Behind the Scenes of Robinhood Markets's Latest Options Trends

Behind the Scenes of Robinhood Markets's Latest Options Trends

Financial giants have made a conspicuous bullish move on Robinhood Markets. Our analysis of options history for Robinhood Markets (NASDAQ:HOOD) revealed 12 unusual trades.

金融巨头对罗宾汉市场采取了明显的看涨举动。我们对罗宾汉市场(纳斯达克股票代码:HOOD)期权历史的分析显示了12笔不寻常的交易。

Delving into the details, we found 50% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $70,550, and 10 were calls, valued at $465,794.

深入研究细节,我们发现50%的交易者看涨,而41%的交易者表现出看跌趋势。在我们发现的所有交易中,有2笔是看跌期权,价值为70,550美元,10笔是看涨期权,价值465,794美元。

Expected Price Movements

预期的价格走势

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $13.0 to $35.0 for Robinhood Markets during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注Robinhood Markets在过去一个季度的价格范围从13.0美元到35.0美元不等。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

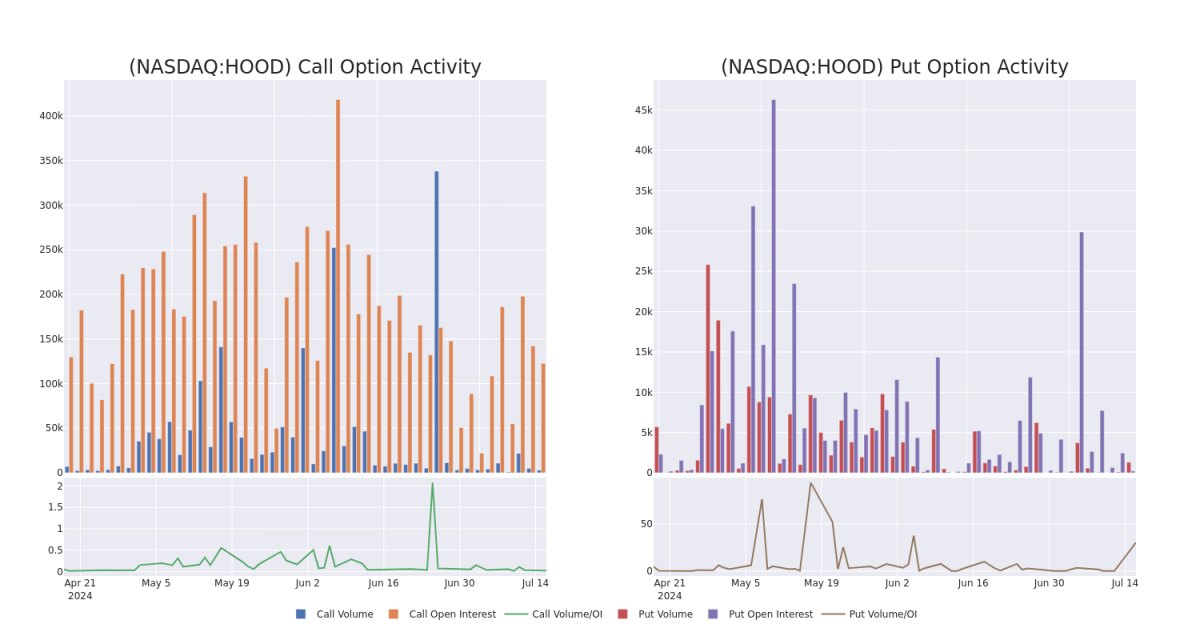

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Robinhood Markets's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Robinhood Markets's whale trades within a strike price range from $13.0 to $35.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪给定行使价下Robinhood Markets期权的流动性和利息。下面,我们可以观察到过去30天内Robinhood Markets所有鲸鱼交易的看涨期权和看跌期权交易量和未平仓合约的变化,其行使价在13.0美元至35.0美元之间。

