What the Options Market Tells Us About Oracle

What the Options Market Tells Us About Oracle

Deep-pocketed investors have adopted a bullish approach towards Oracle (NYSE:ORCL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ORCL usually suggests something big is about to happen.

深谋远虑的投资者对Oracle(NYSE:ORCL)采取了看好的态度,这是市场参与者不应该忽视的事情。我们在Benzinga对公开期权记录的跟踪披露了这一重大动作。这些投资者的身份尚不明确,但ORCL的如此重大举措通常意味着大事将要发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Oracle. This level of activity is out of the ordinary.

我们从观察中获得了这一信息,当Benzinga的期权扫描器突出了Oracle的13项非凡期权活动时。这种活动水平超出了常规范畴。

The general mood among these heavyweight investors is divided, with 46% leaning bullish and 46% bearish. Among these notable options, 6 are puts, totaling $294,190, and 7 are calls, amounting to $603,572.

这些大时代的投资者的总体心态分为两派,其中46%看好,46%看淡。在这些值得注意的期权中,有6个看跌期权,总额为294,190美元,7个看涨期权,总额为603,572美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $125.0 and $165.0 for Oracle, spanning the last three months.

在评估成交量和持仓量之后,我们发现主要的市场搬动者正在关注Oracle的价格区间,涵盖了过去三个月的125.0美元到165.0美元之间。

Insights into Volume & Open Interest

成交量和持仓量分析

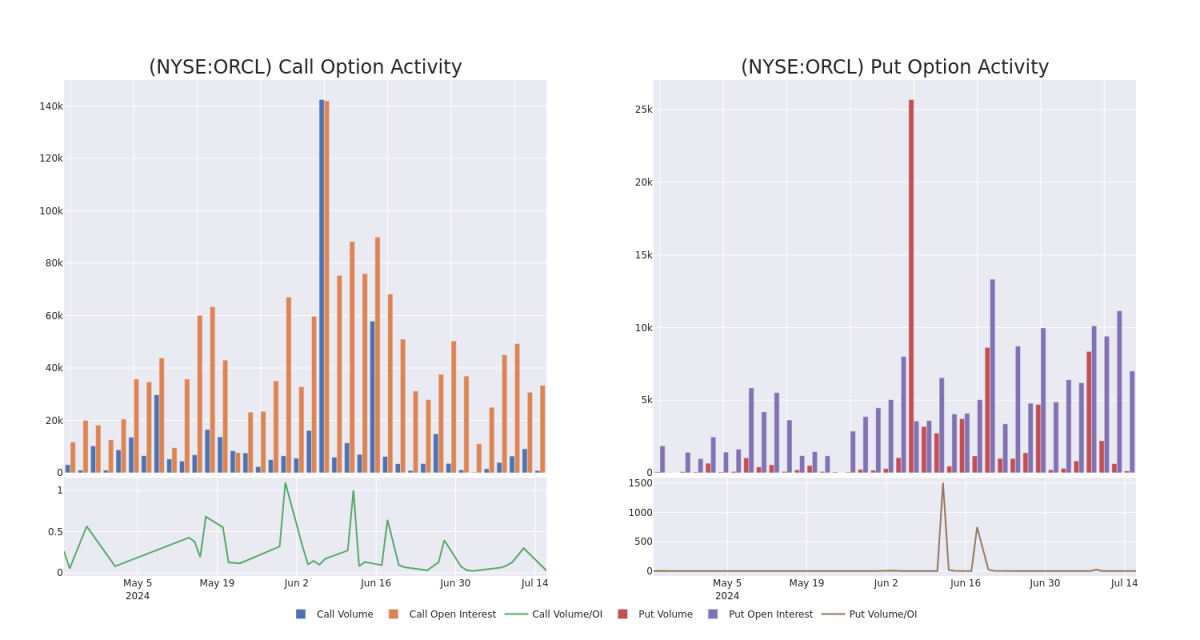

In today's trading context, the average open interest for options of Oracle stands at 2086.23, with a total volume reaching 624.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Oracle, situated within the strike price corridor from $125.0 to $165.0, throughout the last 30 days.

