Pfizer Options Trading: A Deep Dive Into Market Sentiment

Pfizer Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bearish move on Pfizer. Our analysis of options history for Pfizer (NYSE:PFE) revealed 11 unusual trades.

金融巨头对辉瑞采取了明显的看跌举动。我们对辉瑞(纽约证券交易所代码:PFE)期权历史的分析显示了11笔不寻常的交易。

Delving into the details, we found 27% of traders were bullish, while 72% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $154,085, and 9 were calls, valued at $424,990.

深入研究细节,我们发现27%的交易者看涨,而72%的交易者表现出看跌倾向。在我们发现的所有交易中,有2笔是看跌期权,价值为154,085美元,9笔是看涨期权,价值424,990美元。

Expected Price Movements

预期的价格走势

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $32.5 for Pfizer over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将辉瑞的价格定在15.0美元至32.5美元之间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

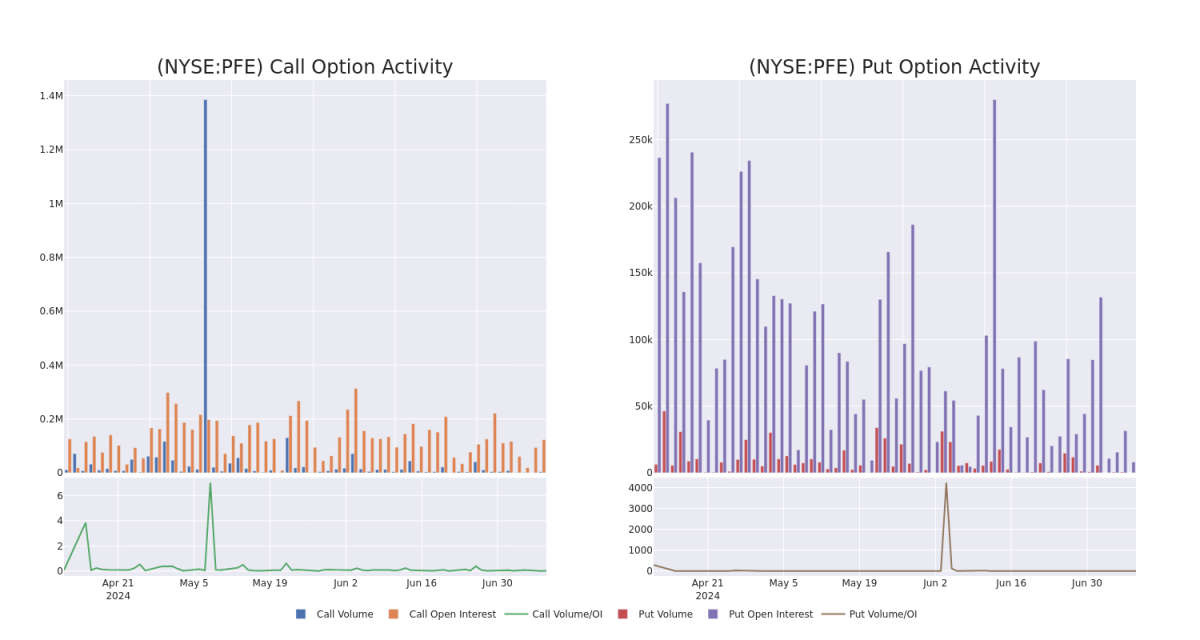

In terms of liquidity and interest, the mean open interest for Pfizer options trades today is 13140.3 with a total volume of 3,820.00.

就流动性和利息而言,辉瑞期权交易的平均未平仓合约为13140.3,总交易量为3,820.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Pfizer's big money trades within a strike price range of $15.0 to $32.5 over the last 30 days.