Robinhood Markets Option Volume And Open Interest Over Last 30 Days

Robinhood Markets 过去 30 天的期权交易量和未平仓合约

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | SWEEP | BEARISH | 08/02/24 | $3.8 | $3.7 | $3.72 | $21.00 | $111.5K | 1.4K | 905 |

| HOOD | CALL | TRADE | BULLISH | 08/16/24 | $1.3 | $1.24 | $1.3 | $26.00 | $65.0K | 13.1K | 4 |

| HOOD | CALL | TRADE | BEARISH | 08/16/24 | $3.05 | $3.0 | $3.01 | $23.00 | $60.2K | 13.1K | 667 |

| HOOD | CALL | SWEEP | BULLISH | 01/17/25 | $4.0 | $3.85 | $3.94 | $25.00 | $55.1K | 53.9K | 86 |

| HOOD | CALL | TRADE | BEARISH | 01/16/26 | $12.2 | $12.0 | $12.0 | $15.00 | $36.0K | 5.9K | 0 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 引擎罩 | 打电话 | 扫 | 粗鲁的 | 08/02/24 | 3.8 美元 | 3.7 美元 | 3.72 美元 | 21.00 美元 | 111.5 万美元 | 1.4K | 905 |

| 引擎罩 | 打电话 | 贸易 | 看涨 | 08/16/24 | 1.3 美元 | 1.24 美元 | 1.3 美元 | 26.00 美元 | 65.0 万美元 | 13.1K | 4 |

| 引擎罩 | 打电话 | 贸易 | 粗鲁的 | 08/16/24 | 3.05 美元 | 3.0 美元 | 3.01 美元 | 23.00 美元 | 60.2 万美元 | 13.1K | 667 |

| 引擎罩 | 打电话 | 扫 | 看涨 | 01/17/25 | 4.0 美元 | 3.85 美元 | 3.94 | 25.00 美元 | 55.1 万美元 | 53.9 K | 86 |

| 引擎罩 | 打电话 | 贸易 | 粗鲁的 | 01/16/26 | 12.2 美元 | 12.0 美元 | 12.0 美元 | 15.00 美元 | 36.0 万美元 | 5.9K | 0 |

About Robinhood Markets

关于罗宾汉市场

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. It earns transaction-based revenues from routing user orders for options, equities, and cryptocurrencies to market makers when a routed order is executed.

Robinhood Markets Inc正在创建一个现代金融服务平台。它设计自己的产品和服务,并通过专有技术支持的基于应用程序的单一云平台交付。其垂直整合平台使新产品和服务的引入成为可能,例如加密货币交易、股息再投资、部分股票、经常性投资和IPO Access。它通过在执行传送的订单时将用户对期权、股票和加密货币的订单传送给做市商来获得基于交易的收入。

Following our analysis of the options activities associated with Robinhood Markets, we pivot to a closer look at the company's own performance.

在分析了与Robinhood Markets相关的期权活动之后,我们将转向仔细研究公司自身的表现。

Where Is Robinhood Markets Standing Right Now?

Robinhood Markets 现在处于什么位置?

- With a volume of 9,542,766, the price of HOOD is up 2.11% at $24.45.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 22 days.

- HOOD的交易量为9,542,766美元,价格上涨2.11%,至24.45美元。

- RSI指标暗示标的股票可能接近超买。

- 下一份财报预计将在22天后公布。

Professional Analyst Ratings for Robinhood Markets

Robinhood 市场的专业分析师评级

5 market experts have recently issued ratings for this stock, with a consensus target price of $22.0.

5位市场专家最近发布了该股的评级,共识目标价为22.0美元。

- Showing optimism, an analyst from Wolfe Research upgrades its rating to Outperform with a revised price target of $29.

- Consistent in their evaluation, an analyst from Deutsche Bank keeps a Hold rating on Robinhood Markets with a target price of $20.

- Consistent in their evaluation, an analyst from Goldman Sachs keeps a Neutral rating on Robinhood Markets with a target price of $21.

- Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for Robinhood Markets, targeting a price of $20.

- An analyst from Piper Sandler has decided to maintain their Neutral rating on Robinhood Markets, which currently sits at a price target of $20.

- 沃尔夫研究的一位分析师表现出乐观的态度,将其评级上调至跑赢大盘,目标股价为29美元。

- 德意志银行的一位分析师在评估中保持了对Robinhood Markets的持有评级,目标价为20美元。

- 高盛的一位分析师在评估中保持对Robinhood Markets的中性评级,目标价为21美元。

- 巴克莱银行的一位分析师坚持其立场,继续对Robinhood Markets维持减持评级,目标价格为20美元。

- 派珀·桑德勒的一位分析师已决定维持对罗宾汉市场的中性评级,该评级目前的目标股价为20美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Robinhood Markets options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。通过Benzinga Pro的实时提醒,随时了解Robinhood Markets的最新期权交易。