This Is What Whales Are Betting On BlackRock

This Is What Whales Are Betting On BlackRock

Whales with a lot of money to spend have taken a noticeably bullish stance on BlackRock.

有大量资金的鲸鱼对贝莱德采取了明显看涨的态度。

Looking at options history for BlackRock (NYSE:BLK) we detected 8 trades.

查看贝莱德(NYSE:BLK)的期权历史,我们检测到8笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 37% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有50%的投资者持有看好期望,而37%的人持有看淡期望。

From the overall spotted trades, 5 are puts, for a total amount of $316,463 and 3, calls, for a total amount of $161,259.

从总体上看,有5笔看跌期权交易,总金额为316,463美元和3笔看涨期权交易,总金额为161,259美元。

What's The Price Target?

价格目标是什么?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $680.0 to $910.0 for BlackRock over the last 3 months.

考虑到这些合约的成交量和未平仓合约量,过去3个月内鲸鱼一直将贝莱德的目标价位区间定为680.0至910.0美元。

Volume & Open Interest Trends

成交量和未平仓量趋势

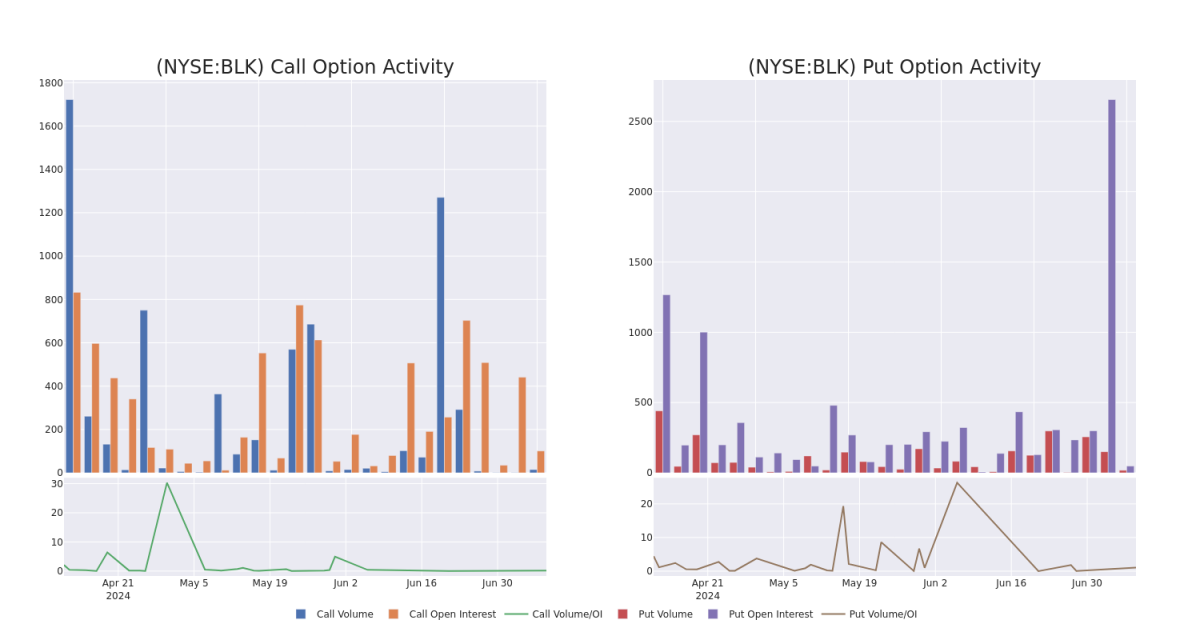

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in BlackRock's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to BlackRock's substantial trades, within a strike price spectrum from $680.0 to $910.0 over the preceding 30 days.

