A Closer Look at Roku's Options Market Dynamics

A Closer Look at Roku's Options Market Dynamics

Financial giants have made a conspicuous bullish move on Roku. Our analysis of options history for Roku (NASDAQ:ROKU) revealed 10 unusual trades.

金融巨头对Roku表现出明显的看好态度。我们对Roku (纳斯达克: ROKU)选项历史记录进行分析,发现有10次不寻常的交易。

Delving into the details, we found 60% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $88,050, and 8 were calls, valued at $489,291.

深入了解细节后,我们发现60%的交易员看涨,而30%呈看淡态度。我们发现所有交易中,有2笔看跌操作,价值为$88,050,还有8笔看涨操作,价值为$489,291。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $65.0 for Roku during the past quarter.

分析这些合同的成交量和持仓量,似乎大型交易商在过去的季度里一直在关注Roku在$55.0到$65.0之间的价格窗口。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

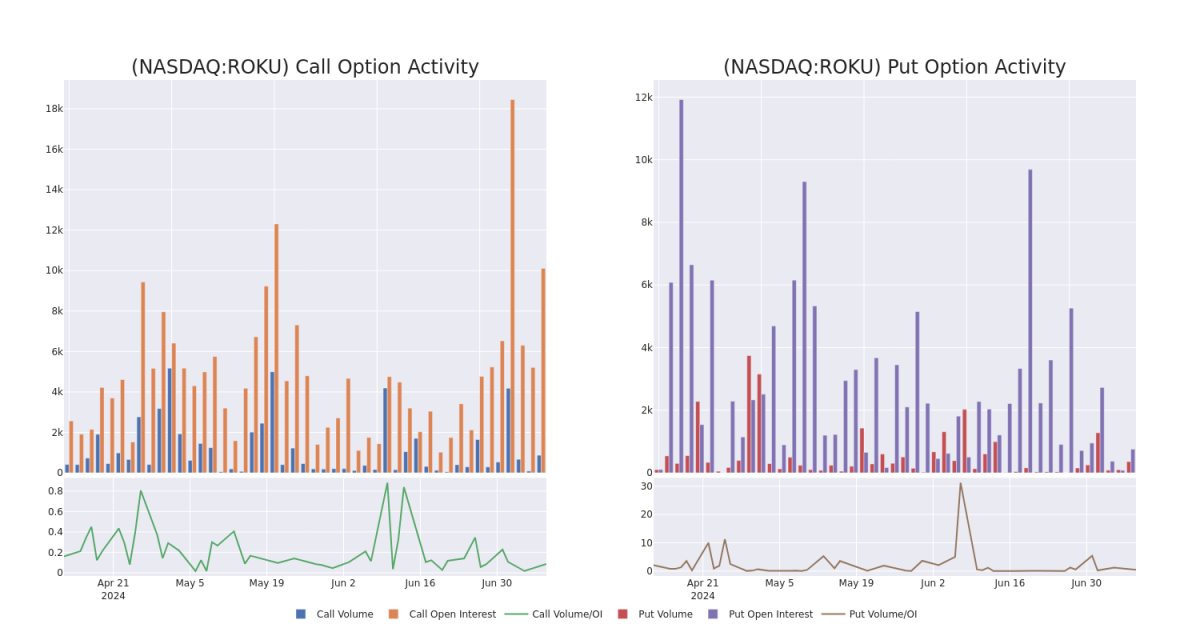

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Roku's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Roku's whale trades within a strike price range from $55.0 to $65.0 in the last 30 days.

