Unpacking the Latest Options Trading Trends in Atlassian

Unpacking the Latest Options Trading Trends in Atlassian

Investors with a lot of money to spend have taken a bullish stance on Atlassian (NASDAQ:TEAM).

有很多闲钱的投资者对Atlassian(NASDAQ: TEAM)持有看涨态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录中发现,今天这些头寸已经出现了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with TEAM, it often means somebody knows something is about to happen.

无论是机构还是富人,我们并不知道。但是,当TEAm发生这样的大事时,通常意味着有人知道即将发生的事情。

Today, Benzinga's options scanner spotted 21 options trades for Atlassian.

今天,Benzinga的期权扫描仪发现了21个Atlassian的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 47% bullish and 28%, bearish.

这些大额交易者的整体情绪分为47%的看涨和28%的看跌。

Out of all of the options we uncovered, there was 1 put, for a total amount of $28,260, and 20, calls, for a total amount of $1,185,667.

在我们发现的所有期权中,有1个看跌期权,总金额为$28,260,还有20个看涨期权,总金额为$1,185,667。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $170.0 to $220.0 for Atlassian over the last 3 months.

综合考虑这些合同的成交量和未平仓合约量,似乎鲸鱼们在过去的3个月里将目标价位范围定在了$170.0到$220.0之间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

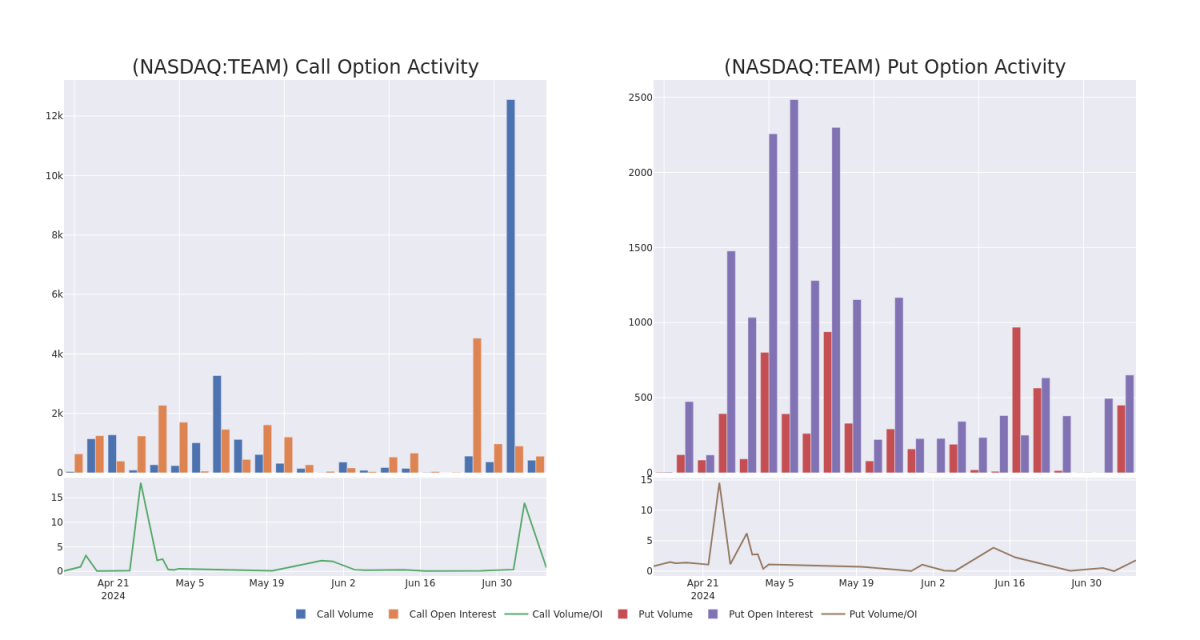

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Atlassian's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Atlassian's substantial trades, within a strike price spectrum from $170.0 to $220.0 over the preceding 30 days.

