Wall Street's Most Accurate Analysts Say Buy These 3 Utilities Stocks Delivering High-Dividend Yields

Wall Street's Most Accurate Analysts Say Buy These 3 Utilities Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

即使市场处于历史高点,也会在动荡和不确定性时期,许多投资者转向股息率较高的股票。这些公司通常具有较高的自由现金流量,并用高分红回报股东。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga的读者可以查看我们的分析师股票评级页面,查看最新的分析师对他们最喜爱的股票的看法。交易员可以浏览Benzinga的广泛分析师评级数据库,包括按分析师准确性排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilities sector.

以下是公用事业板块三只高股息精准分析师的评级。

Atlantica Sustainable Infrastructure plc (NASDAQ:AY)

Atlantica可持续基础设施股份有限公司(纳斯达克:AY)

- Dividend Yield: 8.10%

- B of A Securities analyst Julien Dumoulin-Smith maintained a Buy rating and cut the price target from $22 to $20 on March 26. This analyst has an accuracy rate of 70%.

- RBC Capital analyst Shelby Tucker maintained an Outperform rating and slashed the price target from $26 to $24 on March 4. This analyst has an accuracy rate of 63%.

- Recent News: On May 28, the company announced it entered into a definitive agreement to be acquired by Energy Capital Partners.

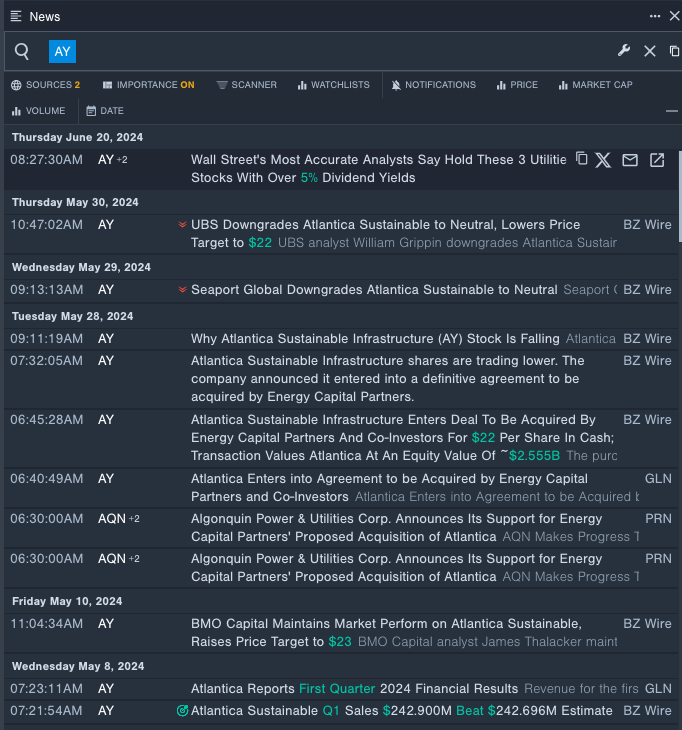

- Benzinga Pro's real-time newsfeed alerted to latest Atlantica Sustainable Infrastructure's news

- 股息收益率:8.10%

- BofA证券分析师Julien Dumoulin-Smith于3月26日维持了买入评级,将目标价从22美元下调至20美元。该分析师的准确率为70%。

- RBC Capital分析师Shelby Tucker于3月4日维持跑赢大盘评级,将目标价从26美元下调至24美元。该分析师的准确率为63%。

- 最近资讯:公司宣布于5月28日签署明确的协议,被Energy Capital Partners收购。

- Benzinga资讯的实时新闻提醒最新的Atlantica可持续基础设施股份投资资讯。

Clearway Energy, Inc. (NYSE:CWEN)

Clearway Energy,Inc.(纽交所:CWEN)

- Dividend Yield: 6.67%

- Oppenheimer analyst Noah Kaye maintained an Outperform rating and raised the price target from $33 to $37 on Jan. 19. This analyst has an accuracy rate of 67%.

- B of A Securities analyst Julien Dumoulin-Smithupgraded the stock from Neutral to Buy on Oct. 6, 2023. This analyst has an accuracy rate of 70%.

- Recent News: On May 9, Clearway Energy posted a first-quarter GAAP loss of 2 cents per share.

