Ericsson Gains Premarket After Q2 Print, What's Going On?

Ericsson Gains Premarket After Q2 Print, What's Going On?

Ericsson (NASDAQ:ERIC) reported second-quarter fiscal 2024 results. The stock price climbed after the print.

爱立信(纳斯达克股票代码:ERIC)报告了2024财年第二季度业绩。印度股价在公布后上涨。

Sales declined 7% year-over-year to 59.8 billion Swedish Krona. In USD, sales of $5.597 billion beat the analyst consensus estimate of $5.363 billion. The sales decline was due to an 11% decrease in Networks.

营业额同比下降7%至598亿瑞典克朗。按美元计算,销售额为55.97亿美元,打败了分析师共识预期的53.63亿美元。销售额的下降是由于网络减少了11%。

Group organic sales declined by 7% Y/Y. Organic sales were stable in Cloud Software and Services and Enterprise.

集团有机销售额同比下降了7%。云软件和服务以及企业的有机销售额保持稳定。

Adjusted gross margin improved to 43.9% from 38.3% Y/Y, driven primarily by improved gross margin in Networks.

调整后毛利率从去年同期的38.3%提高到43.9%,主要是由于网络毛利率的改善。

Adjusted EBIT margin was (19.9)% versus 4.4% Y/Y due to a non-cash impairment loss relating to the Vonage acquisition. Adjusted EBITA margin improved to 6.8% from 5.7% a year ago.

由于与Vonage收购相关的非现金减值损失,调整后EBIt利润率为(19.9)%,而去年同期为4.4%。调整后EBITA利润率从去年同期的5.7%提高到6.8%。

Ericsson reported an EPS loss of SEK (3.34) versus SEK (0.21) Y/Y. In USD, EPS of $0.01 missed the analyst consensus estimate of $0.05.

爱立信的每股收益为SEk(3.34),而去年同期为SEk(0.21)。按美元计算,每股收益为0.01美元,低于分析师共识预期的0.05美元。

Free cash flow before M&A was SEK 7.595 billion in the quarter, benefiting from the operational improvements.

在M&A之前的自由现金流在本季度为75.95亿瑞典克朗,受益于运营改善。

As of June 30, 2024, net cash stood at SEK 28.7 billion.

截至2024年6月30日,净现金为287亿瑞典克朗。

Ericsson is taking further actions to address the ongoing challenges in the declining telecom equipment market, Bloomberg cites CFO Lars Sandstrom. In a Bloomberg interview, Sandstrom emphasized that a significant portion of the company's cost base is connected to personnel, and adjustments may be necessary moving forward.

据彭博社援引财务长Lars Sandstrom的话说,爱立信正在采取进一步措施应对衰落的电信设备市场。在接受彭博社采访时,他强调公司成本的很大一部分与员工有关,未来可能需要做出调整。

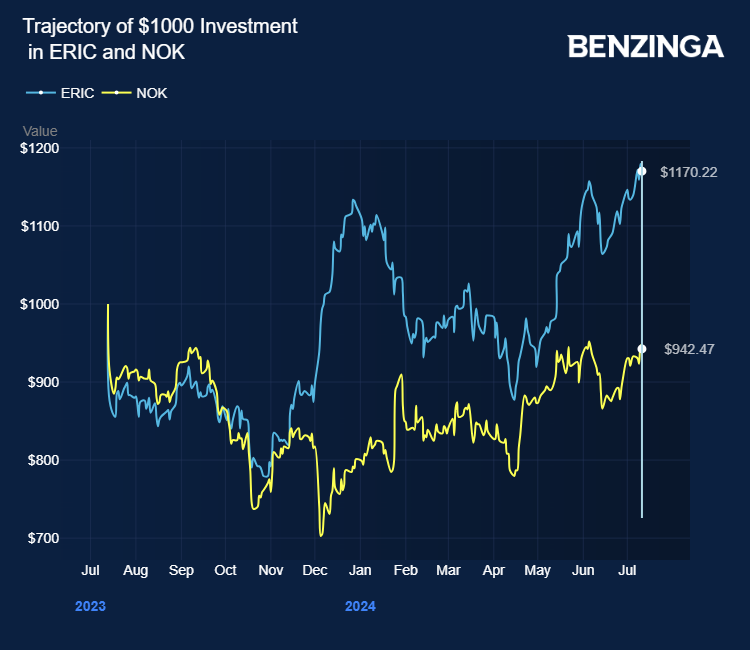

Ericsson and its Nordic competitor Nokia Corp (NYSE:NOK) have struggled with a lackluster telecom equipment market for years as the anticipated surge in 5G technology spending did not materialize. Despite this, there are signs that sales will stabilize this year. Ericsson's $14 billion network deal with US operator AT&T Inc (NYSE:T) will likely start contributing to revenue in the second half of the year.

爱立信及其挪威竞争对手诺基亚公司(纽约证券交易所:NOK)多年来一直在衰弱的电信设备市场中苦苦挣扎,因为预期中的5g技术支出激增没有出现。尽管如此,有迹象表明今年销售额将稳定。爱立信与美国运营商AT&t Inc(纽约证券交易所:T)的140亿美元网络交易很可能在今年下半年开始对营业收入产生贡献。

The prolonged downturn led Ericsson to cut approximately 8% of its workforce, or 8,500 employees, last year to reduce expenses. In March, the company announced the elimination of 1,200 jobs in Sweden. CEO Börje Ekholm acknowledged the challenging market conditions due to the slow pace of investments in India but anticipated benefits from North American contract deliveries in the latter half of the year.

由于印度投资步伐缓慢,使爱立信陷入长期衰退,去年公司裁员约8,500人,占员工总数的8%,以降低开支。3月份,公司宣布在瑞典裁减1,200个工作岗位。首席执行官Börje Ekholm承认由于印度投资步伐缓慢,市场条件具有挑战性,但预计后半年将从北美合同交付中获益。

Outlook: Ericsson expects a third-quarter adjusted gross margin of 45-47% and restructuring charges of SEK 3.0-4.0 billion in 2024.

展望: Ericsson预计第三季度的调整后毛利率为45-47%,2024年的重组费用为SEk 30-40亿。

Price Action: ERIC shares are up 2.97% at $6.58 premarket at the last check Friday.

截至周五上午最后一次检查,ERIC股票上涨2.97%,报6.58美元。

Photo by Mats Wiklund via Shutterstock

通过Shutterstock的Mats Wiklund拍摄的照片