支付解决方案,重点放在在线交易方面。该公司在2023年末拥有4.26亿活跃账户。该公司还拥有Venmo,这是一个人对人的支付平台。

After a thorough review of the options trading surrounding PayPal Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对环绕paypal控股的期权交易进行全面审查后,我们着手更详细地审查公司的情况。这包括对其当前市场状态和表现进行评估。

Present Market Standing of PayPal Holdings

paypal控股的当前市场地位

- With a trading volume of 3,357,655, the price of PYPL is up by 1.32%, reaching $59.75.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 28 days from now.

- PYPL的成交量为3,357,655股,股价上涨了1.32%,达到了59.75美元。

- 目前的RSI值表明该股票目前处于超买和超卖之间的中立状态。

- 下一次财报发布时间定于28天后。

Expert Opinions on PayPal Holdings

关于PayPal Holdings的专家意见

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $73.8.

过去一个月,5位行业分析师分享了他们对这支股票的看法,提出了一个平均目标价值为73.8美元的建议。

- An analyst from Susquehanna upgraded its action to Positive with a price target of $71.

- In a cautious move, an analyst from Goldman Sachs downgraded its rating to Neutral, setting a price target of $69.

- An analyst from Citigroup has decided to maintain their Buy rating on PayPal Holdings, which currently sits at a price target of $81.

- An analyst from Evercore ISI Group persists with their In-Line rating on PayPal Holdings, maintaining a target price of $70.

- Reflecting concerns, an analyst from Keefe, Bruyette & Woods lowers its rating to Outperform with a new price target of $78.

- 来自Susquehanna的分析师将其股票评级上调为Positive,目标价值为71美元。

- 高盛的分析师采取谨慎态度,将其评级下调为Neutral,设定了一个69美元的目标价值。

- 花旗集团的一位分析师决定维持其对PayPal Holdings的买入评级,其当前价格目标为81美元。

- Evercore ISI Group的分析师坚持对PayPal Holdings的In-Line评级,保持目标价值为70美元。

- 反映担忧,Keefe,Bruyette & Woods的分析师将其评级下调为Outperform,并设定了一个新的目标价值为78美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest PayPal Holdings options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。精明的交易者通过不断地自我教育、调整策略、监控多个因子以及密切关注市场动向来管理这些风险。通过Benzinga Pro的实时提醒了解最新的paypal控股期权交易动态。