STI Chalks up 5.7% Total Return in 1H24

STI Chalks up 5.7% Total Return in 1H24

-

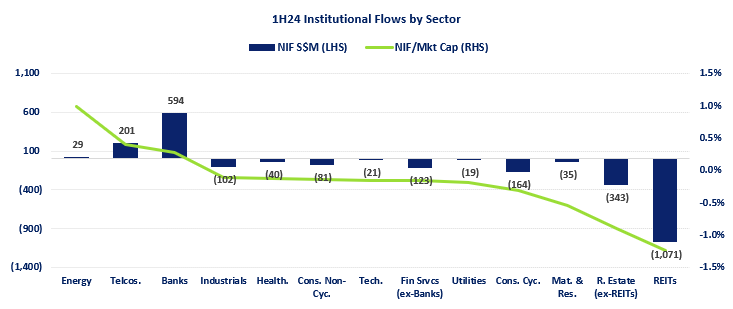

The STI generated a 2.9% gain to 3,332.8, with dividends boosting the total return to 5.7% in 1H24. The trio of STI Banks, YZJ Shipbuilding & Singtel led the STI gains in 1H24. By Sector, the Banks booked S$594 of net institutional inflow partially offsetting the net institutional outflow for the broader stock market, led by the S-REIT Sector.

-

In June, Singtel led the STI stocks with an 11% gain to S$2.75. The stock also booked the highest net institutional inflow for the month. Interest in the stock this year has seen its average daily turnover surge by more than 40% in 1H24 vs CY23. The company recent rolled out its ST28 strategic growth plan & continues to maintain a CETP of S$3.15.

-

Proportionate to sector market cap, the Energy Sector saw the highest net institutional inflow in 1H24 at 1.0% with Dyna-Mac, Geo Energy, Mermaid Maritime, Atlantic Navigation, MTQ Corporation and Zheneng Jinjiang Environment booking the most net institutional inflow in the Sector.

- STI在1H24年创造了2.9%的收益,为3332.8点,股息提高了总回报率,达到5.7%。 STI Banks,YZJ Shipbuilding和Singtel在1H24年带领STI实现收益。从板块角度来看,银行业的资金净流入为新币594亿,部分抵消了由S-REIT板块引领的整个股票市场的资金净流出。

- 在6月, Singtel以11%的收益率领先STI股票,达到2.75新币,该股票还同月录得最高的资金净流入。今年对该股票的兴趣导致其1H24年的平均日成交额比CY23年增长了超过40%。该公司最近推出了其ST28战略增长计划,并继续保持3.15新币的CETP。

- 按板块市值比例,能源化工板块1H24年的资金净流入最高,为1.0%,其中Dyna-Mac,Geo Energy,Mermaid Maritime,Atlantic Navigation,MTQ Corporation和Zheneng Jinjiang Environment等股票在该板块中记录了最多的资金净流入。

The STI gained 2.9% in 1H24, ending June at 3,332.8, with dividends boosting the STI total return to 5.7% in 1H24. This brought the STI total return from the end of 2019, to 30 June 2024, to 25.2% or 5.1% on an annualised basis. Over the same 54 months, the indicative Compound Annual Growth Rate (CAGR) of month-end dollar cost averaging on an STI ETF amounted to 4.2%, excluding transaction costs.

STI在1H24年实现2.9%的收益,在6月份以3332.8点结束,股息提高STI的总回报率,达到5.7%。这使得从2019年底到2024年6月30日的STI总回报率为25.2%,或者年化收益率为5.1%。在同样的54个月内,月末定期定额投资STI ETF的年复合增长率(CAGR)为4.2%,不包括交易成本。

The SPDR STI ETF and Nikko AM Singapore STI ETF experienced net redemptions in 2Q24 as the STI Total Return Index booked all-time highs. Combined STI ETF net redemptions were S$92M in 2Q24 versus net creations of S$97M in 1Q24.

