Workday's Options Frenzy: What You Need to Know

Workday's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on Workday. Our analysis of options history for Workday (NASDAQ:WDAY) revealed 8 unusual trades.

金融巨头在Workday上进行了显眼的多头行动。我们对Workday(NASDAQ:WDAY)期权历史的分析显示,出现了8次非同寻常的交易。

Delving into the details, we found 75% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $219,339, and 5 were calls, valued at $299,648.

深入研究后,我们发现75%的交易者看涨,有25%的交易者表现出看跌的趋势。我们发现所有交易中有3次看跌,价值为219,339美元,5次看涨,价值为299,648美元。

What's The Price Target?

目标价是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $230.0 for Workday over the recent three months.

根据交易活动,显然重要的投资者正在瞄准Workday在最近三个月的价格区间,从200.0美元到230.0美元。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Workday's options for a given strike price.

这些数据可以帮助您追踪给定行权价格的Workday期权的流动性和兴趣。

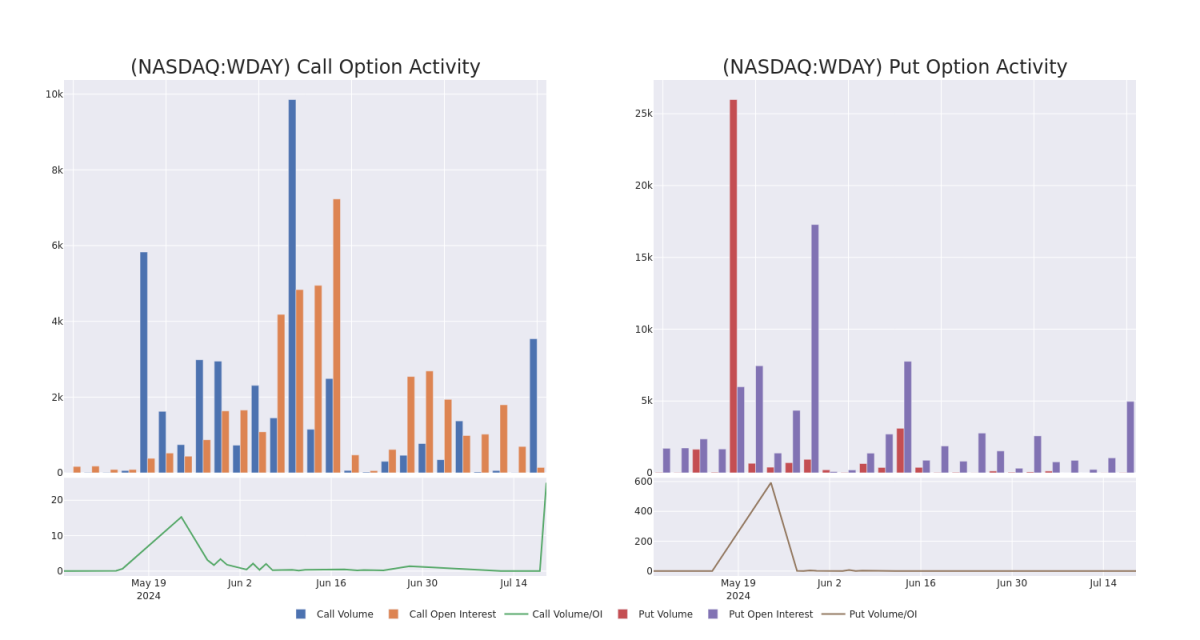

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Workday's whale activity within a strike price range from $200.0 to $230.0 in the last 30 days.

下面,我们可以观察Workday在30天内所有看涨和看跌活动的成交量和未平仓利息的演变,范围是200.0美元到230.0美元。

Workday Call and Put Volume: 30-Day Overview

Workday看涨期权和看跌期权成交量:30天概述

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | CALL | SWEEP | BULLISH | 07/19/24 | $3.3 | $3.1 | $3.3 | $222.50 | $119.7K | 681.4K | |

| WDAY | PUT | TRADE | BULLISH | 03/21/25 | $15.4 | $13.8 | $14.42 | $210.00 | $115.3K | 210 | |

| WDAY | PUT | SWEEP | BULLISH | 08/16/24 | $0.9 | $0.75 | $0.75 | $200.00 | $78.4K | 88720 | |

| WDAY | CALL | TRADE | BULLISH | 01/16/26 | $60.1 | $58.8 | $60.0 | $200.00 | $60.0K | 742 | |

| WDAY | CALL | TRADE | BULLISH | 01/16/26 | $60.0 | $59.0 | $59.62 | $200.00 | $53.6K | 7412 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | 看涨 | SWEEP | 看好 | 07/19/24 | $3.3 | $3.1 | $3.3 | $222.50 | $119.7K | 681.4K | |

| WDAY | 看跌 | 交易 | 看好 | 03/21/25 | $15.4 | $13.8 | $14.42 | 目标股价为$210.00。 | $115.3K | 210 | |

| WDAY | 看跌 | SWEEP | 看好 | 08/16/24 | $0.9 | 0.75美元 | 0.75美元 | 。 | $78.4K | 88720 | |

| WDAY | 看涨 | 交易 | 看好 | 01/16/26 | $60.1 | $58.8 | $60.0 | 。 | $60.0K | 742 | |

| WDAY | 看涨 | 交易 | 看好 | 01/16/26 | $60.0 | $59.0 | $59.62 | 。 | $53.6K | 7412 |

About Workday

关于Workday

Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions. Known for being a cloud-only software provider, Workday is headquartered in Pleasanton, California. Founded in 2005, Workday now employs over 18,000 employees.

Workday是一家提供人力资本管理、财务管理和业务规划解决方案的软件公司。Workday以云计算软件提供商而闻名,总部位于加利福尼亚州普莱森顿。该公司成立于2005年,现有员工超过18,000人。

Following our analysis of the options activities associated with Workday, we pivot to a closer look at the company's own performance.

在分析了与Workday相关的期权交易活动后,我们转而更仔细地关注该公司自身的表现。

Workday's Current Market Status

Workday当前的市场状况

- Currently trading with a volume of 1,490,307, the WDAY's price is down by -1.99%, now at $225.99.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 34 days.

- 目前交易量为1,490,307,WDAY的价格下跌了-1.99%,现在为225.99美元。

- RSI读数表明该股目前可能接近超买水平。

- 预计发布收益报告还有34天。

What The Experts Say On Workday

关于Workday,专家怎么说

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $242.33333333333334.

在过去的一个月中,有3位行业分析师分享了他们对这支股票的看法,提出了平均目标价为242.33333333333334美元。

- An analyst from Wells Fargo has decided to maintain their Overweight rating on Workday, which currently sits at a price target of $275.

- An analyst from Piper Sandler has decided to maintain their Overweight rating on Workday, which currently sits at a price target of $262.

- An analyst from Guggenheim has revised its rating downward to Sell, adjusting the price target to $190.

- 富国银行的分析师决定维持他们对Workday的增持评级,目前的价格目标为275美元。

- 派杰投资的分析师决定维持他们对Workday的增持评级,目前的价格目标为262美元。

- 一位来自古根海姆的分析师已将其评级下调为卖出,并将价格目标调整为190美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Workday with Benzinga Pro for real-time alerts.

期权交易涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略性交易调整、利用各种因子并保持对市场动态的关注来缓解这些风险。通过Benzinga Pro获取Workday的最新期权交易,以获取实时警报。