Market Whales and Their Recent Bets on NKE Options

Market Whales and Their Recent Bets on NKE Options

Financial giants have made a conspicuous bullish move on Nike. Our analysis of options history for Nike (NYSE:NKE) revealed 42 unusual trades.

金融巨头对耐克做出了明显的看好举动。我们分析了耐克(NYSE:NKE)期权历史,发现有42个飞凡交易。

Delving into the details, we found 52% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $672,529, and 30 were calls, valued at $1,690,407.

深入了解细节后,我们发现52%的交易者看涨,而40%的交易者呈现看淡趋势。在我们发现的所有交易中,有12个看跌的期权,价值为672,529美元,有30个看涨的期权,价值为1,690,407美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $95.0 for Nike over the recent three months.

根据最近三个月的交易活动,看起来重要投资者的目标价区间是60.0美元到95.0美元。

Insights into Volume & Open Interest

成交量和持仓量分析

In terms of liquidity and interest, the mean open interest for Nike options trades today is 4458.39 with a total volume of 43,881.00.

就流动性和兴趣而言,耐克期权今天的平均持仓量是4458.39,总成交量为43,881.00。

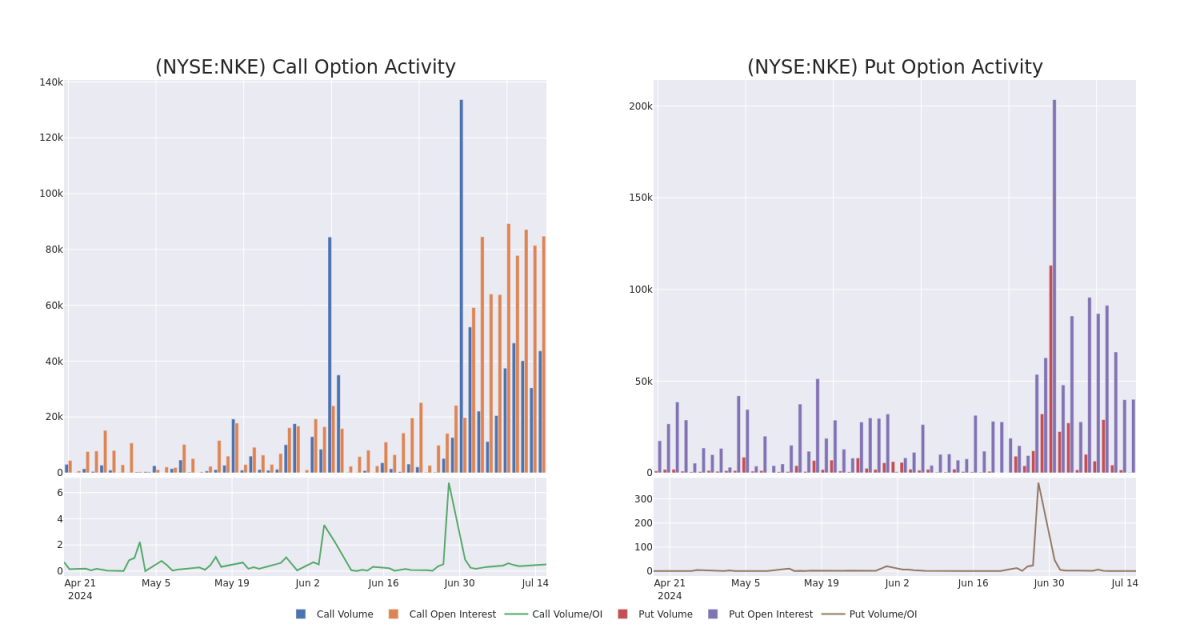

In the following chart, we are able to follow the development of volume and open interest of call and put options for Nike's big money trades within a strike price range of $60.0 to $95.0 over the last 30 days.

