UOL Chairman Wee Ee Lim Builds Interest

UOL Chairman Wee Ee Lim Builds Interest

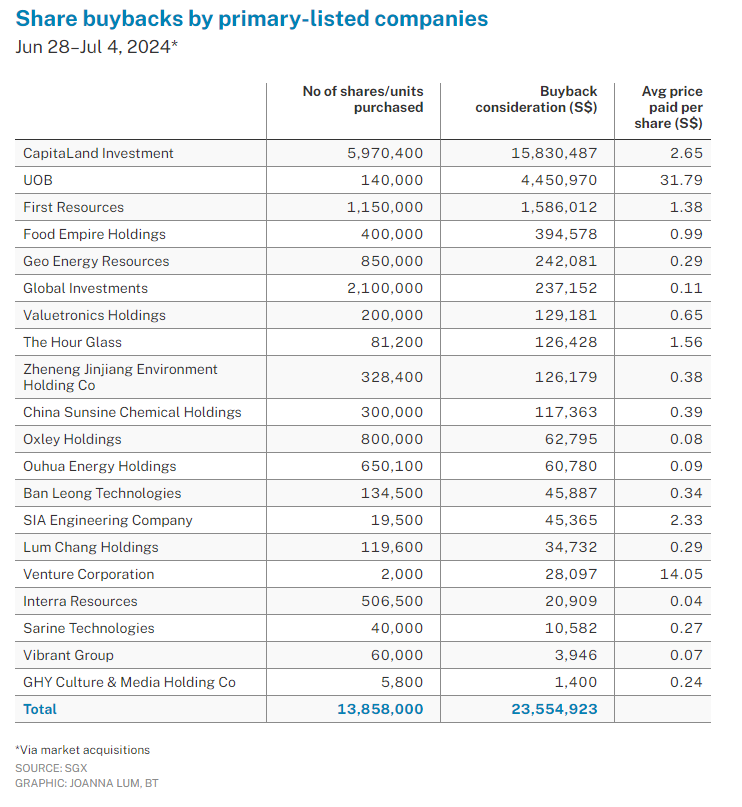

Institutions were net buyers of Singapore stocks over the five trading sessions through to Jul 4, with S$188 million of net institutional inflow, as 20 primary-listed companies conducted buybacks with a total consideration of S$23.6 million.

7月4日,机构净买入新加坡股票,净机构资金流入1.88亿元。20家主板上市公司进行了回购,总回购金额为2360万元。

CapitaLand Investment : 9CI 0% (CLI) led the buyback consideration tally for the five sessions, acquiring 5,970,400 shares at an average price of S$2.65 per share. This brings the percentage of shares acquired on the current mandate to 1.47 per cent of the issued shares (excluding treasury shares) as of the date of the share-buyback resolution.

凯德置地投资:9CI 0%(CLI)在这五个交易日中领导了回购额统计,以每股2.65新元的平均价格收购了5,970,400股。这将该公司在当前授权范围内收购的股份占已发行股份(不包括库藏股)的1.47%(自股份回购决议日期起)。

For the contingent of non-STI primary-listed companies that conducted buybacks, First Resources : EB5 +0.72% led the consideration tally with 1.15 million shares purchased at an average price of S$1.38 per share.

对于进行回购的非海峡时报指数(STI)主板上市公司而言,益资源(First Resources)EB5 +0.72%以1.38新元的平均价格购买了115万股。

OUE also filed that the date of purchase of its off-market acquisition of 84,038,036 shares was Jul 5.

OUE还宣布,其以场外交易方式获取了84,038,036股的日期为7月5日。

Leading the net institutional inflow were DBS, UOB, Singtel, OCBC, Seatrium, Yangzijiang Shipbuilding, Sats, Great Eastern, Mapletree Pan Asia Commercial Trust, and Venture Corporation.

领先的净机构资金流入公司为星展银行、大华银行、新加坡电信、华侨银行、海庭、扬子江船业、新翔集团、大东方控股、万宝路泛亚商业信托和创业公司。

Meanwhile, Sembcorp Industries, Genting Singapore, Jardine Cycle & Carriage, Singapore Airlines, Mapletree Industrial Trust, Singapore Exchange, Keppel, CapitaLand Ascendas Reit, Wilmar International and CapitaLand Ascott Trust led the net institutional outflow.

同时,新加坡工业、云顶新加坡、怡和汽车、新加坡航空、万宝路工业信托、新加坡交易所、吉宝、凯德商业安达仕房产信托、威廉多美和凯德公寓信托领导了净机构资金流出。

The five trading sessions saw around 100 director interests and substantial shareholdings filed for close to 50 primary-listed stocks. Directors or chief executives filed 19 acquisitions, and no disposals, while substantial shareholders filed 11 acquisitions and nine disposals.