随着STI总回报指数创下历史新高,SPDR STI ETF和Nikko Am Singapore STI ETF在第二季度经历了净赎回。 STI ETF的净赎回在2Q24年达到9200万新币,而在1Q24年达到9700万新币的净创建。

Energy-adjacent stocks, Singtel & STI Banks Led 1H24 Net Institutional Inflows, S-REITs Led Outflows

能源化工相关股票,Singtel和STI银行带领1H24资金净流入,S-REIT板块引领资金净流出

In 1H24, the broader Singapore stock market booked S$1.175 billion of net institutional outflow, driven by S$1.071 billion of net institutional outflow from the S-REIT Sector. For context, as of 30 June, the total market capitalisation of the Singapore stock market stood at S$793 billion and for every nine stocks that booked net institutional outflow in 1H24, eight stocks booked net institutional inflow.

在1H24年,更广泛的新加坡股市记录了11.75亿新币的资金净流出,其中最大的资金净流出来自S-REIT板块的10.71亿新币。为了提供背景,截至6月30日,新加坡股市的总市值为793亿新币,在1H24年中,有九支股票的资金净流出,其中八支股票的资金净流入。

The net institutional flow (NIF) of the stock Sectors in 1H24 are illustrated below, with the Energy Sector seeing S$29 million of net institutional inflow, representing 1.0% of the combined S$2.9 billion Sector market capitalisation as of 30 June, to the S-REIT Sector net institutional outflow representing 1.2% of its Sector market capitalisation as of 30 June.

1H24年股票板块的资金净流入(NIF)如下所示,其中能源化工板块的资金净流入为2900万新币,占总市值29亿新币的1.0%,而S-REIT板块的资金净流出则代表其市值的1.2%。

United Overseas Bank and Oversea-Chinese Banking Corporation in addition to Singapore Telecommunications and Yangzijiang Shipbuilding Holdings booked the highest net institutional inflow in 1H24. Likewise, three of the strongest growing sectors in the Singapore economy in 1Q24 included Transportation and Storage, Finance & Insurance and Information & Communications.

大华银行和华侨银行以及新加坡电信和扬子江船舶控股在1H24年录得的最高资金净流入。 同样,在新加坡经济中增长最强的三个行业是运输和仓储、金融与保险以及信息和通信。

The 10 stocks that booked the highest net institutional inflow in 1H24 are tabled below.

以下是在1H24年中记录最高资金净流入的十只股票。

| Stock | Code | Mkt Cap S$M | 1H24 NIF S$M | 1H24 TR% | 2019 - 30 June 2024 TR % | ROE % | P/B (x) | 5-year Avg P/B (x) | Div Yield % | Sector |

| UOB | U11 | 52,438 | 399 | 13 | 47 | 12.5 | 1.13 | 1.05 | 5.4 | Banks |

| OCBC Bank | O39 | 64,855 | 223 | 14 | 64 | 13.2 | 1.20 | 1.03 | 5.7 | Banks |

| Singtel | Z74 | 45,411 | 217 | 11 | -3 | 3.1 | 1.82 | 1.53 | 3.8 | Telecommunications |

| YZJ Shipbldg SGD | BS6 | 9,718 | 172 | 71 | 423 | 21.3 | 2.49 | 0.88 | 2.6 | Industrials |

| ST Engineering | S63 | 13,504 | 121 | 14 | 35 | 24.1 | 5.48 | 5.14 | 3.7 | Industrials |

| Venture | V03 | 4,125 | 65 | 8 | 8 | 9.5 | 1.46 | 1.85 | 5.3 | Technology |

| ComfortDelGro | C52 | 2,903 | 53 | -2 | -32 | 7.0 | 1.12 | 1.27 | 5.0 | Industrials |

| Great Eastern | G07 | 12,145 | 38 | 49 | 39 | 10.3 | 1.54 | 1.11 | 2.9 | Financial Services |

| Thai Bev | Y92 | 11,307 | 37 | -10 | -40 | 13.7 | 1.53 | 2.66 | 5.0 | Consumer Non-Cyclicals |

| SATS | S58 | 4,248 | 34 | 4 | -40 | 2.4 | 1.79 | 2.48 | 0.5 | Industrials |

| 股票 | 代码 | 市值(S$ M) | 1H24 NIF S$M | 1H24 TR% | 2019-2024年6月TR% | ROE% | P / b(倍数) | 5年平均P / b(倍数) | 股息率% | 板块 |

