QuantumScape's Options Frenzy: What You Need to Know

QuantumScape's Options Frenzy: What You Need to Know

High-rolling investors have positioned themselves bearish on QuantumScape (NYSE:QS), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in QS often signals that someone has privileged information.

大量投资者看淡QuantumScape(纽交所:QS),这对散户交易者很重要。这种活动是通过Benzinga跟踪公开期权数据发现的。这些投资者的身份不确定,但QS中出现如此重大的动向往往表明有人拥有特权信息。

Today, Benzinga's options scanner spotted 10 options trades for QuantumScape. This is not a typical pattern.

今天,Benzinga的期权扫描器在QuantumScape中发现了10次期权交易,这不是典型的交易模式。

The sentiment among these major traders is split, with 30% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $39,360, and 9 calls, totaling $354,760.

这些主要的交易者情绪分为看好30%和看淡50% 。在我们确定的所有期权中,有一个看跌期权,达到39360美元,以及9个认购期权,总计354760美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $3.0 and $11.0 for QuantumScape, spanning the last three months.

通过评估交易量和未平仓合约数量,很明显市场主要交易者将重心放在QuantumScape 的3.0美元到11.0美元的价位区间上,时间跨度为过去3个月。

Insights into Volume & Open Interest

成交量和持仓量分析

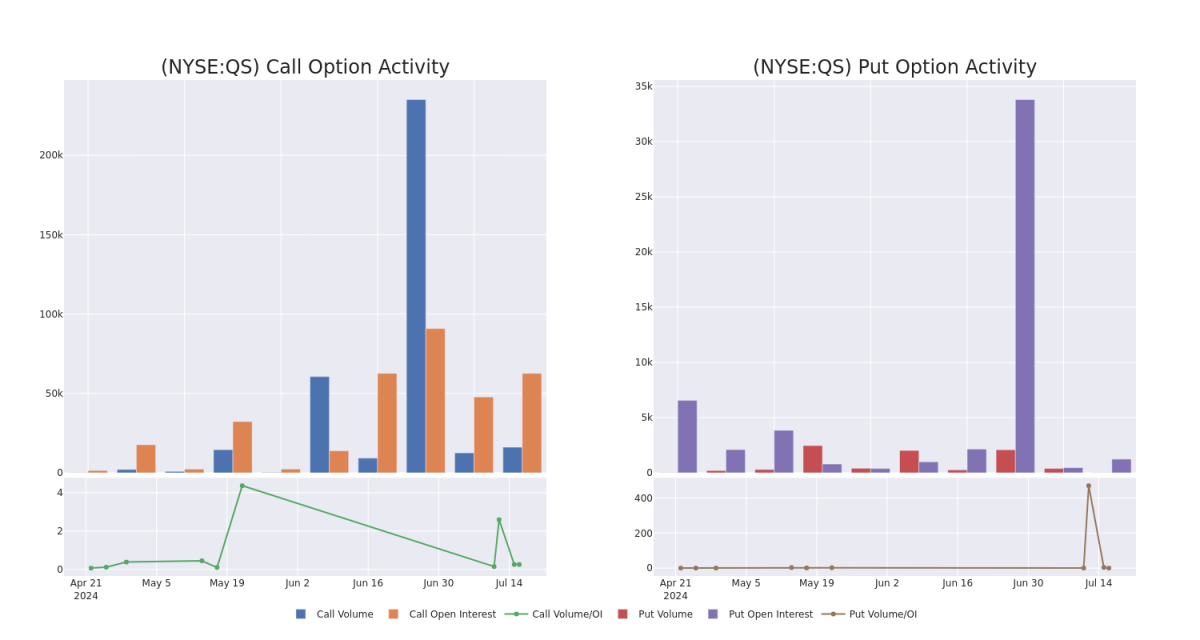

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for QuantumScape's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of QuantumScape's whale trades within a strike price range from $3.0 to $11.0 in the last 30 days.

在交易期权时,观察成交量和未平仓合约量是有帮助的。这些数据可以帮助您跟踪QuantumScape特定行权价的期权流动性和兴趣。在下面,我们可以观察到过去30天内,所有QuantumScape鲸鱼交易中,在3.0美元到11.0美元行权价区间内,认购期权和看跌期权成交量和未平仓合约量的变化。

QuantumScape Option Activity Analysis: Last 30 Days

QuantumScape期权活动分析:过去30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QS | CALL | TRADE | NEUTRAL | 11/15/24 | $2.39 | $2.2 | $2.3 | $8.00 | $68.7K | 2.9K | 80 |

| QS | CALL | TRADE | BULLISH | 01/16/26 | $5.3 | $5.2 | $5.3 | $5.00 | $53.0K | 5.5K | 39 |

| QS | CALL | TRADE | BULLISH | 02/21/25 | $1.66 | $1.66 | $1.66 | $11.00 | $41.5K | 59 | 7 |

| QS | PUT | TRADE | BEARISH | 01/17/25 | $3.2 | $3.1 | $3.2 | $11.00 | $39.3K | 0 | 0 |

| QS | CALL | SWEEP | BEARISH | 01/17/25 | $2.64 | $2.5 | $2.5 | $7.50 | $38.2K | 20.9K | 270 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QS | 看涨 | 交易 | 中立 | 11/15/24 | $2.39 | $2.2 | $2.3 | 8.00美元 | $68.7K | 2.9K | 80 |

| QS | 看涨 | 交易 | 看好 | 01/16/26 | $5.3 | $5.2 | $5.3 | $5.00。 | 53.0千美元 | 5.5K | 39 |

| QS | 看涨 | 交易 | 看好 | 02/21/25 | $1.66 | $1.66 | $1.66 | 11.00美元 | $41.5K | 59 | 7 |

| QS | 看跌 | 交易 | 看淡 | 01/17/25 | $3.2 | $3.1 | $3.2 | 11.00美元 | $39.3K | 0 | 0 |

| QS | 看涨 | SWEEP | 看淡 | 01/17/25 | 2.64美元 | $2.5 | $2.5 | $7.50 | $38.2K | 20.9K | 270 |

About QuantumScape

关于QuantumScape

QuantumScape Corp is engaged in the development of next-generation solid-state lithium-metal batteries for use in electric vehicles. It developed an anode-less cell design, which delivers high energy density while lowering material costs and simplifying manufacturing.

QuantumScape Corp致力于开发下一代固态锂金属电池,用于电动汽车中。它开发了一种无阳极电池设计,可以提高能量密度,降低材料成本并简化制造过程。

Having examined the options trading patterns of QuantumScape, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了QuantumScape的期权交易模式后,我们现在直接将目光转向该公司。这个转变让我们可以深入了解QuantumScape目前的市场地位和表现。

Where Is QuantumScape Standing Right Now?

QuantumScape目前的地位是什么?

- With a trading volume of 16,907,657, the price of QS is down by -3.5%, reaching $8.82.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 7 days from now.

- QS的交易量为16907657,价格下跌了3.5%,达到8.82美元。

- 当前RSI值表明股票可能已经超买。

- 下一个收益报告计划在7天后发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。