Centurion CEO Kong Chee Min Adds to Interest at S$0.59 per Share

Centurion CEO Kong Chee Min Adds to Interest at S$0.59 per Share

Institutions were net buyers of Singapore stocks over the five trading sessions to Jul 11, with S$192 million of net institutional inflow, following the similar pace of S$188 million of net inflow for the preceding five sessions to Jul 4. In the first nine sessions of July, institutions reversed just over one-third of the net outflows booked in the first half of 2024.

7月11日为期5个交易日,机构资金净流入新加坡股市1.92亿新币,与7月4日为期5个交易日同样的1.88亿新币净流入速度相似。7月头9个交易日,机构资金已逆转了上半年净流出资金的三分之一以上。

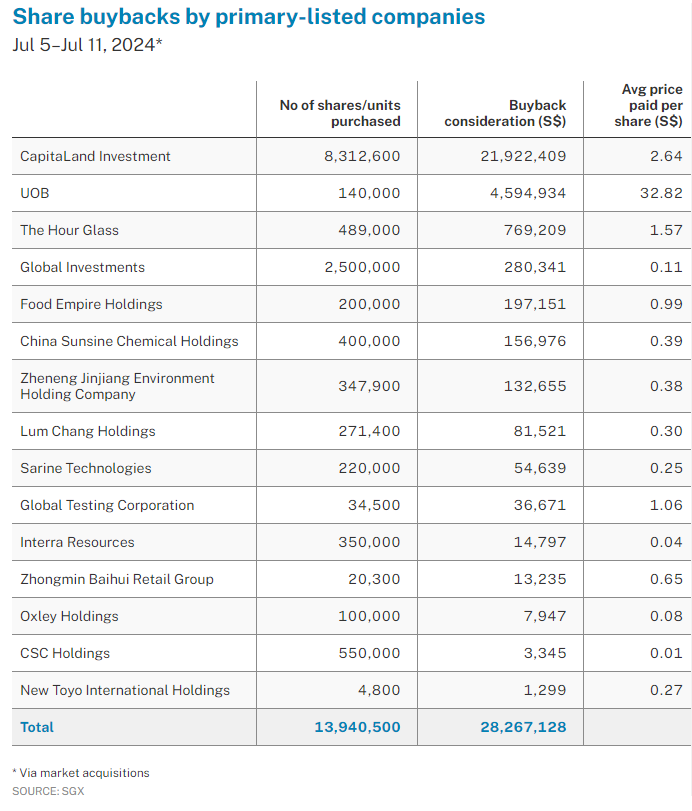

The five sessions till Jul 11 also had 15 primary-listed companies conduct buybacks with a total consideration of S$28.3 million.

7月11日为期5个交易日,买回方共15个主板股,总计2,830万新币,CapitaLand投资以860万新币的总成本领先买回名单。这将百分之1.64的已发行股份(不包括公司库存股份)带入了当前委托买回的股份之列。

CapitaLand Investment led the buyback consideration tally, acquiring 8,312,600 shares at an average price of S$2.64 per share. This brings the percentage of shares acquired on the current mandate to 1.64 per cent of the issued shares (excluding treasury shares) as of the date of the share buyback resolution.

CapitaLand Investment领导买回总额,平均每股2.64新元,买回8,312,600股。这将百分之1.64的已发行股份(不包括公司库存股份)带入了当前授权买回的股份之列。

For the contingent of non-STI primary-listed companies that conducted buybacks over the five sessions, The Hour Glass : AGS 0% led the consideration tally with 489,000 shares acquired at an average price of S$1.57 per share.

买回方为非富时海外主板上市公司,买回方为The Hour Glass,即购买S$1.57/股的489,000股股票。

Leading the net institutional inflow were DBS, UOB, ARA US Hospitality Trust, Singtel, Sats, ST Engineering, OCBC, Singapore Exchange, Great Eastern Holdings and Venture Corp.