在下图中,我们可以跟踪辉瑞过去30天在15.0美元至32.5美元行使价区间内的大额资金交易的看涨和看跌期权交易量和未平仓合约的变化。

Pfizer Option Volume And Open Interest Over Last 30 Days

辉瑞过去30天的期权交易量和未平仓合约

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PFE | CALL | SWEEP | BULLISH | 06/20/25 | $4.15 | $4.0 | $4.15 | $25.00 | $122.0K | 11.0K | 374 |

| PFE | PUT | SWEEP | BEARISH | 12/20/24 | $3.55 | $3.45 | $3.55 | $30.00 | $89.8K | 4.1K | 3 |

| PFE | PUT | SWEEP | BEARISH | 03/21/25 | $6.05 | $5.9 | $5.95 | $32.50 | $64.2K | 3.9K | 0 |

| PFE | CALL | SWEEP | BEARISH | 10/18/24 | $0.53 | $0.5 | $0.5 | $30.00 | $56.5K | 7.0K | 10 |

| PFE | CALL | SWEEP | BEARISH | 01/16/26 | $2.66 | $2.55 | $2.55 | $30.00 | $45.8K | 34.8K | 200 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PFE | 打电话 | 扫 | 看涨 | 06/20/25 | 4.15 美元 | 4.0 美元 | 4.15 美元 | 25.00 美元 | 122.0 万美元 | 11.0K | 374 |

| PFE | 放 | 扫 | 粗鲁的 | 12/20/24 | 3.55 美元 | 3.45 美元 | 3.55 美元 | 30.00 美元 | 89.8 万美元 | 4.1K | 3 |

| PFE | 放 | 扫 | 粗鲁的 | 03/21/25 | 6.05 美元 | 5.9 美元 | 5.95 美元 | 32.50 美元 | 64.2 万美元 | 3.9K | 0 |

| PFE | 打电话 | 扫 | 粗鲁的 | 10/18/24 | 0.53 美元 | 0.5 美元 | 0.5 美元 | 30.00 美元 | 56.5 万美元 | 7.0K | 10 |

| PFE | 打电话 | 扫 | 粗鲁的 | 01/16/26 | 2.66 美元 | 2.55 美元 | 2.55 美元 | 30.00 美元 | 45.8 万美元 | 34.8 K | 200 |

About Pfizer

关于辉瑞

Pfizer is one of the world's largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

辉瑞是全球最大的制药公司之一,年销售额接近 500 亿美元(不包括 COVID-19 产品的销售额)。尽管它历来销售许多类型的医疗保健产品和化学品,但现在处方药和疫苗占销售额的大部分。最畅销的产品包括肺炎球菌疫苗Prevnar 13、抗癌药物Ibrance和心血管治疗药物Eliquis。辉瑞在全球销售这些产品,国际销售额占总销售额的近50%。在国际销售中,新兴市场是主要贡献者。

Following our analysis of the options activities associated with Pfizer, we pivot to a closer look at the company's own performance.

在我们分析了与辉瑞相关的期权活动之后,我们将着手仔细研究公司自身的业绩。

Present Market Standing of Pfizer

辉瑞目前的市场地位

- Currently trading with a volume of 9,849,321, the PFE's price is down by -2.06%, now at $27.35.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 21 days.

- PFE目前的交易量为9,849,321美元,价格下跌了-2.06%,目前为27.35美元。

- RSI读数表明,该股目前在超买和超卖之间处于中立状态。

- 预计收益将在21天后发布。

Professional Analyst Ratings for Pfizer

辉瑞的专业分析师评级

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $45.0.

在过去的一个月中,4位行业分析师分享了他们对该股的见解,提出平均目标价为45.0美元。

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $45.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $45.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $45.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $45.

- 坎托·菲茨杰拉德的一位分析师将其评级下调至增持,新的目标股价为45美元,这反映了人们的担忧。

- 坎托·菲茨杰拉德的一位分析师将其评级下调至增持,目标股价为45美元。

- 坎托·菲茨杰拉德的一位分析师已将其评级下调至增持,将目标股价调整为45美元。

- 坎托·菲茨杰拉德的一位分析师将其评级下调至增持,新的目标股价为45美元,这反映了人们的担忧。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。