What the Options Market Tells Us About Carnival

What the Options Market Tells Us About Carnival

Financial giants have made a conspicuous bullish move on Carnival. Our analysis of options history for Carnival (NYSE:CCL) revealed 8 unusual trades.

金融巨头对嘉年华邮轮做出了明显的看好举动。我们对嘉年华邮轮(NYSE:CCL)期权历史进行分析,发现了8笔异常交易。

Delving into the details, we found 50% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $411,924, and 3 were calls, valued at $229,942.

进一步详细了解后,我们发现50%的交易者看涨,而37%的交易者看淡。在我们发现的所有交易中,有5笔看跌交易,价值为$411,924,还有3笔看涨交易,价值为$229,942。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $16.0 and $22.0 for Carnival, spanning the last three months.

通过评估交易量和未平仓合约,显然主要市场动力放眼于嘉年华邮轮价格在区间$16.0至$22.0内,时间跨度为过去三个月。

Insights into Volume & Open Interest

成交量和持仓量分析

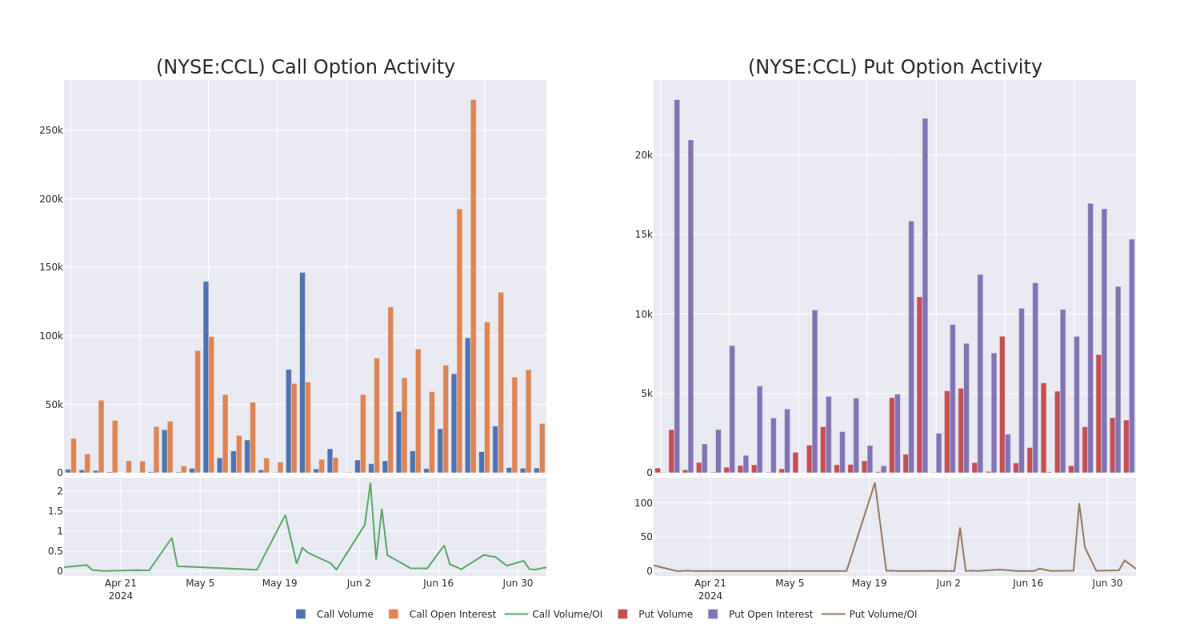

In terms of liquidity and interest, the mean open interest for Carnival options trades today is 6339.62 with a total volume of 6,805.00.

就流动性和利息而言,嘉年华邮轮期权交易的平均未平仓合约为6339.62,总成交量为6805.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Carnival's big money trades within a strike price range of $16.0 to $22.0 over the last 30 days.

