Markets Weekly Update (July 12): The probability of a rate cut in September has increased significantly

Markets Weekly Update (July 12): The probability of a rate cut in September has increased significantly

Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

欢迎来到本周市场更新,本专栏致力于为您传达本周的必要投资见解和可能影响未来市场的重要事件。

Macro Matters

宏观事项

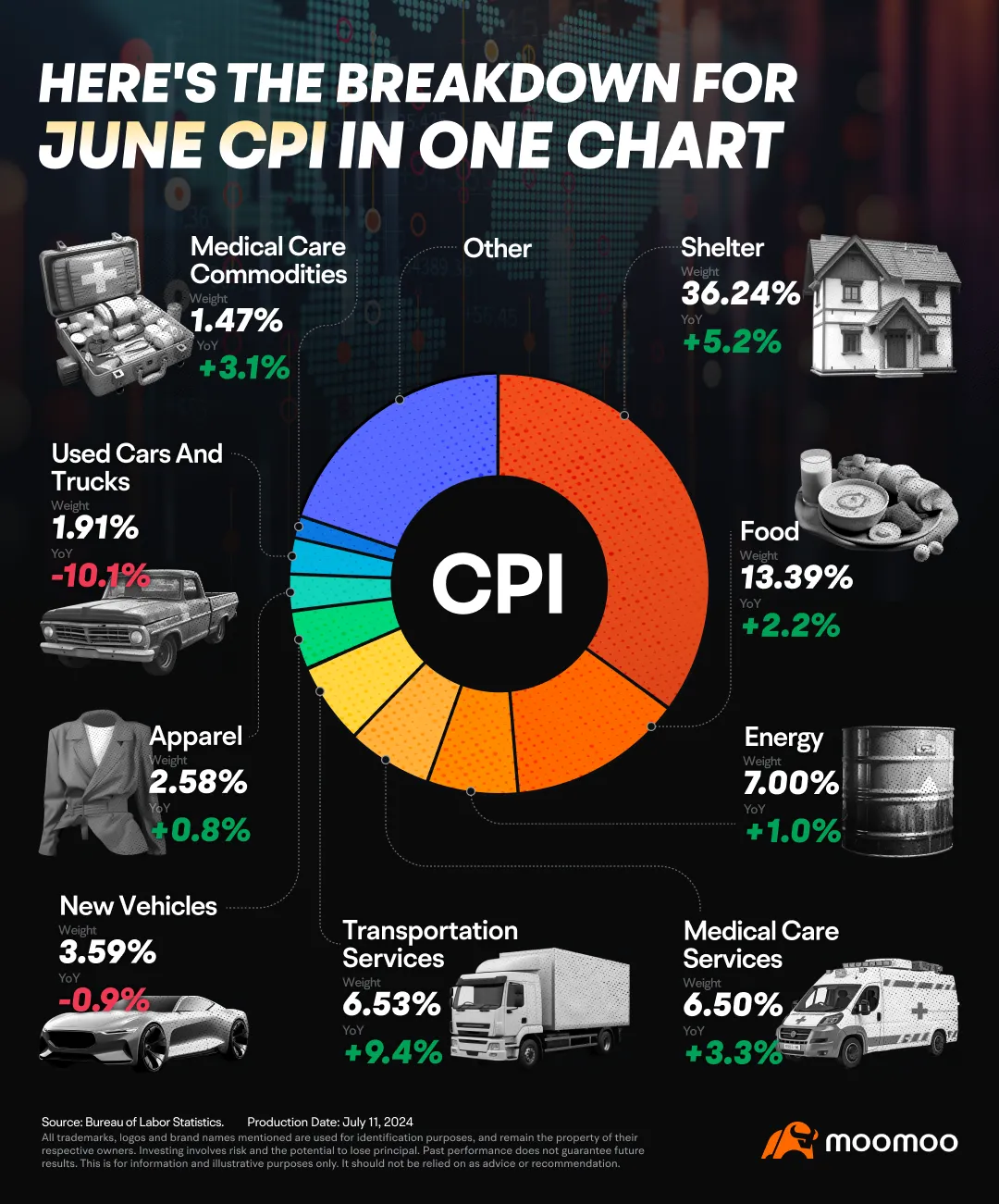

Inflation falls 0.1% in June from prior month

通胀从上月下降了0.1%。

CPI in the United States fell for a third straight month to 3.0% in June from 3.3% in May of 2024. Core consumer prices in the US increased by 3.3% in June of 2024 over the same month in the previous year, down from 3.4% in May.

