Unpacking the Latest Options Trading Trends in ON Semiconductor

Unpacking the Latest Options Trading Trends in ON Semiconductor

Whales with a lot of money to spend have taken a noticeably bearish stance on ON Semiconductor.

拥有大量资金的鲸鱼已明显对安森美半导体持看空态度。

Looking at options history for ON Semiconductor (NASDAQ:ON) we detected 8 trades.

在安森美半导体(纳斯达克股票代码:ON)的期权历史记录中,我们检测到了8起交易。

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 62% with bearish.

如果我们考虑到每个交易的具体情况,准确地说37%的投资者看涨,62%看跌。

From the overall spotted trades, 5 are puts, for a total amount of $233,580 and 3, calls, for a total amount of $230,006.

从总体交易中,有5项认购,总金额为233,580美元,还有3项认沽,总金额为230,006美元。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $80.0 for ON Semiconductor during the past quarter.

分析这些合约的交易量和未平仓量,似乎大玩家在过去的季度一直关注安森美半导体65.0美元至80.0美元价位区间内的价格。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

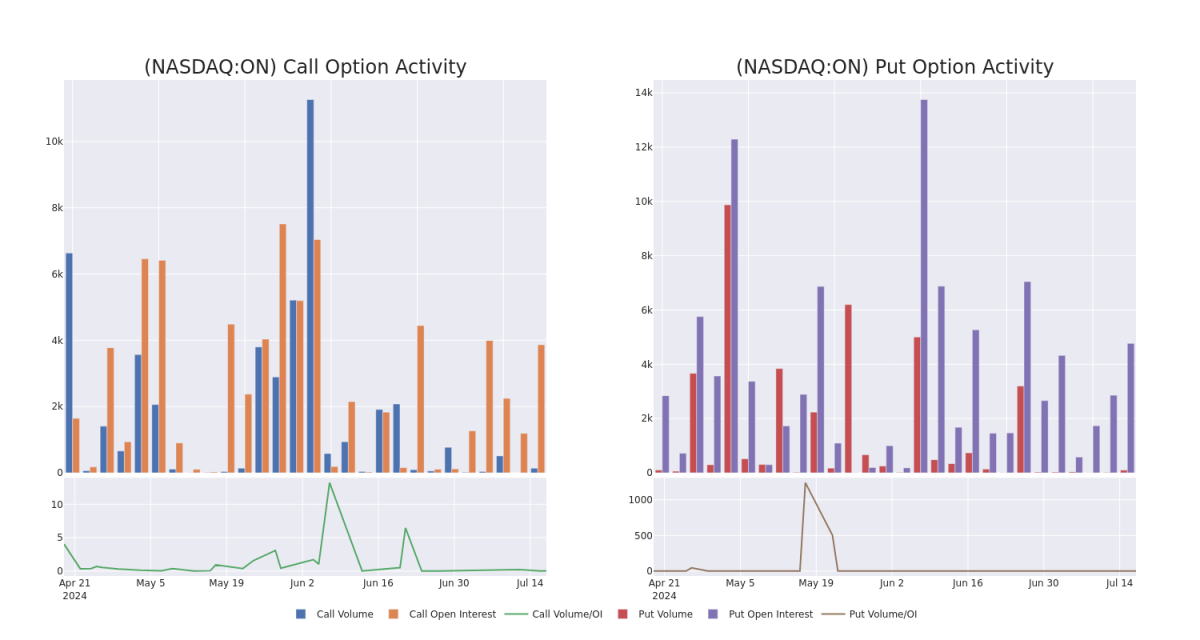

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for ON Semiconductor's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across ON Semiconductor's significant trades, within a strike price range of $65.0 to $80.0, over the past month.

