Verizon Communications Unusual Options Activity

Verizon Communications Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on Verizon Communications (NYSE:VZ).

有很多钱的投资者对Verizon Communications (纽交所:VZ)持看淡态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with VZ, it often means somebody knows something is about to happen.

无论这些投资者是机构还是个人,我们不清楚。但是当这么大的事情发生在VZ时,往往意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 9 uncommon options trades for Verizon Communications.

今天,Benzinga的期权扫描器发现了9笔不寻常的Verizon Communications期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 33% bullish and 44%, bearish.

这些大额交易者的整体情绪在33%的看好和44%的看淡之间分化。

Out of all of the special options we uncovered, 2 are puts, for a total amount of $141,568, and 7 are calls, for a total amount of $514,354.

在我们发现的所有特殊期权中,有2个是看跌期权,总金额为141,568美元,有7个是看涨期权,总金额为514,354美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $35.0 and $45.0 for Verizon Communications, spanning the last three months.

在评估成交量和持仓量后,很明显,主要市场动力是将Verizon Communications定位在35.0美元至45.0美元之间的价格区间,覆盖过去三个月。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

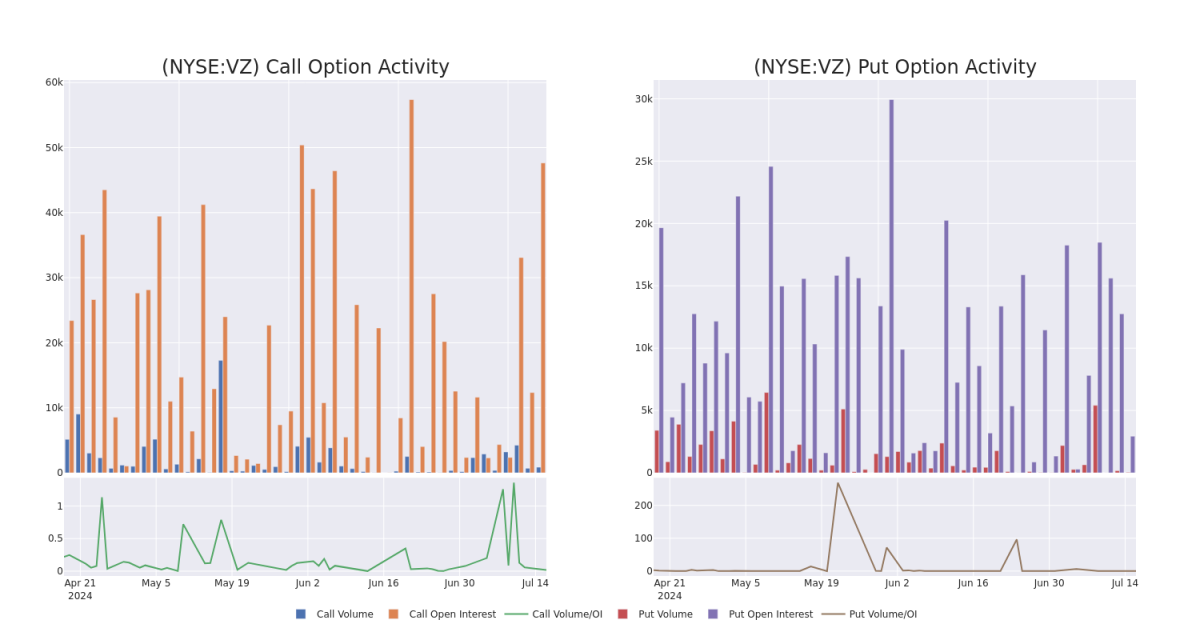

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Verizon Communications's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Verizon Communications's significant trades, within a strike price range of $35.0 to $45.0, over the past month.