在下面的图表中,我们能够跟踪过去30天嘉年华邮轮大额交易的看涨期权和看跌期权成交量和未平仓合约的发展,这些交易的行权价区间为$16.0至$22.0。

Carnival Call and Put Volume: 30-Day Overview

嘉年华邮轮看涨期权和看跌期权成交量:30天概述

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | PUT | SWEEP | BULLISH | 09/20/24 | $1.46 | $1.42 | $1.42 | $18.00 | $167.2K | 1.6K | 3.2K |

| CCL | CALL | SWEEP | BULLISH | 09/20/24 | $1.05 | $0.97 | $1.05 | $18.00 | $123.7K | 1.3K | 3.2K |

| CCL | PUT | SWEEP | BULLISH | 01/17/25 | $5.2 | $5.15 | $5.15 | $22.00 | $76.7K | 784 | 1 |

| CCL | PUT | SWEEP | BEARISH | 09/20/24 | $0.59 | $0.54 | $0.59 | $16.00 | $69.4K | 2.4K | 3.2K |

| CCL | CALL | SWEEP | NEUTRAL | 06/20/25 | $1.52 | $1.41 | $1.52 | $22.00 | $66.4K | 6.3K | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 嘉年华邮轮 | 看跌 | SWEEP | 看好 | 09/20/24 | $1.46 | $1.42 | $1.42 | $18.00 | $167.2K | 1.6K | 3.2K |

| 嘉年华邮轮 | 看涨 | SWEEP | 看好 | 09/20/24 | $1.05 | $0.97 | $1.05 | $18.00 | $123.7K | 1.3K | 3.2K |

| 嘉年华邮轮 | 看跌 | SWEEP | 看好 | 01/17/25 | $5.2 | $5.15 | $5.15 | $22.00 | $76.7K | 784 | 1 |

| 嘉年华邮轮 | 看跌 | SWEEP | 看淡 | 09/20/24 | $0.59 | $0.54 | $0.59 | 16.00美元 | $69.4K | 2.4K | 3.2K |

| 嘉年华邮轮 | 看涨 | SWEEP | 中立 | 06/20/25 | $1.52 | $1.41 | $1.52 | $22.00 | $66.4K | 6.3K | 0 |

About Carnival

关于嘉年华

Carnival is the largest global cruise company, with 92 ships in service at the end of fiscal 2023. Its portfolio of brands includes Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe. It's currently folding its P&O Australia brand into Carnival. The firm also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Carnival's brands attracted nearly 13 million guests in 2019, prior to covid-19, a level it reached again in 2023.

嘉年华是全球最大的邮轮公司,截至2023财年末,公司拥有92艘船只。其品牌组合包括北美的嘉年华邮轮、荷兰美洲、公主邮轮和希伯伦; 英国的P&O邮轮和昆达线; 德国的Aida; 南欧的Costa邮轮。公司目前正在将其P&O澳大利亚品牌纳入嘉年华。该公司还拥有阿拉斯加荷兰美洲公主游览和加拿大育空地区游览。在疫情之前,嘉年华的品牌吸引了近1300万名客人,而这一水平在2023年再次达到。

Present Market Standing of Carnival

嘉年华的现在市场地位

- Currently trading with a volume of 4,711,296, the CCL's price is down by -1.66%, now at $17.16.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 84 days.

- 目前成交量为4,711,296,CCL的价格下跌了-1.66%,现在是$17.16。

- RSI读数表明该股目前可能接近超买水平。

- 预期发布收益为84天。

What The Experts Say On Carnival

专家对嘉年华邮轮的评价

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $22.4.

过去30天内,共有5位专业分析师对这只股票进行了评级,平均目标价为22.4美元。

- An analyst from Argus Research has decided to maintain their Buy rating on Carnival, which currently sits at a price target of $25.

- An analyst from Susquehanna has decided to maintain their Positive rating on Carnival, which currently sits at a price target of $22.

- An analyst from B of A Securities has decided to maintain their Buy rating on Carnival, which currently sits at a price target of $24.

- An analyst from Deutsche Bank persists with their Hold rating on Carnival, maintaining a target price of $19.

- An analyst from Citigroup has decided to maintain their Buy rating on Carnival, which currently sits at a price target of $22.

- 雅运股份的一位分析师决定维持其对嘉年华邮轮的买入评级,目前的价格目标为$25。

- Susquehanna的分析师决定维持对嘉年华邮轮的积极评级,目前的目标价格为22美元。

- 彭博证券的分析师决定维持他们对嘉年华的买入评级,目前的目标价为24美元。

- 德意志银行的一位分析师继续维持他们对嘉年华的持有评级,保持目标价为19美元。

- 花旗集团的一位分析师决定维持其对嘉年华邮轮的买入评级,目前的价格目标为$22。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Carnival with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高的利润潜力。精明的交易者通过不断的教育、战略性的交易调整、利用各种因子以及保持对市场动态的关注来减轻这些风险。使用Benzinga Pro实时警报,了解最新的嘉年华期权交易。