Looking At Deckers Outdoor's Recent Unusual Options Activity

Looking At Deckers Outdoor's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bearish approach towards Deckers Outdoor (NYSE:DECK), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DECK usually suggests something big is about to happen.

深口袋投资者采取了对Deckers Outdoor (NYSE:DECK)的看淡策略,市场参与者不应忽视这一点。我们在Benzinga的公共期权记录跟踪中发现了这一重大举动。这些投资者的身份尚不清楚,但DECk的如此显著变化通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Deckers Outdoor. This level of activity is out of the ordinary.

我们从Benzinga的期权扫描器突出了10项非凡的Deckers Outdoor期权活动,得出了这一信息。这种活动水平是不寻常的。

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 50% bearish. Among these notable options, 5 are puts, totaling $336,418, and 5 are calls, amounting to $214,030.

这些重量级投资者之间的普遍情绪分为两派,30%支持看好,50%看淡。在这些值得注意的期权中,有5个看跌期权,共计336,418美元,5个看涨期权,共计214,030美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $410.0 to $950.0 for Deckers Outdoor over the last 3 months.

通过考虑这些合同的成交量和持仓量,我们可以发现在过去的三个月中,大型投资者一直在针对Deckers Outdoor寻找从410.0到950.0美元价格区间的目标。

Volume & Open Interest Trends

成交量和未平仓量趋势

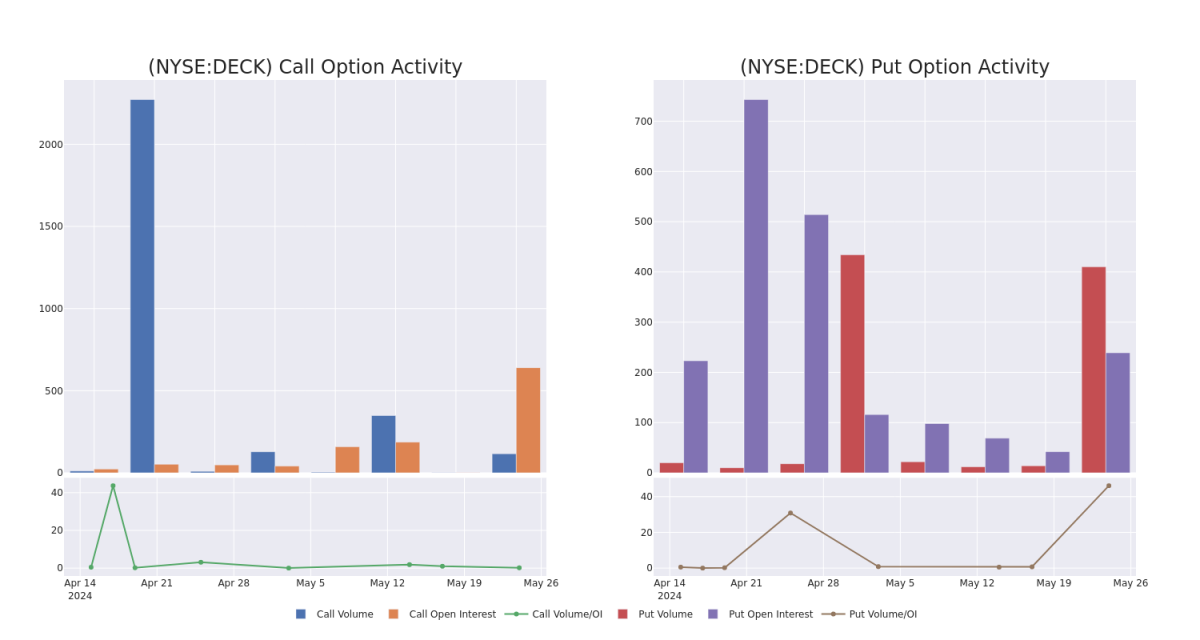

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Deckers Outdoor's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Deckers Outdoor's whale trades within a strike price range from $410.0 to $950.0 in the last 30 days.

