Marathon Petroleum Unusual Options Activity

Marathon Petroleum Unusual Options Activity

Financial giants have made a conspicuous bearish move on Marathon Petroleum. Our analysis of options history for Marathon Petroleum (NYSE:MPC) revealed 24 unusual trades.

金融巨头对马拉松石油采取了明显的看跌举动。我们对马拉松石油公司(纽约证券交易所代码:MPC)期权历史的分析显示了24笔不寻常的交易。

Delving into the details, we found 20% of traders were bullish, while 79% showed bearish tendencies. Out of all the trades we spotted, 22 were puts, with a value of $636,902, and 2 were calls, valued at $84,825.

深入研究细节,我们发现20%的交易者看涨,而79%的交易者表现出看跌倾向。在我们发现的所有交易中,22笔是看跌期权,价值636,902美元,2笔是看涨期权,价值84,825美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $160.0 to $170.0 for Marathon Petroleum over the recent three months.

根据交易活动,看来主要投资者的目标是在最近三个月中将马拉松石油的价格范围从160.0美元扩大到170.0美元。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

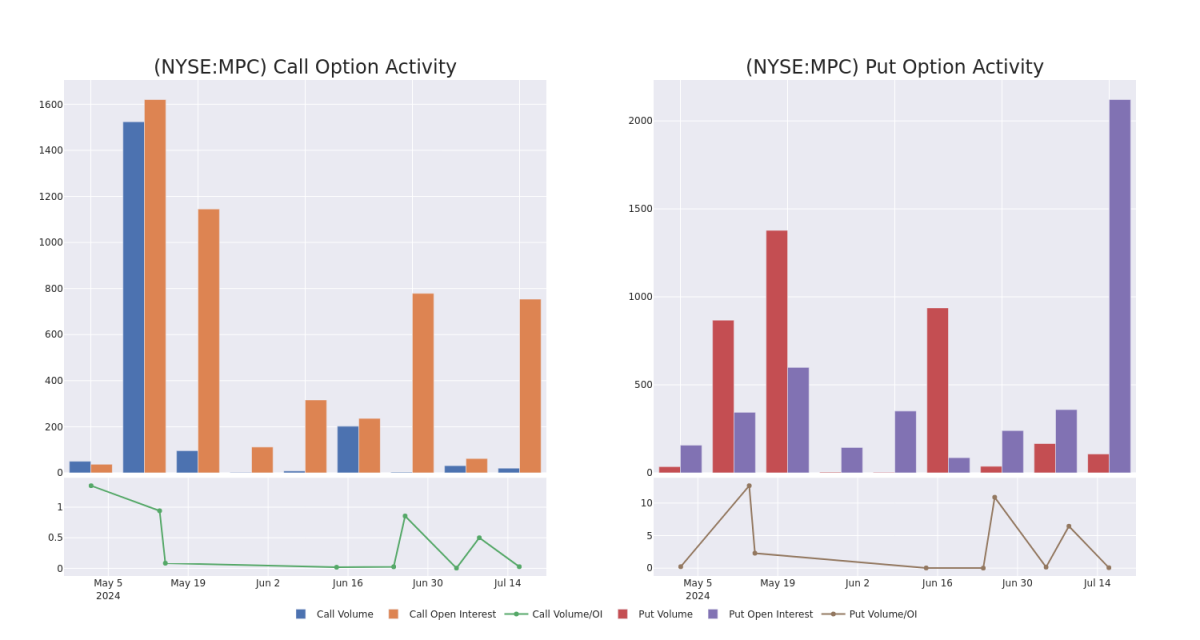

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Marathon Petroleum's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Marathon Petroleum's whale trades within a strike price range from $160.0 to $170.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪给定行使价下马拉松石油期权的流动性和利息。下面,我们可以观察到过去30天内马拉松石油公司所有鲸鱼交易的看涨期权和未平仓合约的分别变化,其行使价在160.0美元至170.0美元之间。

