REIT Watch - Demand Boosts Hotel RevPAR for Hospitality S-REITs

REIT Watch - Demand Boosts Hotel RevPAR for Hospitality S-REITs

Among the seven S-Reit sub-sectors, hospitality S-Reits are the fourth largest in terms of combined market capitalisation.

在七个S-Reit子行业中,酒店S-Reits在综合市值上排名第四。

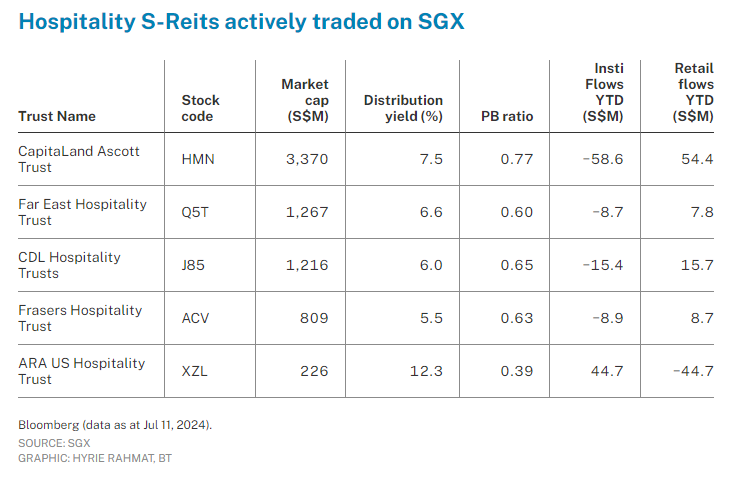

The five actively traded hospitality trusts have an average price-to-book ratio of 0.61 times and an average distribution yield of 7.6 per cent, the second highest across sub-sectors (by market capitalisation-weighted average distribution yields). The five, in terms of market capitalisation, are: CapitaLand Ascott Trust, Far East Hospitality Trust, CDL Hospitality Trusts, Frasers Hospitality Trust, and ARA US Hospitality Trust.

在市值加权平均分配收益率方面,五个活跃交易的酒店信托的平均价格与净值比为0.61倍,平均分配收益率为7.6%,是子行业中(按市值加权平均分配收益率计算)第二高的。按市值排名,这五个信托分别是:凯德阿斯科特信托、远东酒店信托、城发酒店信托、新加坡富时酒店信托和ARA美国酒店信托。

The majority of the five trusts have diversified exposure to international markets, with the exception of two – Far East Hospitality Trust, which has a Singapore-focused hotel and serviced residence portfolio, and ARA US Hospitality Trust, which is a pure-play US hospitality trust.

这五个信托中,多数信托都在国际市场上有多元化的业务,只有两个例外:远东酒店信托,他们的酒店和服务式住宅业务主要集中在新加坡;ARA美国酒店信托则是一家纯美国酒店信托。

Most of the hospitality trusts reported higher RevPAR (revenue per available room) across various geographical markets in their latest round of business updates and earnings reports, driven by the continued international travel recovery and stronger demand drivers such as Mice (meetings, incentives, conferences and exhibitions), sports events, and concerts.

在他们最新一轮的业务报告和财报中,大多数酒店信托在不同的地理市场上报告了更高的RevPAR(每间可用客房的收入),这是受继续走高的国际旅游业复苏以及Mice(会议、奖励、会展和演出)等强劲的需求推动的。

CapitaLand Ascott Trust's (Clas) gross profit in Q1 2024 rose 15 per cent year on year (yoy) on stronger operating performance and contributions from new properties. All its key markets posted positive RevPAU (revenue per available unit) growth yoy, led by Japan, which grew 31 per cent, the UK at 11 per cent and Australia at 8 per cent. Clas recently updated that it has fully acquired a freehold student accommodation property in South Carolina, US, which is expected to generate about 7 per cent Ebitda yield. The property has a pre-leased occupancy rate of 99 per cent for the upcoming academic year with rental growth of 4 per cent and is one of the best-performing accommodation serving the University of South Carolina. Clas will report its H1FY2024 results on Jul 26.