在交易期权时,查看成交量和持仓量是一个非常重要的步骤。这些数据可以帮助您跟踪Deckers Outdoor在特定行权价格的期权的流动性和兴趣。下面,我们可以观察过去30天内,从410.0美元到950.0美元交易价格范围内Deckers Outdoor的所有空头和多头交易的成交量和持仓量的发展情况。

Deckers Outdoor Option Activity Analysis: Last 30 Days

Deckers Outdoor期权活动分析:过去30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DECK | PUT | SWEEP | BEARISH | 07/19/24 | $92.8 | $91.0 | $91.0 | $950.00 | $136.4K | 77 | 1 |

| DECK | PUT | TRADE | BULLISH | 12/20/24 | $116.9 | $114.0 | $114.0 | $950.00 | $91.2K | 23 | 0 |

| DECK | PUT | TRADE | BULLISH | 12/20/24 | $78.9 | $75.8 | $75.8 | $865.00 | $53.0K | 0 | 0 |

| DECK | CALL | TRADE | NEUTRAL | 12/20/24 | $487.0 | $477.0 | $481.09 | $410.00 | $48.1K | 3 | 1 |

| DECK | CALL | SWEEP | NEUTRAL | 08/16/24 | $49.4 | $43.2 | $46.67 | $880.00 | $46.7K | 6 | 2 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DECK | 看跌 | SWEEP | 看淡 | 07/19/24 | $92.8 | $91.0 | $91.0 | $950.00 | $136.4K | 77 | 1 |

| DECK | 看跌 | 交易 | 看好 | 12/20/24 | $116.9 | $114.0 | $114.0 | $950.00 | $91.2K | 23 | 0 |

| DECK | 看跌 | 交易 | 看好 | 12/20/24 | $78.9 | $75.8 | $75.8 | 865.00美元 | 53.0千美元 | 0 | 0 |

| DECK | 看涨 | 交易 | 中立 | 12/20/24 | $487.0 | $477.0 | $481.09 | $410.00 | $48.1K | 3 | 1 |

| DECK | 看涨 | SWEEP | 中立 | 08/16/24 | 49.4美元 | $43.2 | 46.67美元 | $880.00 | $46.7K | 6 | 2 |

About Deckers Outdoor

关于Deckers Outdoor

Deckers Outdoor Corp designs and sells casual and performance footwear, apparel, and accessories. Primary brands include UGG, Teva, and Sanuk. The company distributes Majority of its products through its wholesale business, but it also has a substantial direct-to-consumer business with its company-owned retail stores and websites. Majority of its sales are in the United States, although the company also has retail stores and distributors throughout Europe, Asia, Canada, and Latin America. It has structured their reporting around six segments which inlcudes the wholesale operations of specific brands like UGG, HOKA, Teva, Sanuk, and Other brands, alongside a segment focused on direct-to-consumer (DTC) operations.

Deckers Outdoor Corp设计和销售休闲和运动鞋类、服装和配件。主要品牌包括UGG、Teva和Sanuk。公司将大部分产品通过批发业务分销出去,但也通过其自营零售店和网站拥有实质性的直接消费者业务。其销售的大部分产品在美国,尽管该公司在欧洲、亚洲、加拿大和拉丁美洲也拥有零售店和经销商。公司围绕六个板块进行报告,其中包括特定品牌(如UGG、HOKA、Teva、Sanuk和其他品牌)的批发业务,以及集中于直接消费者(DTC)业务的板块。

Having examined the options trading patterns of Deckers Outdoor, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

经过对Deckers Outdoor期权交易模式的研究,我们现在将直接将注意力转向公司。这一转变使我们可以深入了解其目前的市场地位和表现。

Present Market Standing of Deckers Outdoor

Deckers Outdoor目前的市场地位

- Trading volume stands at 350,377, with DECK's price down by -0.96%, positioned at $930.0.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 15 days.

- 交易量为350,377,DECK的价格下跌了-0.96%,位于930.0美元。

- RSI指标显示该股票可能已被超卖。

- 预计在15天内公布收益报告。

Expert Opinions on Deckers Outdoor

关于Deckers Outdoor的专家意见

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $1200.0.

在过去30天中,总共有1位专业分析师对这只股票发表了看法,设定了平均目标价为1200.0美元。

- Maintaining their stance, an analyst from BTIG continues to hold a Buy rating for Deckers Outdoor, targeting a price of $1200.

- BTIG的分析师继续维持对Deckers Outdoor的买入评级,目标价为1200美元,和他们的观点一致。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。