PDD Holdings's Options Frenzy: What You Need to Know

PDD Holdings's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bullish stance on PDD Holdings (NASDAQ:PDD).

持有大量资本的投资者对PDD Holdings(纳斯达克:PDD)持看好态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录中发现,今天这些头寸已经出现了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PDD, it often means somebody knows something is about to happen.

无论是机构投资者还是仅是富有的个人投资者,我们并不知道。但当这样大的事情发生在PDD身上,通常意味着有人知晓即将发生的事情。

Today, Benzinga's options scanner spotted 13 options trades for PDD Holdings.

今天,Benzinga的期权扫描器发现PDD Holdings有13个期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 61% bullish and 38%, bearish.

这些大额交易者总的情绪分为61%看好和38%看淡。

Out of all of the options we uncovered, there was 1 put, for a total amount of $504,780, and 12, calls, for a total amount of $2,389,904.

在我们发现的所有期权中,有1个看跌期权,总金额为$504,780,以及12个看涨期权,总金额为$2,389,904。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $135.0 to $175.0 for PDD Holdings during the past quarter.

分析这些合同的成交量和持仓量,似乎过去一季度大的交易者一直在关注PDD Holdings在价格窗口为$135.0到$175.0之间的走势。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

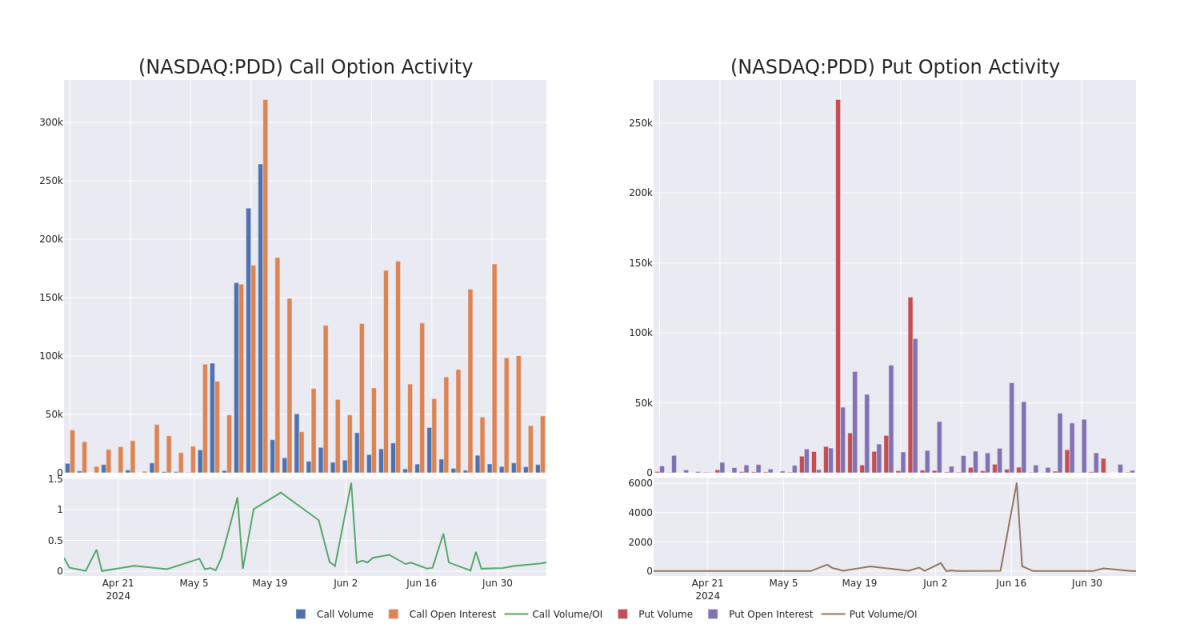

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in PDD Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to PDD Holdings's substantial trades, within a strike price spectrum from $135.0 to $175.0 over the preceding 30 days.

评估成交量和持仓量是期权交易的战略步骤。这些指标揭示了指定执行价格下PDD Holdings期权的流动性和投资者兴趣。以下数据呈现了近30天内$135.0到$175.0执行价格区间内PDD Holdings实质交易关联的看涨和看跌期权的成交量和持仓量波动情况。

PDD Holdings Option Volume And Open Interest Over Last 30 Days

PDD Holdings在过去30天内的期权成交量和未平仓金额

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | TRADE | BULLISH | 10/18/24 | $11.15 | $10.95 | $11.15 | $140.00 | $1.6M | 10.8K | 23 |

| PDD | PUT | TRADE | BULLISH | 10/18/24 | $9.4 | $8.8 | $8.95 | $135.00 | $504.7K | 1.7K | 437 |

| PDD | CALL | SWEEP | BEARISH | 01/17/25 | $5.75 | $5.7 | $5.75 | $175.00 | $128.2K | 7.3K | 202 |

| PDD | CALL | SWEEP | BEARISH | 01/17/25 | $5.9 | $5.75 | $5.75 | $175.00 | $114.4K | 7.3K | 2 |

| PDD | CALL | SWEEP | BULLISH | 08/16/24 | $1.98 | $1.92 | $1.98 | $150.00 | $99.2K | 12.0K | 598 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | 看涨 | 交易 | 看好 | 10/18/24 | $11.15 | $10.95 | $11.15 | $140.00 | $1.6M | 10.8K | 23 |

| PDD | 看跌 | 交易 | 看好 | 10/18/24 | 9.4美元 | $ 8.8 | $8.95 | $135.00 | $504.7K | 1.7K | 437 |

| PDD | 看涨 | SWEEP | 看淡 | 01/17/25 | $5.75 | $5.7 | $5.75 | $175.00 | $128.2K | 7.3K | 202 |

| PDD | 看涨 | SWEEP | 看淡 | 01/17/25 | $5.9 | $5.75 | $5.75 | $175.00 | $114.4K | 7.3K | 2 |

| PDD | 看涨 | SWEEP | 看好 | 08/16/24 | $1.98 | $1.92 | $1.98 | $150.00 | $99.2K | 12.0K | 598 |

About PDD Holdings

关于pdd holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

PDD Holdings是一家跨国商业集团,拥有和经营一系列业务。PDD的目标是将更多的企业和人们引入数字经济,从而使当地社区和小企业能从增加的生产率和新的机会中受益。PDD建立了一个支持其基础业务的采购、物流和履行能力网络。

Present Market Standing of PDD Holdings

PDD Holdings现在市场地位

- Currently trading with a volume of 1,790,399, the PDD's price is up by 1.96%, now at $137.32.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 49 days.

- 目前交易量为1,790,399,PDD的价格上涨了1.96%,现在为$137.32。

- RSI读数表明该股票目前可能接近超卖状态。

- 预计还有49天就要发布收益报告了。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。