通过研究成交量和持仓量,可以提供有关股票研究的重要见解。这些信息是评估Verizon Communications某些行权价格的期权的流动性和利益水平的关键。下面,我们给出了过去一个月内,在35.0美元至45.0美元行权价格范围内,涵盖了Verizon Communications重要交易的看跌和看涨期权成交量和持仓量趋势的快照。

Verizon Communications Call and Put Volume: 30-Day Overview

Verizon Communications看涨和看跌期权成交量:30天概览

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VZ | CALL | SWEEP | BEARISH | 07/26/24 | $1.46 | $1.44 | $1.45 | $40.00 | $131.1K | 4.9K | 302 |

| VZ | CALL | SWEEP | BULLISH | 07/26/24 | $0.65 | $0.62 | $0.65 | $41.50 | $102.7K | 1.6K | 71 |

| VZ | PUT | SWEEP | BEARISH | 06/20/25 | $3.75 | $3.65 | $3.75 | $42.00 | $100.5K | 729 | 0 |

| VZ | CALL | SWEEP | BULLISH | 08/02/24 | $0.8 | $0.74 | $0.74 | $41.50 | $72.1K | 5 | 0 |

| VZ | CALL | SWEEP | BEARISH | 01/17/25 | $7.2 | $7.15 | $7.15 | $35.00 | $71.5K | 12.4K | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| verizon | 看涨 | SWEEP | 看淡 | 07/26/24 | $1.46 | $1.44 | $1.45 | $40.00 | $131.1K | 4.9K | 302 |

| verizon | 看涨 | SWEEP | 看好 | 07/26/24 | $0.65 | $0.62 | $0.65 | 41.50美元 | $102.7K | 1.6K | 71 |

| verizon | 看跌 | SWEEP | 看淡 | 06/20/25 | $3.75 | $3.65 | $3.75 | 根据TipRanks.com数据,Gruber是一位5星分析师,平均回报率为14.5%,成功率为60.5%。Gruber主要研究北美板块的股票,重点关注Solaris Oilfield Infrastructure、Oceaneering International和Atlas Energy Solutions等股票。 | $100.5K | 729 | 0 |

| verizon | 看涨 | SWEEP | 看好 | 08/02/24 | $0.8 | 每加元0.74 | 每加元0.74 | 41.50美元 | $72.1K | 5 | 0 |

| verizon | 看涨 | SWEEP | 看淡 | 01/17/25 | $7.2 | $7.15 | $7.15 | 35.00美元 | $71.5千美元 | 12.4K | 0 |

About Verizon Communications

关于Verizon通信

Wireless services account for about 70% of Verizon Communications' total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 21 million prepaid phone customers (following the acquisition of Tracfone) via its nationwide network, making it the largest US wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 29 million homes and businesses and serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers' networks.

无线服务占Verizon Communications总服务收入的约70%,几乎占其营业收入的全部。该公司通过其全国网络为约9300万后付费手机用户和2100万预付费手机用户提供服务(收购Tracfone之后),是美国最大的无线电信运营商。固定线路电信运营包括东北部的本地网络,覆盖约2900万住宅和企业,为约800万宽带客户提供服务。Verizon还向企业客户全国提供电信服务,通常使用自己和其他运营商的网络。

Following our analysis of the options activities associated with Verizon Communications, we pivot to a closer look at the company's own performance.

在分析与Verizon Communications相关的期权交易活动之后,我们转向更加关注公司的业绩。

Where Is Verizon Communications Standing Right Now?

Verizon Communications现在处于什么状态?

- With a volume of 15,559,676, the price of VZ is up 1.52% at $41.41.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 6 days.

- VZ的成交量为15,559,676股,价格为41.41美元,上涨1.52%。

- RSI指标暗示该股票可能要超买了。

- 下一轮财报将在6天后发布。

Expert Opinions on Verizon Communications

对Verizon Communications的专家意见

In the last month, 1 experts released ratings on this stock with an average target price of $46.5.

在过去一个月中,有1名专家对该股票发布评级,平均目标价为$46.5。

- An analyst from Scotiabank persists with their Sector Perform rating on Verizon Communications, maintaining a target price of $46.

- Scotiabank的分析师坚持对Verizon Communications的板块表现评级,维持46美元的目标价。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Verizon Communications options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。精明的交易者通过不断地自我教育、调整策略、监控多个因子并密切关注市场走势来管理这些风险。从Benzinga Pro获得实时警报,了解最新的Verizon Communications期权交易信息。