| 大华银行 | U11 | 52,438 | 399 | 13 | 47 | 12.5 | 1.13 | 1.05 | 5.4 | 银行业 |

| 华侨银行 | O39 | 64,855 | 223 | 14 | 64 | 13.2 | 1.20 | 1.03 | 5.7 | 银行业 |

| 新电信的数字基建公司总裁张志雄先生表示:"快速增长的工业4.0部门的企业依靠高质量、可靠的连接性来确保顺畅的运营。我们很高兴与日立数码合作,利用Paragon在管理其在日立的制造设施的连接性和云需求。将日立先进的AI应用程序与Paragon的生态系统集成,将增强我们的制造企业解决方案套件,并使其能够使用AI无缝地转型运营。" | Z74 | 45,411 | 217 | 11 | -3 | 3.1 | 1.82 | 1.53 | 3.8 | 电信 |

| 扬子江船业 | BS6 | 9,718 | 172 | 71 | 423 | 21.3 | 2.49 | 0.88 | 2.6 | 工业 |

| 新科工程 | S63 | 13,504 | 121 | 14 | 35 | 24.1 | 5.48 | 5.14 | 3.7 | 工业 |

| 创业公司 | V03 | 4,125 | 65 | 8 | 8 | 9.5 | 1.46 | 1.85 | 5.3 | 技术 |

| 康福德高企业 | C52 | 2,903 | 53 | -2 | -32 | 7.0 | 1.12 | 1.27 | 5.0 | 工业 |

| 大东方控股 | G07 | 12,145 | 38 | 49 | 39 | 10.3 | 1.54 | 1.11 | 2.9 | 服务业 |

| Thai Bev | Y92 | 11,307 | 37 | -10 | -40 | 13.7 | 1.53 | 2.66 | 5.0 | 消费非周期性 |

| 新翔集团 | S58 | 4,248 | 34 | 4 | -40 | 2.4 | 1.79 | 2.48 | 0.5 | 工业 |

Note ADT refers to average daily turnover, NIF refers to Net Institutional Inflow, TR refers to Total Return. Source: SGX, SGX Screener, Refinitiv (Data updated as of 30 June 2024)

注:ADt指的是平均每日成交量,NIF指的是净机构流入,TR指的是总回报。来源:SGX,SGX筛选器,Refinitiv(截至2024年6月30日的数据更新)

As detailed in the table and chart above, with S$217 million of net institutional inflow, Singapore Telecommunications drove the S$201 million Telecommunications Sector's net institutional inflow in 1H24. The stock was the strongest performer in both the STI and a popular global telecommunications stock index in June, with its 11% gain. The stock also saw a significant surge in its average daily turnover (ADT) in 1H24, which was up by more than 40% from CY23.

如上表格和图表所示,新电信凭借新加坡电信板块超过21700万的净机构流入,成为2024上半年该板块热门股票及全球主流电信股指数中表现最强大的股票之一,其在6月份的涨幅为11%,其中成交量的涨幅也相当显著,1H24年同比增长超过40%。

ST28

ST28

On 23 May, Singapore Telecommunications launched ST28, Singtel's new growth plan aimed at enhancing customer experiences and delivering sustained value to shareholders. The plan builds on the successful strategic reset initiated in 2021, focusing on technology and digitalisation. Key areas of focus include connectivity, digital services, and digital infrastructure, with significant investments in 5G. The Group maintain that operational improvements and a capital recycling program have laid a strong foundation for future growth, which the CFO noted in June, has monetised S$8 billion from assets including stakes in Indara (formerly known as Australia Tower Network), Airtel and Nxera to fund growth initiatives since launching in 2021. He added that the Group has identified another S$6 billion in monetisable assets, and will continue to tap external capital partners to jointly fund capital-intensive growth engines.

