Stock Of The Day: NVIDIA Has Another Bearish Engulfing Pattern

Stock Of The Day: NVIDIA Has Another Bearish Engulfing Pattern

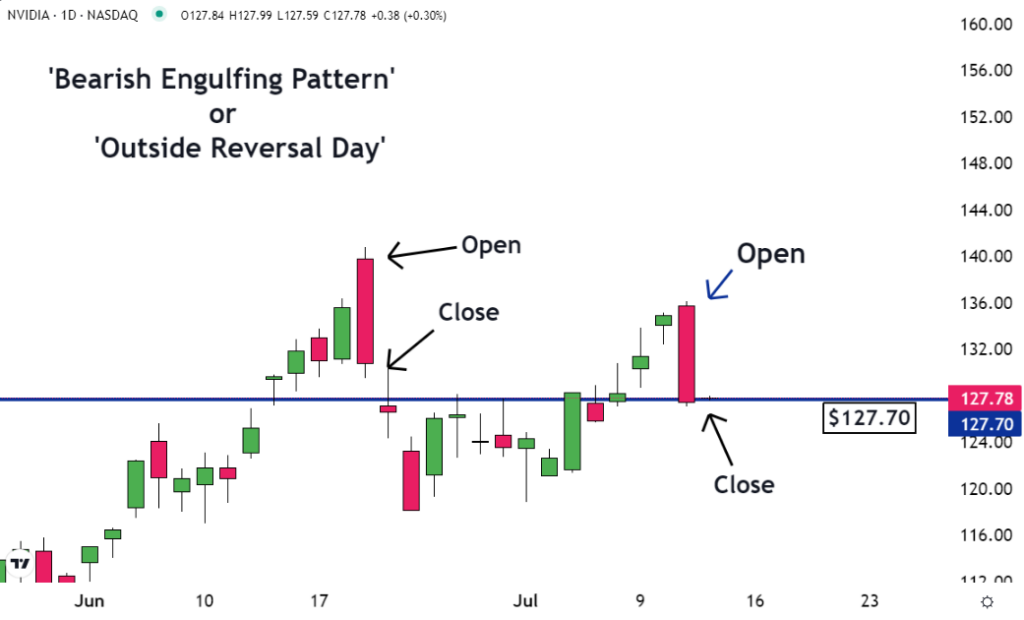

The last time a "bearish engulfing pattern" formed on the chart of NVIDIA Corp (NASDAQ:NVDA) a large move lower followed. Now another one of these patterns has formed — and it may also mean a move lower is coming.

英伟达公司(NASDAQ:NVDA)的图表上上一次形成“看淡吞没模式”时就出现了大幅下跌。现在又出现了另一个这样的模式,这可能也意味着下跌的行情即将到来。

Many technical analysts attempt to identify chart patterns without understanding the price action that creates them. That's why Nvidia is our trading team's Stock of the Day.

许多技术分析师试图在不了解形成它们的价格行情的情况下识别出图表模式。这就是为什么英伟达是我们交易团队今日的股票之一。

The chart illustrates two important technical analysis lessons.

该图表展示了两个重要的技术面分析教训。

Reversals in markets happen when the leadership changes from bulls to bears or bears to bulls. If the change is slow and gradual, a "rounded top" or "rounded bottom" pattern may appear on the chart. If the change takes place over a couple of sessions, it may form a "V top" or "inverted V bottom" pattern.

市场发生逆转是在领先者由牛转熊或由熊转牛时发生的。如果变化是缓慢和渐进的,图表上可能出现“圆顶”或“圆底”模式。如果变化在几个交易日内发生,可能形成“V型顶部”或“倒V型底部”模式。

And when the change in leadership takes place in just one day, an "engulfing pattern" may appear.

当领先者在一天内进行交接时,可能会出现“吞没模式”。

Bearish Pattern for Nvidia

英伟达的看淡模式

The important thing about this bearish engulfing pattern for Nvidia is the price action that caused it to form. In the morning it looked like it was going to be another up day. The opening price was higher than the previous day's close. It looked like the uptrend was going to continue.

这个关于英伟达的看淡吞没模式的重要之处在于导致它出现的价格行情。早上看起来又要再次上涨。开盘价高于前一日收盘价。看来上升趋势将会继续。

But by the end of the day, something important happened. The sellers overpowered the buyers. They even pushed the price below the previous day's opening price.

但到了一天结束时,发生了一些重要的事情。卖方压过了买方。他们甚至将价格压低到了前一天的开盘价以下。

The open was higher than the previous close, and the close was lower than the previous open. The price action "engulfed" the prior day's action.

开盘价高于前一日收盘价,收盘价低于前一日开盘价。价格行情“吞没”了前日的价格行情。

Most volume trades on the open and the close. Because of this there, is typically support at these levels. The fact that the stock fell right through them shows the sellers are extremely aggressive.

大多数成交量集中在开盘和收盘时段。因此,在这些水平上通常会有支撑位。股票穿过这些水平的事实表明卖方非常有攻击性。

Support for Nvidia

英伟达的支撑位

There's another lesson on this chart.

这张图表还有另一个教训。

As you can see, after yesterday's sell-off, the shares closed just below $128.00. This isn't a coincidence. There is support here for Nvidia because these levels were previously resistance.

正如你所看到的,昨天股票下跌后,股价收于$128.00以下。这不是巧合。这里对英伟达有支撑位,因为这些水平之前曾经是阻力位。

Many traders who sold while the shares were at the resistance decided they made a mistake when the price moved higher. Some of them decided to buy their shares back if they could get them for the same price that they were sold for.

许多交易员在股票处于阻力位时出售,当价格上涨时,他们决定买回股票,以相同的价格将其卖出。

As a result, now that the price has fallen back to these levels, buy orders are placed. And if there are enough of these orders, it will create support at what had been resistance.

因此,现在,价格回落到这些水平,买单被下单。如果有足够多的买单,它将在曾经的阻力位上形成支撑位。

To understand technical analysis, traders need to understand what chart patterns are. More importantly, they need to understand the price action that creates them.

要理解技术面分析,交易员需要了解图表模式究竟是什么。更重要的是,他们需要了解导致图表形成的价格行情。

The image was created using artificial intelligence by MidJourney.

这张图片是由MidJourney使用人工智能创建的。