在期权交易中评估成交量和未平仓合约量是一个战略性的步骤。这些指标揭示了在特定行权价格下贝莱德期权的流动性和投资者兴趣。接下来的数据可视化了在680.0至910.0美元行权价格范围内,过去30天内贝莱德的看涨期权和看跌期权的成交量和未平仓合约量的波动。

BlackRock Option Activity Analysis: Last 30 Days

贝莱德期权活动分析:过去30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BLK | PUT | SWEEP | BULLISH | 01/16/26 | $90.2 | $87.2 | $87.38 | $820.00 | $122.3K | 27 | 9 |

| BLK | PUT | SWEEP | BULLISH | 01/16/26 | $94.3 | $88.5 | $89.54 | $820.00 | $71.6K | 27 | 1 |

| BLK | CALL | SWEEP | BULLISH | 07/19/24 | $2.45 | $2.4 | $2.45 | $850.00 | $67.1K | 30 | 6 |

| BLK | CALL | SWEEP | NEUTRAL | 01/16/26 | $60.3 | $59.9 | $59.9 | $910.00 | $47.9K | 5 | 8 |

| BLK | CALL | SWEEP | BEARISH | 01/17/25 | $25.4 | $24.3 | $24.3 | $880.00 | $46.1K | 66 | 1 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 贝莱德 | 看跌 | SWEEP | 看好 | 01/16/26 | $90.2美元 | $87.2 | $87.38 | $820.00 | $122.3K | 27 | 9 |

| 贝莱德 | 看跌 | SWEEP | 看好 | 01/16/26 | $94.3 | $88.5 | $89.54 | $820.00 | $71.6K | 27 | 1 |

| 贝莱德 | 看涨 | SWEEP | 看好 | 07/19/24 | $2.45 | $2.4 | $2.45 | $850.00 | $67.1K | 30 | 6 |

| 贝莱德 | 看涨 | SWEEP | 中立 | 01/16/26 | $60.3 | $59.9 | $59.9 | $910.00 | $47.9K | 5 | 8 |

| 贝莱德 | 看涨 | SWEEP | 看淡 | 01/17/25 | 25.4美元 | $24.3 | $24.3 | $880.00 | $46.1K | 66 | 1 |

About BlackRock

关于贝莱德

BlackRock is the largest asset manager in the world, with $10.473 trillion in assets under management at the end of March 2024. Its product mix is fairly diverse, with 54% of managed assets in equity strategies, 27% in fixed income, 9% in multi-asset classes, 7% in money market funds, and 3% in alternatives. Passive strategies account for around two thirds of long-term AUM, with the company's ETF platform maintaining a leading market share domestically and on a global basis. Product distribution is weighted more toward institutional clients, which by our calculations account for around 80% of AUM. BlackRock is geographically diverse, with clients in more than 100 countries and more than one third of managed assets coming from investors domiciled outside the US and Canada.

BlackRock是全球最大的资产管理公司,2024年3月底,资产管理规模达10.473万亿美元。该公司的产品组合相当多样化,54%的托管资产在股票策略上,27%在固定收益上,9%在多种资产类别上,7%在货币市场基金上,3%在另类投资上。被动策略占长期资产管理规模的约三分之二,公司的 ETF平台在国内和全球范围内仍保持着领先的市场份额。产品分销更加偏向机构客户,根据我们的计算,机构客户占总资产规模的约80%。BlackRock在地理上是多样化的,客户遍及100多个国家,超过三分之一的托管资产来自于美国和加拿大以外的投资者。

Present Market Standing of BlackRock

贝莱德现市场的地位

- Trading volume stands at 325,725, with BLK's price up by 1.25%, positioned at $800.05.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 6 days.

- 交易量为325,725,BLK股票价格上涨1.25%,位于800.05美元。

- RSI指示股票可能已超买。

- 将在6天内公布收益预测。

Professional Analyst Ratings for BlackRock

贝莱德的专业分析师评级

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $942.0.

在过去的一个月中,有2位行业分析师分享了他们对这只股票的看法,建议一个平均目标价为942.0美元。

- Consistent in their evaluation, an analyst from Keefe, Bruyette & Woods keeps a Outperform rating on BlackRock with a target price of $915.

- Maintaining their stance, an analyst from TD Cowen continues to hold a Buy rating for BlackRock, targeting a price of $969.

- 在他们的评估中一致,Keefe、Bruyette & Woods的分析师认为贝莱德的目标价为915美元,维持看涨评级。

- TD Cowen的分析师继续持有贝莱德的买入评级,目标价为969美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest BlackRock options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在收益。精明的交易员通过不断学习、调整策略、监控多个因子以及密切关注市场波动来管理这些风险。通过Benzinga Pro实时提醒了解最新的贝莱德期权交易情况。