2021年5月23日,新电信推出了ST28,该计划旨在增强客户体验,为股东提供持续价值。该计划建立在2021年成功启动的战略重置之上,重点关注技术和数字化。其重点关注的领域包括连接、数字服务和数字基础设施,以及对5G的重大投资。该集团表示,经营改善和资本回收计划为未来的增长奠定了坚实的基础。首席财务官在6月份指出,自发布以来,他们已经从类似于Indara(前身为澳洲塔网)、艾泰和Nxera等资产中变现了800亿新元,以资助增长计划。他补充说,该集团已经确定了另外600亿新元的可变现资产,将继续寻求外部资本合作伙伴,以共同资助资本密集型的增长动力。

Energy-adjacent Stocks with Most Net Institutional Inflow in 1H24

1H24年净机构流入最多的与能源相关的股票

Stocks that led the net institutional inflow to the Energy/Oil & Gas sector included Dyna-Mac Holdings, Geo Energy Resources, Mermaid Maritime Public Co, Atlantic Navigation HLDG(S), MTQ Corporation and Zheneng Jinjiang Environment Holding Company. These six stocks generated average and median total returns of 29% in 1H24.

领导能源/石油和天然气板块的净机构流入的股票包括Dyna-Mac Holdings、Geo Energy Resources、Mermaid Maritime Public Co、Atlantic Navigation HLDG(S)、MTQ Corporation和Zheneng Jinjiang Environment Holding Company。这六只股票在1H24年产生了平均和中位数总回报率为29%。

A pioneer in China's Waste-to-Energy (WTE) industry, Zheneng Jinjiang Environment Holding Company also underwent a strategic transformation in 2021, leveraging technology and digitalisation. As of December 2023, the Group had invested in 27 WTE facilities, three kitchen waste treatment facilities and eight waste resource recycling facilities, managing a total waste treatment capacity of 44,405 tonnes per day and generated nearly 4.012 billion kWh of green electricity, enough to power 2.96 million households. The stock generated a 33% total return in 1H24, reducing its decline in total return since the end of 2019 to 36%.

作为中国废物转能行业的先驱,浙能锦江环境控股有限公司也在2021年经历了战略转型,利用技术和数字化。截至2023年12月,该集团投资了27个废物转能设施、3个厨余垃圾处理设施和8个废物资源回收设施,管理着总处理能力为44,405吨/天的废物,产生了近40.12亿千瓦时的绿色电力,足以为296万户家庭供电。该股票在1H24年创造了33%的总回报率,自2019年末以来的总回报率下降了36%。

2H24 Key Economic Drivers

2H24年关键经济驱动因素

The global economic outlook for 2H24 indicates a complex interplay of factors. Policy support in China and rate cuts in advanced economies are expected to stimulate growth, while persistent high rates from the Federal Reserve and geoeconomic fragmentation may pose risks. The semiconductor industry's resurgence and the continued shift towards sustainability are likely to impact manufacturing and exports. Despite potential challenges, such as commodity price volatility and geopolitical tensions, these developments could continue to drive competition and innovation, particularly digitalisation, in the global market.

2H24年全球经济前景表明,诸多因素存在复杂的交织关系。中国的政策支持以及发达经济体的降息预计将刺激增长,而联邦储备委员会高利率以及地缘经济的分化可能带来风险。半导体行业的复苏以及持续向可持续性的转变可能会影响制造业和出口。尽管存在潜在的挑战,例如商品价格波动和地缘政治紧张局势,但这些发展可能继续推动全球市场中的竞争和创新,特别是数字化。

Market sentiment is currently leaning towards a reduction in the Fed Funds Rate by end September with a significant portion of analysts anticipating a cut. Despite this, inflation expectations remain slightly above the Fed's target, as the PCE Core Deflator is projected to hover around 2.5% to 2.7, as seen in the recently reported May print. Meanwhile, the Jackson Hole Symposium, set for late August, could be pivotal in shaping future monetary policy, as it historically influences central banking decisions and economic discourse. However, according to Nareit officials in 1H24, institutional investors and primary issuers in the US REIT market are very much focused the Federal Reserve actually announcing a rate cut, rather than signalling a cut.