在交易期权时,查看成交量和持仓量是一种非常强大的方法,因为这些数据可以帮助您跟踪Roku的期权的流动性和市场兴趣。下面,我们可以观察过去30天内所有Roku大客户在$55.0到$65.0之间的行权价内看跌和看涨期权分别的成交量和持仓量的变化趋势。

Roku Option Activity Analysis: Last 30 Days

Roku期权活动分析:最近30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROKU | CALL | SWEEP | BULLISH | 01/16/26 | $17.35 | $17.25 | $17.35 | $65.00 | $172.8K | 836 | 0 |

| ROKU | CALL | SWEEP | BULLISH | 08/16/24 | $3.95 | $3.9 | $3.95 | $65.00 | $74.6K | 1.0K | 4 |

| ROKU | CALL | TRADE | BEARISH | 01/16/26 | $18.3 | $18.25 | $18.25 | $65.00 | $60.2K | 836 | 419 |

| ROKU | PUT | SWEEP | BEARISH | 08/02/24 | $5.95 | $5.8 | $5.9 | $63.00 | $59.0K | 8 | 0 |

| ROKU | CALL | SWEEP | BULLISH | 10/18/24 | $11.05 | $10.95 | $11.05 | $55.00 | $51.9K | 866 | 1 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROKU | 看涨 | SWEEP | 看好 | 01/16/26 | $17.35 | $17.25 | $17.35 | $65.00 | $172.8K | 836 | 0 |

| ROKU | 看涨 | SWEEP | 看好 | 08/16/24 | $3.95 | $3.9 | $3.95 | $65.00 | $74.6K | 1.0K | 4 |

| ROKU | 看涨 | 交易 | 看淡 | 01/16/26 | $18.3 | $18.25 | $18.25 | $65.00 | $60.2K | 836 | 419 |

| ROKU | 看跌 | SWEEP | 看淡 | 08/02/24 | $5.95 | $5.8 | $5.9 | $63.00 | 59.0千美元 | 8 | 0 |

| ROKU | 看涨 | SWEEP | 看好 | 10/18/24 | $11.05 | $10.95 | $11.05 | $55.00 | $51.9K | 866 | 1 |

About Roku

关于Roku

Roku enables consumers to stream television programming. It has more than 80 million streaming households and provided well over 100 billion streaming hours in 2023. Roku is the top streaming operating system in the US, reaching more than half of broadband households, according to the company. Roku's OS is built into streaming devices and televisions that Roku sells and on connected televisions from other manufacturers that license Roku's name and software. Roku also operates the Roku Channel, a free, ad-supported streaming television platform that offers a mix of on-demand and live television programming. Roku generates revenue primarily from selling devices, licensing, and advertising, and it receives fees from subscription streaming platforms that sell subscriptions through Roku.

Roku使消费者能够流式传输电视节目。该公司拥有超过8000万个流式传输家庭,并提供了超过1000亿小时的流媒体时间。据该公司称,Roku是美国排名前列的流媒体操作系统,在美国有超过一半的宽带家庭使用。Roku的操作系统内建于Roku销售的流媒体设备和电视,并内置于其他制造商许可Roku名称和软件的连接电视上。Roku还经营Roku频道,这是一个免费的广告支持流媒体电视平台,提供按需和直播电视节目的混合内容。Roku主要通过销售设备、许可和广告获取营业收入,并从通过Roku销售订阅的订阅流平台收取费用。

Having examined the options trading patterns of Roku, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Roku的期权交易模式后,我们现在把注意力直接转向该公司。这个转变让我们可以深入了解它目前的市场地位和表现。

Roku's Current Market Status

Roku的当前市场状态

- Currently trading with a volume of 1,851,177, the ROKU's price is up by 2.25%, now at $62.39.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 16 days.

- ROKU交易量为1,851,177,涨幅为2.25%,目前报$62.39。

- RSI读数表明该股目前可能接近超买水平。

- 预计16天后发布收益报告。

What The Experts Say On Roku

专家对Roku的评价

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $87.5.

在过去30天中,共有2名专业分析师对该股票发表了意见,设定了平均目标价格为$87.5。

- An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $75.

- An analyst from Needham downgraded its action to Buy with a price target of $100.

- Wedbush的一位分析师将其评级下调为“跑赢大盘”,将价格目标调整为$75。

- Needham的一位分析师将其评级下调为“购买”,并将价格目标设定为$100。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Roku with Benzinga Pro for real-time alerts.

期权交易涉及更高的风险,但同时也具有更高的利润潜力。精明的交易员通过持续的教育、战略性的交易调整、利用各种因子以及关注市场动态来减轻这些风险。通过Benzinga Pro获得实时提醒,了解Roku的最新期权交易。