出现净流入的公司有:大华银行(DBS)、大华银行(UOb)、ARA US Hospitality Trust、新电信(Singtel)、新翔集团(Sats)、新科工程(St Engineering)、华侨银行(OCBC)、新加坡交易所(Singapore Exchange)、大东方控股(Great Eastern Holdings)和胜捷企业(Venture Corp)。

During the week, Acrophyte completed the acquisition of a 19 per cent stapled security interest in ARA US Hospitality Trust, increasing the stapled security holdings owned by the Tang Group in ARA US Hospitality Trust to 28.3 per cent. Acrophyte is a multinational conglomerate with expertise spanning the entire real estate spectrum and the hospitality sector. The company operates and invests in hospitality assets in various locations, boasting a proven track record in both operations and investments.

Acrophyte在本周完成了对ARA US Hospitality Trust 19%的份额收购,并将AT组合修整至其对ARA US Hospitality Trust的持股量升至28.3%。Acrophyte是一家跨国综合企业,专业涉足整个房地产领域和酒店业。该公司在各地经营和投资酒店资产,拥有实现运营和投资的良好记录。

Meanwhile, Singapore Airlines, Jardine Cycle & Carriage, Wilmar International, Seatrium, Mapletree Industrial Trust, Sembcorp Industries, CapitaLand Ascendas Reit, Mapletree Logistics Trus, Genting Singapore, and CapitaLand Ascott Trust led the net institutional outflow.

净流出的公司:新加坡航空(Singapore Airlines)、怡和汽车(Jardine Cycle & Carriage)、Wilmar International、海庭(Seatrium)、Mapletree Industrial Trust、Sembcorp Industries、凯德Ascendas房地产投资信托基金(CapitaLand Ascendas Reit)、万宝物流信托(Mapletree Logistics Trus)、云顶新加坡(Genting Singapore)和凯德雅诗阁信托(CapitaLand Ascott Trust)。

In the five trading sessions, 70 director interests and substantial shareholdings filed for more than 30 primary-listed stocks. Directors or CEOs filed 14 acquisitions, and no disposals, while substantial shareholders filed eight acquisitions and three disposals.

5个交易日里,70名董事利益和实质性股份持有人为30多个主板上市公司做出申报。其中,董事或首席执行官提交了14宗收购案,未提交出售的信息,而实质性股东提交了8宗收购案和3宗出售案。

Hiap Hoe

协和公司

Between Jul 3 and 4, Hiap Hoe executive chairman Teo Ho Beng acquired 500,000 shares at an average price of S$0.603 per share. With a consideration of S$301,250, this increased his total interest in the regional premium real estate group from 75.07 per cent to 75.18 per cent.

七月三至四日,协和执行主席张浩明以0.603新币/股的平均价收购了500,000股,以30.125万新币的代价将其对区域优质房地产集团的总股权从75.07%增加到75.18%。

Teo has been gradually increasing his total interest from 74.86 per cent in early June. He has more than 42 years of experience in the construction and property industries, and over 27 years of experience in the leisure industry. He is responsible for the formulation of corporate strategies and policies for the group. In addition, he sits on the board of Ley Choon Group Holdings as non-executive director.

张浩明在建筑和地产行业拥有超过42年的经验,在休闲产业拥有超过27年的经验,负责制定公司战略和政策。此外,他还担任立堾集团控股有限公司的非执行董事。

The group noted in February that it is concentrating on enhancing the rental yields and occupancy rates of its properties to bolster its steady income stream. The two newly rebranded hotels in Singapore are anticipated to positively impact the group's financial outcomes, despite the competitive nature of the hotel industry.

集团在2月份表示,该集团正在集中精力提高其房地产物业的租金收益率和入住率,以增强稳定收入流。预计新加坡两家新近改名的酒店将对该集团的财务业绩产生积极影响,尽管酒店行业竞争激烈。

The group has since completed the acquisition of the Great Eastern Motor Lodge in Western Australia in March and the sale of the Four Points by Sheraton in Melbourne Docklands in April.