在今天的交易环境中,Oracle期权的平均持仓量为2086.23,总成交量达到624.00。附带的图表勾画了Oracle高价值交易的看涨和看跌期权成交量和持仓量的进展情况,这些期权均位于从125.0美元到165.0美元的行权价格带内,在过去的30天内发生。

Oracle Call and Put Volume: 30-Day Overview

Oracle看涨期权和看跌期权成交量:30天概览

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | CALL | SWEEP | BULLISH | 12/19/25 | $30.95 | $30.3 | $30.95 | $125.00 | $216.6K | 2.4K | 0 |

| ORCL | CALL | TRADE | BEARISH | 12/20/24 | $18.65 | $18.25 | $18.35 | $130.00 | $165.1K | 2.2K | 0 |

| ORCL | PUT | TRADE | BEARISH | 06/20/25 | $28.0 | $27.1 | $28.0 | $165.00 | $140.0K | 350 | 0 |

| ORCL | CALL | SWEEP | BULLISH | 08/16/24 | $0.37 | $0.36 | $0.36 | $155.00 | $72.7K | 3.6K | 255 |

| ORCL | CALL | TRADE | BULLISH | 12/20/24 | $6.05 | $6.0 | $6.03 | $155.00 | $60.3K | 5.9K | 14 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 看涨 | SWEEP | 看好 | 2025年12月19日 | $30.95 | $30.3 | $30.95 | $125.00 | $216.6K | 2.4K | 0 |

| ORCL | 看涨 | 交易 | 看淡 | 12/20/24 | $18.65 | $18.25 | $18.35 | $130.00 | $165.1K | 2.2K | 0 |

| ORCL | 看跌 | 交易 | 看淡 | 06/20/25 | $28.0 | $27.1 | $28.0 | 165.00美元 | 140,000美元 | 350 | 0 |

| ORCL | 看涨 | SWEEP | 看好 | 08/16/24 | $0.37 | $0.36 | $0.36 | $155.00 | $72.7K | 3.6千 | 255 |

| ORCL | 看涨 | 交易 | 看好 | 12/20/24 | $6.05 | $6.0 | $6.03 | $155.00 | $60.3K | 5.9K | 14 |

About Oracle

关于Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Oracle向全球企业提供数据库技术和企业资源规划(ERP)软件。Oracle成立于1977年,是第一个商用SQL数据库管理系统的创始人。如今,Oracle在175个国家拥有430,000个客户,由136,000名员工支持。

Following our analysis of the options activities associated with Oracle, we pivot to a closer look at the company's own performance.

在对Oracle的期权活动进行分析之后,我们将转向更密切关注公司的表现。

Current Position of Oracle

Oracle的当前位置

- With a trading volume of 2,560,240, the price of ORCL is down by -2.11%, reaching $139.59.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 54 days from now.

- 在2,560,240的交易量下,ORCL的价格下跌了-2.11%,达到了139.59美元。

- 目前的RSI值表明该股票目前处于超买和超卖之间的中立状态。

- 下一个收益报告将在54天后公布。

What The Experts Say On Oracle

专家们对Oracle的评价

4 market experts have recently issued ratings for this stock, with a consensus target price of $152.25.

4位市场专家最近对这只股票发表了评级,其中共识目标价为152.25美元。

- In a cautious move, an analyst from Guggenheim downgraded its rating to Buy, setting a price target of $175.

- Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Oracle with a target price of $150.

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Oracle, maintaining a target price of $125.

- An analyst from Argus Research has decided to maintain their Buy rating on Oracle, which currently sits at a price target of $159.

- 为谨慎起见,来自古根海姆的一位分析师将其评级下调为买入,并设置了每股175美元的目标价格。

- 派杰投资公司的分析师在评估中保持了对Oracle的超配评级,目标价为150美元。

- 大摩资源lof的分析师坚持给Oracle打持平评级,并维持目标价125美元。

- 雅运股份的分析师决定维持对Oracle的买入评级,目标价为159美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $125.0 and $165.0 for Oracle, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $125.0 and $165.0 for Oracle, spanning the last three months.