Spotlight on Lockheed Martin: Analyzing the Surge in Options Activity

Spotlight on Lockheed Martin: Analyzing the Surge in Options Activity

Benzinga's options scanner has just identified more than 12 option transactions on Lockheed Martin (NYSE:LMT), with a cumulative value of $733,005. Concurrently, our algorithms picked up 6 puts, worth a total of 400,235.

Benzinga的期权扫描仪刚刚在洛克希德·马丁公司(纽约证券交易所代码:LMT)上发现了超过12笔期权交易,累计价值为733,005美元。同时,我们的算法获得了6个看跌期权,总价值400,235个。

Expected Price Movements

预期的价格走势

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $470.0 to $515.0 for Lockheed Martin over the recent three months.

根据交易活动,主要投资者的目标似乎是洛克希德·马丁公司最近三个月的价格区间从470.0美元到515.0美元不等。

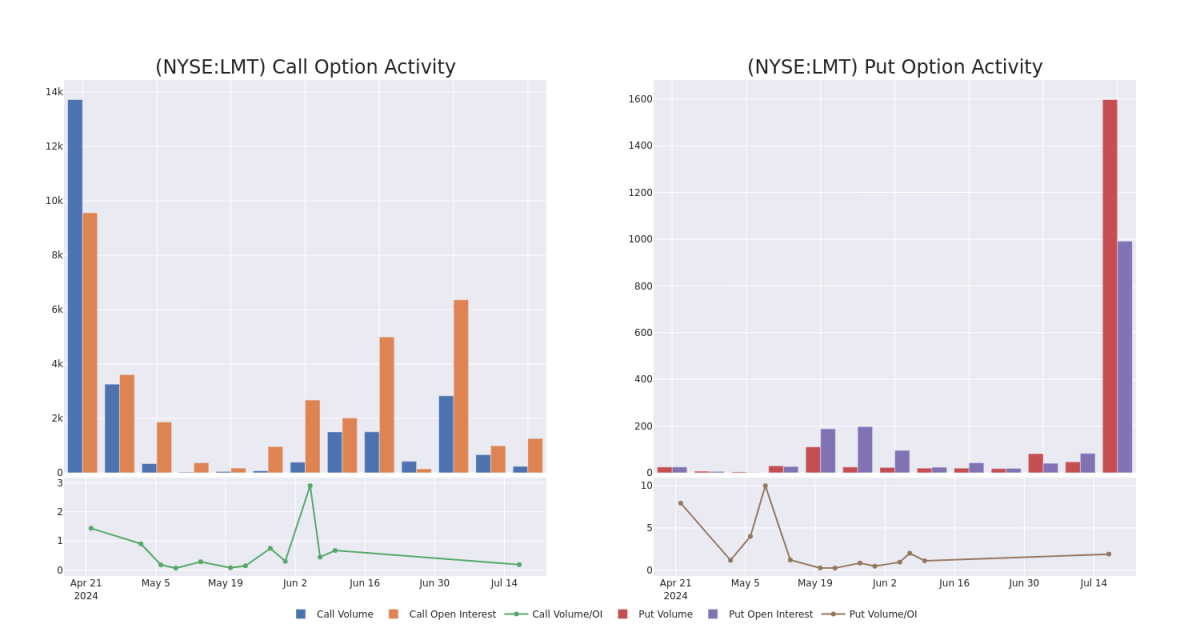

Volume & Open Interest Trends

交易量和未平仓合约趋势

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Lockheed Martin's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Lockheed Martin's significant trades, within a strike price range of $470.0 to $515.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量洛克希德·马丁公司期权在特定行使价下的流动性和利息水平的关键。下面,我们简要介绍了过去一个月洛克希德·马丁公司重大交易的看涨期权和未平仓合约的趋势,行使价区间为470.0美元至515.0美元。

Lockheed Martin Option Activity Analysis: Last 30 Days

洛克希德·马丁公司期权活动分析:过去 30 天

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | CALL | SWEEP | BULLISH | 09/20/24 | $2.0 | $1.95 | $1.95 | $515.00 | $94.3K | 61 | 0 |

| LMT | CALL | SWEEP | BULLISH | 08/16/24 | $9.2 | $9.1 | $9.19 | $480.00 | $93.5K | 1.1K | 62 |

| LMT | CALL | SWEEP | BULLISH | 08/16/24 | $9.2 | $8.8 | $9.16 | $480.00 | $91.8K | 1.1K | 62 |

| LMT | PUT | TRADE | BULLISH | 08/16/24 | $8.0 | $7.7 | $7.8 | $470.00 | $78.0K | 842 | 101 |

| LMT | PUT | TRADE | BULLISH | 08/16/24 | $8.0 | $7.8 | $7.8 | $470.00 | $78.0K | 842 | 0 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | 打电话 | 扫 | 看涨 | 09/20/24 | 2.0 美元 | 1.95 美元 | 1.95 美元 | 515.00 美元 | 94.3 万美元 | 61 | 0 |

| LMT | 打电话 | 扫 | 看涨 | 08/16/24 | 9.2 美元 | 9.1 美元 | 9.19 美元 | 480.00 美元 | 93.5 万美元 | 1.1K | 62 |

| LMT | 打电话 | 扫 | 看涨 | 08/16/24 | 9.2 美元 | 8.8 美元 | 9.16 美元 | 480.00 美元 | 91.8 万美元 | 1.1K | 62 |

| LMT | 放 | 贸易 | 看涨 | 08/16/24 | 8.0 美元 | 7.7 美元 | 7.8 美元 | 470.00 美元 | 78.0 万美元 | 842 | 101 |

| LMT | 放 | 贸易 | 看涨 | 08/16/24 | 8.0 美元 | 7.8 美元 | 7.8 美元 | 470.00 美元 | 78.0 万美元 | 842 | 0 |

About Lockheed Martin

关于洛克希德·马丁公司

Lockheed Martin is the world's largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Lockheed's largest segment is aeronautics, which derives upward of two-thirds of its revenue from the F-35. Lockheed's remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

洛克希德·马丁公司是世界上最大的国防承包商,自2001年赢得F-35联合打击战斗机计划以来,一直主导西方高端战斗机市场。洛克希德最大的细分市场是航空,其收入的三分之二以上来自F-35。洛克希德的其余部分是旋转和任务系统,主要包括西科斯基直升机业务;导弹和火力控制,用于制造导弹和导弹防御系统;以及太空系统,后者生产卫星并从联合发射联盟合资企业获得股权收入。

Current Position of Lockheed Martin

洛克希德·马丁公司目前的立场

- With a volume of 530,883, the price of LMT is up 1.47% at $475.45.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 6 days.

- LmT的价格上涨了1.47%,至475.45美元,交易量为530,883美元。

- RSI指标暗示标的股票可能接近超买。

- 下一份财报预计将在6天后公布。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lockheed Martin with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解洛克希德·马丁公司的最新期权交易,以获取实时警报。

Lockheed Martin is the world's largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Lockheed's largest segment is aeronautics, which derives upward of two-thirds of its revenue from the F-35. Lockheed's remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

Lockheed Martin is the world's largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Lockheed's largest segment is aeronautics, which derives upward of two-thirds of its revenue from the F-35. Lockheed's remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.