Decoding Lowe's Companies's Options Activity: What's the Big Picture?

Decoding Lowe's Companies's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on Lowe's Companies. Our analysis of options history for Lowe's Companies (NYSE:LOW) revealed 26 unusual trades.

金融巨头对劳氏公司作出了明显的看淡举动。我们对劳氏公司(NYSE:LOW)期权历史的分析显示,有26次非常规交易。

Delving into the details, we found 34% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $486,643, and 17 were calls, valued at $770,523.

进一步了解细节,我们发现有34%的交易员看涨,而38%显示出看淡的趋势。在我们发现的所有交易中,有9个看跌期权,价值486,643美元,有17个看涨期权,价值770,523美元。

Predicted Price Range

预测价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $210.0 to $280.0 for Lowe's Companies during the past quarter.

分析这些合约的成交量和未平仓量,似乎大球员在过去的季度里一直在关注劳氏公司价格范围在210.0美元至280.0美元之间的窗口期。

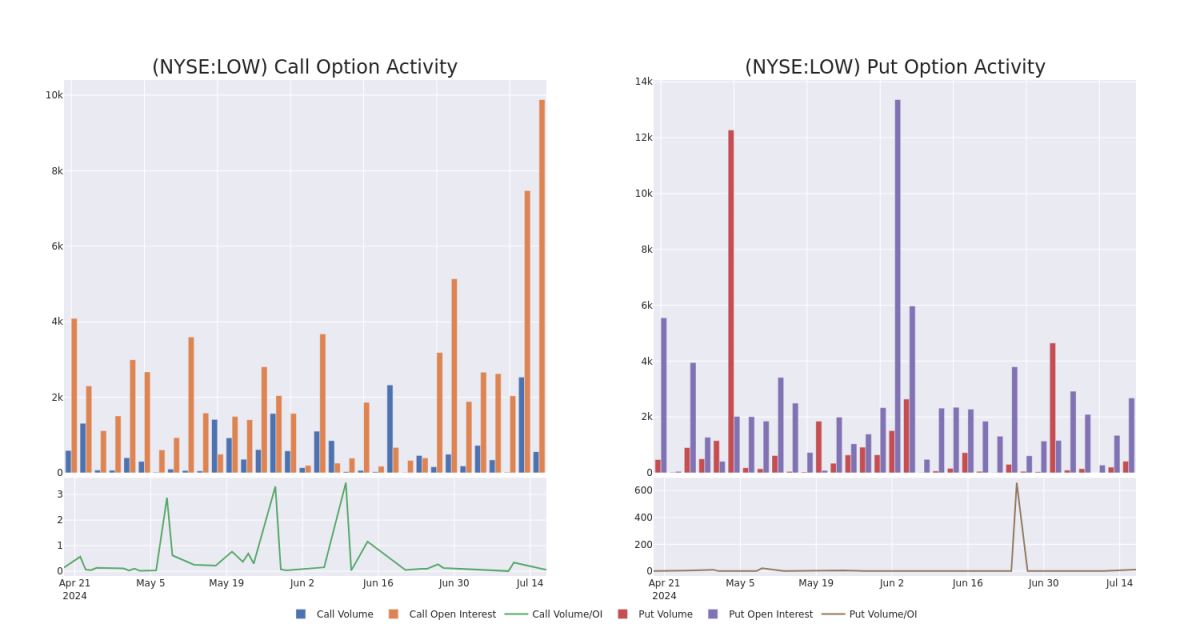

Volume & Open Interest Trends

成交量和未平仓量趋势

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lowe's Companies's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lowe's Companies's substantial trades, within a strike price spectrum from $210.0 to $280.0 over the preceding 30 days.