Marathon Petroleum Option Activity Analysis: Last 30 Days

马拉松石油期权活动分析:过去 30 天

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPC | CALL | SWEEP | BEARISH | 01/17/25 | $18.85 | $18.4 | $18.4 | $160.00 | $55.2K | 272 | 0 |

| MPC | CALL | SWEEP | BULLISH | 12/20/24 | $11.85 | $11.8 | $11.85 | $170.00 | $29.6K | 37 | 0 |

| MPC | PUT | SWEEP | BEARISH | 06/20/25 | $14.7 | $14.2 | $14.7 | $160.00 | $29.4K | 677 | 0 |

| MPC | PUT | TRADE | BEARISH | 06/20/25 | $14.65 | $14.25 | $14.65 | $160.00 | $29.3K | 677 | 73 |

| MPC | PUT | SWEEP | BEARISH | 06/20/25 | $14.6 | $14.2 | $14.6 | $160.00 | $29.2K | 677 | 46 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPC | 打电话 | 扫 | 粗鲁的 | 01/17/25 | 18.85 美元 | 18.4 美元 | 18.4 美元 | 160.00 美元 | 55.2 万美元 | 272 | 0 |

| MPC | 打电话 | 扫 | 看涨 | 12/20/24 | 11.85 美元 | 11.8 美元 | 11.85 美元 | 170.00 美元 | 29.6 万美元 | 37 | 0 |

| MPC | 放 | 扫 | 粗鲁的 | 06/20/25 | 14.7 美元 | 14.2 美元 | 14.7 美元 | 160.00 美元 | 29.4 万美元 | 677 | 0 |

| MPC | 放 | 贸易 | 粗鲁的 | 06/20/25 | 14.65 美元 | 14.25 美元 | 14.65 美元 | 160.00 美元 | 29.3 万美元 | 677 | 73 |

| MPC | 放 | 扫 | 粗鲁的 | 06/20/25 | 14.6 美元 | 14.2 美元 | 14.6 美元 | 160.00 美元 | 29.2 万美元 | 677 | 46 |

About Marathon Petroleum

关于马拉松石油

Marathon Petroleum is an independent refiner with 13 refineries in the midcontinent, West Coast, and Gulf Coast of the United States with total throughput capacity of 3.0 million barrels per day. Its Dickinson, North Dakota, facility produces 184 million gallons a year of renewable diesel. Its Martinez, California, facility will have the ability to produce 730 million gallons a year of renewable diesel once converted. The firm also owns and operates midstream assets primarily through its listed master limited partnership, MPLX.

马拉松石油公司是一家独立的炼油厂,在美国中部大陆、西海岸和墨西哥湾沿岸拥有13家炼油厂,总吞吐量为每天300万桶。其位于北达科他州狄金森的工厂每年生产1.84亿加仑的可再生柴油。其位于加利福尼亚州马丁内斯的工厂一旦改造,将有能力每年生产7.3亿加仑的可再生柴油。该公司还主要通过其上市主有限合伙企业MPLX拥有和运营中游资产。

Following our analysis of the options activities associated with Marathon Petroleum, we pivot to a closer look at the company's own performance.

在分析了与马拉松石油相关的期权活动之后,我们将转向仔细研究公司自身的表现。

Marathon Petroleum's Current Market Status

马拉松石油的当前市场状况

- Trading volume stands at 542,244, with MPC's price down by -0.03%, positioned at $165.51.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 19 days.

- 交易量为542,244美元,货币政策委员会的价格下跌了-0.03%,为165.51美元。

- RSI指标显示该股可能接近超卖。

- 预计将在19天内公布财报。

What Analysts Are Saying About Marathon Petroleum

分析师对马拉松石油的看法

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $200.8.

在过去的一个月中,5位行业分析师分享了他们对该股的见解,提出平均目标价为200.8美元。

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Marathon Petroleum with a target price of $196.

- Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for Marathon Petroleum, targeting a price of $231.

- Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Marathon Petroleum, targeting a price of $201.

- Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Outperform rating for Marathon Petroleum, targeting a price of $191.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Marathon Petroleum, targeting a price of $185.

- 富国银行的一位分析师在评估中保持对马拉松石油的增持评级,目标价为196美元。

- 杰富瑞的一位分析师保持立场,继续维持马拉松石油的买入评级,目标价格为231美元。

- 瑞穗的一位分析师保持立场,继续对马拉松石油公司维持中性评级,目标价格为201美元。

- 丰业银行的一位分析师坚持其立场,继续维持马拉松石油的行业跑赢大盘评级,目标价格为191美元。

- 巴克莱的一位分析师保持立场,继续维持马拉松石油的增持评级,目标价格为185美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。