目前市场情绪倾向于在9月底前减少联邦基金利率,其中很大一部分分析师预计将进行削减。尽管如此,通胀预期仍然略高于联邦储备的目标,因为核心PCE平减指数预计将在2.5%到2.7%左右徘徊,就像5月份宣布的数据一样。与此同时,定于8月下旬的杰克逊霍尔对话会可能对形成未来货币政策产生重要影响,因为它在历史上影响着央行的决策和经济话语。然而,在1H24年,根据Nareit官员的说法,美国REIt市场中的机构投资者和发行主体非常关注联邦储备实际宣布降息,而不是发出信号。

Further Resources and Research

更多资源和研究

- Weekly Fund Flow Report: Data Reports - Singapore Exchange (SGX)

- 每周资金流动报告:数据报告-新加坡交易所(SGX)

Recent Financial Results/Business Updates

最近的财务业绩/业务更新

- UOB: UOB Annual Report 2023

- OCBC: OCBC Annual Report 2023

- Singtel: Singtel Annual Report 2024

- Yangzijiang Shipbuilding: Yangzijiang Shipbuilding 1Q2024 Business Update | Yangzijang Shipbuilding Annual Report 2023

- ST Engineering: ST Engineering 1Q2024 Market Update | ST Engineering Annual Report 2023

- Venture: Venture 1Q2024 Business Update | Venture Annual Report 2023

- ComfortDelGro: ComfortDelGro Annual Report 2023

- Great Eastern: Great Eastern Annual Report 2023

- Thai Bev: Thai Bev 1H24 Financial Results | Thai Bev Annual Report 2023

- Geo Energy Resources: Geo Energy Resources Annual Report 2023

- Mermaid Maritime Public: Mermaid Maritime Public Annual Report 2023

- Atlantic Navigation: Atlantic Navigation Annual Report 2023

- MTQ Corporation: MTQ Corporation Annual Report 2023

- Zheneng Jinjiang Environment: Zheneng Jinjiang Environment Annual Report 2023

- 大华银行:UOb年度报告2023

- 华侨银行:华侨银行2023年度报告

- 新电信:新电信2024年度报告

- 扬子江造船:扬子江造船2023年一季度业务更新|扬子江造船2023年度报告

- 新科工程:新科工程2023年一季度市场更新|新科工程2023年度报告

- 创业公司:Venture 1Q2024 业务更新 | 创业公司 2023 年度报告

- 康福德高企业:康福德高企业 2023 年度报告

- 大东方控股:大东方控股 2023 年度报告

- Thai Bev:Thai Bev 1H24 财务结果 | Thai Bev 2023 年度报告

- Geo Energy Resources:Geo Energy Resources 2023 年度报告

- mermaid海事:mermaid海事 2023 年度报告

- Atlantic Navigation:Atlantic Navigation 2023 年度报告

- 万度力:万度力 2023 年度报告

- 浙能锦江环境控股:浙能锦江环境控股 2023 年度报告

Related Analyst Reports

相关分析师报告

- Singtel: CGS-CIMB - SingTel update : Yield and growth

- SATS: DBS - SATS update : Outperformance across all metrics

- Dyna-Mac: OCBC – Dyna-Mac Holdings Update: Order wins galore

- Geo Energy Resources: KGI Securities – Geo Energy Resources Update: A good time to enter

- 中国银河 - 新电信更新: 收益和成长

- 大华银行 - 新翔集团更新: 所有板块的表现超常

- 华侨银行 - 精砺控股更新: 设备获得订单

- 凯基证券 - Geo Energy Resources 更新: 现在进入的好时机

Company interviews

公司采访

- Dyna-Mac: kopi-C with Dyna-Mac's CEO: 'We went from near-bankruptcy to having a record order book'

- Singtel: kopi-C with Singtel's Group CFO: 'We create an impact in the lives of more than 700 million people'

- kopi-C 与 Dyna-Mac 的 CEO:'我们从接近破产到创造了创纪录的60档摆盘'

- kopi-C 与 Singtel 的集团首席财务官:'我们为超过7000万人民群众带来影响'

Enjoying this read?

喜欢这篇文章吗?

- Subscribe now to our SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 现在订阅我们新加坡交易所我的网关新加坡交易所上市公司资讯、板块表现、新产品发布更新以及研报摘要,一网打尽,请参阅SGX My Gateway通讯。

- 请订阅我们的SGX Invest Telegram 频道以便于获取最新资讯新加坡交易所投资欲知更多详情,请关注我们的Telegram 频道。