美国CPI自2024年5月的3.3%下降至2024年6月的3.0%,连续第三个月下降。美国核心消费者价格于2024年6月同比增长3.3%,低于5月的3.4%。

Compared to the previous month, the CPI unexpectedly declined 0.1%, following a flat reading in May and compared to expectations of a 0.1% rise. Core CPI monthly rate edged down to 0.1% from 0.2%, below expectations of 0.2%.

与前一个月相比,CPI意外下降了0.1%,5月份则为持平,而市场预期则会上涨0.1%。核心消费者价格指数月率从0.2%下降至0.1%,低于市场预期的0.2%。

Powell cautions that maintaining elevated interest rates for too long might hurt the economy.

鲍威尔警告称,过长时间维持高利率可能会伤害经济。

Federal Reserve Chair Jerome Powell on Tuesday expressed concern that holding interest rates too high for too long could jeopardize economic growth.

美联储主席杰罗姆·鲍威尔周二表示,过长时间保持高利率可能会危及经济增长。

“Reducing policy restraint too late or too little could unduly weaken economic activity and employment,” Powell said in remarks for appearances this week on Capitol Hill.

鲍威尔在出席国会听证会的发言中表示:“过晚或过少地减缓政策将不正当地削弱经济活动和就业。”

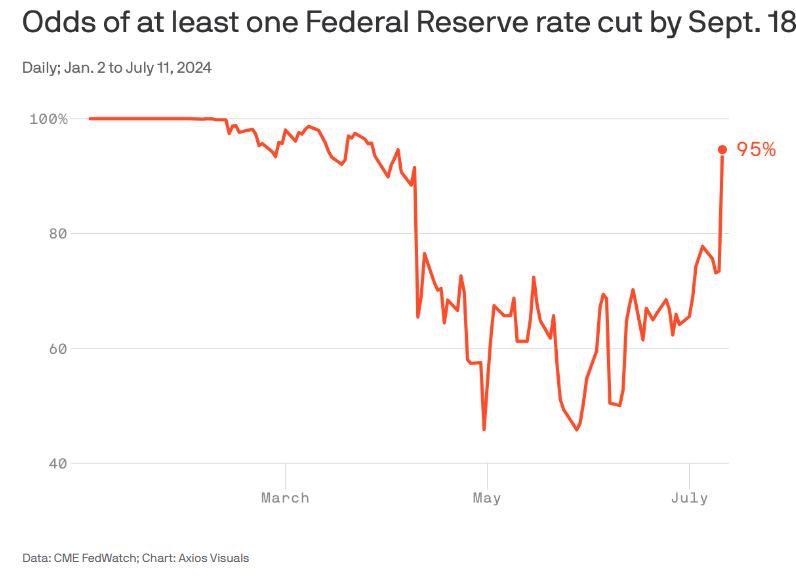

Markets expect the Fed to begin cutting rates in September and likely following up with another quarter percentage point reduction by the end of the year. FOMC members at their June meeting, however, indicated just one cut.

市场预计美联储将在9月开始降息,年底时再降低0.25个百分点左右。但在6月份的FOMC会议上,成员们表示只会降息一次。

After the benign inflation report, the CME Fed Funds futures markets spiked to pricing in a 95% probability that the Fed will cut in September.

在本次平稳的通胀报告之后,芝加哥商品交易所的美联储联邦基金期货市场大幅上涨,预计美联储将在9月降息的概率达95%。

Gold surges past $2400 as june cpi reveals declining inflation.

6月CPI报告显示通货膨胀持续下降,黄金价格飙升至2400美元以上。

The gold market responded positively to CPI report. Spot gold is currently trading at $2,413.92, representing a substantial daily gain of $42.79 or 1.8%. Gold futures for August delivery also saw significant increases, reaching $2,421.90 as of 5:20 PM ET, up $42.20 or 1.77%. The August contract touched an intraday high of $2,430.40.

