P/E Ratio Insights for IDEXX Laboratories

P/E Ratio Insights for IDEXX Laboratories

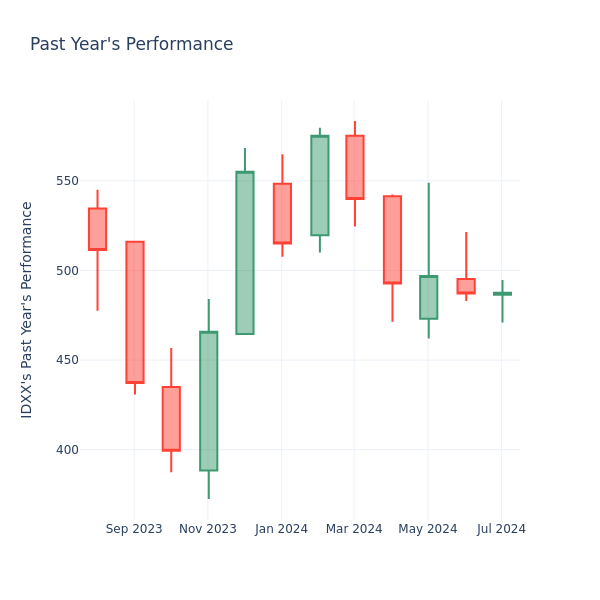

In the current market session, IDEXX Laboratories Inc. (NASDAQ:IDXX) price is at $487.60, after a 0.87% increase. However, over the past month, the stock fell by 3.66%, and in the past year, by 9.18%. Shareholders might be interested in knowing whether the stock is undervalued, even if the company is performing up to par in the current session.

在当前的市场交易中,IDEXX实验室公司(纳斯达克股票代码:IDXX)的价格在上涨0.87%之后为487.60美元。但是,在过去的一个月中,该股下跌了3.66%,在过去的一年中下跌了9.18%。股东们可能有兴趣知道该股票是否被低估,即使该公司在本交易日的表现达到了面值。

Comparing IDEXX Laboratories P/E Against Its Peers

将IDEXX实验室的市盈率与同行进行比较

The P/E ratio is used by long-term shareholders to assess the company's market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

长期股东使用市盈率来根据总市场数据、历史收益和整个行业来评估公司的市场表现。较低的市盈率可能表明股东预计该股将来不会表现更好,也可能意味着该公司的估值被低估了。

Compared to the aggregate P/E ratio of the 50.77 in the Health Care Equipment & Supplies industry, IDEXX Laboratories Inc. has a lower P/E ratio of 46.84. Shareholders might be inclined to think that the stock might perform worse than it's industry peers. It's also possible that the stock is undervalued.

与医疗保健设备及用品行业50.77的总市盈率相比,IDEXX Laboratories Inc.的市盈率较低,为46.84。股东们可能倾向于认为该股的表现可能比业内同行差。该股票也有可能被低估。

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

总之,市盈率是分析公司市场表现的有用指标,但它有其局限性。虽然较低的市盈率可能表明公司被低估了,但也可能表明股东对未来的增长不抱期望。此外,市盈率不应孤立使用,因为行业趋势和商业周期等其他因素也可能影响公司的股价。因此,投资者应将市盈率与其他财务指标和定性分析结合使用,以做出明智的投资决策。