Unpacking the Latest Options Trading Trends in Accenture

Unpacking the Latest Options Trading Trends in Accenture

Whales with a lot of money to spend have taken a noticeably bearish stance on Accenture.

持有大量资金的鲸鱼明显对埃森哲持看淡态度。

Looking at options history for Accenture (NYSE:ACN) we detected 8 trades.

查看埃森哲(纽约证券交易所:ACN)期权历史记录,我们发现了8笔交易。

If we consider the specifics of each trade, it is accurate to state that 12% of the investors opened trades with bullish expectations and 87% with bearish.

如果我们考虑每笔交易的具体情况,准确地说有12%的投资者持看好预期的交易,87%持看淡预期。

From the overall spotted trades, 5 are puts, for a total amount of $431,155 and 3, calls, for a total amount of $244,480.

从总体交易情况来看,5个是看跌期权,金额总计431,155美元,3个是看涨期权,金额总计244,480美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $240.0 and $325.0 for Accenture, spanning the last three months.

在评估交易量和持仓量后,很明显主要市场动态关注的是埃森哲在240.0美元至325.0美元的价格区间,跨越了过去三个月。

Insights into Volume & Open Interest

成交量和持仓量分析

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Accenture's options for a given strike price.

该数据可以帮助您跟踪特定行权价格下埃森哲期权的流动性和关注度。

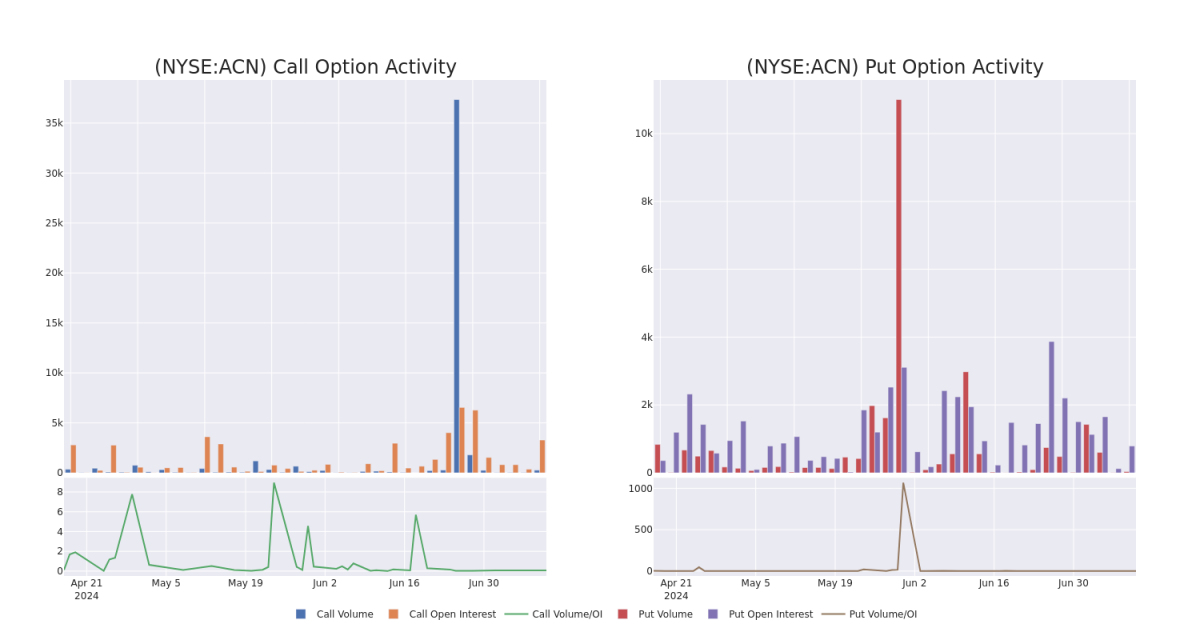

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Accenture's whale activity within a strike price range from $240.0 to $325.0 in the last 30 days.