黄金市场积极响应了CPI报告,即时金价格为每盎司2413.92美元,日涨幅1.8%,涨幅为42.79美元。截至下午5:20,8月黄金期货合约也出现了显著增长,达2421.90美元,上涨了42.20美元,涨幅为1.77%。8月的期货合约触及了每盎司2430.40美元的日内高点。

Smart Money Flow

智能资金流

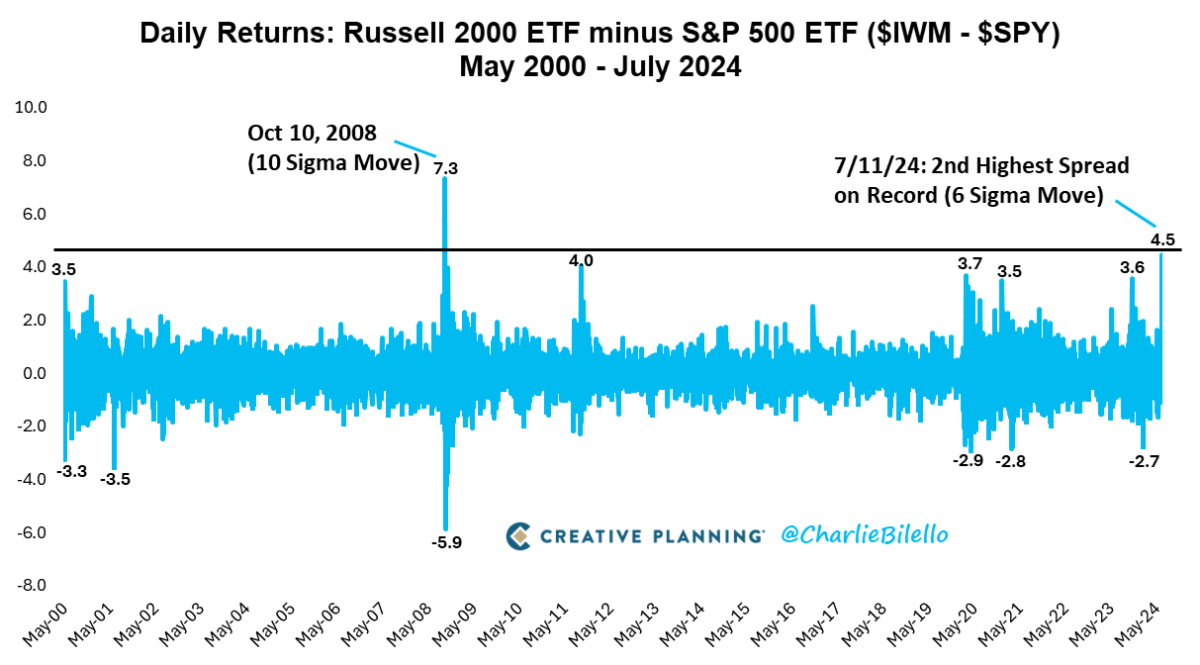

Small caps outperformed Large caps by 4.5% Thursday, a 6 standard deviation event and the 2nd biggest outperformance on record .

小盘股周四表现超过大盘股4.5%,这是一个6个标准差事件,也是有记录以来的第二大超额表现。

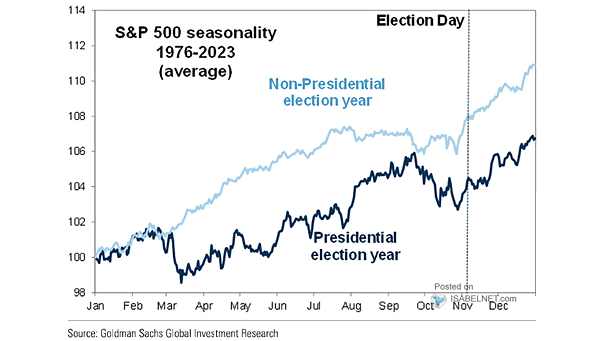

Seasonality analysis suggests that the second half of July can be a relatively weak time for U.S. stocks in years with a presidential election.