自那时起,该集团于3月完成了西澳大利亚大东方汽车旅馆的收购,并于4月出售了位于墨尔本碼頭區的Sheraton 四点酒店。

Centurion Corp

胜捷企业

On Jul 4, Centurion Corp CEO Kong Chee Min acquired 115,000 shares, at an average price of S$0.59 cents per share. This increased his direct interest in the global provider of specialised accommodation from 0.04 per cent to 0.06 per cent. His preceding acquisitions were on May 10, with 75,000 shares acquired at an average price of S$0.498 per share, and Mar 1 with 72,000 shares acquired at an average price of S$0.425 per share.

7月4日,胜捷企业首席执行官康志民以0.59新币/股的平均价格收购了115,000股,增加了他在全球专业住宿供应商的直接持股量从0.04%到0.06%。

The rally in the share price has seen the price-to-book ratio of the stock increase from 0.4 times at the end of 2023 to 0.6 times the previous week. For the first quarter of this year, Centurion reported revenue of S$61.1 million. This represented growth of 30 per cent over its Q1 2023 revenue of S$47.1 million. Prior to Q1FY24, Centurion had a 26 per cent compound annual growth rate in its accommodation revenue from its FY11 to FY23.

该股价上涨,市盈率从2023年底的0.4倍增长到上周的0.6倍。对于今年第一季度,胜捷企业报告营收为6110万新元。这较其2023年第一季度的4710万新元增长了30%。

From a geographical perspective, Singapore contributes around two-thirds of the group's revenue. From a business segment perspective, roughly 75 per cent of its revenue comes from purpose built workers accommodation (PBWA), while the remaining 25 per cent is attributed to purpose built student accommodation (PBSA). The group expects the current growth drivers of the PBWA sector to include positive regulatory factors and a demand-supply dynamic characterised by a high global demand for migrant workers, an increasing recognition of the need for better welfare for migrant workers, and a market that is undersupplied with purpose-built, professionally managed dormitory beds.

从地理角度看,新加坡的贡献约占该集团收入的三分之二。从业务领域的角度看,约75%的收入来自建造工人住宿(PBWA),而剩下的25%归因于建造专用学生住宿(PBSA)。该集团预计PBWA部门的当前增长驱动因素包括积极的监管因素和需求供应动态,这一动态以全球对移民工的高需求、日益认识到需要为移民工提供更好福利和市场缺乏专用、专业管理的宿舍床位的市场为特征。

While Centurion's share price has gained 46 per cent in the year to Jul 11, the average daily turnover of the stock is up 140 per cent from 2023 levels. In 2023, Centurion completed its voluntary withdrawal of its dual listing on the main board of The Stock Exchange of Hong Kong. It announced on Jul 3 that its indirect 60 per cent-owned subsidiary, Centurion-Lionrock (HK), through Centurion Overseas Investments, signed a master lease with Abercorn Investments to lease 50 residential flats in Hong Kong, with plans to convert them into worker accommodation for 550 beds. The joint venture company is also partly owned (40 per cent) by LionRock Property, an independent third party and joint venture partner.

尽管胜捷企业的股价在截至7月11日的一年中上涨了46%,但该股票的平均日成交量比2023年上升了140%。胜捷企业于2023年完成了在香港交易所主板上的自愿退市。该公司7月3日宣布,其间接控股的60%子公司Centurion-Lionrock (HK)通过Centurion海外投资与Abercorn Investments签订了主租约,租赁香港的50套住宅公寓,并计划将其改造为550张工人宿舍床位。该合资公司也是独立第三方合作伙伴LionRock Property (40%)的部分所有者。

Kong joined the group in March 1996 and was appointed to the board in March 2000. He served as a board member until May 2015. In August 2011, he became the CEO, taking charge of the group's operations, business strategies, and long-term growth. Before his CEO role, he was the regional CEO and finance director, assisting the former group CEO in strategic development and growth of the optical disc business. In January 2022, Kong was appointed a member of the executive committee.

