Fed Rate Cut Expectations Drop Mortgage Rates To 4-Month Lows: Surge In New Applications, Refinance Demand

Fed Rate Cut Expectations Drop Mortgage Rates To 4-Month Lows: Surge In New Applications, Refinance Demand

The anticipation of Federal Reserve rate cuts is starting to have a favorable impact on the real estate mortgage market.

美国联邦储备委员会加息的预期开始对房地产抵押贷款市场产生了积极影响。

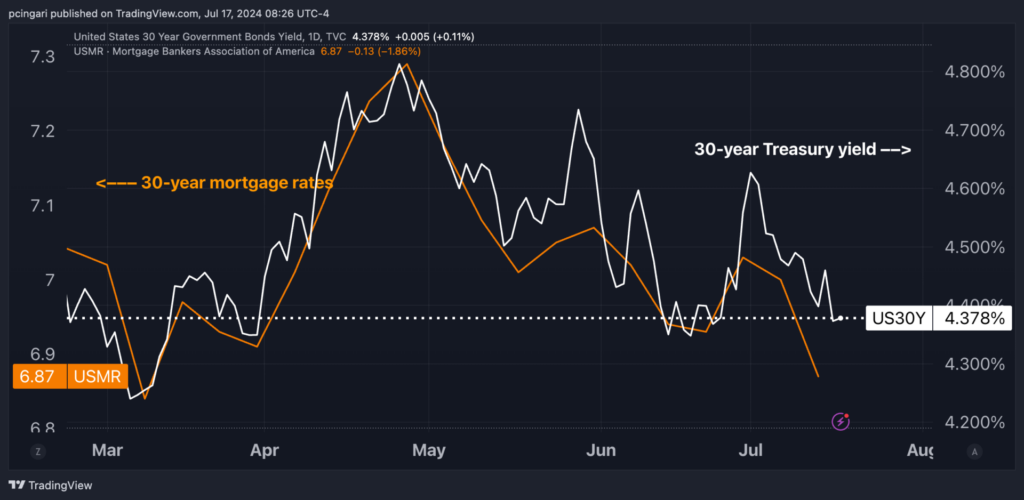

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased by 13 basis points to 6.87% for the week ending July 12, 2024, down from 7% the prior week, as reported by the Mortgage Bankers Association Wednesday.

根据周三房屋抵押贷款银行家协会的报道,符合贷款平衡(贷款额度不超过766,550美元)的30年期固定利率抵押贷款的平均合同利率下降了13个基点,至6.87%,截至2024年7月12日的一周,较上一周的7%下降。

This decline represents the most significant drop in borrowing costs in around four months and the lowest rate since early March.

这次下降代表了近四个月以来借贷成本的最显著下降,也是自3月初以来的最低利率。

Fed Rate Cut Bets, Lower Treasury Yields Push Mortgage Rates Down

联邦基金利率下调预期和国债收益率下降推动抵押贷款利率下降。

The reduction was largely propelled by rising expectations on Fed rate cuts and the fall in 30-year Treasury yields, a key indicator for long-term mortgage rates, which decreased by approximately 30 basis points month-to-date to 4.37%.

长期抵押贷款利率的关键指标30年期国库券收益率本月迄今已下降约30个基点至4.37%,这次降低主要受到联邦基金利率下调预期和这种预期带来的印象的推动。

Market expectations for a 25 basis point rate cut in September have surged to nearly 100%, up from a 60% likelihood a month ago, according to the CME FedWatch Tool.

根据CME FedWatch Tool的数据,市场预计9月份将降息25个基点的可能性已经飙升至将近100%,一个月前这个可能性还只有60%。

Joel Kan, the MBA's vice president, said, "Mortgage rates declined last week, as recent signs of cooling inflation and the increased likelihood of Fed rate cuts later this year pulled them lower."