这五个交易日中,近50家主板上市公司的近100个董事利益和实质性股权持有情况的申报。董事或首席执行官共申报了19份收购文件,没有出售,而实质性股东则申报了11份收购和9份出售文件。

UOL Group

华业集团

Between Jun 27 and 28, Wee Investments acquired 426,700 shares of UOL Group at an average price of S$5.20 per share. With a consideration of S$2.2 million, this increased the deemed interests of UOL Group chairman Wee Ee Lim and director Wee Ee-chao.

6月27日至28日,黄氏投资公司以每股5.20新元的平均价格收购了UOL Group的426,700股。这增加了UOL集团主席黄伊林和董事黄伊超的认定利益。共计220万元。

This has brought the total interest of Wee Ee Lim from 15.74 per cent to 15.79 per cent.

这使黄伊林的总权益从15.74%升至15.79%。

The preceding acquisition of UOL Group shares by Wee Investments via a market transaction was back in March 2023 with 300,000 shares bought at S$6.74 per share.

之前,黄氏投资公司通过市场交易收购UOL Group股票是在2023年3月,他们以每股6.74新元的价格购买了300,000股。

Wee Ee Lim was appointed chairman of the group in February 2024. Prior to this, he was deputy chairman from the time of the appointment in August 2015.

在2024年2月,黄伊林被任命为集团主席。在此之前,自2015年8月被任命为副主席。

He is also the chairman of Singapore Land Group and a non-executive and non-independent director of UOB.

他还是新加坡联合地产集团的主席,是大华银行的非执行独立董事。

In addition, he is the president and CEO of Haw Par Corporation since 2003 and has been closely involved in the management and growth of the Haw Par Group for more than 30 years.

此外,自2003年以来,他一直是虎豹企业的总裁兼首席执行官,并密切参与虎豹集团的管理和发展超过30年。

An STI constituent, UOL Group is a leading Singapore-listed property and hospitality group.

作为海峡时报指数(STI)成分股之一,华业集团是一家领先的在新加坡上市的房地产和酒店集团。

With a rich history that began as Faber Union in 1963, today UOL Group maintains a robust portfolio that includes residential properties, commercial investments, and a strong foothold in the hospitality industry, with around S$22 billion in total assets.

华业集团的历史可以追溯到1963年的Faber Union,它目前拥有庞大的组合,包括住宅物业,商业投资以及在酒店业拥有坚实的立足点,总资产约为220亿新元。

For its FY23 (ended Dec 31), UOL Group reported a 44 per cent increase in net attributable profit to S$707.7 million, mainly due to a gain of S$442.3 million from the sale of a wholly owned subsidiary which held Parkroyal on Kitchener Road. In FY23, 85 per cent of the group's revenue was from Singapore.

在其2023财年(截至12月31日)里,华业集团的归属于母公司股东的净利润增长了44%,达到707.7万新元,主要是由于全资子公司Parkroyal on Kitchener Road的出售收益高达442.3万新元。在2023财年中,该集团的营业收入有85%来自新加坡。

Looking to the remainder of FY24, Wee Ee Lim maintains that demand for private residential properties in Singapore is expected to grow at a slower pace. He adds that office rents are likely to moderate due to new pipeline of offices and more companies may right-size in view of economic uncertainties.

在剩余的2024财年中,黄伊林表示,新加坡私人住宅物业的需求预计增长速度将放缓。他补充说,由于新的办公室建设大量投入,办公室租金可能会有所稳定,而在经济不确定性的背景下,更多的公司可能会对规模进行调整。

On the hospitality side, Wee Ee Lim expects that with tourism projected to recover fully this year, the retail sector should benefit with higher tourist arrivals, and retail rents would be further supported by a lack of supply in retail space. Likewise, he expects that Singapore's hospitality sector is likely to continue its growth with the regional travel recovery.

在酒店方面,黄伊林预计,随着旅游业今年预计完全恢复,零售业应受益于更多的游客到来,而零售租金也将受到零售面积供应不足的支持。同样,他预计新加坡的酒店业将继续增长,受到区域旅游复苏的推动。

As at Jul 4, UOL Group maintains a return-on-equity ratio of 6.5 per cent, and as at the same date, a price-to-book ratio of 0.4x, a discount to the five-year average price-to-book ratio of 0.6x.

截至7月4日,华业集团的净资产收益率为6.5%,与截至同日期的市净率为0.4倍,低于五年平均市净率0.6倍。

The stock has ranked as Singapore's 23rd most traded by average daily turnover this year, in addition to ranking among the 10 stocks that have booked the most net retail inflow.

今年以来,该股票一直是新加坡交易量排名第23位的股票之一,还进入了10只积累了最多零售业流入的股票之列。

The Reuters Consensus Estimate Target Price for UOL Group is S$7.715. This represents the average of individual estimates provided by analysts covering the company, with estimates typically representing analyst's opinion of the stock performance over the next 18 months.

路氹集团的路透共识目标价为7.715新元。这代表了分析师覆盖的公司提供的个人估计的平均值,通常估计代表着分析师在未来18个月内股票表现的意见。

Raffles Medical Group

莱佛士医疗集团

On Jun 27, Raffles Medical Group executive chairman Loo Choon Yong acquired 800,000 shares at an average price of S$0.98 per share. This increased his total interest from 54.90 per cent to 54.94 per cent.

