Is Now An Opportune Moment To Examine The Brink's Company (NYSE:BCO)?

Is Now An Opportune Moment To Examine The Brink's Company (NYSE:BCO)?

The Brink's Company (NYSE:BCO), might not be a large cap stock, but it saw a significant share price rise of 23% in the past couple of months on the NYSE. The company's trading levels have reached its high for the past year, following the recent bounce in the share price. As a well-established company, which tends to be well-covered by analysts, you could assume any recent changes in the company's outlook is already priced into the stock. However, could the stock still be trading at a relatively cheap price? Today we will analyse the most recent data on Brink's's outlook and valuation to see if the opportunity still exists.

布林克公司(NYSE:BCO)可能不是一只大盘股,但在过去几个月中在纽交所股价上涨了23%。公司的交易水平已达到去年以来的最高水平,随着股价的最近反弹。作为一家成熟的公司,往往受到分析师的广泛关注,您可以假设公司近期的任何变化已经计价到股票中。然而,该股票是否仍然在相对便宜的价格上交易?今天我们将分析布林克最近的前景和价值数据,看看机会是否仍然存在。

Is Brink's Still Cheap?

布林克还便宜吗?

According to our price multiple model, where we compare the company's price-to-earnings ratio to the industry average, the stock currently looks expensive. We've used the price-to-earnings ratio in this instance because there's not enough visibility to forecast its cash flows. The stock's ratio of 38.89x is currently well-above the industry average of 28.87x, meaning that it is trading at a more expensive price relative to its peers. If you like the stock, you may want to keep an eye out for a potential price decline in the future. Given that Brink's's share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

根据我们的价格多元模型,我们将公司的市盈率与行业平均值进行比较,发现该股票当前看起来很贵。我们在这个实例中使用了市盈率,因为没有足够的可见性来预测其现金流。该股票的市盈率为38.89倍,目前远高于行业平均值28.87倍,这意味着相对于同行而言它正在以更昂贵的价格交易。如果您喜欢该股票,您可能需要密切关注未来可能发生的价格下跌。由于布林克的股价相当波动(即其价格波动相对于整个市场比较明显),这可能意味着价格可能会下降,给我们在未来另一个买入的机会。这是基于它的高beta,这是股价波动性的一个很好的指标。

What does the future of Brink's look like?

布林克的未来会是什么样子?

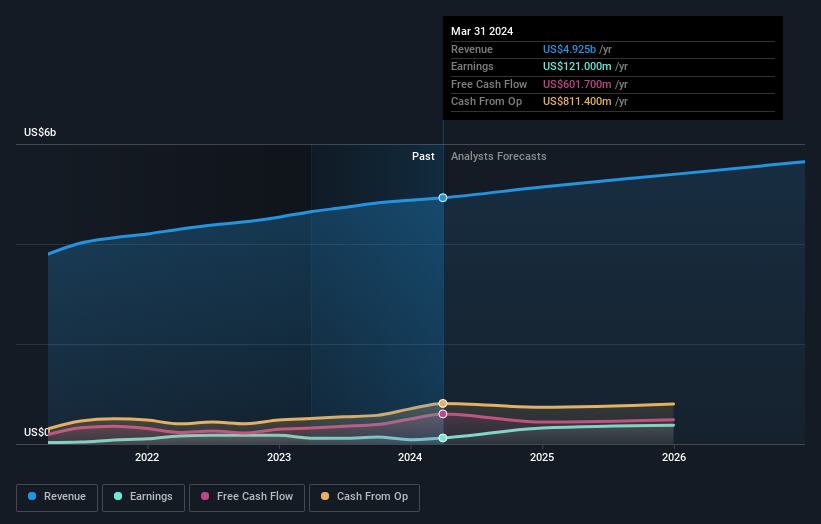

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let's also take a look at the company's future expectations. In Brink's' case, its earnings over the next year are expected to double, indicating an incredibly optimistic future ahead. This should lead to stronger cash flows, feeding into a higher share value.

如果投资者希望在其投资组合中寻求增长,则可能需要在购买股票之前考虑一家公司的前景。购买前景看好的伟大公司与便宜的价格始终是一项不错的投资,因此让我们也来看看该公司未来的预期。在布林克的情况下,其未来一年的收益预计将翻一番,表明其未来非常乐观。这将带来更强劲的现金流,进而提高股价。

What This Means For You

这对您意味着什么?

Are you a shareholder? BCO's optimistic future growth appears to have been factored into the current share price, with shares trading above industry price multiples. At this current price, shareholders may be asking a different question – should I sell? If you believe BCO should trade below its current price, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. But before you make this decision, take a look at whether its fundamentals have changed.

您是股东吗? BCO的乐观增长前景似乎已经计价到当前的股价中,股价高于行业价格多元化。在当前价格下,股东们可能会问一个不同的问题- 我应该卖掉吗?如果您认为BCO应该在当前价格以下交易,则在价格跌向行业市盈率时高价卖出并再次买入可能会获利。但在做出这个决定之前,请查看它的基本面是否发生了变化。

Are you a potential investor? If you've been keeping tabs on BCO for some time, now may not be the best time to enter into the stock. The price has surpassed its industry peers, which means it is likely that there is no more upside from mispricing. However, the positive outlook is encouraging for BCO, which means it's worth diving deeper into other factors in order to take advantage of the next price drop.

您是潜在投资者吗?如果您一直在关注BCO,现在可能不是进入该股票的最佳时机。价格已超过行业同行,这意味着可能没有更多的错价空间。然而,乐观的前景令人鼓舞,这意味着有必要深入研究其他因素,以便利用未来的价格下跌。

Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example - Brink's has 2 warning signs we think you should be aware of.

请记住,当分析股票时,值得注意其中涉及的风险。例如-布林克有2个警告标志,我们认为您应该意识到这些。

If you are no longer interested in Brink's, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

如果您不再对布林克感兴趣,您可以使用我们的免费平台查看我们的超过50只高增长潜力股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容感到担忧?请直接与我们联系。或者,发送电子邮件至editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有反馈?对内容感到担忧?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。