检查交易量和未平仓量对股票研究提供了关键的见解,这些信息对于衡量安森美半导体在某些行权价上的期权流动性和利益水平至关重要。下面,我们将在过去一个月内的安森美半导体收盘价65.0美元至80.0美元行权价范围内,呈现认购和认沽交易量和未平仓量的趋势快照。

ON Semiconductor Option Activity Analysis: Last 30 Days

安森美半导体期权活动分析:最近30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ON | CALL | SWEEP | BEARISH | 09/20/24 | $7.8 | $7.35 | $7.39 | $75.00 | $147.9K | 1.4K | 53 |

| ON | PUT | SWEEP | BEARISH | 08/16/24 | $1.71 | $1.6 | $1.71 | $70.00 | $84.9K | 2.7K | 0 |

| ON | CALL | SWEEP | BULLISH | 12/20/24 | $8.65 | $8.45 | $8.56 | $80.00 | $55.6K | 335 | 5 |

| ON | PUT | TRADE | BEARISH | 07/26/24 | $1.1 | $1.01 | $1.07 | $74.00 | $53.5K | 173 | 0 |

| ON | PUT | SWEEP | BEARISH | 08/02/24 | $4.0 | $3.85 | $3.97 | $77.00 | $39.6K | 133 | 36 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 安大略 | 看涨 | SWEEP | 看淡 | 09/20/24 | $7.8 | $7.35 | $7.39 | $75.00 | $147.9K | 1.4千 | 53 |

| 安大略 | 看跌 | SWEEP | 看淡 | 08/16/24 | $1.71 | $1.6 | $1.71 | 70.00美元 | $84.9K | 2.7K | 0 |

| 安大略 | 看涨 | SWEEP | 看好 | 12/20/24 | $ 8.65 | 8.45美元 | $8.56 | $80.00 | $55.6K | 335 | 5 |

| 安大略 | 看跌 | 交易 | 看淡 | 07/26/24 | $1.1 | $1.01 | $1.07 | $74.00 | $53.5K | 173 | 0 |

| 安大略 | 看跌 | SWEEP | 看淡 | 08/02/24 | $4.0 | $3.85 | $3.97 | $77.00 | $39.6K | 133 | 36 |

About ON Semiconductor

关于ON Semiconductor

Onsemi is a supplier of power semiconductors and sensors focused on the automotive and industrial markets. Onsemi is the second-largest power chipmaker in the world and the largest supplier of image sensors to the automotive market. While the firm used to be highly vertically integrated, it now pursues a hybrid manufacturing strategy for flexible capacity. Onsemi is pivoting to focus on emerging applications like electric vehicles, autonomous vehicles, industrial automation, and renewable energy.

Onsemi是一家供应汽车和工业市场电力半导体和传感器的供应商,是全球第二大功率芯片制造商,也是汽车市场图像传感器最大的供应商。虽然公司过去高度垂直整合,但现在采取混合制造策略以获得灵活的生产能力。Onsemi正在转向关注新兴应用,如新能源汽车、自动驾驶汽车、工业自动化和可再生能源。

Having examined the options trading patterns of ON Semiconductor, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审视完ON Semiconductor的期权交易模式之后,我们的关注现在直接转向了公司本身。通过这样的转移,我们可以深入研究它现在的市场地位和表现。

ON Semiconductor's Current Market Status

安森美半导体当前市场状态

- With a volume of 9,330,035, the price of ON is down -4.17% at $75.46.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 12 days.

- 交易量达到9,330,035股,ON的股价下跌了4.17%,至75.46美元。

- RSI指标暗示该股票可能要超买了。

- 下一次公布的收益预计将在12天后发行。

What The Experts Say On ON Semiconductor

专家对ON Semiconductor的看法

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $80.5.

在过去一个月中,4位行业分析师分享了他们对该股票的看法,提出了80.5美元的平均目标价。

- Reflecting concerns, an analyst from Citigroup lowers its rating to Neutral with a new price target of $77.

- Reflecting concerns, an analyst from Morgan Stanley lowers its rating to Underweight with a new price target of $65.

- An analyst from Susquehanna has decided to maintain their Positive rating on ON Semiconductor, which currently sits at a price target of $95.

- An analyst from Keybanc has decided to maintain their Overweight rating on ON Semiconductor, which currently sits at a price target of $85.

- 花旗集团(Citigroup)的分析师担忧,将评级下调为中立,并定下新的77美元的目标价。

- 大摩资源lof(Morgan Stanley)的分析师担心情况出现,将评级下调为弱势股,目标价下调至65美元。

- Susquehanna的一位分析师决定维持对ON Semiconductor的积极评级,目标价为95美元。

- Keybanc的分析师决定维持对安森美半导体的超配评级,目前股价为85美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。