2022年6月27日,莱佛士医疗集团执行董事兼主席陆俊勇以每股0.98新元的平均价格收购了80万股。这将他的总持股从54.90%提高到54.94%。

Since, late February, Dr Loo has been gradually increasing his total interest in the stock from 53.02 per cent.

自2月底以来,陆博士一直在逐渐增加他在该股票中的总持股,总持股从53.02%增加。

LMS Compliance

LMS Compliance

Between July 2 and July 3, Louis May Pte Ltd acquired 261,000 shares of LMS Compliance at an average price of S$0.36 per share. This increased the aggregate deemed interest of executive director and CEO, Dr Ooi Shu Geok, and executive director and chief development officer, Chong Moi Me, from 83.21 per cent to 83.50 per cent.

Louis May Pte Ltd在7月2日至7月3日以每股0.36新元的平均价格收购了LMS Compliance的261,000股。这将执行董事兼首席执行官Ooi Shu Geok博士和执行董事兼首席发展官Chong Moi Me的集体被视为利益从83.21%提高至83.50%。

Both Dr Ooi and Chong are deemed interested in the Catalist-listed company shares held by Louis May and Fitcorp Value.

Ooi博士和Chong被视为对Louis May和Fitcorp Value持有的Catalist上市公司股票感兴趣。

CLI leads H1 2024 buyback consideration tally

CLI领导H1 2024回购考虑总数

In H1 2024, the total consideration of on-market share buybacks filed by close to 70 SGX primary-listed companies amounted to S$714 million, more than doubling the S$324 million of consideration reported for H1 2023.

在H1 2024,近70家SGX主板上市公司的市场回购总考虑金额为71400万新元,超过了H1 2023报告的32400万新元的考虑金额的两倍以上。

Share buybacks by way of market acquisitions are 'on-market', that is the company buys the shares from any willing seller at prevailing market value.

通过市场收购进行的股票回购是“在市场上”的,即公司以流通市值为基础从任意卖方购买股票。

Motivations for share buybacks can include employee compensation plans (such as share option schemes or employee share purchase plans) or long-term capital management.

进行股票回购的动机可能包括员工补偿计划(例如股票期权计划或员工购股计划)或长期资本管理。

The month of June saw more than S$200 million in buyback consideration, which was the highest monthly tally since September 2022.

6月份回购考虑总数超过20000万新元,是自2022年9月以来最高的。

CapitaLand Investment led the H1 2024 buyback consideration with 100,451,300 shares acquired at an average price of S$2.73 per share.

凯德置地投资以每股2.73新元的平均价格收购了100,451,300股,成为H1 2024回购考虑的领先者。

For the current mandate from Apr 25, through to Jun 30, CLI bought back 1.36 per cent of its issued shares (excluding treasury shares).

到目前为止,从4月25日到6月30日,CLI回购了其发行股票(不包括库存股)的1.36%。

The global real asset manager maintained that its share buybacks provide for "greater flexibility over its share capital structure with a view to improving, inter alia, its return on equity".

这个全球性的实物管理公司强调,它的股票回购提供了“在股票资本结构方面更大的灵活性,以提高其股本回报率”.

It also emphasised that it will only conduct share buybacks when it is of the view that such acquisitions will or will likely be in the interests of the company.

该公司还强调,只有在认为这种收购为公司的利益时,它才会进行股票回购。

OCBC, City Developments and UOB lodged the next highest on-market buyback considerations for H1 2024.

华侨银行,新加坡城发展和大华银行(UOB)是H1 2024市场回购考虑总额排名之后的公司。

Olam Group, Yangzijiang Financial Holding and First Resources booked the highest buyback consideration for the non-STI stocks.

Olam Group,扬子江金融控股和益资源分别预订了非STI股票的最高回购考虑总额。

Olam Group maintains that its buyback programme catalyses greater value for investors.

Olam Group表示,其回购计划促进了对投资者的更大价值。

Yangzijiang Financial Holding maintains its share buybacks as an effective method of returning value to shareholders and will continue doing so when circumstances permit.

扬子江金融控股认为,其股票回购是为股东创造价值的有效方式,只有在情况允许的情况下才会继续进行。

The asset manager adds that it takes the amount of surplus cash available, its share price level, and prevailing market conditions, into consideration when engaging in share buybacks.

该资产管理人表示,在进行股票回购时,考虑到可用盈余现金金额、股价水平和当前市场情况。

Inside Insights is a weekly column on The Business Times, read the original version.

《商业时报》的“行业内视”是一个每周专栏。 原版。

Enjoying this read?

喜欢这篇文章吗?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即订阅SGX My Gateway通讯,以获取最新市场资讯、板块表现、新产品发布更新以及新交易所上市公司的研报汇编。

- 通过我们的SGX Invest Telegram频道保持最新。