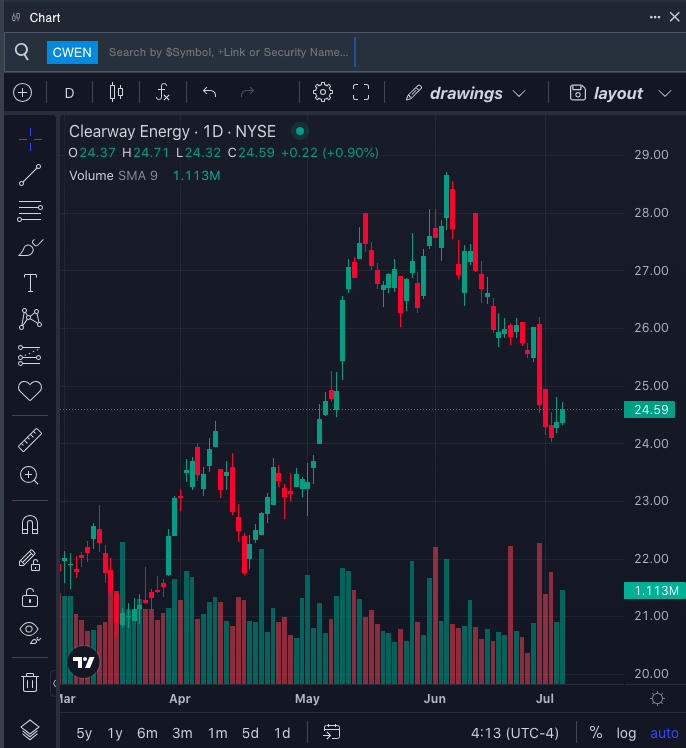

- Benzinga Pro's charting tool helped identify the trend in CWEN's stock.

- 股息收益率:6.67%

- Oppenheimer分析师Noah Kaye于1月19日维持跑赢大盘评级,将目标价从33美元上调至37美元。该分析师的准确率为67%。

- BofA证券分析师Julien Dumoulin-Smith于2023年10月6日将该股从中立评级调升至买入评级。该分析师的准确率为70%。

- 最近的消息:5月9日,Clearway Energy发布了每股亏损2美分的一季度财报。

- Benzinga资讯的K线工具帮助识别了CWEN股票的趋势。

Eversource Energy (NYSE:ES)

Eversource Energy(纽交所:ES)

- Dividend Yield: 4.99%

- Wells Fargo analyst Neil Kalton maintained an Overweight rating and raised the price target from $69 to $72 on May 3. This analyst has an accuracy rate of 67%.

- Guggenheim analyst Shahriar Pourreza upgraded the stock from Neutral to Buy and boosted the price target from $60 to $72 on Jan. 22. This analyst has an accuracy rate of 66%.

- Recent News: On May 1, Eversource Energy posted better-than-expected first-quarter earnings.

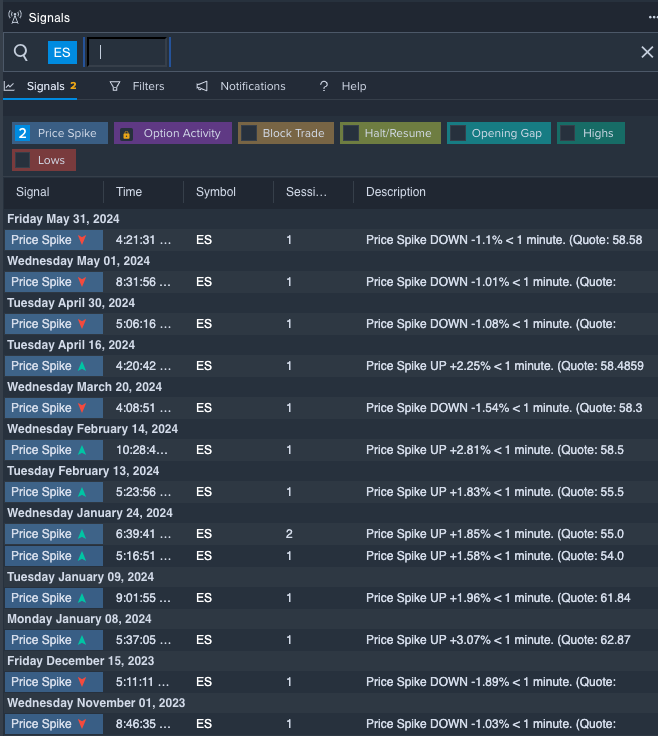

- Benzinga Pro's signals feature notified of a potential breakout in Eversource Energy's shares.

- 股息收益率:4.99%

- Wells Fargo分析师Neil Kalton于5月3日维持超配评级,将目标价从69美元上调至72美元。该分析师的准确率为67%。

- Guggenheim分析师Shahriar Pourreza于1月22日将该股从中立评级调升至买入评级,并将价格目标从60美元提高至72美元。该分析师的准确率为66%。

- 最近的消息:5月1日,Eversource Energy发布了超预期的一季度收益。

- Benzinga资讯的信号功能通知了Eversource Energy股票潜在的突破。