评估成交量和未平仓量是期权交易的一个战略步骤。这些指标揭示了特定执行价格下交易员对劳氏公司期权的流动性和投资者兴趣。即将发布的数据将可视化显示过去30天内劳氏公司在$210.0至$280.0执行价格区间内大交易的成交量和未平仓量波动情况,涉及看涨和看跌期权。

Lowe's Companies Call and Put Volume: 30-Day Overview

劳氏公司看涨和看跌期权成交量:30天总览

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LOW | PUT | SWEEP | BULLISH | 09/20/24 | $9.45 | $8.85 | $8.85 | $240.00 | $196.4K | 653 | 10 |

| LOW | CALL | TRADE | BEARISH | 09/20/24 | $4.0 | $3.8 | $3.8 | $260.00 | $134.5K | 1.6K | 20 |

| LOW | CALL | SWEEP | NEUTRAL | 07/26/24 | $2.78 | $2.74 | $2.74 | $245.00 | $82.2K | 141 | 402 |

| LOW | CALL | SWEEP | BULLISH | 07/26/24 | $32.6 | $30.3 | $31.89 | $210.00 | $63.6K | 29 | 0 |

| LOW | PUT | SWEEP | BEARISH | 06/20/25 | $18.2 | $18.15 | $18.2 | $240.00 | $49.1K | 155 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 低 | 看跌 | SWEEP | 看好 | 09/20/24 | 9.45 | $8.85 | $8.85 | $240.00 | $196.4K | 653 | 10 |

| 低 | 看涨 | 交易 | 看淡 | 09/20/24 | $4.0 | $3.8 | $3.8 | $260.00 | $134.5K | 1.6K | 20 |

| 低 | 看涨 | SWEEP | 中立 | 07/26/24 | $2.78 | $2.74 | $2.74 | 245.00美元 | $82.2K | 141 | 402 |

| 低 | 看涨 | SWEEP | 看好 | 07/26/24 | $32.6 | $30.3 | $31.89 | 目标股价为$210.00。 | $63.6K | 29 | 0 |

| 低 | 看跌 | SWEEP | 看淡 | 06/20/25 | $18.2 | $18.15 | $18.2 | $240.00 | $49.1K | 155 | 0 |

About Lowe's Companies

关于Lowe's Companies

Lowe's is the second-largest home improvement retailer in the world, operating more than 1,700 stores in the United States, after the 2023 divestiture of its Canadian locations (RONA, Lowe's Canada, Réno-Dépôt, and Dick's Lumber). The firm's stores offer products and services for home decorating, maintenance, repair, and remodeling, with maintenance and repair accounting for two thirds of products sold. Lowe's targets retail do-it-yourself (around 75% of sales) and do-it-for-me customers as well as commercial and professional business clients (around 25% of sales). We estimate Lowe's captures a high-single-digit share of the domestic home improvement market, based on US Census data and management's market size estimates.

Lowe's是全球第二大家居装修零售商,在加拿大区域业务剥离(RONA、Lowe's Canada、Réno-Dépôt和Dick's Lumber)之后,在美国共经营超过1,700家商店。该公司的商店提供家庭装饰、维护、维修和翻新的产品和服务,其中维护和维修占销售产品的三分之二。Lowe's主要目标客户是零售自助服务(约75%的销售额)和零售服务(约25%的销售额)客户,以及商业和专业客户。根据美国人口普查数据和管理层的市场规模估计,我们预计Lowe's公司在国内家装市场占据了高位数位份额。

Present Market Standing of Lowe's Companies

劳氏公司当前的市场状况

- Currently trading with a volume of 1,862,491, the LOW's price is up by 1.73%, now at $245.13.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 34 days.

- 交易量为1,862,491股,LOW的价格上涨1.73%,现为245.13美元。

- RSI读数表明该股目前可能接近超买水平。

- 预计发布收益报告还有34天。

Expert Opinions on Lowe's Companies

关于劳氏公司的专家意见

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $225.0.

过去30天里,一共有1位专业分析师对这支股票发表了评论,设定了平均目标价为225.0美元。

- An analyst from Evercore ISI Group persists with their In-Line rating on Lowe's Companies, maintaining a target price of $225.

- Evercore的一个分析师团队坚持给劳氏公司打出了一般评级,并维持了225美元的目标价。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lowe's Companies with Benzinga Pro for real-time alerts.

期权交易涉及更大的风险,但也提供了更高的利润潜力。精明的交易员通过持续学习、战略性地调整交易、利用各种因子并紧密关注市场动态来减轻这些风险。使用Benzinga Pro进行实时警报,及时了解劳氏公司最新的期权交易情况。