We Think Zurn Elkay Water Solutions (NYSE:ZWS) Can Manage Its Debt With Ease

We Think Zurn Elkay Water Solutions (NYSE:ZWS) Can Manage Its Debt With Ease

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Zurn Elkay Water Solutions Corporation (NYSE:ZWS) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Zurn Elkay Water Solutions's Net Debt?

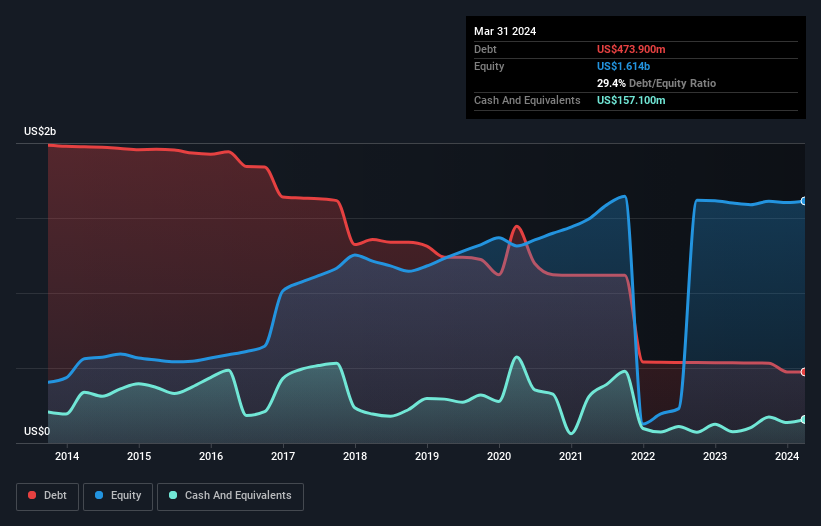

The image below, which you can click on for greater detail, shows that Zurn Elkay Water Solutions had debt of US$473.9m at the end of March 2024, a reduction from US$534.3m over a year. However, it also had US$157.1m in cash, and so its net debt is US$316.8m.

How Strong Is Zurn Elkay Water Solutions' Balance Sheet?

According to the last reported balance sheet, Zurn Elkay Water Solutions had liabilities of US$210.6m due within 12 months, and liabilities of US$839.7m due beyond 12 months. Offsetting this, it had US$157.1m in cash and US$230.5m in receivables that were due within 12 months. So it has liabilities totalling US$662.7m more than its cash and near-term receivables, combined.

Since publicly traded Zurn Elkay Water Solutions shares are worth a total of US$4.97b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Looking at its net debt to EBITDA of 1.0 and interest cover of 6.1 times, it seems to us that Zurn Elkay Water Solutions is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. In addition to that, we're happy to report that Zurn Elkay Water Solutions has boosted its EBIT by 45%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Zurn Elkay Water Solutions's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Zurn Elkay Water Solutions generated free cash flow amounting to a very robust 98% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

Zurn Elkay Water Solutions's conversion of EBIT to free cash flow suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its EBIT growth rate also supports that impression! Zooming out, Zurn Elkay Water Solutions seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. Another factor that would give us confidence in Zurn Elkay Water Solutions would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com