Inflation Drop Fuels Rate Cut Speculation, Investors Shift To Sector Laggards, Russell 2000 Surges Over 3.6%: This Week In The Markets

Inflation Drop Fuels Rate Cut Speculation, Investors Shift To Sector Laggards, Russell 2000 Surges Over 3.6%: This Week In The Markets

Consumer price index data this week provided encouraging signs that American inflation is moving ever closer to the Federal Reserve's much-discussed 2% target.

本周消费者价格指数数据为美国通胀率接近美联储广泛讨论的2%目标提供了鼓舞人心的迹象。

This fueled speculation about interest rate cuts.

这引发了有关降息的猜测。

The annual inflation rate dropped more than expected to 3% in June 2024, reaching its lowest level since March 2021. Remarkably, the monthly inflation rate showed a contraction of 0.1% for the first time since May 2020.

2024年6月,年通胀率下降幅度超过预期,达到3%,达到2021年3月以来的最低水平。值得注意的是,月通胀率首次自2020年5月以来出现0.1%的收缩。

Investors and economists increased their convictions on the Fed's readiness to cut interest rates in September, pushing market-implied odds of a cut to over 90%.

投资者和经济学家加强了他们对美联储准备在9月份降息的信念,促使市场隐含的降息概率超过90%。

A higher-than-expected producer inflation data report Friday did little to alter these expectations significantly, as the latest consumer sentiment report from the University of Michigan confirmed subdued morale and a decline in inflation expectations.

上周五出人意料的生产者通胀数据报告对这些预期并没有产生重大影响,因为密歇根大学的最新消费者情绪报告证实了冷静的士气和对通胀预期的下降。

In the markets, sectors previously impacted by high interest rates — and have not yet priced in potential reductions in borrowing costs — outperformed the tech sector, which had already largely anticipated such rate cuts.

在市场上,受高利率影响的行业,这些行业尚未完全定价于潜在的贷款成本降低,表现优于已经大幅预期此类利率削减的科技板块。

The equal-weight S&P 500, as tracked by the Invesco S&P 500 Equal Weight ETF (NYSE:RSP) outpaced the cap-weighted S&P 500, monitored through the SPDR S&P 500 ETF Trust (NYSE:SPY), while value stocks outperformed their growth counterparts.

景顺S&P 500等权重ETF (NYSE: RSP) 跑赢了SPDR S&P 500 ETF Trust (NYSE: SPY) 追踪的S&P 500指数,而价值股表现优于增长股。

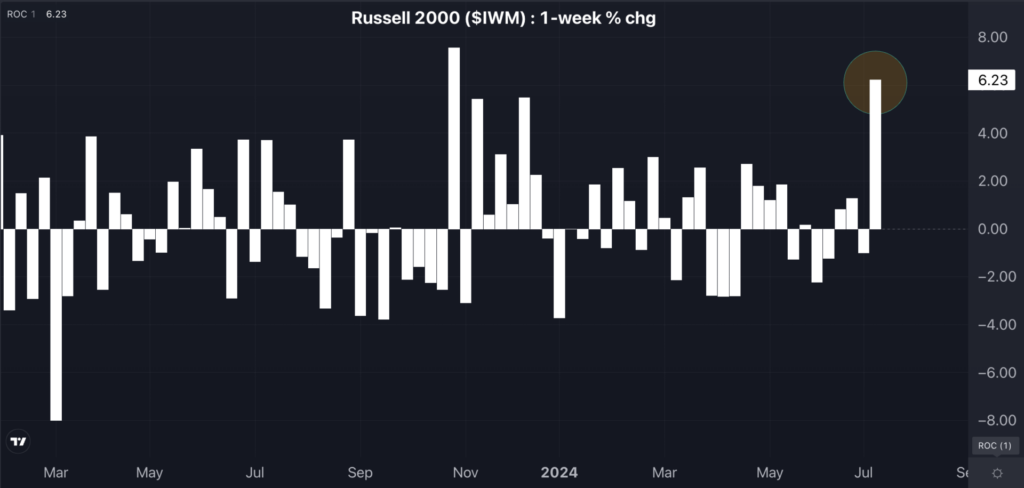

Both the real estate sector — as tracked by the Real Estate Select Sector SPDR Fund (NYSE:XLRE) – and the Russell 2000 small-cap index — as replicated by the iShares Russell 2000 ETF (NYSE:IWM) – achieved their strongest week of the year.

房地产业板块(由Real Estate Select Sector SPDR Fund (NYSE: XLRE)追踪)和罗素2000小市值股指数(由iShares Russell 2000 ETF (NYSE: IWM) 复制)均取得了本年度最强劲的一周。

Chart Of The Week: Russell 2000 Enjoyed Strongest Week Since October 2023

本周一图:罗素2000指数自2023年10月以来取得最强劲的一周。

You might have missed...

你可能错过了...。

Rare Market Dynamic: On Thursday, the Russell 2000 surged 3.63% while the Russell 1000 large-cap index fell 0.66% — the fifth time in history that the performance difference between the two indexes exceeded 4%. It has previously occurred during major market downturns. This time it came near an all-time high for the S&P 500.

罕见的市场动态:在周四,罗素2000上涨3.63%,而罗素1000大盘指数下跌了0.66%——这是历史上第五次两个指数之间的表现差异超过4%。它曾经出现在主要市场下跌期间。这一次它接近S&P 500的历史最高点。

Weight-Loss Pill: Pfizer Inc. (NYSE:PFE) announced advancements in its once-daily weight-loss pill, danuglipron, showing a favorable pharmacokinetic and safety profile. The pharma giant plans to conduct dose optimization studies in late 2024.

减肥药:辉瑞公司 (NYSE: PFE) 宣布其一日一次的减肥药丹糊利龙有了进展,显示了良好的药代动力学和安全性。这家制药巨头计划在2024年底进行剂量优化研究。

Tech Stock Poll: Apple Inc. (NASDAQ:AAPL), Microsoft Corp. (NYSE:MSFT), Meta Platforms Inc. (NASDAQ:META) and Alphabet Inc. (NASDAQ:GOOGL) all hit 52-week highs. A Benzinga poll reveals investor preferences:

科技股票投票:苹果 (NASDAQ: AAPL)、微软 (NYSE: MSFT)、Meta平台公司 (NASDAQ: META) 和Alphabet公司 (NASDAQ: GOOGL) 都达到了52周高点。Benzinga的一项民意调查揭示了投资者的偏好:

- Microsoft led with 32%

- Apple at 29%

- Google at 23%,

- Meta at 16%.

- 微软以32%领先

- 苹果的占比为29%

- 谷歌占23%,

- Meta的占比为16%。

Investors cited artificial intelligence growth potential and valuations as key factors influencing their choices.

投资者指出,人工智能增长潜力和估值是影响他们选择的关键因素。

Now Read:

现在阅读:

- IPO-Ready Shein Enjoys More Traffic Than Fast-Fashion Rivals, Data Shows: Are Temu, Poshmark In The Dust?

- IPO准备:Shein的流量比快速时尚竞争对手更多,数据显示:Temu和Poshmark在尘埃里吗?

Image: Shutterstock

图片:shutterstock