Smart Money Is Betting Big In LLY Options

Smart Money Is Betting Big In LLY Options

High-rolling investors have positioned themselves bearish on Eli Lilly and Co (NYSE:LLY), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in LLY often signals that someone has privileged information.

高仓位投资者看淡Eli Lilly and Co (纽交所:LLY),散户交易者需要注意。我们从Benzinga的公开期权数据中发现了这一活动。这些投资者的身份不确定,但LLY的如此重大变化通常意味着有人具有内幕消息。

Today, Benzinga's options scanner spotted 12 options trades for Eli Lilly and Co. This is not a typical pattern.

今天,Benzinga的期权扫描器发现了12个Eli Lilly and Co的期权交易。这不是一个典型的模式。

The sentiment among these major traders is split, with 41% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $50,300, and 11 calls, totaling $569,034.

这些主要交易者的情绪分为两种,看好占41%,看淡占50%。在我们找到的所有期权中,有一个看跌期权,金额为50,300美元,有11个看涨期权,总金额为569,034美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $630.0 to $960.0 for Eli Lilly and Co over the recent three months.

根据交易活动,看来这些重大投资者正在瞄准Eli Lilly and Co的价格区间,涵盖最近三个月的630.0美元到960.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

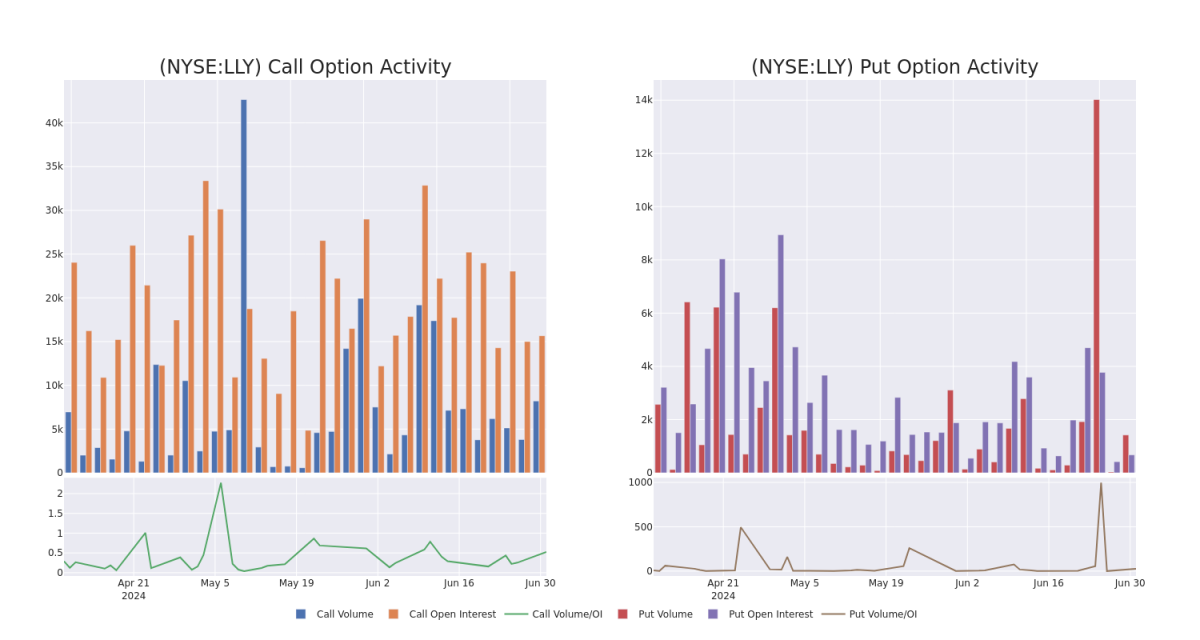

In today's trading context, the average open interest for options of Eli Lilly and Co stands at 451.5, with a total volume reaching 20.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Eli Lilly and Co, situated within the strike price corridor from $630.0 to $960.0, throughout the last 30 days.