在下面,我们可以看到过去30天内,所有埃森哲鲸鱼活动中涉及行权价区间在240.0美元至325.0美元之间的看涨期权和看跌期权的成交量和持仓量的演变。

Accenture 30-Day Option Volume & Interest Snapshot

埃森哲30天期权成交量和利息快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACN | CALL | SWEEP | BEARISH | 08/16/24 | $9.7 | $9.6 | $9.6 | $315.00 | $187.2K | 665 | 17 |

| ACN | PUT | SWEEP | BEARISH | 09/20/24 | $8.2 | $8.1 | $8.2 | $315.00 | $157.4K | 141 | 32 |

| ACN | PUT | TRADE | BEARISH | 09/20/24 | $12.8 | $12.6 | $12.8 | $325.00 | $79.3K | 143 | 9 |

| ACN | PUT | TRADE | BULLISH | 09/20/24 | $12.6 | $12.4 | $12.4 | $320.00 | $76.8K | 363 | 1 |

| ACN | PUT | SWEEP | BEARISH | 07/26/24 | $8.1 | $8.0 | $8.0 | $325.00 | $70.4K | 0 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACN | 看涨 | SWEEP | 看淡 | 08/16/24 | 9.7 | 9.6 | 9.6 | $315.00 | $187.2K | 665 | 17 |

| ACN | 看跌 | SWEEP | 看淡 | 09/20/24 | $8.2 | $8.1 | $8.2 | $315.00 | $157.4千美元 | 141 | 32 |

| ACN | 看跌 | 交易 | 看淡 | 09/20/24 | $12.8 | $12.6 | $12.8 | $325.00 | $79.3K | 143 | 9 |

| ACN | 看跌 | 交易 | 看好 | 09/20/24 | $12.6 | $12.4 | $12.4 | $320.00 | $76.8K | 363 | 1 |

| ACN | 看跌 | SWEEP | 看淡 | 07/26/24 | $8.1 | $8.0 | $8.0 | $325.00 | $70.4K | 0 | 0 |

About Accenture

关于埃森哲

Accenture is a leading global IT-services firm that provides consulting, strategy, and technology and operational services. These services run the gamut from aiding enterprises with digital transformation to procurement services to software system integration. The company provides its IT offerings to a variety of sectors, including communications, media and technology, financial services, health and public services, consumer products, and resources. Accenture employs just under 500,000 people throughout 200 cities in 51 countries.

Accenture是一家领先的全球IT服务公司,提供咨询、战略、技术和运营服务。这些服务从帮助企业进行数字化转型到采购服务、软件系统集成等方方面面。该公司将其IT服务提供给包括通信、媒体和科技、金融服务、健康和公共服务、消费品和资源在内的各个行业。Accenture在全球51个国家的200个城市拥有近500,000名员工。

After a thorough review of the options trading surrounding Accenture, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面审查围绕埃森哲期权交易后,我们继续深入研究该公司。这包括对其当前市场地位和表现的评估。

Current Position of Accenture

埃森哲的当前位置

- Currently trading with a volume of 3,863,005, the ACN's price is up by 2.33%, now at $317.87.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 73 days.

- ACN目前成交量为3,863,005股,价格上涨了2.33%,现在为317.87美元。

- RSI读数表明股票目前可能超买。

- 预计发布收益还有73天。

What Analysts Are Saying About Accenture

分析师对埃森哲的评论

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $354.0.

过去一个月中,有5名行业分析师分享了他们对该股票的见解,提出平均目标价为354.0美元。

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Accenture with a target price of $350.

- An analyst from Susquehanna persists with their Neutral rating on Accenture, maintaining a target price of $350.

- An analyst from Citigroup persists with their Buy rating on Accenture, maintaining a target price of $350.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Accenture, targeting a price of $400.

- Consistent in their evaluation, an analyst from Piper Sandler keeps a Neutral rating on Accenture with a target price of $320.

- 在评估中保持一致,巴克莱银行的一名分析师保持持股超重评级,目标价为350美元。

- Susquehanna的一位分析师继续持中立评级,维持目标价为350美元。

- 花旗集团的一位分析师坚持对 Accenture 给出买入评级,维持目标价为 $350。

- 大摩资源lof一位分析师继续保持持股超重评级,目标价格为400美元。

- 派杰投资的一位分析师一如既往地给予 Accenture 股票中立评级,并设定目标价为 $320。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Accenture options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在收益。精明的交易者通过不断教育自己、调整策略、监控多个因子和密切关注市场动向来管理这些风险。通过来自Benzinga Pro的实时警报及时了解最新的埃森哲期权交易。