Slowing Rates Of Return At Zangge Mining (SZSE:000408) Leave Little Room For Excitement

Slowing Rates Of Return At Zangge Mining (SZSE:000408) Leave Little Room For Excitement

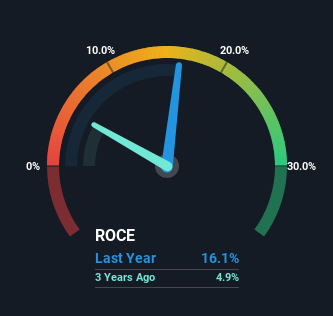

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So, when we ran our eye over Zangge Mining's (SZSE:000408) trend of ROCE, we liked what we saw.

如果您正在寻找多倍股,有几件事需要注意。理想情况下,一个企业将展示两种趋势;首先是日益增长的资本回报率(ROCE),其次是日益增加的资本投入。最终,这表明这是一家正在以递增的回报率重新投资利润的企业。所以,当我们审视Zangge Mining(深证:000408)ROCE的趋势时,我们喜欢看到的东西。

Understanding Return On Capital Employed (ROCE)

上面您可以看到蒙托克可再生能源现行ROCE与之前资本回报的比较,但过去只能知道这么多。如果您感兴趣,可以查看我们免费的蒙托克可再生能源分析师报告,了解分析师的预测。

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Zangge Mining is:

仅为澄清,如果您不确定,ROCE是评估公司收益率(以百分比表示)在其业务中投资的资本的度量标准。这种计算的公式在Zangge Mining上的结果是:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

资产雇用回报率(ROCE)是指企业利润,即企业税前利润除以企业投入的总资本(负债加股权)。如果ROCE高于企业财务成本的承受能力,那么企业就会创造出更多的价值。

0.16 = CN¥2.2b ÷ (CN¥14b - CN¥567m) (Based on the trailing twelve months to March 2024).

0.16=人民币22亿÷(人民币140亿-人民币567m)(基于2024年3月的过去12个月)。

Therefore, Zangge Mining has an ROCE of 16%. On its own, that's a standard return, however it's much better than the 5.5% generated by the Chemicals industry.

因此,Zangge Mining的ROCE为16%。单独来看,这是一个标准的回报,但比化学品行业的5.5%要好得多。

Above you can see how the current ROCE for Zangge Mining compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Zangge Mining for free.

您可以看到上面的内容,当前Zangge Mining的ROCE与之前的资本回报相比如何,但过去只能了解到这么多。如果您愿意,您可以免费查看分析师关于Zangge Mining的预测。

The Trend Of ROCE

当寻找下一个倍增器时,如果您不确定从哪里开始,请关注几个关键趋势。首先,我们希望看到一个经过验证的资本使用率。如果您看到这一点,通常意味着这是一家拥有出色业务模式和大量盈利再投资机会的公司。然而,调查蒙托克可再生能源公司(NASDAQ:MNTK)后,我们认为它的现行趋势不符合倍增器的模式。

While the current returns on capital are decent, they haven't changed much. The company has employed 71% more capital in the last five years, and the returns on that capital have remained stable at 16%. 16% is a pretty standard return, and it provides some comfort knowing that Zangge Mining has consistently earned this amount. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

虽然目前的资本回报率还不错,但并没有太大变化。在过去的五年中,该公司的资本投入增加了71%,而其资本回报率稳定在16%左右。16%是一个相当标准的回报率,并且这表明Zangge Mining持续地获得了这个水平的回报率。在这个水平上稳定的回报虽然可能不太令人兴奋,但如果它们能够长期保持,通常会为股东带来不错的回报。

On a side note, Zangge Mining has done well to reduce current liabilities to 4.0% of total assets over the last five years. Effectively suppliers now fund less of the business, which can lower some elements of risk.

顺便说一句,Zangge Mining在过去的五年中已成功将流动负债降至总资产的4.0%以下。有效地减少了供应商对企业的资助,减小了部分风险。

The Bottom Line On Zangge Mining's ROCE

Zangge Mining的ROCE底线

In the end, Zangge Mining has proven its ability to adequately reinvest capital at good rates of return. On top of that, the stock has rewarded shareholders with a remarkable 246% return to those who've held over the last five years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

最后,Zangge Mining已经证明了其以良好的回报率充分重新投资资本的能力。此外,该股票在过去五年中为持有者提供了令人瞩目的246%的回报。因此,尽管投资者似乎已经认识到这些有前途的趋势,我们仍然认为该股票值得进一步研究。

On a separate note, we've found 1 warning sign for Zangge Mining you'll probably want to know about.

另外,我们发现藏格矿业有1个警告信号,您可能需要了解。

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Hao Tian International Construction Investment Group确实存在一些风险,我们已经发现了一条警示标志,你可能会感兴趣。对于那些喜欢投资于实力雄厚的公司的人,可以查看这个由财务状况强大、股本回报率高的公司组成的免费列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

0.16 = CN¥2.2b ÷ (CN¥14b - CN¥567m)

0.16 = CN¥2.2b ÷ (CN¥14b - CN¥567m)