凯德阿斯科特信托(Clas)2024年第一季度的毛利润同比增长15%,主要是由于表现更加强劲的业务和新业务的贡献。该公司的所有关键市场的RevPAU(每可用单元的收入)同比增长幅度都保持在正数,其中日本增长31%,英国增长11%,澳大利亚增长8%。Clas最近更新,已经完全收购了美国南卡罗来纳州的一处永久物业,预计将产生约7%的Ebitda收益率。该物业即将到来的学年的出租率为99%,租金增长率为4%,是南卡罗来纳大学的最佳住宿之一。Clas将于7月26日公布其H1FY2024年度报告。

Far East Hospitality Trust's (FEHT) hotel RevPAR grew 6.7 per cent in Q1 2024 with a 1.5 per cent decline in RevPAU for its smaller serviced residence portfolio, due to the expiration of a few long-stay contracts during the earlier part of the quarter. However, average daily rate for both its hotel and serviced residences remained resilient and grew 8.8 per cent and 2.9 per cent, respectively. FEHT will report its H1FY2024 results on Jul 30.

远东酒店信托(FEHT)2024年第一季度酒店RevPAR增长了6.7%,较早季度初期少数长期合同到期造成的服务式住宅组合的RevPAU下降1.5%。然而,酒店和服务式住宅的平均每日房价仍保持弹性,分别增长了8.8%和2.9%。FEHt将于7月30日公布其H1FY2024年度报告。

CDL Hospitality Trusts (CDLHT) registered positive RevPAR growth across all its geographical markets in Q1 2024, largely driven by increased occupancies. Markets which led growth were Japan, which grew 32.6 per cent; Italy, up 27.5 per cent; and Singapore, which grew 16.6 per cent in RevPAR yoy. CDLHT notes that international tourism recovery is well on its path towards pre-Covid levels, but headwinds from geopolitical uncertainties continue. For core market Singapore, CDLHT's managers see a promising outlook, and believe the recovery of Chinese arrivals will help create demand compression in the market. CDLHT will report its H1FY2024 results on Jul 30.

CDL城发酒店信托(CDLHT)2024年第一季度在各个地理市场上均取得了正的RevPAR增长,主要是由于入住率的增加。领先市场的增长包括日本,增长了32.6%,意大利上涨27.5%,新加坡RevPAR同比增长16.6%。CDLHt指出,国际旅游业复苏已朝着恢复疫情前水平的路径前进,但地缘政治不确定因素仍然存在。对于主要市场新加坡,CDLHT的经理们看到了一个可观的前景,并相信中国游客到来的恢复将有助于创造市场的需求压缩。CDLHt将于7月30日公布首个财务半年度报告。

Frasers Hospitality Trust, which reported its H1FY2024 results earlier this year, observed higher gross revenue of 1.7 per cent yoy due to a slight improvement in hospitality portfolio performance. However, distribution per stapled security declined 13.7 per cent due mainly to higher finance costs.

富时酒店信托报告了2024年上半年的业绩,毛收入同比增长1.7%,主要是由于酒店组合表现略有改善。但由于融资成本上升,份额的每股分配收益下降了13.7%。

Pure-play US upscale select-service hospitality trust, ARA US Hospitality Trust updated that its Q1 2024 gross operating profit and net property income margins for the portfolio improved marginally to 29.5 per cent and 17.8 per cent, respectively. During the quarter, its portfolio occupancy decreased 2.2 percentage points to 59.5 per cent, due to demand displacement from asset enhancement improvement projects at four properties, which are expected to be in a better position to drive revenues and profits moving forward.

美国ARA酒店信托更新了其第一季度2024年度的毛收益和净物业收入率,从而使组合边际改善至29.5%和17.8%。在本季度内,其组合占用率下降了2.2个百分点,至59.5%,这是由于四个物业的资产增值改善项目所导致的需求抵消,这些项目预计将能够更好地推动未来的收入和利润。

REIT Watch is a regular column on The Business Times, read the original version.

信托观察是商业时报的一篇定期专栏,阅读原始版本。

Enjoying this read?

喜欢这篇文章吗?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即订阅SGX My Gateway通讯,以获取最新市场资讯、板块表现、新产品发布更新以及新交易所上市公司的研报汇编。

- 请在我们的新加坡交易所投资Telegram频道中保持最新。

Most of the hospitality trusts reported higher RevPAR (revenue per available room) across various geographical markets in their latest round of business updates and earnings reports, driven by the continued international travel recovery and stronger demand drivers such as Mice (meetings, incentives, conferences and exhibitions), sports events, and concerts.

Most of the hospitality trusts reported higher RevPAR (revenue per available room) across various geographical markets in their latest round of business updates and earnings reports, driven by the continued international travel recovery and stronger demand drivers such as Mice (meetings, incentives, conferences and exhibitions), sports events, and concerts.