康突明于1996年3月加入该集团,并于2000年3月被任命为董事。他担任董事会成员直至2015年5月。在2011年8月,他成为了CEO,负责集团的运营、业务策略和长期增长。在担任CEO之前,他是该地区的CEO和财务总监,协助前集团CEO在光盘业务的战略发展和成长方面。在2022年1月,康氏被任命为执行委员会成员。

Zico Holdings

凯利板的控股公司Zico Holdings

On Jul 4, Zico Holdings group CEO Ng Hock Heng acquired 1,791,000 shares at S$0.04 per share. With a consideration of S$77,246, this increased his direct interest in the Catalist-listed stock from 2.97 per cent to 3.41 per cent. His preceding acquisition was on Mar 12, with 1,050,198 shares acquired at S$0.04 per share. Ng has been the executive director at Zico Holdings since 2014 and was appointed as the group CEO in May 2023, as part of the company's planned leadership transition. His key responsibilities include overseeing overall operations, managing the advisory and transaction services, the management of support services and licensing services segments, as well as developing and managing the group's new services.

7月4日,凯利板Zico Holdings集团首席执行官黄福贤以每股0.04新币的价格获得了1,791,000股。考虑到77,246新元,这增加了他对该股的直接持股比例从2.97%到3.41%。他之前的收购是在3月12日,以每股0.04新币的价格获得了1,050,198股。黄福贤自2014年以来一直是Zico Holdings的执行董事,并于2023年5月被任命为集团首席执行官,作为公司计划领导层过渡的一部分。他的主要职责包括监督整个运营,管理咨询和交易服务,支持服务和授权服务细分市场的管理,以及开发和管理集团的新服务。

Accrelist

Accrelist

Between Jul 4 and 10, Accrelist executive chairman and managing director Terence Tea Yeok Kian acquired 633,600 shares at an average price of S$0.05 per share. With a consideration of S$31,708, this increased his total interest in the Catalist-listed company from 26.18 per cent to 26.38 per cent. Dr Tea has gradually increased his total interest from 23.13 per cent at the end of 2023. He is tasked with guiding the group's expansion and strategic direction by identifying and fostering new business opportunities. His extensive corporate experience and strategic insights are invaluable to the board, particularly in advising on corporate affairs and driving business strategy implementation.

7月4日至10日,Accrelist的执行主席兼董事总经理Terence Tea Yeok Kian以每股0.05新币的平均价格获得了633,600股。考虑到31,708新元,这增加了他对该上市公司的持股比例从26.18%到26.38%。Tea博士已逐步增加他的总持股比例,从2023年底的23.13%。他的任务是通过识别和培育新的业务机会来引导集团的扩张和战略方向。他丰富的企业经验和战略洞察力对董事会非常宝贵,特别是在企业事务顾问和推动业务战略实施方面。

Accrelist is vigorously exploring new ventures, with an intensified emphasis on medical aesthetics. Its wholly owned subsidiaries, operating under the Accrelist Medical Aesthetics umbrella and known as AM Aesthetics, along with AM Skincare, are at the forefront of this initiative. Accrelist also holds a majority 53.31 per cent stake in Jubilee Industries Holdings, a comprehensive provider in the electronic manufacturing services (EMS) sector, through its mechanical business unit. This unit specialises in precision plastic injection moulding and mould design and fabrication services, catering to the EMS industry's needs.

Accrelist正在积极探索新的业务,重点关注医学美容。其全资子公司,运营在Accrelist Medical Aesthetics旗下并被称为Am Aesthetics和Am Skincare,是这项倡议的前沿。Accrelist还通过其机械业务部门持有Jubilee Industries Holdings的大多数股权,后者是电子制造服务(EMS)行业的综合供应商。该部门专业从事精密塑料注塑成型和模具设计及制造服务,满足EMS行业的需求。

Inside Insights is a weekly column on The Business Times, read the original version.

《商业时报》的每周专栏“Inside Insights”,请阅读原文。

Enjoying this read?

喜欢这篇文章吗?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即订阅SGX My Gateway通讯,以获取最新市场资讯、板块表现、新产品发布更新以及新交易所上市公司的研报汇编。

- 通过我们的SGX Invest Telegram频道保持最新。