在下面的图表中,我们可以跟踪过去30天内,耐克的成交量和持仓量的发展情况,涵盖了60.0美元到95.0美元之间看涨和看跌期权的大型交易。

Nike Option Activity Analysis: Last 30 Days

耐克期权活动分析:近30天

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | CALL | TRADE | BEARISH | 10/18/24 | $3.85 | $3.75 | $3.76 | $75.00 | $376.0K | 7.2K | 529 |

| NKE | PUT | SWEEP | BEARISH | 03/21/25 | $7.9 | $7.8 | $7.9 | $75.00 | $233.0K | 6.7K | 2 |

| NKE | CALL | TRADE | BEARISH | 12/20/24 | $2.79 | $2.73 | $2.75 | $82.50 | $192.5K | 876 | 2.6K |

| NKE | CALL | SWEEP | BEARISH | 06/20/25 | $8.05 | $7.85 | $7.8 | $75.00 | $117.3K | 2.4K | 27 |

| NKE | CALL | TRADE | BULLISH | 09/20/24 | $4.3 | $4.3 | $4.3 | $70.00 | $86.0K | 1.9K | 231 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 耐克 | 看涨 | 交易 | 看淡 | 10/18/24 | $3.85 | $3.75 | $3.76 | $75.00 | $376.0K | 7,200 | 529 |

| 耐克 | 看跌 | SWEEP | 看淡 | 03/21/25 | $7.9 | $7.8 | $7.9 | $75.00 | $233.0K | 6.7千 | 2 |

| 耐克 | 看涨 | 交易 | 看淡 | 12/20/24 | $2.79 | $2.73 | $2.75 | $82.50 | $192.5K | 876 | 2.6K |

| 耐克 | 看涨 | SWEEP | 看淡 | 06/20/25 | $8.05 | $7.85 | $7.8 | $75.00 | $117.3K | 2.4K | 27 |

| 耐克 | 看涨 | 交易 | 看好 | 09/20/24 | $4.3 | $4.3 | $4.3 | 70.00美元 | $86.0K | 1.9K | 231 |

About Nike

关于耐克

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

耐克是世界上最大的运动鞋和服装品牌。主要类别包括篮球,跑步和足球(足球)。鞋类销售占据其销售额的三分之二左右。其品牌包括耐克,乔丹(高档的运动鞋和服装)和匡威(休闲鞋类)。耐克通过公司所有的店铺,特许经营店和第三方零售商在全球销售产品。该公司还在40多个国家和地区运营电子商务平台。几乎所有产品都由30多个国家的代工厂商代工生产。耐克成立于1964年,总部位于俄勒冈州比弗顿。

Where Is Nike Standing Right Now?

耐克现在处于什么位置?

- With a trading volume of 19,855,350, the price of NKE is up by 2.09%, reaching $72.8.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 72 days from now.

- NKE的成交量达到19,855,350,涨幅为2.09%,达到72.8美元。

- 当前RSI指标表明该股可能被超卖。

- 下一份财报将在72天后发布。

Expert Opinions on Nike

对耐克的专家意见

In the last month, 5 experts released ratings on this stock with an average target price of $110.4.

在过去一个月中,有5位专家发布了对该股票的评级,平均目标价为110.4美元。

- An analyst from Guggenheim persists with their Buy rating on Nike, maintaining a target price of $115.

- An analyst from Telsey Advisory Group persists with their Outperform rating on Nike, maintaining a target price of $100.

- An analyst from Oppenheimer upgraded its action to Outperform with a price target of $120.

- An analyst from Citigroup persists with their Buy rating on Nike, maintaining a target price of $102.

- An analyst from Telsey Advisory Group persists with their Outperform rating on Nike, maintaining a target price of $115.

- Guggenheim的分析师坚持对耐克的买入评级,目标价保持在115美元。

- Telsey咨询集团的分析师坚持对耐克的跑赢评级,目标价保持在100美元。

- Oppenheimer的分析师将其评级提升为跑赢,并设定了120美元的目标价。

- 花旗集团的分析师坚持对耐克的买入评级,目标价保持在102美元。

- Telsey咨询集团的分析师坚持对耐克的跑赢评级,目标价保持在115美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Nike options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在收益。审慎的交易者通过不断的自我教育、调整他们的策略、监控多个因子并密切关注市场行情来管理这些风险。通过Benzinga Pro的实时警报保持对最新的耐克期权交易的了解。