Behind the Scenes of ARM Holdings's Latest Options Trends

Behind the Scenes of ARM Holdings's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on ARM Holdings.

有大量资金可以花的鲸鱼对ARM Holdings采取了明显的看跌立场。

Looking at options history for ARM Holdings (NASDAQ:ARM) we detected 22 trades.

查看ArM Holdings(纳斯达克股票代码:ARM)的期权历史记录,我们发现了22笔交易。

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 50% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,36%的投资者以看涨的预期开启交易,50%的投资者持看跌预期。

From the overall spotted trades, 9 are puts, for a total amount of $371,073 and 13, calls, for a total amount of $709,822.

在已发现的全部交易中,有9笔是看跌期权,总额为371,073美元,13笔看涨期权,总额为709,822美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $200.0 for ARM Holdings over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将Arm Holdings的价格范围从70.0美元扩大到200.0美元。

Volume & Open Interest Trends

交易量和未平仓合约趋势

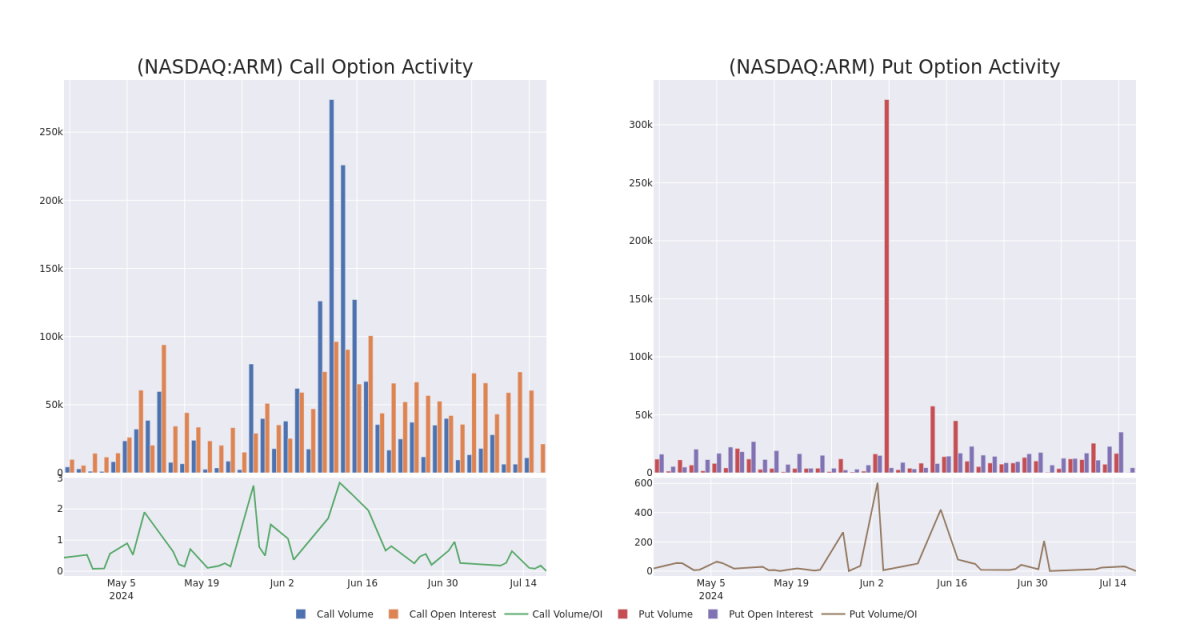

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for ARM Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ARM Holdings's whale trades within a strike price range from $70.0 to $200.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪给定行使价下arM Holdings期权的流动性和利息。下面,我们可以分别观察过去30天在行使价范围内的Arm Holdings所有鲸鱼交易的看涨期权和看跌期权交易量和未平仓合约的变化。

