ServiceNow's Options Frenzy: What You Need to Know

ServiceNow's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on ServiceNow. Our analysis of options history for ServiceNow (NYSE:NOW) revealed 21 unusual trades.

金融巨头对ServiceNow采取了明显的看涨举动。我们对ServiceNow(纽约证券交易所代码:NOW)期权历史的分析显示了21笔不寻常的交易。

Delving into the details, we found 47% of traders were bullish, while 28% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $320,442, and 13 were calls, valued at $559,904.

深入研究细节,我们发现47%的交易者看涨,而28%的交易者表现出看跌趋势。在我们发现的所有交易中,有8笔是看跌期权,价值320,442美元,13笔是看涨期权,价值559,904美元。

Expected Price Movements

预期的价格走势

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $1140.0 for ServiceNow over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将ServiceNow的价格定在400.0美元至1140美元之间。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

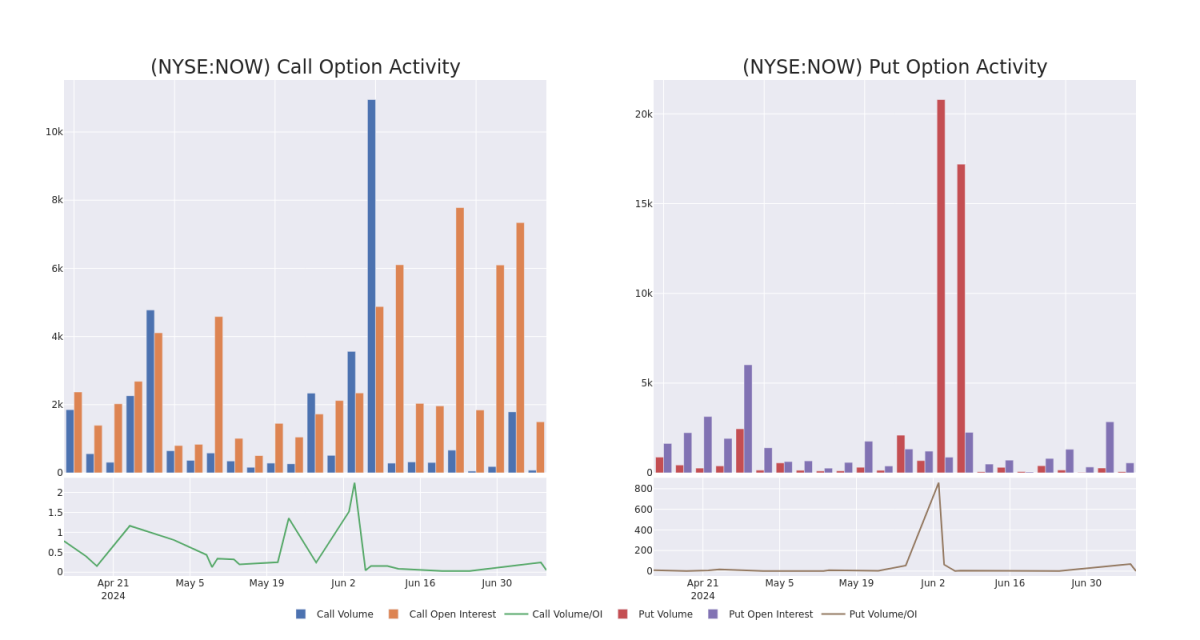

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in ServiceNow's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to ServiceNow's substantial trades, within a strike price spectrum from $400.0 to $1140.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了指定行使价下ServiceNow期权的流动性和投资者对ServiceNow期权的兴趣。即将发布的数据可视化了与ServiceNow的大量交易相关的看涨期权和看跌期权的交易量和未平仓合约的波动,在过去30天内,行使价范围从400.0美元到1140美元不等。

ServiceNow Option Volume And Open Interest Over Last 30 Days

过去 30 天的 ServiceNow 期权交易量和未平仓合约

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | CALL | SWEEP | BULLISH | 08/02/24 | $10.1 | $5.2 | $10.0 | $825.00 | $100.0K | 82 | 0 |

| NOW | CALL | TRADE | BULLISH | 01/16/26 | $168.0 | $158.0 | $168.0 | $730.00 | $67.2K | 31 | 0 |

| NOW | PUT | TRADE | BEARISH | 08/16/24 | $39.0 | $36.4 | $39.0 | $770.00 | $58.5K | 133 | 0 |

| NOW | PUT | SWEEP | BEARISH | 08/16/24 | $40.1 | $39.3 | $40.1 | $760.00 | $52.1K | 81 | 2 |

| NOW | CALL | TRADE | BULLISH | 01/16/26 | $102.0 | $97.8 | $101.1 | $880.00 | $50.5K | 80 | 0 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 现在 | 打电话 | 扫 | 看涨 | 08/02/24 | 10.1 | 5.2 美元 | 10.0 美元 | 825.00 美元 | 10.0K | 82 | 0 |

| 现在 | 打电话 | 贸易 | 看涨 | 01/16/26 | 168.0 美元 | 158.0 美元 | 168.0 美元 | 730.00 美元 | 67.2 万美元 | 31 | 0 |

| 现在 | 放 | 贸易 | 粗鲁的 | 08/16/24 | 39.0 美元 | 36.4 美元 | 39.0 美元 | 770.00 美元 | 58.5 万美元 | 133 | 0 |

| 现在 | 放 | 扫 | 粗鲁的 | 08/16/24 | 40.1 美元 | 39.3 美元 | 40.1 美元 | 760.00 美元 | 52.1 万美元 | 81 | 2 |

| 现在 | 打电话 | 贸易 | 看涨 | 01/16/26 | 102.0 美元 | 97.8 美元 | 101.1 美元 | 880.00 美元 | 50.5 万美元 | 80 | 0 |

About ServiceNow

关于 ServiceNow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

ServiceNow Inc提供软件解决方案,通过SaaS交付模式构建和自动化各种业务流程。该公司主要专注于为企业客户提供IT职能。ServiceNow从IT服务管理开始,扩展到IT职能部门,最近将其工作流程自动化逻辑引向了IT以外的职能领域,尤其是客户服务、人力资源服务交付和安全运营。ServiceNow 还提供应用程序开发平台即服务。

Where Is ServiceNow Standing Right Now?

ServiceNow 现在处于什么位置?

- Currently trading with a volume of 711,194, the NOW's price is down by -2.78%, now at $744.88.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 15 days.

- 目前的交易量为711,194美元,NOW的价格下跌了-2.78%,目前为744.88美元。

- RSI读数表明,该股目前可能接近超买。

- 预计财报将在15天后发布。

Expert Opinions on ServiceNow

专家对 ServiceNow 的看法

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $836.0.

在过去的30天中,共有5位专业分析师对该股发表了看法,将平均目标股价定为836.0美元。

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $900.

- An analyst from Guggenheim downgraded its action to Sell with a price target of $640.

- An analyst from Stifel has decided to maintain their Buy rating on ServiceNow, which currently sits at a price target of $820.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $900.

- An analyst from Keybanc persists with their Overweight rating on ServiceNow, maintaining a target price of $920.

- 尼德姆的一位分析师已将其评级下调至买入,将目标股价调整为900美元。

- 古根海姆的一位分析师将其股票评级下调至卖出,目标股价为640美元。

- Stifel的一位分析师已决定维持对ServiceNow的买入评级,目前的目标股价为820美元。

- 尼德姆的一位分析师已将其评级下调至买入,将目标股价调整为900美元。

- Keybanc的一位分析师坚持对ServiceNow的增持评级,维持920美元的目标价格。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。