评估成交量和未平仓合约量是期权交易中的一项战略步骤。这些指标揭示了在指定执行价格下Atlassian期权的流动性和投资者兴趣。即将发布的数据将可视化展现过去30天内在执行价格$170.0到$220.0的看涨和看跌期权成交量和未平仓合约量的波动,以此呈现Atlassian的重要交易。

Atlassian Call and Put Volume: 30-Day Overview

Atlassian看涨期权和看跌期权成交量:30天概览

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TEAM | CALL | TRADE | BEARISH | 09/20/24 | $7.7 | $7.4 | $7.3 | $190.00 | $505.8K | 2.4K | 1.5K |

| TEAM | CALL | TRADE | BEARISH | 01/17/25 | $13.5 | $13.2 | $13.2 | $200.00 | $66.0K | 583 | 4 |

| TEAM | CALL | SWEEP | BEARISH | 09/20/24 | $9.5 | $9.3 | $9.5 | $190.00 | $56.4K | 2.4K | 352 |

| TEAM | CALL | SWEEP | BULLISH | 09/20/24 | $9.9 | $9.8 | $9.8 | $190.00 | $45.0K | 2.4K | 84 |

| TEAM | CALL | SWEEP | BEARISH | 09/20/24 | $10.1 | $9.6 | $9.6 | $190.00 | $43.2K | 2.4K | 307 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| team | 看涨 | 交易 | 看淡 | 09/20/24 | $7.7 | $7.4 | $7.3 | $190.00 | $505.8K | 2.4K | 1.5K |

| team | 看涨 | 交易 | 看淡 | 01/17/25 | $13.5 | $13.2 | $13.2 | 。 | $66.0K | 583 | 4 |

| team | 看涨 | SWEEP | 看淡 | 09/20/24 | $9.5 | $9.3 | $9.5 | $190.00 | $56.4K | 2.4K | 352 |

| team | 看涨 | SWEEP | 看好 | 09/20/24 | $9.9 | $9.8 | $9.8 | $190.00 | $45.0K | 2.4K | 84 |

| team | 看涨 | SWEEP | 看淡 | 09/20/24 | $10.1 | 9.6 | 9.6 | $190.00 | $43.2K | 2.4K | 307 |

About Atlassian

关于Atlassian

Atlassian produces software that helps teams work together more efficiently and effectively. The company provides project planning and management software, collaboration tools, and IT help desk solutions. The company operates in four segments: subscriptions (term licenses and cloud agreements), maintenance (annual maintenance contracts that provide support and periodic updates and are generally attached to perpetual license sales), perpetual license (upfront sale for indefinite usage of the software), and other (training, strategic consulting, and revenue from the Atlassian Marketplace app store). Atlassian was founded in 2002 and is headquartered in Sydney.

Atlassian生产的软件帮助团队更加高效、有效地协同工作。公司提供项目计划和管理软件、协作工具和IT帮助台解决方案。公司分为四个部分:订阅(期限许可证和云协议)、维护(提供支持和周期性更新的年度维护合同,通常与永久许可证销售捆绑)、永久许可证(一次性软件使用的销售收入)和其他(培训、战略咨询以及来自Atlassian Marketplace应用商店的收入)。Atlassian成立于2002年,总部位于悉尼。

Having examined the options trading patterns of Atlassian, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审视Atlassian的期权交易模式后,我们的注意力现在直接转向公司。这种转移使我们可以深入探讨其现有的市场地位和表现。

Present Market Standing of Atlassian

Atlassian的现有市场地位

- Currently trading with a volume of 1,104,674, the TEAM's price is down by -1.98%, now at $174.45.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 22 days.

- 目前成交量为1,104,674的TEAM价格下跌了-1.98%,现在为$174.45。

- RSI读数表明该股目前可能接近超买水平。

- 预计将在22天内发布财报。

What Analysts Are Saying About Atlassian

关于Atlassian,分析师们在说些什么

In the last month, 2 experts released ratings on this stock with an average target price of $237.5.

在过去的一个月里,有2位专家对这支股票发布了评级,平均目标价为$237.5。

- An analyst from Wells Fargo persists with their Overweight rating on Atlassian, maintaining a target price of $250.

- An analyst from Piper Sandler upgraded its action to Overweight with a price target of $225.

- 富国银行的一位分析师坚持给予Atlassian股票超配评级,维持目标价250美元。

- 派杰投资的分析师将其股票评级升级为超配,目标价为225美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。