在今天的交易环境中,Eli Lilly and Co的期权平均持仓量为451.5份,总成交量为20.00。附带的图表描述了过去30天Eli Lilly and Co高价值交易的看涨期权和看跌期权的成交量和持仓量的进展,位于630.0美元到960.0美元的行权价走廊中。

Eli Lilly and Co Option Volume And Open Interest Over Last 30 Days

Eli Lilly and Co过去30天期权成交量和持仓量

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | CALL | TRADE | BULLISH | 08/23/24 | $49.8 | $43.0 | $48.24 | $900.00 | $144.7K | 2 | 0 |

| LLY | CALL | TRADE | BEARISH | 07/05/24 | $55.9 | $48.95 | $51.22 | $850.00 | $76.8K | 95 | 0 |

| LLY | CALL | SWEEP | BEARISH | 08/16/24 | $24.45 | $22.5 | $23.2 | $950.00 | $69.5K | 943 | 0 |

| LLY | PUT | TRADE | BEARISH | 06/20/25 | $50.3 | $47.85 | $50.3 | $800.00 | $50.3K | 51 | 0 |

| LLY | CALL | TRADE | NEUTRAL | 08/16/24 | $78.45 | $71.8 | $75.63 | $850.00 | $45.3K | 840 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | 看涨 | 交易 | 看好 | 08/23/24 | $49.8 | $43.0 | $48.24 | $900.00 | $144.7K | 2 | 0 |

| LLY | 看涨 | 交易 | 看淡 | 07/05/24 | $55.9 | $48.95 | $51.22 | $850.00 | $76.8K | 95 | 0 |

| LLY | 看涨 | SWEEP | 看淡 | 08/16/24 | $24.45 | 22.5 | $23.2 | $950.00 | $69.5K | 943 | 0 |

| LLY | 看跌 | 交易 | 看淡 | 06/20/25 | $50.3 | $47.85 | $50.3 | $800.00 | $50.3K | 51 | 0 |

| LLY | 看涨 | 交易 | 中立 | 08/16/24 | $78.45 | $71.8 | $75.63 | $850.00 | $45.3K | 840 | 0 |

About Eli Lilly and Co

关于礼来

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for diabetes; and Taltz and Olumiant for immunology.

礼来是一家专注于神经科学、心脏代谢、癌症和免疫学的制药公司。礼来的主要产品包括用于癌症的维津尼奥;马天尼罗、泽普邦、贾达信、特鲁利康、胰岛素诺和人用胰岛素用于糖尿病;以及用于免疫学的塔吉特和优泰乐。

Eli Lilly and Co's Current Market Status

礼来当前的市场状态币

- With a volume of 164,284, the price of LLY is down -0.05% at $897.62.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 32 days.

- LLY的成交量为164,284,报价为897.62美元,下跌了0.05%。

- RSI指标暗示该股票可能要超买了。

- 下一步将在32天内发布。

Expert Opinions on Eli Lilly and Co

关于Eli Lilly and Co的专家意见

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $958.8.

在过去一个月里,有5位行业分析师分享了他们对这只股票的看法,提出了平均目标价$958.8。

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on Eli Lilly and Co, which currently sits at a price target of $1023.

- Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Eli Lilly and Co, targeting a price of $1000.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $885.

- An analyst from BMO Capital persists with their Outperform rating on Eli Lilly and Co, maintaining a target price of $1001.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $885.

- 摩根士丹利的一位分析师决定维持其对Eli Lilly and Co的超配评级,目前的股价目标为1023美元。

- b的一位分析师继续持有礼来的买入评级,目标价为1000美元。

- Cantor Fitzgerald的一位分析师已经将其评级下调为超配,将目标价调整为885美元。

- BMO Capital的一位分析师坚持对礼来保持超买评级,维持目标价为1001美元。

- Cantor Fitzgerald的一位分析师将其评级下调为超配,目标价为885美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Eli Lilly and Co options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在回报。精明的交易者通过持续教育自己、调整策略、监控多个因子、密切关注市场动态来管理这些风险。通过Benzinga Pro全天实时提醒了解最新的礼来期权交易。