美国银行家协会的副总裁乔尔·坎说:“抵押贷款利率上周下降,因为最近通胀减缓的迹象和后年下半年联邦基金利率降息的可能性增加,这些都使利率下降。”

Rising Mortgage Demand

抵押贷款利率下降13个基点对需求产生了积极影响,上周新抵押贷款和现有抵押贷款再融资的申请量大幅上升。

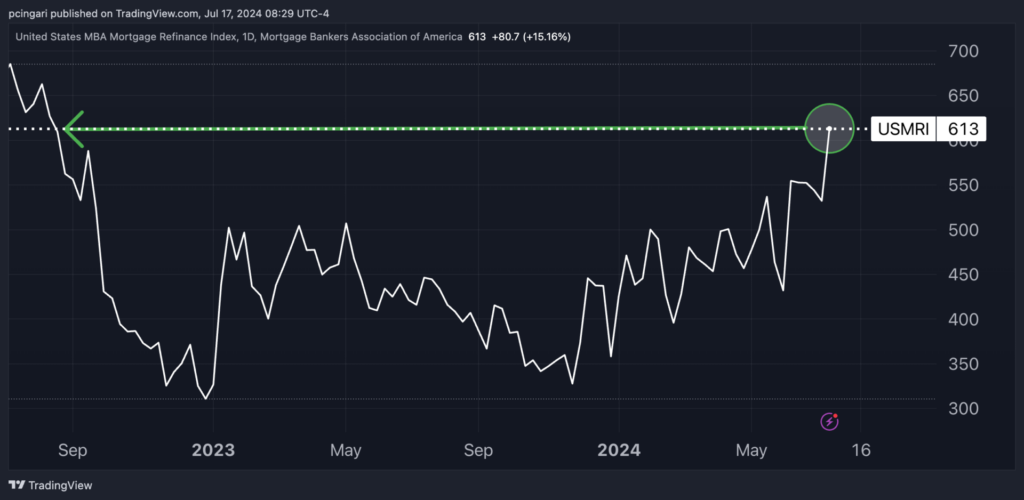

The 13 basis point reduction in mortgage rates has positively influenced demand, with applications for new mortgages and refinancing existing mortgages rising significantly last week.

根据美国银行家协会的数据,美国的抵押贷款申请在7月的第三周跃升3.9%,从前两周的下跌中恢复,并实现了一个月以来的最大增幅。

According to MBA data, mortgage applications in the U.S. jumped by 3.9% in the third week of July, recovering from declines in the previous two weeks to achieve the sharpest increase in a month.

尤其对每周利率变化敏感的抵押贷款再融资申请量与上周相比增加了15%,达到两年来的最高水平。

Refinancing applications, which are particularly sensitive to weekly rate changes, increased by 15% from the previous week, reaching their highest level in two years.

房地产选择行业SPDR基金(NYSE: XLRE)周三在发布时交易上涨1.33%,周二收盘时上涨1%。Vanguard Real Estate ETF(NYSE: VNQ)上涨1.27%。

Market Reactions

市场反应

The Real Estate Select Sector SPDR Fund (NYSE:XLRE) traded 1.33% higher at the time of publication Wednesday, after closing 1% higher Tuesday. The Vanguard Real Estate ETF (NYSE:VNQ) was up 1.27%.

房地产业选择板块 SPDR 基金(纽交所:XLRE)周三发行时交易上涨了1.33%,周二收盘时上涨了1%。不动产信托指数ETF-Vanguard(纽交所:VNQ)上涨了1.27%。

Top performers in the premarket were:

早盘表现最佳的公司有:

- SL Green Realty Corp. (NYSE:SLG) up 2.30%.

- CubeSmart (NYSE:CUBE) up 1.90%.

- National Storage Affiliates Trust (NYSE:NSA) up 0.90%.

- Kennedy-Wilson Holdings, Inc. (NYSE:KW) up 0.56%.

- Alexandria Real Estate Equities (NYSE:ARE) up 0.54%.

- Vornado Realty Trust (NYSE:VNO) up 0.47%.

- SL Green Realty Corp.(纽约证券交易所股票代码:SLG)上涨2.30%。

- CubeSmart(纽约证券交易所股票代码:CUBE)上涨1.90%。

- National Storage Affiliates Trust(纽约证券交易所股票代码:NSA)上涨0.90%。

- Kennedy-Wilson Holdings,Inc.(纽约证券交易所股票代码:KW)上涨0.56%。

- Alexandria Real Estate Equities(纽约证券交易所股票代码:ARE)上涨0.54%。

- Vornado Realty Trust(纽约证券交易所股票代码:VNO)上涨0.47%。

- Regional Bank Gains Hit Levels Unseen Since Silicon Valley Bank's Failure As Investor Sentiment Shifts To Small-Cap Names

- 投资者情绪转向小盘股,区域银行收益达到自硅谷银行失败以来的空前水平

Photo: Shutterstock

Photo: shutterstock