ARM Holdings Call and Put Volume: 30-Day Overview

ARM Holdings 看涨和看跌交易量:30 天概述

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ARM | CALL | SWEEP | BEARISH | 07/26/24 | $9.15 | $8.1 | $9.0 | $160.00 | $180.0K | 549 | 30 |

| ARM | CALL | TRADE | BEARISH | 09/20/24 | $18.8 | $18.65 | $18.65 | $165.00 | $104.4K | 784 | 20 |

| ARM | PUT | SWEEP | BULLISH | 07/19/24 | $14.0 | $13.45 | $13.45 | $175.00 | $67.2K | 1.5K | 65 |

| ARM | CALL | SWEEP | BEARISH | 11/15/24 | $15.15 | $14.85 | $14.91 | $200.00 | $59.6K | 567 | 0 |

| ARM | PUT | SWEEP | BULLISH | 07/19/24 | $13.95 | $13.45 | $13.45 | $175.00 | $48.4K | 1.5K | 65 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 手臂 | 打电话 | 扫 | 粗鲁的 | 07/26/24 | 9.15 美元 | 8.1 美元 | 9.0 美元 | 160.00 美元 | 180.0K | 549 | 30 |

| 手臂 | 打电话 | 贸易 | 粗鲁的 | 09/20/24 | 18.8 美元 | 18.65 美元 | 18.65 美元 | 165.00 美元 | 104.4 万美元 | 784 | 20 |

| 手臂 | 放 | 扫 | 看涨 | 07/19/24 | 14.0 美元 | 13.45 美元 | 13.45 美元 | 175.00 美元 | 67.2 万美元 | 1.5K | 65 |

| 手臂 | 打电话 | 扫 | 粗鲁的 | 11/15/24 | 15.15 美元 | 14.85 美元 | 14.91 美元 | 200.00 美元 | 59.6 万美元 | 567 | 0 |

| 手臂 | 放 | 扫 | 看涨 | 07/19/24 | 13.95 美元 | 13.45 美元 | 13.45 美元 | 175.00 美元 | 48.4 万美元 | 1.5K | 65 |

About ARM Holdings

关于 ARM 控股

Arm Holdings is the IP owner and developer of the ARM architecture (ARM stands for Acorn RISC Machine), which is used in 99% of the world's smartphone CPU cores, and it also has high market share in other battery-powered devices like wearables, tablets, or sensors. Arm licenses its architecture for a fee, offering different types of licenses depending on the flexibility the customer needs. Customers like Apple or Qualcomm buy architectural licenses, which allows them to modify the architecture and add or delete instructions to tailor the chips to their specific needs. Other clients directly buy off-the-shelf designs from Arm. Off-the-shelf and architectural customers pay a royalty fee per chip shipped.

Arm Holdings是ARM架构(ARM代表Acorn RISC Machine)的知识产权所有者和开发者,该架构用于全球99%的智能手机CPU内核,并且在可穿戴设备、平板电脑或传感器等其他电池供电设备中也占有很高的市场份额。Arm 对其架构进行付费许可,根据客户需要的灵活性提供不同类型的许可证。苹果或高通等客户购买架构许可证,这使他们能够修改架构并添加或删除指令,以根据自己的特定需求定制芯片。其他客户直接从Arm购买现成设计。现成和架构客户为每发货的芯片支付特许权使用费。

Having examined the options trading patterns of ARM Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了ARM Holdings的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Present Market Standing of ARM Holdings

ARM Holdings目前的市场地位

- With a trading volume of 2,712,048, the price of ARM is down by -1.31%, reaching $159.58.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 13 days from now.

- ARM的交易量为2712,048美元,价格下跌了-1.31%,至159.58美元。

- 当前的RSI值表明,该股目前在超买和超卖之间处于中立状态。

- 下一份收益报告定于即日起13天后发布。

Expert Opinions on ARM Holdings

关于ARM Holdings的专家意见

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $169.0.

在过去的30天中,共有1位专业分析师对该股发表了看法,将平均目标股价定为169.0美元。

- An analyst from Guggenheim persists with their Buy rating on ARM Holdings, maintaining a target price of $169.

- 古根海姆的一位分析师坚持对ARM Holdings的买入评级,将目标价维持在169美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ARM Holdings with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了获得更高利润的可能性。精明的交易者通过持续的教育、战略交易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解ARM Holdings的最新期权交易,获取实时提醒。