Builders FirstSource's Options: A Look at What the Big Money Is Thinking

Builders FirstSource's Options: A Look at What the Big Money Is Thinking

Financial giants have made a conspicuous bullish move on Builders FirstSource. Our analysis of options history for Builders FirstSource (NYSE:BLDR) revealed 9 unusual trades.

金融巨头对builders firstsource进行了明显的看好操作。我们对builders firstsource(纽交所:BLDR)期权历史数据的分析显示了9个飞凡交易。

Delving into the details, we found 55% of traders were bullish, while 22% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $137,200, and 7 were calls, valued at $479,961.

深入研究后,我们发现55%的交易者看多,22%的交易者看淡。我们发现所有交易中有2个看空期权,价值$137,200,7个看多期权,总价值为$479,961。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $145.0 to $195.0 for Builders FirstSource over the recent three months.

根据交易活动,显然重要的投资者们在最近三个月里都瞄准了builders firstsource从$145.0到$195.0的股价领域。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

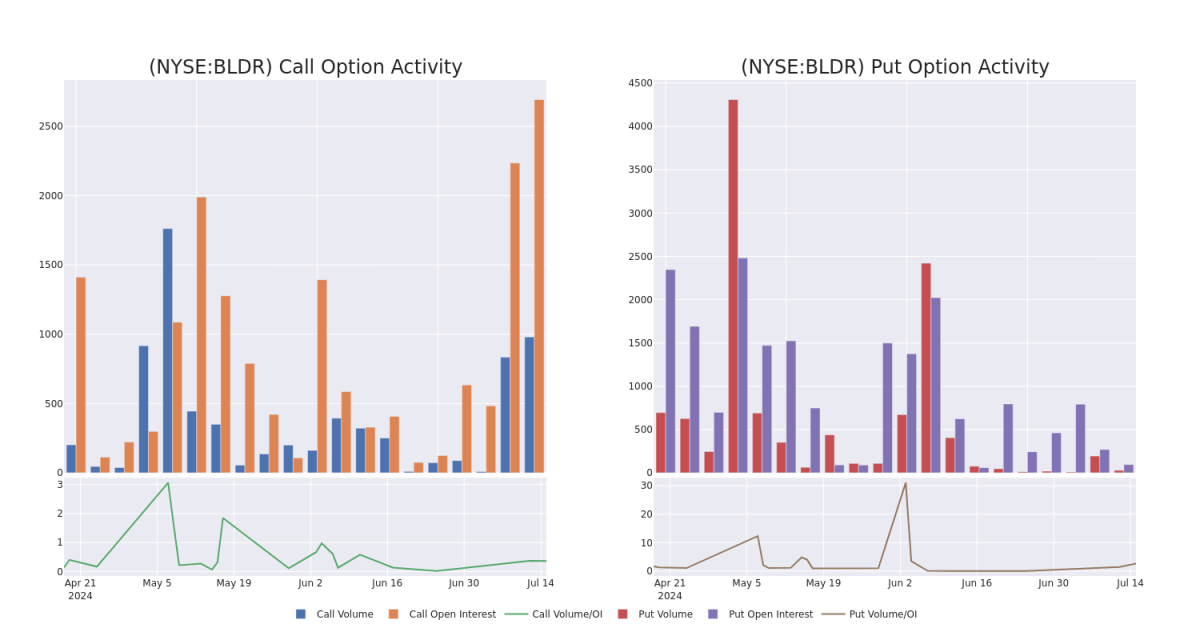

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Builders FirstSource's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Builders FirstSource's substantial trades, within a strike price spectrum from $145.0 to $195.0 over the preceding 30 days.

在期权交易中,评估成交量和持仓量是一个战略性的步骤。这些量度指标揭示了投资者在指定行权价格下对builders firstsource的期权的流动性和兴趣。即将公布的数据显示了在$145.0到$195.0行权价格范围内与 builders firstsource 的大宗交易相关的看多期权和看空期权的成交量和持仓量的波动情况,时间跨度为30日。

Builders FirstSource 30-Day Option Volume & Interest Snapshot

builders firstsource 30天期权成交量和持仓量快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BLDR | CALL | SWEEP | BULLISH | 08/16/24 | $5.4 | $5.3 | $5.3 | $165.00 | $243.4K | 593 | 151 |

| BLDR | PUT | TRADE | BULLISH | 07/19/24 | $5.8 | $5.3 | $5.3 | $160.00 | $106.0K | 11 | 29 |

| BLDR | CALL | SWEEP | NEUTRAL | 08/16/24 | $5.4 | $5.3 | $5.38 | $165.00 | $68.5K | 593 | 609 |

| BLDR | CALL | SWEEP | BULLISH | 07/19/24 | $9.7 | $9.6 | $9.7 | $145.00 | $45.5K | 673 | 9 |

| BLDR | CALL | TRADE | BEARISH | 07/19/24 | $12.7 | $12.2 | $12.4 | $145.00 | $34.7K | 673 | 133 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BLDR | 看涨 | SWEEP | 看好 | 08/16/24 | $5.4 | $5.3 | $5.3 | 165.00美元 | $243.4K | 593 | 151 |

| BLDR | 看跌 | 交易 | 看好 | 07/19/24 | $5.8 | $5.3 | $5.3 | $160.00 | $106.0K | 11 | 29 |

| BLDR | 看涨 | SWEEP | 中立 | 08/16/24 | $5.4 | $5.3 | $5.38 | 165.00美元 | $68.5K | 593 | 609 |

| BLDR | 看涨 | SWEEP | 看好 | 07/19/24 | 9.7 | 9.6 | 9.7 | $145.00 | $45.5K | 673 | 9 |

| BLDR | 看涨 | 交易 | 看淡 | 07/19/24 | $12.7 | $12.2 | $12.4 | $145.00 | $34.7K | 673 | 133 |

About Builders FirstSource

关于Builders FirstSource

Builders FirstSource Inc is a manufacturer and supplier of building materials. The company offers structural and related building products such as factory-built roof and floor trusses, wall panels and stairs, vinyl windows, custom millwork and trim, and engineered wood. The products can be designed for each home individually and are installed by Builders FirstSource. The company's construction-related services include professional installation, turn-key framing, and shell construction. Builders FirstSource's customers range from large production builders to small custom homebuilders.

Builders FirstSource Inc是建筑材料制造商和供应商。该公司提供结构和相关建筑产品,例如工厂制造的屋顶和楼层桁架、墙板和楼梯、乙烯基窗户、定制的木制品和修饰产品以及工程木材。这些产品可以根据每个家庭的需求进行设计,并由Builders FirstSource安装。该公司的建筑相关服务包括专业安装、交钥匙框架和壳体建设。Builders FirstSource的客户群从大型生产商到小型定制住宅建筑商不等。

After a thorough review of the options trading surrounding Builders FirstSource, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对builders firstsource的期权交易进行全面审查后,我们将对该公司进行更详细的评估,包括对其当前的市场状况和绩效的评估。

Where Is Builders FirstSource Standing Right Now?

builders firstsource现在的处境如何?

- Currently trading with a volume of 1,373,584, the BLDR's price is up by 1.89%, now at $155.61.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 22 days.

- BLDR的成交量目前为1,373,584,涨幅为1.89%,现价为$155.61。

- RSI读数表明该股目前可能接近超买水平。

- 预计将在22天内发布财报。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。