季节性分析表明,在总统选举年份的7月下半年,美国股票可能是相对疲弱的时期。

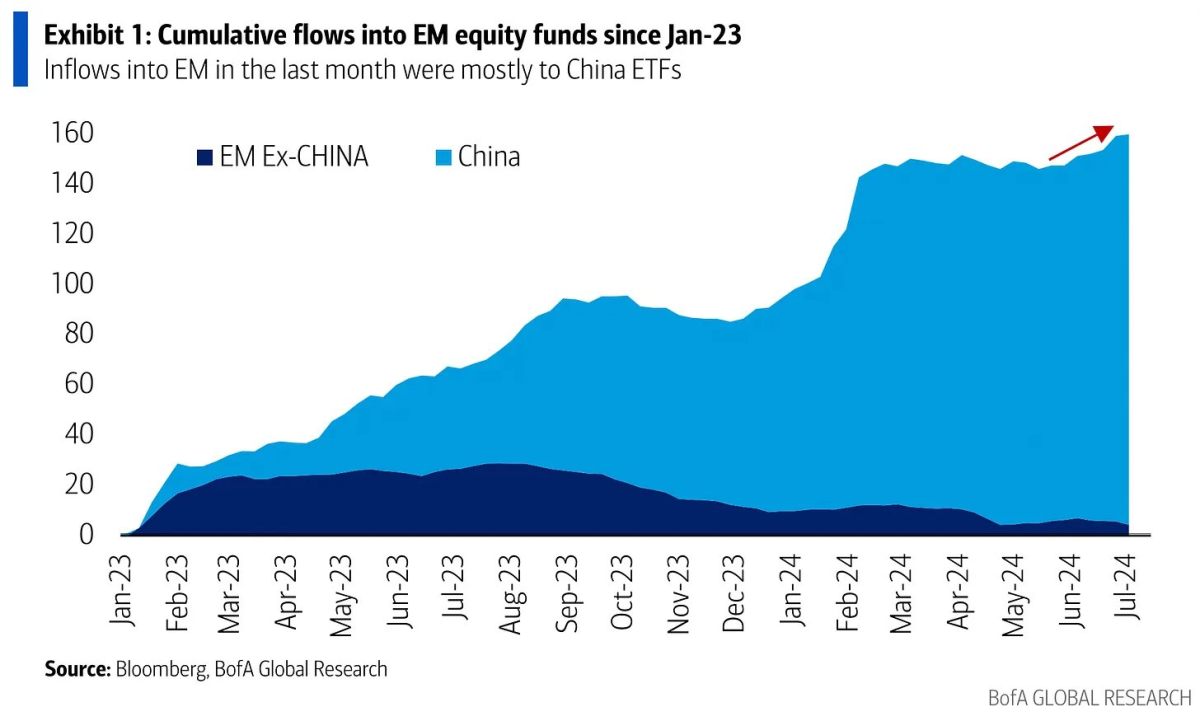

In June, BofA saw US$12bn into EM equity funds (after 3 months of flat flows) but almost all inflows were directed into China ETFs.

6月份,美银美林看到了价值120亿美元的新兴市场股票基金流入(经过三个月平稳的资金流动),但几乎所有的资金流入都被分配到了中国ETF。

Top Corporate News

头条公司新闻

Tesla shares close down 8% after report of robotaxi unveiling delay.

据报道,特斯拉公布的无人出租车计划推迟了,导致特斯拉股价下跌8%。

Tesla shares closed down about 8% on Thursday after Bloomberg reported that the electric vehicle maker is delaying the unveiling of its Robotaxi by two months.

彭博新闻社报道称,特斯拉股价周四下跌约8%,因为这家电动汽车制造商推迟了为期两个月的无人驾驶汽车的发布。

After previously announcing that it would introduce its robotaxi on Aug. 8, Tesla has pushed the launch back to October to give teams working on the project more time to build prototypes, according to Bloomberg, which cited people familiar with the decision.

