Snap's Options Frenzy: What You Need to Know

Snap's Options Frenzy: What You Need to Know

Investors with significant funds have taken a bearish position in Snap (NYSE:SNAP), a development that retail traders should be aware of.

拥有大量资金的投资者对Snap(纽约证券交易所代码:SNAP)持看跌立场,零售交易者应该注意这一事态发展。

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in SNAP usually indicates foreknowledge of upcoming events.

今天,通过对本辛加可公开访问的期权数据的监控,这引起了我们的注意。这些投资者的确切性质仍然是个谜,但是SNAP的如此重大举动通常表明对即将发生的事件的预感。

Today, Benzinga's options scanner identified 9 options transactions for Snap. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 33% being bullish and 55% bearish. Of all the options we discovered, 8 are puts, valued at $341,814, and there was a single call, worth $173,810.

今天,Benzinga的期权扫描仪为Snap确定了9笔期权交易。这是一种不寻常的事件。这些大型交易者的情绪喜忧参半,33%的人看涨,55%的人看跌。在我们发现的所有期权中,有8个是看跌期权,价值341,814美元,还有一个看涨期权,价值173,810美元。

Predicted Price Range

预测的价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $15.0 and $15.5 for Snap, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场推动者将注意力集中在Snap在过去三个月的15.0美元至15.5美元之间的价格区间上。

Volume & Open Interest Trends

交易量和未平仓合约趋势

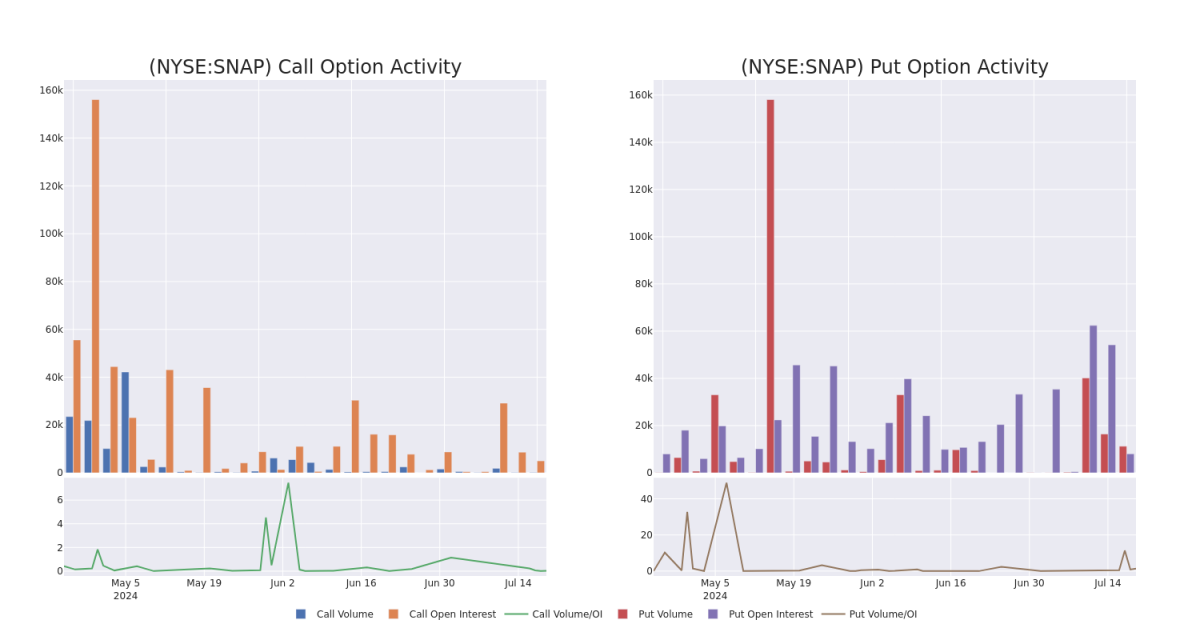

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Snap's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Snap's significant trades, within a strike price range of $15.0 to $15.5, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量Snap期权在特定行使价下的流动性和利息水平的关键。下面,我们简要介绍了过去一个月Snap在15.0美元至15.5美元行使价区间内的重要交易的看涨期权和未平仓合约的交易量和未平仓合约的趋势。

Snap Option Volume And Open Interest Over Last 30 Days

过去 30 天的 Snap Option 交易量和未平仓合约

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | CALL | SWEEP | BEARISH | 07/26/24 | $0.36 | $0.34 | $0.35 | $15.00 | $173.8K | 5.0K | 155 |

| SNAP | PUT | SWEEP | BEARISH | 07/19/24 | $0.94 | $0.85 | $0.85 | $15.50 | $66.9K | 8.0K | 3.7K |

| SNAP | PUT | SWEEP | BULLISH | 07/19/24 | $0.95 | $0.85 | $0.85 | $15.50 | $62.7K | 8.0K | 1.5K |

| SNAP | PUT | SWEEP | BULLISH | 07/19/24 | $1.1 | $0.72 | $0.8 | $15.50 | $51.1K | 8.0K | 3.0K |

| SNAP | PUT | SWEEP | BEARISH | 07/19/24 | $0.89 | $0.88 | $0.89 | $15.50 | $36.3K | 8.0K | 751 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 拍下 | 打电话 | 扫 | 粗鲁的 | 07/26/24 | 0.36 美元 | 0.34 美元 | 0.35 美元 | 15.00 美元 | 173.8 万美元 | 5.0K | 155 |

| 拍下 | 放 | 扫 | 粗鲁的 | 07/19/24 | 0.94 美元 | 0.85 美元 | 0.85 美元 | 15.50 美元 | 66.9 万美元 | 8.0K | 3.7K |

| 拍下 | 放 | 扫 | 看涨 | 07/19/24 | 0.95 美元 | 0.85 美元 | 0.85 美元 | 15.50 美元 | 62.7 万美元 | 8.0K | 1.5K |

| 拍下 | 放 | 扫 | 看涨 | 07/19/24 | 1.1 美元 | 0.72 美元 | 0.8 美元 | 15.50 美元 | 51.1 万美元 | 8.0K | 3.0K |

| 拍下 | 放 | 扫 | 粗鲁的 | 07/19/24 | 0.89 美元 | 0.88 美元 | 0.89 美元 | 15.50 美元 | 36.3 万美元 | 8.0K | 751 |

About Snap

关于 Snap

Snap owns one of the most popular social networking apps, Snapchat, claiming more than 400 million daily active users as of the end of 2023. Snap generates nearly all its revenue from advertising. While only about one quarter of users are in North America, the region accounts for about 65% of sales.

Snap拥有最受欢迎的社交网络应用程序之一Snapchat,截至2023年底,其每日活跃用户超过4亿。Snap 几乎所有的收入都来自广告。虽然只有大约四分之一的用户在北美,但该地区约占销售额的65%。

After a thorough review of the options trading surrounding Snap, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕Snap的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Where Is Snap Standing Right Now?

Snap 现在站在哪里?

- With a volume of 54,463, the price of SNAP is down 0.0% at $14.57.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 13 days.

- SNAP的交易量为54,463美元,价格下跌0.0%,至14.57美元。

- RSI 指标暗示,标的股票目前在超买和超卖之间保持中立。

- 下一份财报预计将在13天后公布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $15.0 and $15.5 for Snap, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $15.0 and $15.5 for Snap, spanning the last three months.