A Closer Look at Morgan Stanley's Options Market Dynamics

A Closer Look at Morgan Stanley's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on Morgan Stanley (NYSE:MS).

有大量资金可以花的投资者对摩根士丹利(纽约证券交易所代码:MS)采取了看涨立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

今天,当我们在本辛加追踪的公开期权历史记录中出现头寸时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MS, it often means somebody knows something is about to happen.

这些是机构还是仅仅是富人,我们都不知道。但是,当多发性硬化症发生这么大的事情时,通常意味着有人知道某件事即将发生。

Today, Benzinga's options scanner spotted 8 options trades for Morgan Stanley.

今天,本辛加的期权扫描仪发现了摩根士丹利的8笔期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 62% bullish and 37%, bearish.

这些大额交易者的整体情绪分为62%看涨和37%(看跌)。

Out of all of the options we uncovered, there was 1 put, for a total amount of $25,200, and 7, calls, for a total amount of $324,592.

在我们发现的所有期权中,有1个看跌期权,总额为25,200美元,还有7个看涨期权,总额为324,592美元。

What's The Price Target?

目标价格是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $85.0 to $102.0 for Morgan Stanley over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将摩根士丹利的价格范围从85.0美元扩大到102.0美元。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

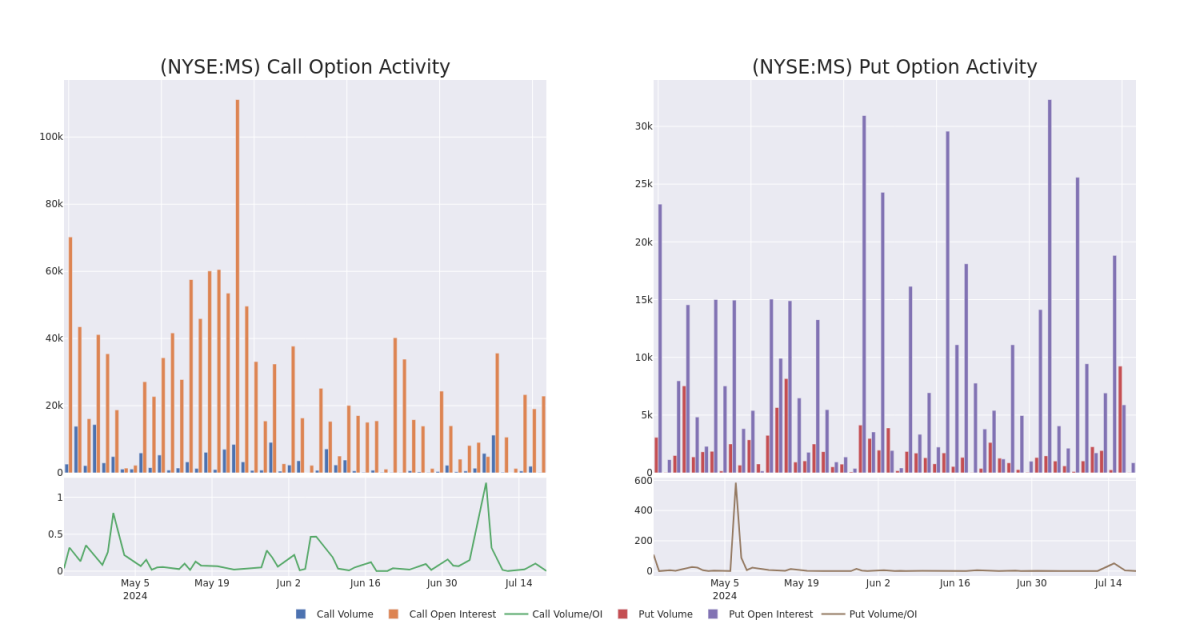

In terms of liquidity and interest, the mean open interest for Morgan Stanley options trades today is 3387.71 with a total volume of 106.00.

就流动性和利息而言,今天摩根士丹利期权交易的平均未平仓合约为3387.71,总交易量为106.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Morgan Stanley's big money trades within a strike price range of $85.0 to $102.0 over the last 30 days.

在下图中,我们可以跟踪过去30天摩根士丹利在85.0美元至102.0美元行使价区间内的大额资金交易的看涨期权和未平仓合约的变化。

Morgan Stanley Option Activity Analysis: Last 30 Days

摩根士丹利期权活动分析:过去 30 天

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | CALL | SWEEP | BULLISH | 12/20/24 | $8.75 | $8.05 | $8.75 | $100.00 | $65.6K | 1.3K | 0 |

| MS | CALL | TRADE | BULLISH | 07/19/24 | $18.25 | $18.1 | $18.25 | $85.00 | $52.9K | 1.1K | 5 |

| MS | CALL | SWEEP | BEARISH | 07/19/24 | $5.8 | $5.55 | $5.6 | $98.00 | $50.3K | 1.1K | 1 |

| MS | CALL | SWEEP | BULLISH | 07/19/24 | $9.3 | $8.75 | $9.35 | $95.00 | $46.7K | 17.4K | 1 |

| MS | CALL | SWEEP | BULLISH | 12/20/24 | $8.85 | $8.75 | $8.85 | $100.00 | $44.2K | 1.3K | 75 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | 打电话 | 扫 | 看涨 | 12/20/24 | 8.75 美元 | 8.05 美元 | 8.75 美元 | 100.00 美元 | 65.6 万美元 | 1.3K | 0 |

| MS | 打电话 | 贸易 | 看涨 | 07/19/24 | 18.25 美元 | 18.1 美元 | 18.25 美元 | 85.00 美元 | 52.9 万美元 | 1.1K | 5 |

| MS | 打电话 | 扫 | 粗鲁的 | 07/19/24 | 5.8 美元 | 5.55 美元 | 5.6 美元 | 98.00 美元 | 50.3 万美元 | 1.1K | 1 |

| MS | 打电话 | 扫 | 看涨 | 07/19/24 | 9.3 美元 | 8.75 美元 | 9.35 美元 | 95.00 美元 | 46.7 万美元 | 17.4K | 1 |

| MS | 打电话 | 扫 | 看涨 | 12/20/24 | 8.85 美元 | 8.75 美元 | 8.85 美元 | 100.00 美元 | 44.2 万美元 | 1.3K | 75 |

About Morgan Stanley

关于摩根士丹利

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments with approximately 45% of net revenue from its institutional securities business, 45% from wealth management, and 10% from investment management. About 30% of its total revenue is from outside the Americas. The company had over $5 trillion of client assets as well as around 80,000 employees at the end of 2023.

摩根士丹利是一家全球投资银行,通过其传统公司,其历史可以追溯到1924年。该公司拥有机构证券、财富管理和投资管理部门,约45%的净收入来自机构证券业务,45%来自财富管理,10%来自投资管理。其总收入中约有30%来自美洲以外。截至2023年底,该公司拥有超过5万亿美元的客户资产和约8万名员工。

Following our analysis of the options activities associated with Morgan Stanley, we pivot to a closer look at the company's own performance.

在分析了与摩根士丹利相关的期权活动之后,我们将转向仔细研究公司自身的表现。

Present Market Standing of Morgan Stanley

摩根士丹利目前的市场地位

- Currently trading with a volume of 1,786,779, the MS's price is down by 0.0%, now at $104.81.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 89 days.

- MS目前的交易量为1,786,779美元,价格下跌了0.0%,目前为104.81美元。

- RSI读数表明,该股目前可能接近超买。

- 预计收益将在89天后发布。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Morgan Stanley options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。通过Benzinga Pro的实时警报,随时了解摩根士丹利的最新期权交易。