特斯拉此前曾宣布将于8月8日推出无人驾驶出租车,但据彭博社报道,特斯拉将这一发布时间推迟至10月,以便负责该项目的团队有更多的时间来建立原型。

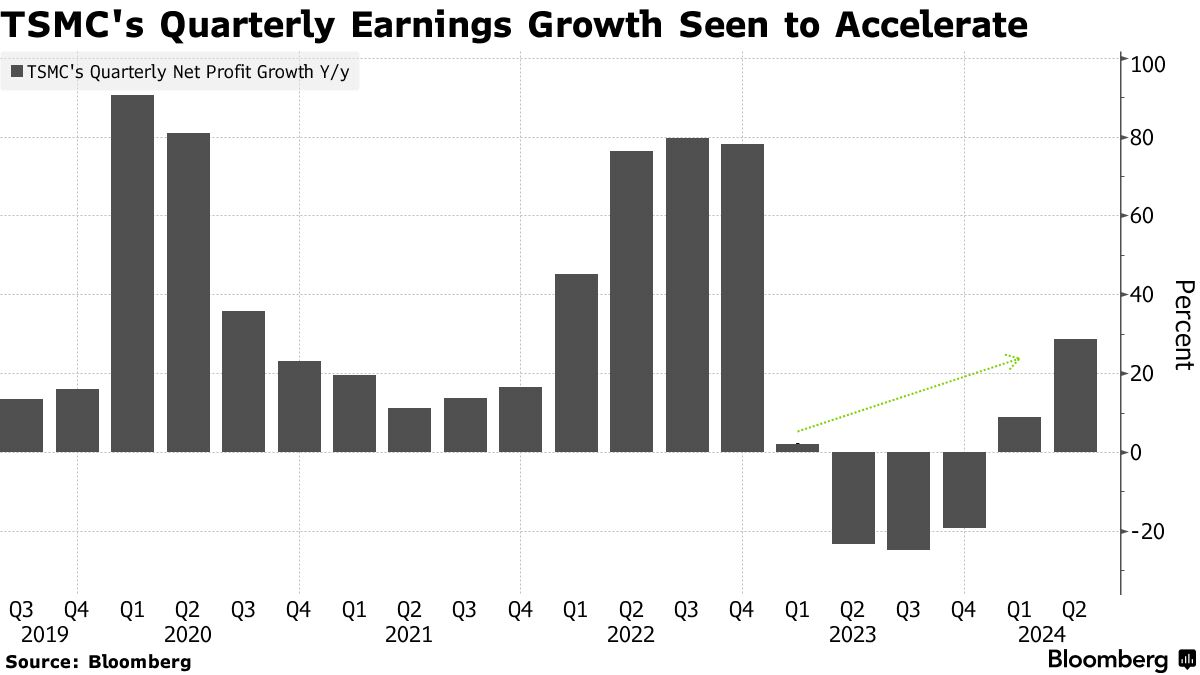

Tsmc’s second quarter results may fuel its $420 billion rally as ai demand soars.

台积电第二季度业绩可能会推动其4,200亿美元的业绩飙升,因为人工智能需求不断增长。

The world’s biggest contract chipmaker will probably report a 29% increase in second-quarter net income on , 18th July, according to the median estimate of analysts surveyed by Bloomberg. More importantly, analysts from JPMorgan Chase & Co. to Morgan Stanley expect it to also raise its full-year sales guidance, justifying another round of valuation expansion.

全球最大的合同芯片制造商可能会报告第二季度净利润增长29%,根据Bloomberg调查的分析师的中位数估计,7月18日。更重要的是,来自JPMorgan Chase和大摩资源lof等机构的分析师预计,它还将提高全年销售指导,证明有另一轮的估值扩张。

Delta Stock Leads Airline Retreat After Delivering Q2 Miss, Soft Guidance.

达美航空发布第二季度业绩不佳的指引,股价下跌为航空公司撤回。

Delta Air Lines reported an 11.9% decline in earnings to $2.36 per share adjusted, just missing FactSet views of $2.37 per share. Adjusted revenue rose 5.4% to $15.41 billion, marking a record for the June-ending quarter. However, Delta's sales results fell short of estimates for $15.45 billion in revenue. Delta Air Lines guided Q3 earnings between $1.70 to $2 per share, compared to $2.03 per share last year.

Delta Air Lines每股盈利下降11.9%,达到了每股2.36美元的调整值,仅轻微低于FactSet预期的每股2.37美元。虽然Delta的调整后营收上涨了5.4%,达到了创纪录的154.1亿元,但其销售业绩表现不佳,营收结果短于预计的154.5亿元。Delta Air Lines预计第三季度每股收益介于1.70美元至2美元之间,而去年同期为2.03美元。

Upcoming Economic Data

免责声明:本演示仅供信息和教育目的;不是任何特定投资或投资策略的建议或认可。在此提供的投资信息具有一般性质,仅供说明目的,并可能不适合所有投资者。它是在没有考虑个人投资者的财务知识水平、财务状况、投资目标、投资时间范围或风险承受能力的情况下提供的。在做出任何投资决策之前,您应考虑此信息是否适合您的相关个人情况。过去的投资业绩并不表明或保证未来的成功。收益将有所不同,所有投资都存在风险,包括本金损失。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易应用程序,在美国,Moomoo Financial Inc 为投资者提供投资产品和服务,为 FINRA/SIPC 的成员。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易应用程序,在美国,Moomoo Financial Inc 为投资者提供投资产品和服务,为 FINRA/SIPC 的成员。

Compared to the previous month, the CPI unexpectedly declined 0.1%, following a flat reading in May and compared to expectations of a 0.1% rise. Core CPI monthly rate edged down to 0.1% from 0.2%, below expectations of 0.2%.

Compared to the previous month, the CPI unexpectedly declined 0.1%, following a flat reading in May and compared to expectations of a 0.1% rise. Core CPI monthly rate edged down to 0.1% from 0.2%, below expectations of 0.2%.