Sieyuan Electric Co., Ltd.'s (SZSE:002028) Business Is Trailing The Market But Its Shares Aren't

Sieyuan Electric Co., Ltd.'s (SZSE:002028) Business Is Trailing The Market But Its Shares Aren't

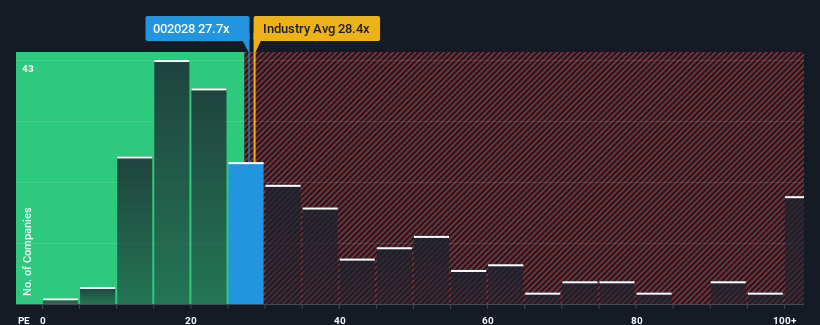

It's not a stretch to say that Sieyuan Electric Co., Ltd.'s (SZSE:002028) price-to-earnings (or "P/E") ratio of 27.7x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 28x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Sieyuan Electric as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Sieyuan Electric would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 20% last year. The latest three year period has also seen an excellent 65% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 21% per annum as estimated by the analysts watching the company. That's shaping up to be materially lower than the 24% per year growth forecast for the broader market.

With this information, we find it interesting that Sieyuan Electric is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Sieyuan Electric's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Sieyuan Electric with six simple checks.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com